Highlights of this issue :

1. Large buy orders for Ethereum call options

2. Four major drivers influence the market

01

X Viewpoint

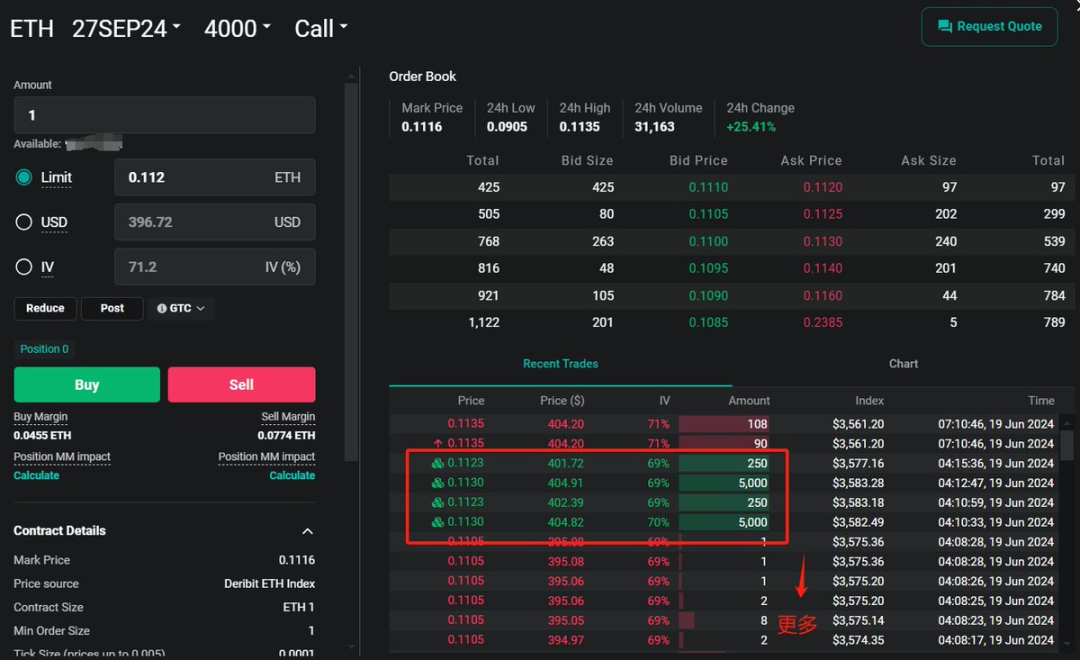

1. Ms. Lin @Deribit (@LinChen91162689): There is a large buy order for ETH call options. Is the ETF coming?

ETH's 4000 call option expiring at the end of September, a large single purchase of 30,500 ETH was completed, paying 12.23 million US dollars!

