Liquid Staking is emerging as a breakthrough solution that allows Solana users to maximize returns from Stake SOL Token without locking up assets. The article provides an in-depth analysis of the operating mechanism, benefits, potential risks, and DeFi applications surrounding Liquid Staking on Solana.

Introduce

In February 2021, Solana validators voted to enable Stake rewards and inflation for the SOL Token. This move allows regular SOL Token holders to Stake their SOL with their chosen validator to verify on chain transactions, and in return, users will earn profits on their Stake Token . them in exchange for securing the Solana blockchain.

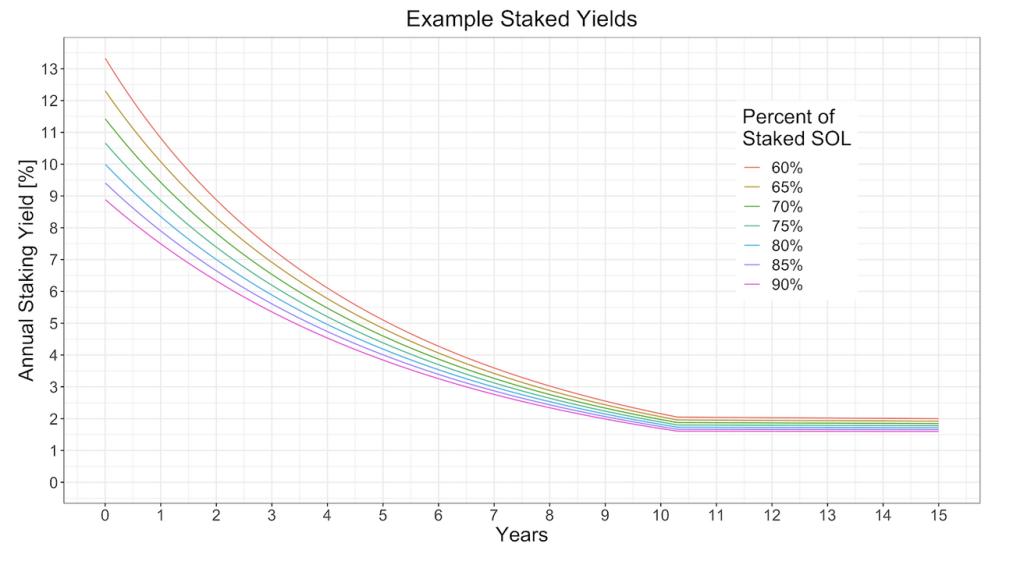

This return is based on many factors including Solana's current inflation rate, the total amount of SOL Stake across all validators, and the specific validator's performance and commissions during that period. Solana starts with an initial annual inflation rate of 8% , with this rate decreasing by 15% each year to achieve a long-term annual inflation rate of 1.5% .

There are currently around 1,750 active validators on the network and over 65% of the total SOL supply is Stake.

By default, Stake SOL Token with a validator will keep the Token locked to the validator, preventing users from using their Token as collateral. Unstaking also subjects users to a period of approximately 48 hours, as users will only receive their SOL Token back at the end of the epoch.

And that's where Liquid Staking comes in.

How does Liquid Staking work?

