We are at a stage in the cycle where most people are severely traumatized by the bear market, and we are hovering below all-time highs. Even as people are worried, our prices continue to climb, which is a good sign because bull markets tend to climb over walls of worry. The top is only near when people stop worrying and think this is a new paradigm, and 99.9% of people won't sell at the top anyway, so everyone is better off scaling over time and retaining as much capital as possible.

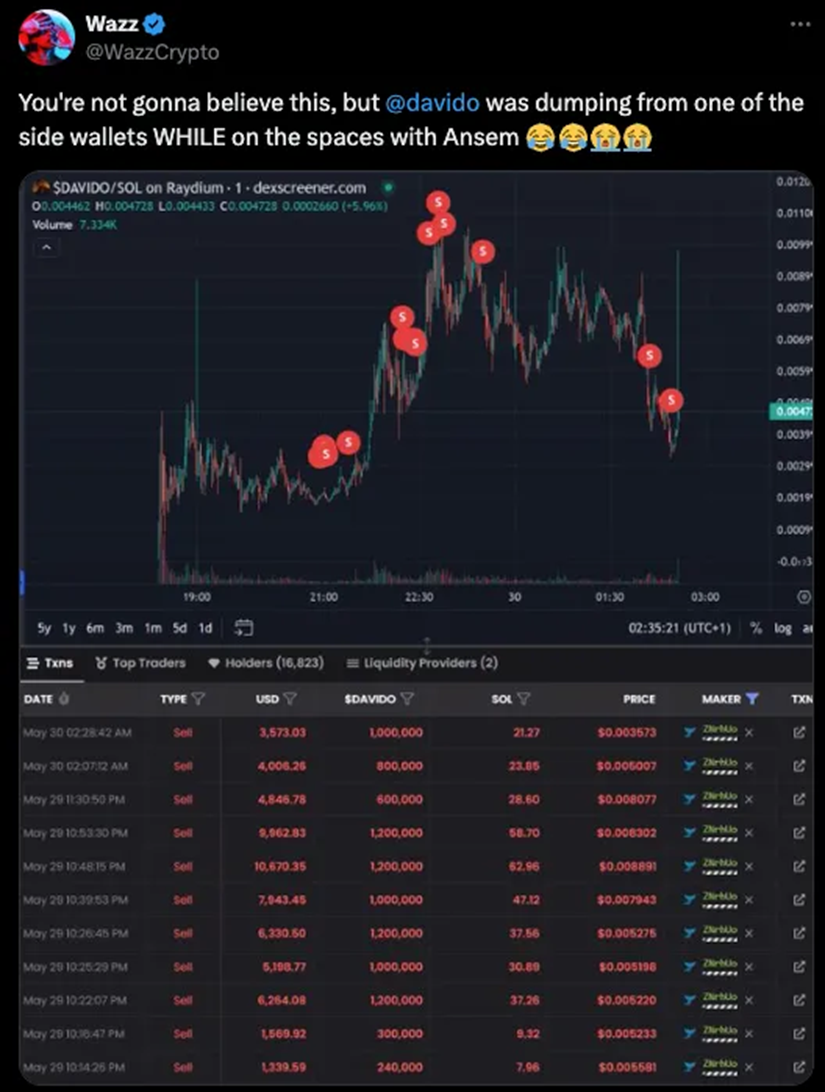

Still, we’ve had a ton of news this past week, and memecoins and celebrities have been in the spotlight (yes, you heard that right). The likes of Iggy Azalea, Soulja Boy, Lil Pump, and others have come to the fore again. People remember the top signals from the last cycle and are now worried again.

Market Summary

• ECB plans first rate cut

•DWF Labs CEO announces plans to invest in Memecoin

•FTX executive Ryan Salame sentenced to 7.5 years in prison

•The Uniswap Foundation’s on-chain proposal for fee conversion will be released on May 31st.

