Original author: Zixi.eth

Let's update our recent views on ton, DLDR, and the following is the material for everyone to read slowly:

The Ton ecosystem is still in its early stages. Ton has great potential, but projects in the Ton ecosystem may not have a chance for large funds.

After Ton started building its ecosystem in the second half of last year, we saw the first wave of the Ton ecosystem explosion this year. Overall, the Ton Foundation has very good execution capabilities and it took less than a year to take shape.

Ton foundation is very clear about what should be decentralized and what should be centralized. For example, wallets and payments should be centralized, which was one of WeChat's core competitiveness back then, and Ton is also very clear about it. Only when the problem of fund custody security is solved (everyone will trust TG's technology, and wallets will not be lost), simple payment of funds (no need to use cumbersome bank card payments, all on-chain through Ton/U), and simple and easy to use (no need to go to metamask or okx wallet, or jump 78 times when buying things on Taobao in the early years), can the web3 version of WeChat payment be truly realized. Other ecosystems adopt the idea of crypto native, outsource everything, and encourage the community to do it.

The profit model of ecological projects no longer needs to be like a simple web2/3 project, and the profit model has begun to diversify. The Web2 model can collect advertising fees, sell users to exchanges, sell value-added services in games, charge subscription fees, and not issue coins. The Web3 model can charge financial protocol fees such as defi, sell NFTs, and issue coins.

The characteristics of TG are that it has basic traffic and solves the payment problem. These users have certain crypto knowledge, but the users are scattered in low-value areas, and the unit value of most users is not high. Does this mean that Ton should not make web3 financial tools, but should be more inclined to web2 traffic strategy?

Ton ecosystem itself is an HTML5 web2 company, but it adds blockchain at the payment/settlement level. Similarly, why do these projects have to add Ton? In theory, it is entirely possible to use tg's traffic, and then use polygon, or solana, or other L2. Returning to the essence, TG has traffic, and Ton provides settlement. Other ecological projects do not have to start from scratch, they can just add Ton (just like travala booking air tickets and hotels, Oobit crypto payment, Ton is a good embellishment, not the core)

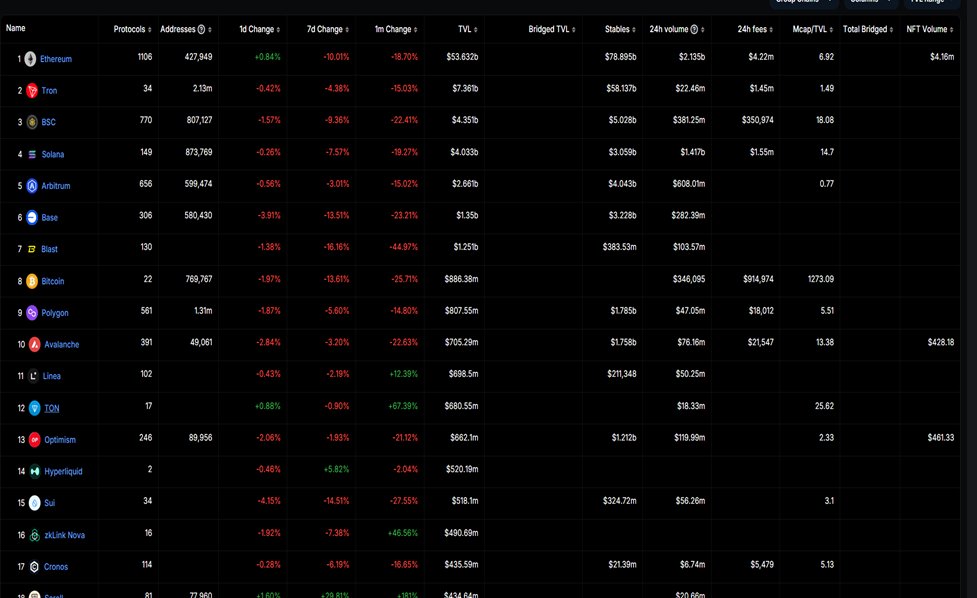

The TVL on the chain is growing fast, but it is limited by the small market value of Ton, so the ceiling will be relatively small. DeFi should still be done on BTC and Ethereum. However, Ton is different from BTC and Ethereum. Ton's chips are relatively concentrated. Do Ton's core stakeholders have financial needs? I am personally conservative about innovation on the asset side that is not BTC and Ethereum. This is no longer the era of DeFi and finance.

TG is a completely unregulated environment. This means that those who do traffic and casino business are completely free from legal supervision.

At present, it may make more sense to do business on the project than to invest in it. A large number of projects have already achieved considerable income, such as Catizen's income exceeding 10 million US dollars and Hamster's daily income of one million US dollars. However, as an investor, the profit and loss ratio is not high.