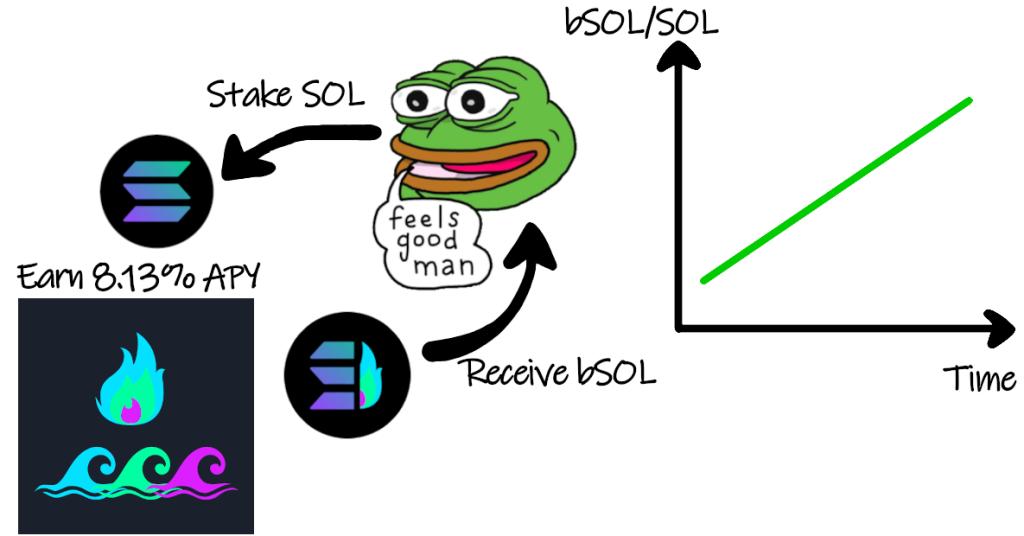

Liquid Staking protocols return users a receipt Token in exchange for Stake SOL . This Token represents the user's Stake SOL and is used to redeem them (along with earned rewards).

Taking SolBlaze as an example, users who deposit into SolBlaze will receive bSOL, which represents their Stake SOL to the protocol. Rewards are automatically accumulated into the bSOL Token , resulting in bSOL increasing in value relative to the value of SOL over time.

This Stake reward is distributed by all Stake protocols. Liquid Staking additionally enables the use of receipt Token in DeFi applications, allowing Stake to further leverage their Stake SOL . However, these strategies are not without risk, which we will XEM a closer look at at the end of this article.

Why should you choose Liquid Staking?

Liquidation and flexibility

Liquid Staking allows Stake to use Liquid Staking Token in DeFi protocols to earn additional profits, such as by providing liquidation on decentralized exchanges (DEXs) and lending on protocols currency market.

Improved Solana decentralization

In traditional Stake , most users delegate their SOL Token to a single validator, and usually only to the top validators who already hold most of the Stake SOL . This is said to create a centralization risk for Solana because SOL is Stake centrally to a small portion of the total number of active validators. The top 21 validators on Solana hold more than 33% of the total Stake. If these 21 validators collude to act in a negative way, they can censor transactions or sabotage the blockchain.

Liquid Staking protocols seek to mitigate this centralization risk. When users deposit their SOL Token into these protocols, these Token are distributed to hundreds of validators to further decentralize the network. This further increases Solana 's security and resistance to malicious attackers.

Each Liquid Staking protocol has its own selection of validators managed to create a balance between high rewards, high quality, and scale to improve decentralization in the network without affecting Stake rewards for their users. .

Token incentives

Liquid Staking protocols often offer private Token incentives. Protocols like Marinade and SolBlaze reward their users with their native Token , MNDE and BLZE respectively. Jito Network, another popular provider, rewarded users with a JTO Token Airdrop , based on the amount and duration of SOL Stake with them before the Airdrop.

Overview of Liquid Staking on Solana

Today, Liquid Staking protocols account for over 80% of TVL on Solana at $3 billion. While there are nearly 30 different Liquid Staking Token and SOL providers on Solana , the majority of Solana 's Liquid Staking SOL is Stake by three leading providers: Marinade Finance, Jito, and SolBlaze.

Marinade Finance

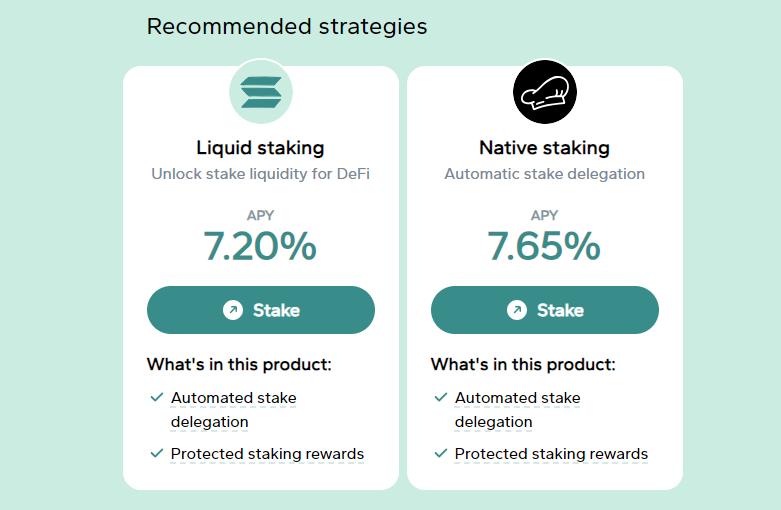

Marinade Finance is the first Liquid Staking protocol on Solana, launched in March 2021. Currently, they offer both Liquid Staking and Native Staking.