•Binance Labs invests in Aevo

• Articles on inflation attacks

•GCR's account was hacked , he claimed that X's insiders were bribed

• DeFi funds raise funds for new decentralized stablecoins

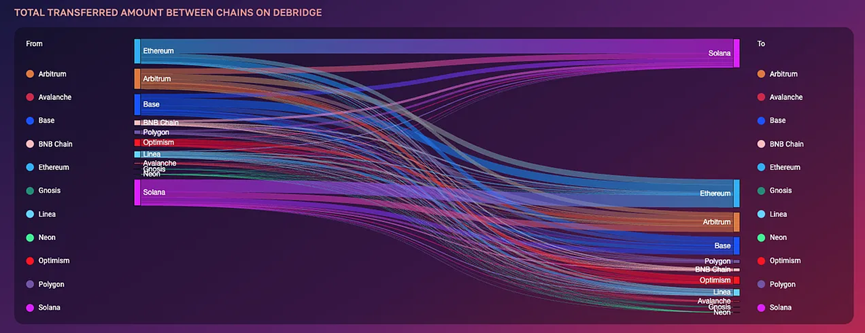

Cross-chain bridge flow

With multiple celebrities appearing on Crypto Twitter with the intent to launch tokens, it would not be surprising to see capital flowing into Solana once again as people chase the price of these tokens to rise. This is where things get weird, as I don’t see this behavior stopping anytime soon. However, when something like this happens, make sure the majority of your portfolio is professionally managed, as surprises can come at any time.

