Cryptocurrency investment outflows increased last week, reaching the highest level recorded in March. This came in response to the Federal Open Market Committee (FOMC) meeting.

Bitcoin price upside potential remains limited as investors' risk appetite declines.

Cryptocurrency investment outflow exceeds $600 million

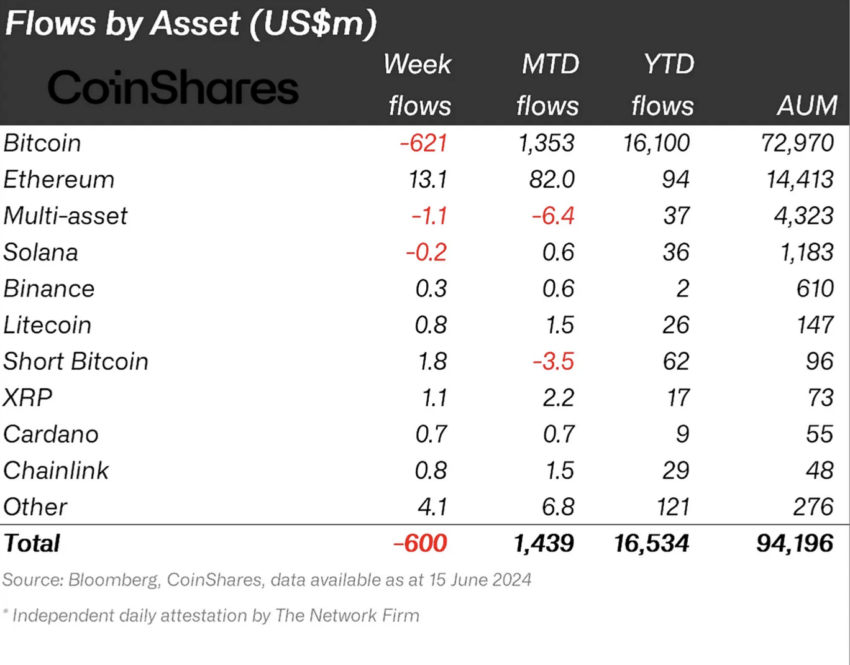

According to a CoinShares report, $600 million outflowed from digital asset investment products last week, hitting the highest recorded on March 22. Bitcoin accounted for most of the negative outflows, with $621 million outflow. Conversely, altcoins such as Ethereum (ETH) and Ripple (XRP) recorded net inflows of $13 million and $1 million, respectively.

“These outflows and recent price declines have reduced total assets under management (AuM) from more than $100 billion to $94 billion during the week. Outflows were entirely focused on Bitcoin, with $621 million flowing out, while weakness led to $1.8 million flowing into short Bitcoin,” CoinShares analysts reported.

CoinShares analysts attributed the negative trend to the U.S. Federal Reserve's "more hawkish than expected" stance at last week's FOMC meeting. The cheering decline in the US Consumer Price Index (CPI) on June 12 allowed digital assets to recoup some of the losses, but that changed very quickly when the Federal Reserve raised hopes of more lenient policies in the near term.

Read more: Cryptocurrencies vs. Stocks: Where to Invest in 2024

The Fed's updated dot plot reduces the number of interest rate cuts this year to one, down from three in the previous version. For ordinary investors, the prospect of fewer interest rate cuts is negative for cryptocurrencies. The FOMC meeting is an important event where key decisions are made on monetary policy and the interest rates at which banks lend to each other.

By region, the United States had the largest outflow of funds at $565 million. However, Canada , Switzerland, and Sweden also recorded negative net outflows of $15 million, $24 million, and $15 million, respectively.

Ethereum among altcoins that showed positive trends

As seen earlier, Ethereum avoided the negative outlook of the BTC market by recording net inflows of up to $13 million. Ethereum market sentiment remains strong amid speculation that an Ethereum spot ETF will be launched soon. Bloomberg analyst Eric Balchunas expects the financial product to launch on July 2.

“Update: We are moving up the Over/Under date for the launch of the Ether spot ETF to July 2nd. Today, staff sent a comment to the issuers on the S-1, and it was very light and nothing major, asking them to resubmit within a week. It was. We'll likely declare it effective next week and work to get it done over the holiday weekend. Anything is possible, but this is our best guess at the moment,” Balchunas said .

Balchunas’ Optimism comes after U.S. Securities and Exchange Commission (SEC) Chairman Gary Gensler confirmed that an Ethereum spot ETF would be launched “ sometime this summer .”

Read more: Ethereum ETF explained: What it is and how it works

At a Senate hearing last week, Gensler emphasized that the Form 19b-4 approved in May came from the stock exchanges expected to list the ETF. It also said that the issuer registration process is still ongoing. Nonetheless, Gensler hoped issuers would finalize the registration process within the summer.

Trusted

The information contained on the BeInCrypto website is published in good faith and for informational purposes only. Users are solely responsible for any consequences arising from their use of information on the website.

In addition, some contents are AI-translated English versions of BeInCrypto articles.