Native Staking, also known as Marinade Native, allows depositors to Stake with a certain number of validators, without going through a smart contract, while still maintaining custody of their Token . Marinade Native targets institutional investors who seek to Stake their SOL holdings for profit but may not want to accept the smart contract risks associated with Liquid Staking or the centralization risks involved. involves direct Stake with a single validator.

Products are provided by Marinade Finance

Jito

Jito launched in November 2022, following the demise of FTX. Jito quickly gained popularity in the second half of 2023 with a rewards program and then an Airdrop in December.

One aspect of Jito's product involves Maximal Extractable Value (MEV), which is the profit generated from how validators sort, include or exclude transactions in a specific block. MEV traders, sometimes called prospectors, can pay validators to arrange transactions in specific ways to seek profits from these transactions. Jito's validator client, which runs on all validators that Jito authorizes, previously included MEV functionality. Jito promoted its Liquid Staking pool as one that grants users MEV rewards on top of their Stake profits.

However, in March 2024, Jito disabled MEV functionality on their validator client, citing its negative impact on Solana users due to the ' sandwich attacks ' it enabled .

SolBlaze

SolBlaze is the last of the three companies to launch, having only appeared on the market in 2023. Currently, it has the most validators with 305, compared to Jito's 148 and Marinade Finance's 292.

SolBlaze is also the first company to launch custom Liquid Staking , allowing Liquid Staking users to Stake with specific validators or groups of validators of their choice.

DeFi & Liquid Staking Token

One of the main strengths of Liquid Staking Token is composability. This means these Token can easily be used in DeFi applications.

Provide liquidation

Users can deposit their Liquid Staking Token into liquidation pools on the DEX to facilitate swaps between Liquid Staking Token and other Token on Solana. In return, users earn fees from swaps made within their liquidation pool as well as any other Token incentives provided by the specific protocol. A popular strategy among traders looking to avoid temporary losses (a common problem for DEX LP ) is to provide liquidation to other Liquid Staking Token or the SOL itself. wrapped to reduce price fluctuations. While returns from this method are typically lower due to the large number of LP, it is considered by many to be less risky and tends to be popular with DeFi newcomers.

Loan market

Another commonly used strategy is to lend Liquid Staking Token on money market platforms or DEXs in perpetuity. Users aim to earn from interest payments made by borrowers on the respective platform. Some platforms such as Kamino Finance and MarginFi support major Liquid Staking Token such as JitoSOL, mSOL and bSOL.

A factor for lenders could also be the ability to borrow on their deposited Liquid Staking Token . Currently, Kamino Finance allows loans on Liquid Staking Token with loan-to-value ratios up to 45%. Simply put, this means that with a $1,000 mSOL deposit, users will be able to borrow up to $450 at a set interest rate.