The life cycle of projects here may be shorter. For example, most users of Catizen and Hamster are freeloaders. Once the token is issued, the freeloaders will dump the market, and the project will basically end by 50%. Is it possible to evolve into an extreme ROI business?

Crowdsourcing projects may be naturally suitable for TG. It is also because TG gathers a large number of non-high-value people (the user profile may be a bit similar to YGG). Are crowdsourcing projects with positive cash flow suitable for TG? For example, data labeling, data collection for autonomous driving, and food delivery.

TG is currently the fifth largest social platform, founded by the Durov brothers in 2013. Ton was established in 2017, the mainnet was launched in the second half of 2021, and it was not until 2023 that it began to officially promote and operate. Ton's comparable objects are Solana and Base, because both Solana and Base are high-performance public chains with obvious 2C attributes. Solana used to rely on FTX, Base relied on Coinbase, and Ton relied on TG, all of which have certain traffic carriers. Judging from the current Weekly active wallet, Ton's growth has surpassed Base, and is currently close to half of Solana. At present, Ton's play style is completely copied from WeChat applet, starting its own unique web3 road.

(Image source: folius ventures)

In 13 years, the Durov brothers founded TG;

In 2018, Pavel Durov launched TON and raised $1.7 billion in ICO.

In 2020, under the entanglement of the SEC, TG gave up the leading development of TON; at the same time, the TON community established the TON Foundation to continue to lead the development of TON;

The mainnet will be launched and the token will be issued in September 21;

During the period from 2021 to the beginning of 2022, the Ton foundation and miners accumulated 80%+Ton chips;

In September 2023, TG announced an exclusive partnership with Ton, and its ecological strategy was to copy and paste the WeChat applet.

In February 2024, Pantera invested $300m in Ton;

