By Jack Inabinet, Bankless

Translated by: Kate, Mars Finance

Can BTC break through its all-time high?

Decision time? Crypto assets posted steady gains overnight after a stagnant weekend as global market participants returned to their desks. But the rally stalled shortly after the U.S. market opened! Why are prices encountering resistance?

Confirmation last month that a pending spot Ethereum ETF application would be approved by the U.S. Securities and Exchange Commission (SEC) boosted crypto prices, putting many tokens within striking distance of reaching new cycle highs.

The unexpected shift in approval odds caused underexposed traders to enthusiastically copy ETH, pushing the token to a new cycle high above $4,000; Bitcoin was pushed to within 2% of its all-time high, briefly touching $72,000.

Source: TradingView

While Ethereum reached a higher local high last Monday, Bitcoin was hammered before reaching its high last week, a potentially worrying sign for bulls that sellers retain some degree of control. As Bitcoin falls from a lower local high for the third time after attempting a breakout, the crypto market appears to be at a critical make-or-break moment…

A sustained rally would quickly push Bitcoin to new all-time highs and would undoubtedly provide a major boost to broader crypto asset valuations, however, a breakdown from here would see the coin fall back to the lows of the $60,000 range that has supported prices for the past three months, followed by further downside.

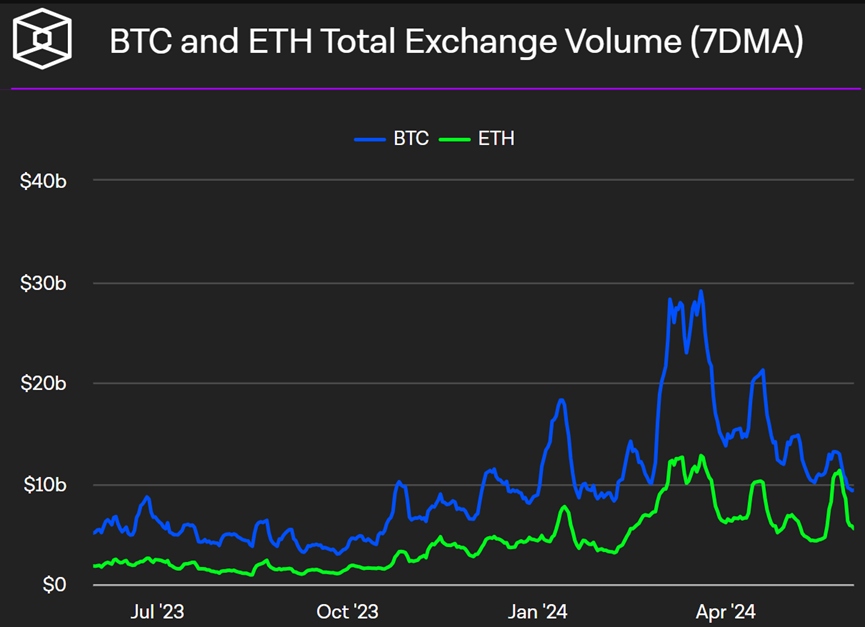

Incidentally, spot volumes for both BTC and ETH have dropped significantly over the last week, indicating a lack of interest at current prices, which suggests that the trend could reverse in the near future.

Source: The Block

While crypto markets have been relatively free of notable volatility following confirmation of the spot ETH ETF approval, certain TradFi assets have seen erratic price action this morning.

After disappearing from social media for two weeks, GameStock bull going by the pseudonym “Roaring Kitty” (aka Keith Gill) returned to the spotlight last weekend when he disclosed that he owns 5 million shares of GME, revealed himself as a “whale” who accumulated a huge bullish position in the stock last week, and tweeted a green uno reverse card.

GME shares more than doubled amid renewed excitement over the meme, rising as high as $45 in pre-market trading this morning, but have since given back most of those gains, falling to as low as $28 in cash trading.

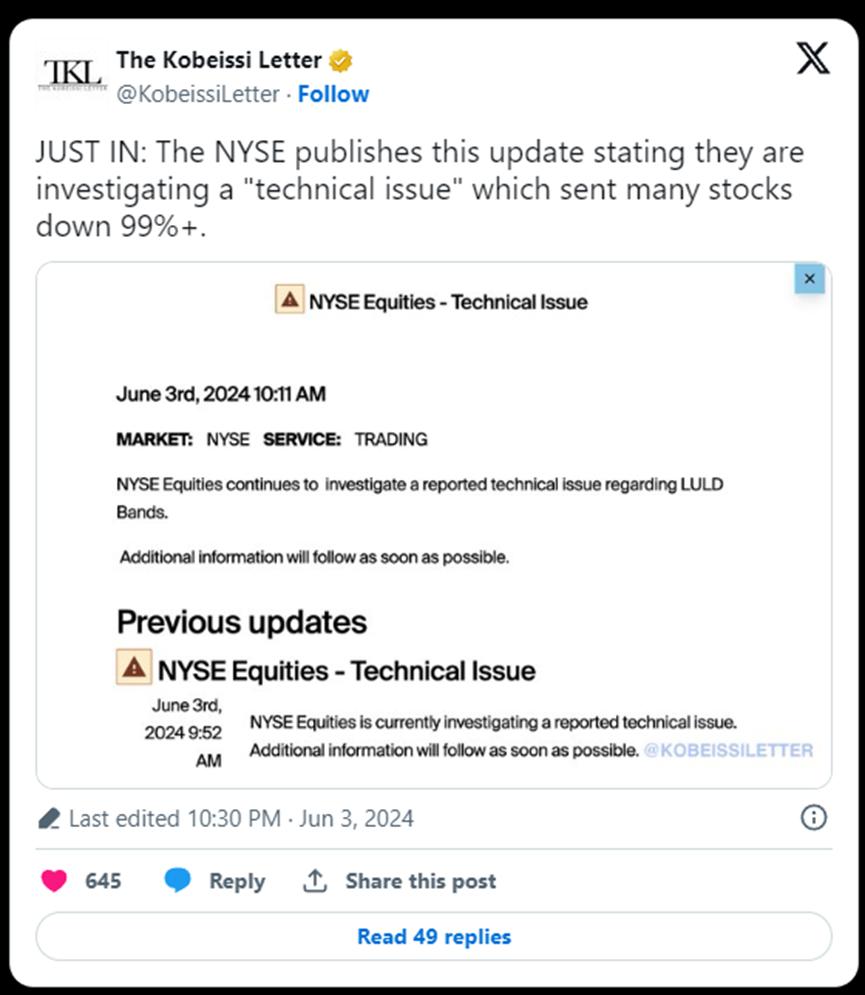

The New York Stock Exchange also experienced a major outage this morning, being forced to halt trading in 50 listed assets, seemingly due to a software update that impacted price range guardrails designed to limit volatility.

The most notably affected asset was Class A shares of Warren Buffet's Berkshire Hathaway, which fell 99% when trading opened this morning before being halted.

https://x.com/KobeissiLetter/status/1797636987366818141