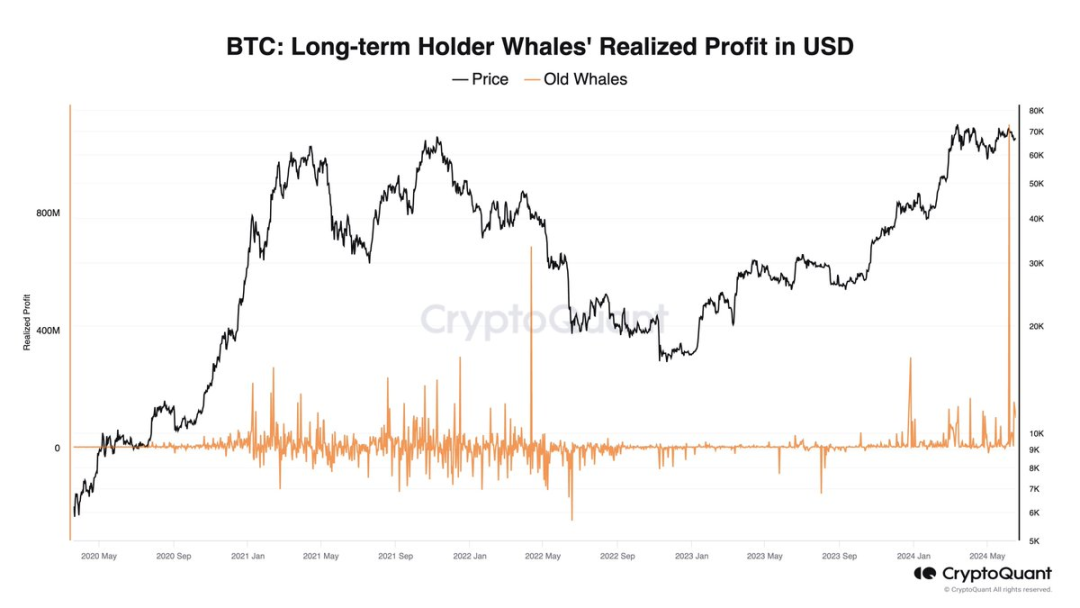

2. Ki Young Ju (@ki_young_ju): The market may see a lot of selling

#Bitcoin long-term holder whales sold $1.2B in the past 2 weeks, likely through brokers.

ETF netflows are negative with $460M outflows in the same period.

If this ~$1.6B in sell-side liquidity isn't bought OTC, brokers may deposit $BTC to exchanges, impacting the market.

(Translation: In the past two weeks, long-term BTC holders sold $1.2 billion of BTC through brokers, and the ETF had a net outflow of $460 million; if the $1.6 billion sell order does not have enough buying orders on the OTC, brokers will deposit these BTC into the exchange, thereby affecting the market price.)

3. DC is greater than C (@DL_W59): Trading requires psychological control

The longer I trade, the more I think of the saying: Those who know how to buy are apprentices, and those who know how to sell are masters. The test of altcoins is the ability to sell. I have studied many secondary altcoins from 2020 to date, including some memes on dex.

Market makers usually increase the price by about 10 times, and the K-line trend is exactly 10 times from the lowest to the highest. Why is it 10 times? And the market value after 10 times just meets the market liquidity sentiment.

Is this metaphysics? The market makers are so tacitly in sync, they insert the pin to that position, and then just pull it up by about 10 times based on that position.

Generally, the K-line has a 10-fold increase from the lowest to the highest, and almost no one can get it right at the starting position. So the most you can get is 2-3 times, and you have to be extremely smart to get it. But if you don’t know how to estimate the market value and can’t control your emotions, it’s easy to get stuck. The more you chase the rise, the easier it is to get stuck. There are not many ten-fold copycat projects in the market during the general rise of copycats, so you can imagine. In addition, even if there are more than 10 times coins (30 times, 50 times, 100 times or more), it is in a crazy bull market when the emotions are extremely fomo, but there are very few such projects. Even if you can choose it, can you hold it?

The market may not keep rising, but it may keep falling. If you want to really make a lot of money in the secondary spot market, you need to have imagination, but you have to combine the actual market conditions and market value estimates, and you can't be too greedy.