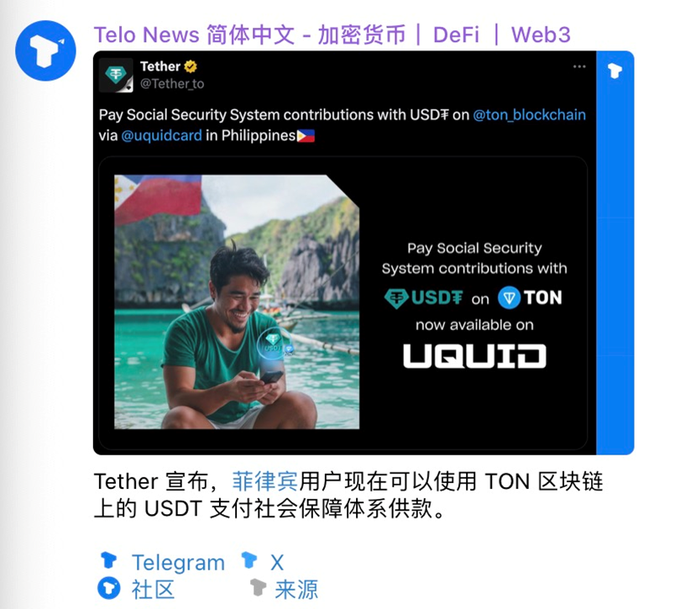

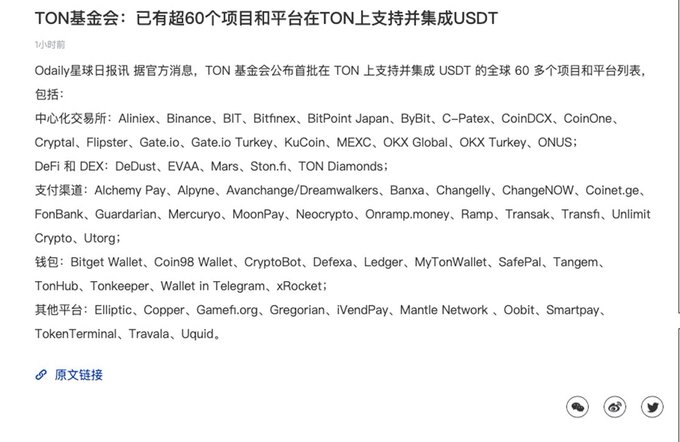

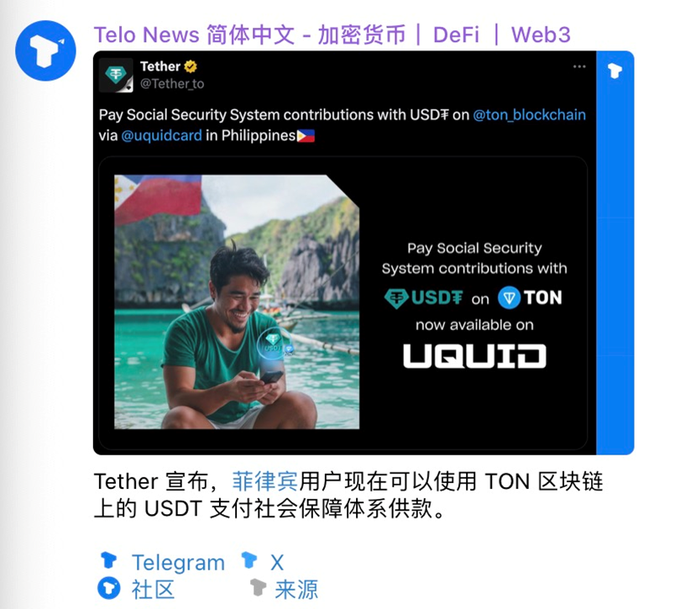

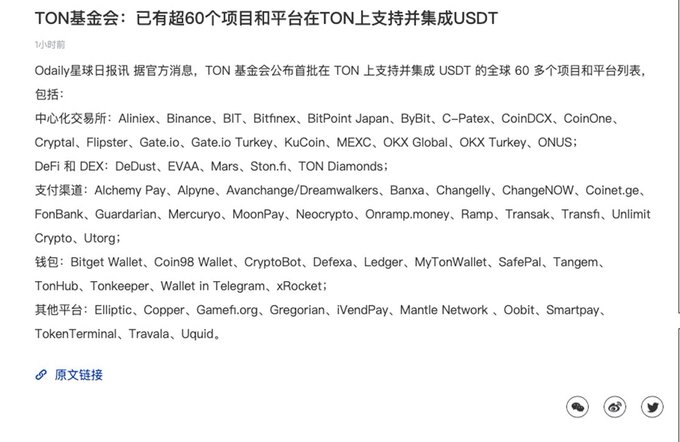

In April 2024, Tether began to deploy USDT on Ton, and users were able to start transferring money through TG;

In June 2024, Notcoin/Hamster/Catizen and others started to become popular in TG.

The risk of highly concentrated chips needs to be considered.

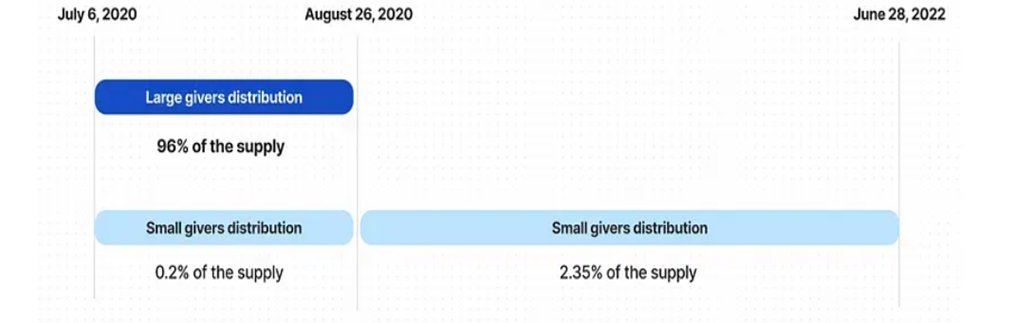

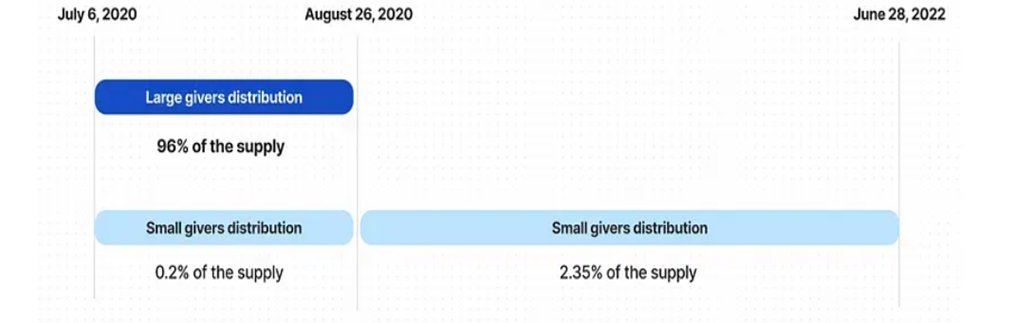

There are two types of contract addresses: Small Givers and Large Givers. The latter distributes more tokens each time (100,000 each time instead of 100), but requires more computing power.

Telegram launched token mining on July 6, 2020, transferring tokens through system addresses to 20 contracts that distribute tokens.

Mining lasts from July 6, 2020 to June 28, 2022, but almost all tokens issued were distributed in the first 51 days:

From July 6, 2020 to August 26, 2020, Large Givers distributed 4.8 billion (96%) tokens, and Small Givers distributed 9.9 million tokens (0.2%);

From August 27, 2020 to June 28, 2022, Small Givers distributed 117.3 million tokens (2.35%).