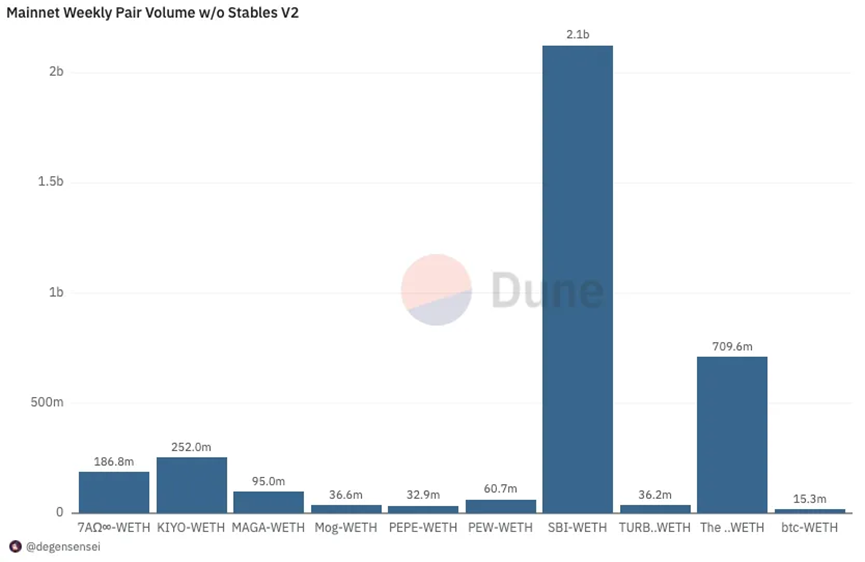

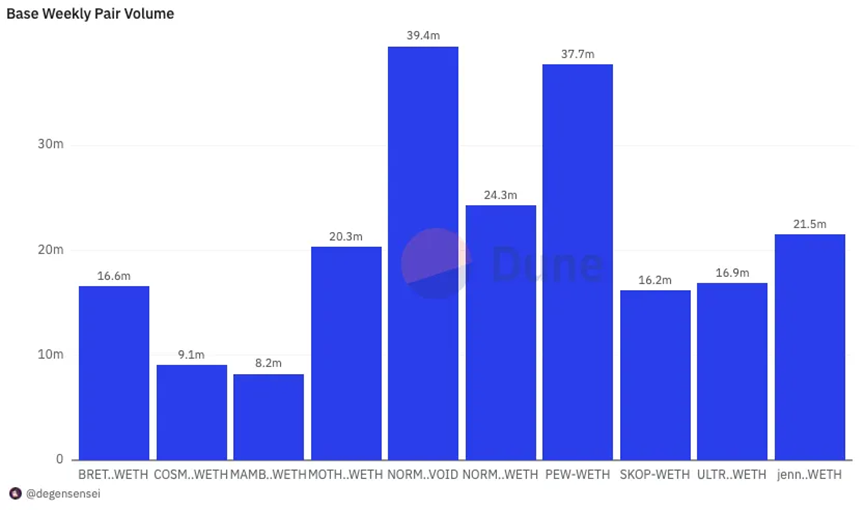

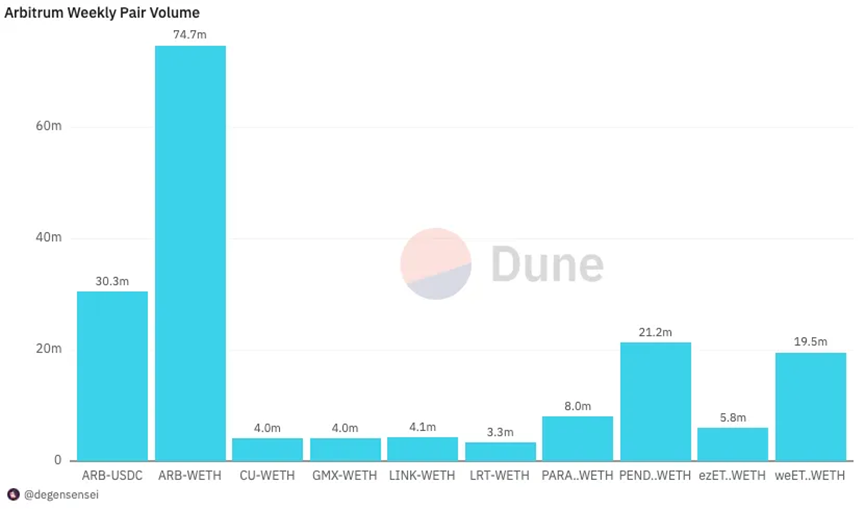

DEX Volume

All activity continues to accelerate, except for Base, which continues to slumber compared to the other chains. It still offers an asymmetric opportunity with the upcoming launch of the Coinbase Smart Wallet, which should kick-start the next Base season. Right now, Ethereum activity has surged, and will likely continue to do so until gas fees become too high.

Trading volume

The mainnet volume has exploded over the past week and we are finally seeing real bull numbers now. As the focus has been on Memes, they have dominated the trading tokens over the past week. Given that the volume is artificial, SBI can be ignored despite how eye-catching it is on the chart. The same is true for KIYO and The Glitch. However, MAGA, MOG, PEPE, PEW, and TURBO have all exploded in price and volume over the past week.

Normie was at the top of the volume chart and went to zero due to last week’s hack. PEW joined the PEW bandwagon on ETH and is heavily traded on Base, even though it’s not the same token. There are still no winners in the Base ecosystem, and a large number of on-chain users may be sensing a storm brewing there.

Arbitrum has also slowed down compared to last week, PENDLE is just as hot now as it was then, and ARB token activity is also slowing down. However, the Arbitrum LTIPP (Long Term Incentive Pilot Program) will probably start next week, so if you are unsure which way the market will go, you should take the opportunity to get rewards from this pool.

NFT Trading Volume

Aside from the rally that occurred when Ethereum exploded, NFTs are weak across the board. While they are starting to show some interest, their value probably won’t explode until the frenzy phase, when people have made a lot of money and want to show it off by displaying high-value NFTs, and most NFTs are overpriced.

It’s been a long time since there was an interesting mint on ETH outside of Heroglyphs, and this is probably not going to change anytime soon.

The NFT craze is a good sign that we are nearing the end of a cycle, keep that in mind when you see them going crazy.