Leveraged Staking

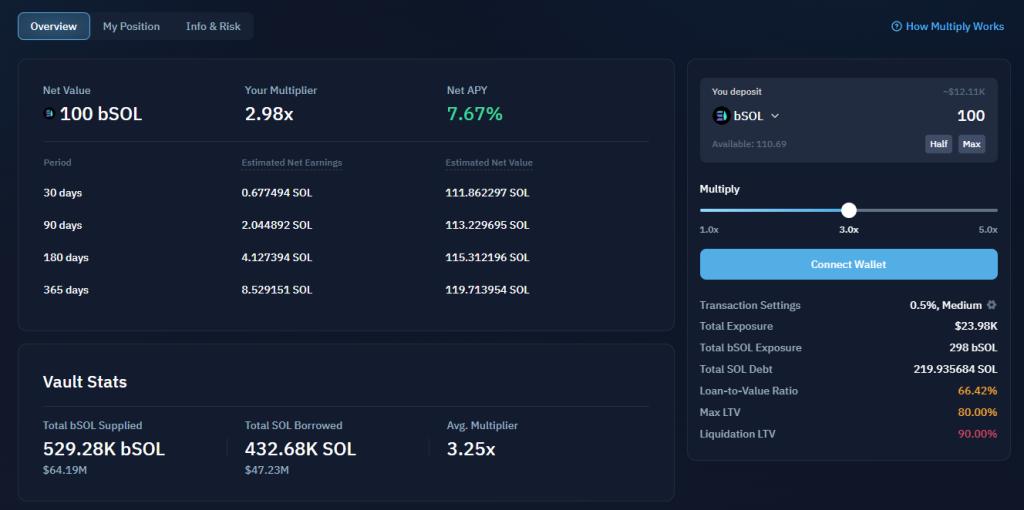

This refers to a situation where users use leverage to Stake significantly more SOL than they currently have by borrowing SOL through money market platforms. For example, Kamino Finance supports this strategy in their “Multiply” product, allowing users to leverage their Stake up to 5 times.

When users deposit their Liquid Staking Token , Kamino will use a Flash Loan to borrow SOL using their deposit, which will be immediately swapped for the target Liquid Staking Token (in case This is bSOL). This batch of Liquid Staking Token is deposited into Kamino's Lending product, from which SOL is borrowed to repay the initial Flash Loan .

This strategy, like most leveraged strategies, is not without significant and material risks. The use of higher leverage may result in liquidation during high price volatility events. Additionally, socialized losses on lending platforms are often distributed among all users, which can also push highly leveraged positions toward or even liquidation.

Risks of Liquid Staking

Non-exhaustive overview of the risks associated with Liquid Staking:

Smart contract vulnerabilities

One notable risk that Liquid Staking Token are subject to is smart contract risk. Since the Token Issuance and withdrawals of SOL deposits are governed by smart contracts, vulnerabilities in the Liquid Staking smart contract can be exploited leading to loss of funds for depositors.

Lost Peg

One of the main reasons why people prefer Liquid Staking over traditional Stake is the ability to swap between Liquid Staking Token and the underlying asset without having to wait for the unstaking period.

Under normal circumstances, Liquid Staking Token trade in tandem with their underlying assets. Using Marinade's mSOL example, 1 mSOL is currently equivalent to approximately 1.1886 SOL at the time of writing. This ratio is not 1:1 and will continue to increase over time as it includes cumulative rewards from Liquid Staking.

During periods of strong market volatility, Liquid Staking Token may deviate from the expected price. This is called peg loss. Losing the peg makes it difficult for the holder to swap to the underlying asset without incurring a significant loss. For Liquid Staking Token with a low amount of liquidation provided, this risk is significantly higher. If your Liquid Staking Token are used as collateral for a loan in a peg loss event, this may also result in liquidation if the value of your collateral falls below the required threshold.

A real case study is that in December 2023, mSOL lost a significant peg, when mSOL/ SOL fell from 1.14 to a low of 1.01 before recovering during the day. The peg loss event was the result of selling a large amount of mSOL for SOL into an insufficient liquidation pool. Arbitrageurs identified the opportunity and quickly purchased mSOL Token , bringing the Token back to its expected price.

Slashing

On Proof-of- Stake blockchains, validators are responsible for securing the network. Slashing is a punishment mechanism in which a portion of a validator's Stake is confiscated in case they do not comply with the rules of the blockchain. These violations can include double signing, extended downtime, or direct manipulation of the network.

In most Liquid Staking solutions, users do not choose their validator but instead delegate to several validators based on the delegation strategy of the Liquid Staking protocol. This can lead to a loss of user deposits if the validator in the selection is Slashing.

Regulations

Since Liquid Staking is a concept that exists only in the cryptocurrency space, the regulations surrounding these Token are still unclear. Future regulatory action may affect the existence of such services and Token .

Conclude

Liquid Staking has been emerging as a promising solution in the Solana DeFi ecosystem, allowing users to optimize asset performance and deepen participation in the network. The impressive growth of Liquid Staking protocols, demonstrated by TVL, shows its enormous appeal and potential.

However, along with the opportunities to increase profits, Liquid Staking also carries significant risks. From smart contract vulnerabilities, risk of losing peg, Slashing to incomplete legal framework, all are factors that need to be carefully researched by investors before participating.

For Liquid Staking to truly realize its potential and become an indispensable part of Solana DeFi, the entire community needs to join hands in perfecting the technology, raising risk awareness and building a legal framework. Clear and transparent rationale.