02

On-chain data

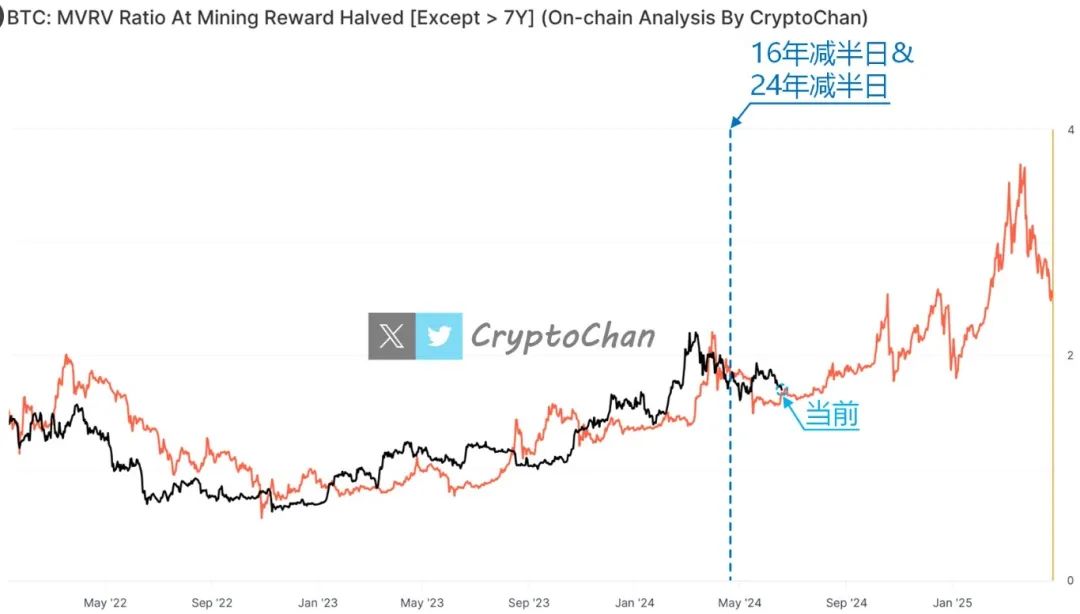

CryptoChan: The current BTC price continues to recover healthily

As shown in the #BTC on-chain indicator in the figure, the current coin price continues to recover healthily. The black line in the figure is the current BTC: MVRV indicator, and the red line is the BTC: MVRV indicator in 2016-2017. Align the two lines on the day when the BTC production is halved. Note: MVRV (Market Value to Realized Value) refers to the ratio of BTC price to the overall average purchase price of BTC on the chain. The MVRV in the figure is a personal modification, and BTC on the chain that has not been moved for more than 7 years is considered to be long-term dormant or lost and excluded from the calculation.

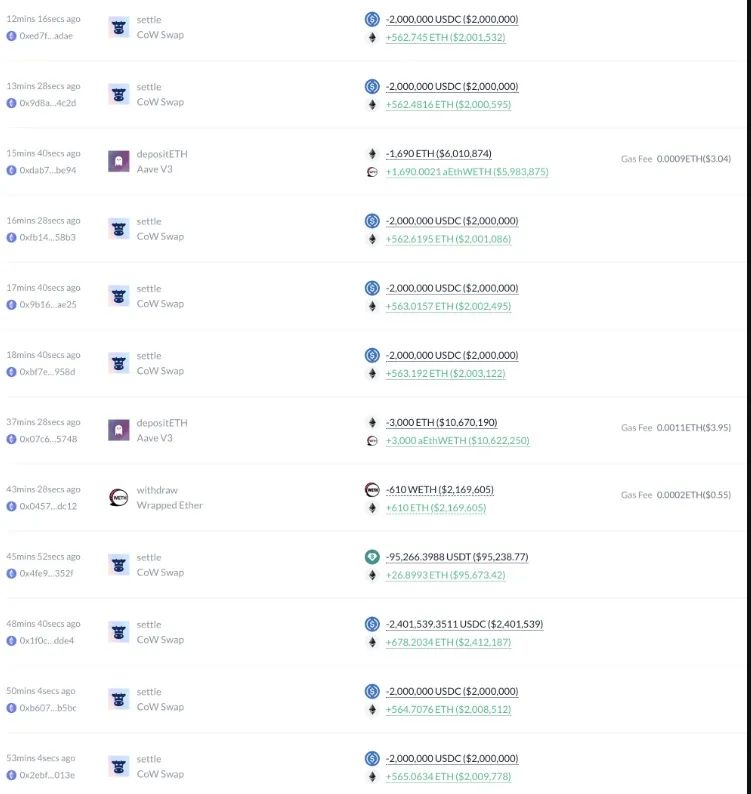

Ember: As soon as the market rebounded, a whale began to leverage ETH

As soon as the market rebounded slightly, whales began to leverage ETH again: a whale spent 18.49 million U to buy 5214 ETH on the chain in the past hour, of which 10 million U was borrowed on Aave. He has spent a total of 20.58 million U to buy 5822.6 ETH in the past 24 hours, with an average price of $3535. In addition, he also bought 4.34 million CRV at a price of $0.287 after the CRV loan position of the founder of Curve was liquidated on June 13, and has currently made a floating profit of $0.28M.

03

Sector Interpretation

According to Coinmarketcap data, the top five currencies in terms of 24-hour popularity are: ZK, MAGA, UDS, TRUMP, and W. According to Coingecko data, in the crypto market, the top five sectors with the highest growth are: Retail, Ethereum Ecosystem, IoT, Fenbushi Capital Portfolio, and Social Money.

Focus: Bitcoin fluctuates repeatedly, and four major drivers influence the market

This round of bull market is very different from previous ones. This article analyzes the main factors driving the development of Bitcoin market and looks forward to the future market of Bitcoin.

Bitcoin ETF: After the Bitcoin ETF was approved, the changes in institutional demand for Bitcoin ETF can be roughly divided into three stages. As can be seen from the figure below (data as of June 15), in the first stage, institutions increased their holdings of Bitcoin ETFs in large quantities, and the demand was very strong; in the second stage, the institutional demand for increasing holdings of Bitcoin ETFs declined significantly, and the selling volume even exceeded the increase in holdings at one point; in the third stage, the institutional demand for Bitcoin ETFs rebounded somewhat compared to the second stage, but fell significantly compared to the first stage.