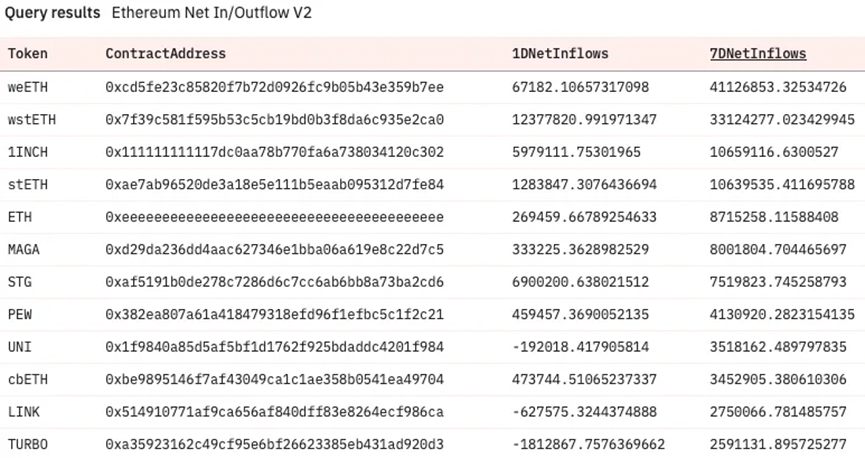

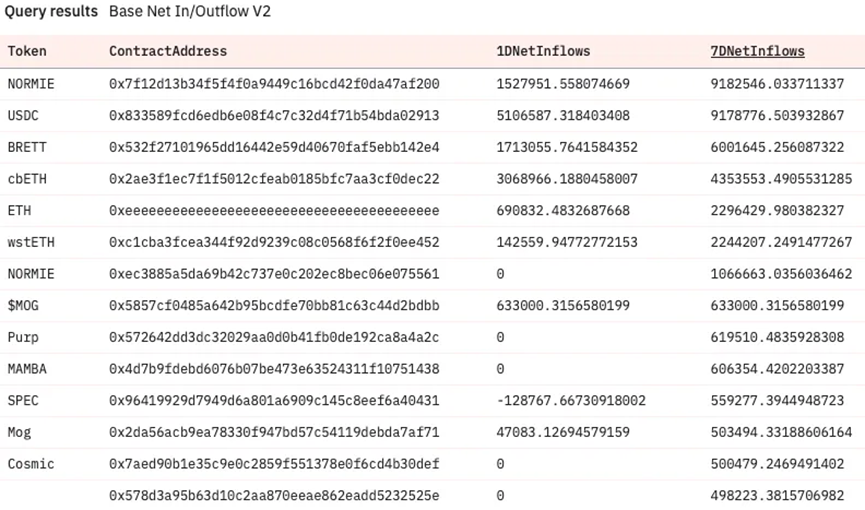

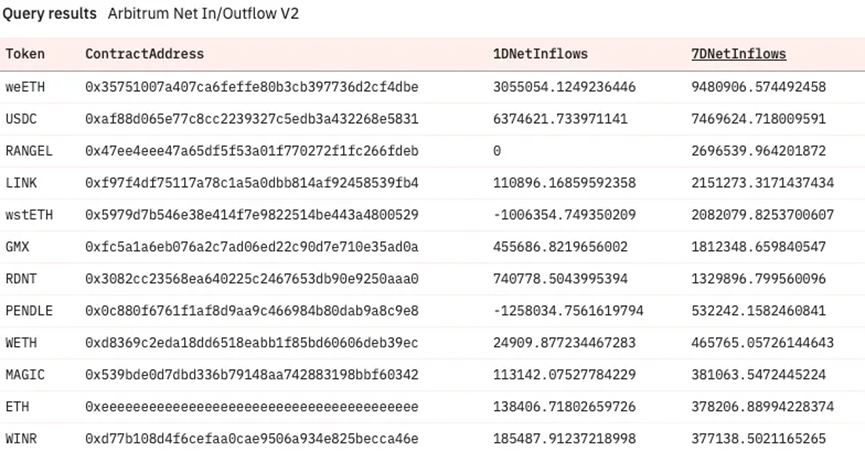

Net Inflow

Surprisingly, 1inch has accumulated a lot of tokens in the past week, which is not something I say often. Maybe something knows something, or there is an announcement coming? Worth watching. The new MAGA token surged to $200M in 3 days as Trump continues to support crypto. STG started pumping as people expected the LayerZero airdrop to be close. PEW is the latest on-chain cooker to surpass 60M after appearing out of nowhere. Interest in UNI tokens is increasing as voting starts tomorrow.

As I mentioned before, NORMIE has been the most accumulated (and sold) coin this past week after it was hacked. Further down you’ll see a second NORMIE token that was created in response to this as a new token was launched. MOG has been the top performing Meme coin along with PEPE this past week as their smart contracts are also live on Base and therefore appear here. Despite the weakness in the AI sector, there has been a renewed interest in the SPEC market.

After hitting bottom when Arthur Hayes sold his position, the price of GMX has continued to climb unnoticed and should be watched closely as it is still accumulating heavily. RDNT is a token built using LayerZero technology and could benefit from the upcoming LZO airdrop. While MAGIC and WINR are gaining interest again, PENDLE is just a juggernaut and will continue to be here, which is great to see.

investigation

Celebrity tokens should not be moved for their own sanity. This is Davido (Afrobeat artist) issuing a coin, getting 20% of the supply and immediately using it for a quick profit.

It's a cold world out there.

Token Unlock

Tornado Cash, May 31, 6.11% of supply, valued at $278,667

• dYdX, June 1, 3.33% of supply, valued at $68 million

•MAV, June 1, 0.41% of supply, valued at $2.85 million

• Redacted, June 1, 1.88% of supply, valued at $3.7 million

• Sui, June 1, 1,71% of supply, valued at $175 million

• Cetus, June 2, 1.25% of supply, valued at $125 million

• Cheelee, June 3, 2.08% of supply, valued at $423.25 million

•Liquity, June 4, 0.75% of supply, valued at $843,917

That's it for this week, and my final message is simple: Keep bullieving!