What is the reason for the huge demand for Bitcoin ETF in the first phase? This article believes that this is the release of the long-accumulated demand of institutions, which in a sense also has the meaning of grabbing shares. However, after Bitcoin reached around $70,000, the market's upward momentum dropped sharply and the selling increased, which shows that institutional demand began to slow down. From a deeper level, this means that the institutional strategy has begun to change from grabbing shares to strategic position building (selling high and buying low), and once they think the price is too high, they tend to sell. In this process of transformation, a very iconic event is that BlackRock's Bitcoin holdings surpassed Grayscale, which has cultivated many companies in the crypto market. This is like in a relay race, the original crypto giant officially handed over the right to speak to the traditional Wall Street giant. What does the recovery of Bitcoin ETF demand in the third phase indicate? On May 1, there was a large-scale sell-off of Bitcoin ETF funds, and the price of Bitcoin fell sharply to $58,307. Then Bitcoin ETF began to increase its holdings again. This may mean that $58,000 is a more appropriate purchase price for Bitcoin. This may also be determined by the mining cost of Bitcoin.

Bitcoin miners: The selling behavior of miners suggests that the price of Bitcoin may be a more suitable selling price in the short term when it is between $69,000 and $71,000, while the shutdown price of a large number of miners is between $58,900 and $63,300, which may be a more suitable buying price in the short term. This can be confirmed by the trend changes of Bitcoin ETF mentioned above, and they have a strong correlation with each other.

Macro-finance: The impact of macro policies is long-term; at the same time, at the key points when certain important data are released, their impact on Bitcoin is extremely significant. With the release of key data, Bitcoin returns to a balance, and the long-short game in the market begins again.

Bitcoin technology development: Judging from the current data, the development of the Bitcoin ecosystem is still in its early stages. The previously popular runes, inscriptions, and Bitcoin Layer 2 are beginning to enter the ecosystem construction period.

From a technical point of view, the new Bitcoin proposal OP_CAT may become the main driving factor and core factor of the next round of Bitcoin's rise. Once it is officially merged into the Bitcoin Core code, it will undoubtedly greatly promote the development of the Bitcoin ecosystem and drive up the price of BTC. From a macro perspective, with the overall upward movement of the interest rate dot chart, the median interest rate in 2024 will be raised from 4.6% to 5.1%, which means that there may be only one interest rate cut this year, and the probability of a rate cut in September has increased. From a medium-term perspective, Bitcoin may usher in a golden September and silver October. From a short-term perspective, the behavior of Bitcoin miners and the shutdown price of mining machines provide a reference price for buying and selling: the bottom range is between $58,900 and $63,300; the short-term top range is between $69,000 and $71,000.

04

Macro Analysis

@Cosmo Jiang: When should you sell long on Ethereum ETF?

1. Bitcoin ETF is a "buy rumor, sell news" event

In our November 2023 Blockchain Investor Letter, we discussed our view that the launch of a spot Bitcoin ETF would be a “buy the rumor, sell the news” event.

We wrote that an ETF would fundamentally change how Bitcoin is accessed, and that unlike previous major launches that marked the peaks of previous cycles (CME futures launch and Coinbase listing), this time around is different.

The launch of the Bitcoin ETF was a “buy the rumor, sell the news” event. Here are the results:

The market reacted positively after initial news of the possible approval of an Ethereum ETF. Ethereum initially surged 25% after early signs of possible ETF approval. Grayscale’s closed-end Ethereum Trust ETHE’s discount narrowed drastically from 21% to just 1% in a matter of days.

Similar to the Bitcoin ETF earlier this year, an Ethereum ETF could attract a large influx of new investors, opening the door to investors who were previously excluded due to compliance reasons or brokerage account restrictions. In addition, we believe that for certain investor groups, the promotion of Ethereum as a "technology platform" may be easier to understand and accept than the promotion of Bitcoin as "digital gold".

Some may argue that Ethereum’s underperformance over the past 1.5 years could make it a strong candidate for a catch-up trade. Additionally, low expectations for inflows could provide a great opportunity for a surprise upside.

However, potential outflows from ETHE (similar to outflows from Grayscale’s converted Bitcoin ETF GBTC) could provide some initial resistance. However, the likes of 3AC and Genesis have less forced selling than GBTC; therefore, outflows may be less severe.

Furthermore, compared to the one-day gap between the SEC’s approval of the spot Bitcoin ETF and subsequent trading, the Ethereum ETF will begin trading much later after the approval date, so investors will have ample time to act on this information.

2. Ethereum ETF and possible knock-on effects of recent regulatory developments

We believe that the approval of the Ethereum ETF, the passage of FIT21, and the shifting political and regulatory environment for cryptocurrencies will have a ripple effect on the industry. In particular, we believe the long tail of digital assets is likely to benefit significantly.

Market Growth and Diversification - While the launch of a Bitcoin ETF is significant, especially as it relates to the use case of the cryptocurrency as a store of value, the existence of an Ethereum ETF could have a significant impact on the broader universe of tokens. Increased attention on Ethereum could spread to the broader protocol space as investors explore Ethereum as a technology platform.

Technological advancement and innovation - If FIT21 passes the Senate and/or creates a clear framework for token projects, this could accelerate the pace of innovation as entrepreneurs have a clear path to launch their projects with less regulatory friction.

Integration with mainstream financial products - Bitcoin ETFs and now Ethereum ETFs will be offered on a typical RIA along with 2,844 other securities. We believe that over time, blockchain will be viewed as just another asset class.

More Crypto ETFs – Earlier this year, many speculated that the approval of a Bitcoin ETF could pave the way for other cryptocurrency ETFs. This is indeed the case. The question now is, with the Ethereum ETF approved, what’s next? BlackRock’s ETF approval record currently stands at 577/1. Monitoring their next move may be illuminating.

Tokens as a form of capital formation — One of our core arguments is that many blockchain-based businesses will choose to organize using tokens rather than equity. Creating a regulatory framework where these tokens can begin to reflect the fundamental value creation of the underlying protocols, and share these cash flows in novel ways with the token holders who contribute to the protocols, is a critical step toward achieving this future.

All in all, the passage of FIT21 and the approval of an Ethereum ETF represent a significant shift in the regulatory and political landscape for cryptocurrency in the U.S. For a while, the industry seemed to be at an impasse, with no idea when progress would be made. We are now in motion.

While this regulatory framework will undoubtedly undergo multiple revisions, it provides a good start. These developments could usher in a new era of cryptocurrency innovation, attract a wider base of investors and users, and ensure that the U.S. cryptocurrency industry does not lag behind the rest of the world.

05

Research Reports

@Miles Deutscher: Million-level projects overwhelmed this round of Altcoin market

In the cryptocurrency space, the over-fragmentation of Altcoin has become a core factor in their weak performance in this cycle. After further research, I found that this fragmentation poses a serious threat to the overall health of the cryptocurrency market. Unfortunately, it seems that we have not yet found a clear solution to this challenge.

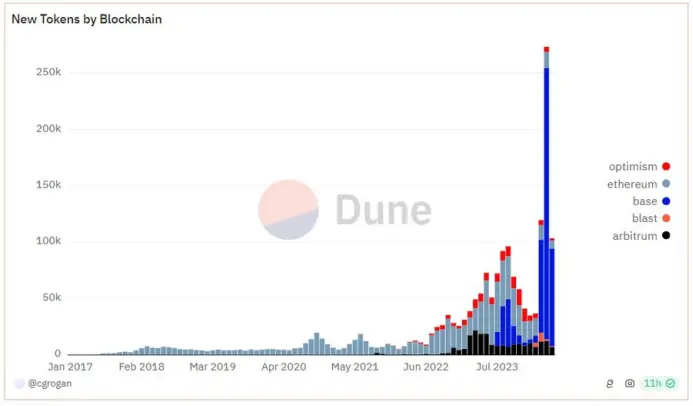

1. 1 million tokens launched since April

Interestingly, the largest quarter of venture capital funding ever ($12 billion) occurred in the first quarter of 2022.

This marked the beginning of the bear market (yes, VCs accurately timed the market's top).

Launching a project in a bear market is tantamount to a death sentence.

Low liquidity + poor sentiment + lack of interest means many new bear market projects die as soon as they come to market.

Therefore, the founders decided to wait for the market to reverse.

Finally, they waited for it in the fourth quarter of 2023.

(Remember, the biggest surge in VC funding was in the first quarter of 2022, 18 months ago).

After months of delays, these projects finally waited for market conditions to improve and launched their tokens. As a result, they took action and launched new projects one after another, entering the market continuously. At the same time, many new players also saw these bullish market conditions as a good opportunity to launch new projects and make a quick profit.

As a result, 2024 saw a historic number of new project launches.

Here are some stats. They’re crazy. Over 1 million new crypto tokens have been launched since April alone. (Half of these are meme tokens created on the Solana network).

According to Coingecko data, the current number of crypto tokens in the market is 5.7 times that of the peak of the bull market in 2021.

2. There is $150-200 million of new supply pressure every day

Although Bitcoin (BTC) has reached an all-time high in this cycle, the over-fragmentation of the cryptocurrency market and the emergence of a large number of new projects have become the most serious problems at present and one of the main reasons for the market's continued struggle this year.

why?

The more tokens are issued, the greater the cumulative supply pressure on the market.

And this supply pressure is "additive".

Many 2021 projects are still being unlocked, and the supply is "superimposed" every year (2022, 2023, 2024).

Current estimates suggest that there is approximately $150 million to $200 million of new supply pressure per day.

This continued selling pressure has had a huge impact on the market.

Think of token dilution as inflation. Just as excessive money printing by governments causes the purchasing power of the dollar to decline relative to goods and services, an excessive supply of tokens in the cryptocurrency market reduces the purchasing power of those tokens relative to other currencies, such as the dollar. Excessive fragmentation of Altcoin is effectively the cryptocurrency version of inflation, and it poses a serious threat to the overall health of the market.

And it’s not just the number of newly issued tokens that’s a problem, the low market cap/high circulation mechanism of many newly issued projects is also a big problem, which leads to a) high degree of fragmentation, and b) constant supply pressure.

All this new issuance and supply would be good if new liquidity entered the market. In 2021, hundreds of new projects are coming online every day — and everything is going up. However, that is not the case right now. So we find ourselves in the following situation:

A) insufficient new liquidity entering the market,

B) Huge dilution/selling pressure from unlocking

3. How can the situation be reversed?

First, I must emphasize that a key problem facing the cryptocurrency market is the lack of sufficient liquidity. Compared to traditional markets such as stocks and real estate, the over-involvement of venture capital firms (VCs) in the cryptocurrency field has become a significant and harmful problem. This over-skewed financing model has led to retail investors feeling frustrated that they cannot win from it, and if they feel that there is no chance of winning, then they will not actively participate in the market.

The meme tokens that have dominated the market this year are exactly where retail investors are looking for a way to win after feeling the lack of profit opportunities elsewhere. Because many high FDV (fully diluted valuation) tokens have done most of their price discovery in the private markets, retail investors often cannot get the 10x, 20x, or 50x returns that VCs can.

In 2021, retail investors will have the opportunity to snap up certain launch tokens and earn literally 100x returns. However, during this cycle, with many tokens being issued at extremely high valuations (e.g., $5 billion, $10 billion, or even $20 billion+), there is little room for price discovery in the public markets. When the unlocked portion of these tokens begins to flow into the market, their prices tend to continue to fall due to the massive increase in supply, creating further challenges for retail investors.

This is a complex and multi-dimensional question that involves multiple aspects and participants in the cryptocurrency market. Although I cannot give all the definitive answers, here are some thoughts and perspectives on the current dynamics of the cryptocurrency market.

Exchanges can strengthen the fairness of token distribution

Teams can prioritize community allocations and larger pools of funds from real users

A higher percentage could be unlocked at token issuance (perhaps implementing measures such as a tiered sales tax to discourage sell-offs).

Even if insiders don’t enforce these changes, the market will eventually do so. Markets always self-correct and adjust, and as the effectiveness of current models diminishes and the public reacts, things may change in the future.

At the end of the day, a more retail-oriented market is good for everyone. For projects, venture capital, and exchanges. More users is good for everyone. Most of the current problems are symptoms of short-sightedness (and the industry’s immaturity).

Also, on the exchange side, I’d also like to see exchanges be more pragmatic. One way to offset the crazy new listings/dilution is to be equally ruthless on delistings. Let’s clear out those 10,000 dead projects that are still sucking up precious liquidity.

The market needs to give retail investors a reason to come back. At least, this can solve half of the problem.

Whether it’s the rise of Bitcoin, an Ethereum ETF, a macro shift, or a killer app that people actually want to use.

There are many potential catalysts.

Hopefully I have been able to provide some understanding to those who may be confused as to the recent price action.

Fragmentation is not the only issue, but it is certainly a major one – and one that needs to be discussed.