It is worth noting that a total of 3,278 unique addresses participated in mining, but only 248 addresses participated in the Large Givers allocation. Therefore, we know that 96% of TON's supply was allocated to 248 addresses. Moreover, these 248 addresses are closely connected: we found that many groups of miner addresses are associated with each other and have the same patterns, such as the start and end time of mining or the operation of mined tokens. We also found some retail activity, but the majority of the token supply was mined by a group of interconnected whale.

Source: Whiterabbit

Judging from the structure of the chain, it seems to be a good technical route in 2021. The chain is directly modularized.

The development language of Ton is different from the mainstream web2 and the solidity of Ethereum EVM. Ton has developed its own TVM (Ton virtual machine) and uses three programming languages: Fift, FunC and Tac. These three languages are special development languages on Ton and are relatively new. The overall developer ecosystem is relatively early, mainly because the programming language is relatively early.

FunC is a high-level language designed specifically for programming smart contracts on the TON blockchain. It is a domain-specific, C-like, statically typed language. FunC is used to write smart contracts, which are then compiled into Fift assembly code, which ultimately generates the bytecode for the TON Virtual Machine (TVM). Fift is a low-level assembly language, and FunC programs are compiled into Fift assembly code. Fift is closer to the bottom layer and is usually not used directly to write smart contracts, but rather as an intermediate representation between FunC and TVM bytecode. Tac is designed to provide a higher level of abstraction than FunC while maintaining compatibility with the TON virtual machine.

FunC is a variant of C language, which is a bit similar to C/C++. Ton chose FunC because TG was written in C. Ton abandoned the crypto native idea of EVM solidity and defined its own function as assisting TG in building an ecosystem. This means that Ton is not designed for Web3 Geeks. More scenarios are landing on ordinary web2 users. To put it bluntly, it is a blockchain for TG users, so some technical shadows, such as high concurrency and asynchronous structure, refer to the architecture of web2. So from the perspective of developer ecology, the play style is very web2+web3. This can be seen in the subsequent ecological development.

Why is the ton ecosystem attracting everyone’s attention now?

1. True web2+web3. TG dapp (mini program) has web2 as its main business, and crypto is just a value add. For example, games can generate a lot of revenue through web2 profit models such as advertising, and can avoid the original crypto model of spending money on marketing and data + listing + cutting a wave and running away. In addition, through crypto global payment, cross-border e-commerce/overseas business/airplane and hotel reservations can have new payment expansion channels.

2. Low development cost. Most mini-programs can be deployed through HTML5, and TON provides a series of technical development documents and templates, allowing developers to complete deployment without writing code from scratch. According to feedback, project parties with a Web2 background can complete the deployment of a mini-program within two or three days .

3. For Web3, the Ton ecosystem has opened up new possibilities for project developers. It is no longer obsessed with crypto native tracks such as Infra/DeFi, but supports developers to build products based on multiple fields such as social, games, e-commerce, and cross-border business, thereby broadening the range of choices for project developers.

Finally, when developers develop in the TON ecosystem, they can complete the interaction and integration of multiple products on the Telegram platform. For users, the mini-program applications of the TON ecosystem have obvious advantages in terms of interaction. Users do not need to leave the Telegram platform, and can complete one-stop interactive operations by clicking on the wallet mini-program, without switching to external wallets such as MetaMask. In addition, the wallet on Telegram already supports users to deposit funds with legal currency OTC, that is, users can directly use credit cards to purchase encrypted assets, realizing seamless interaction from capital injection to various applications on the chain.

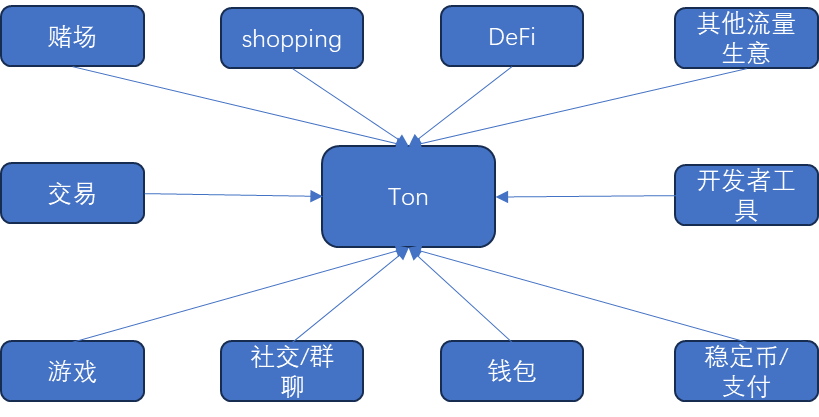

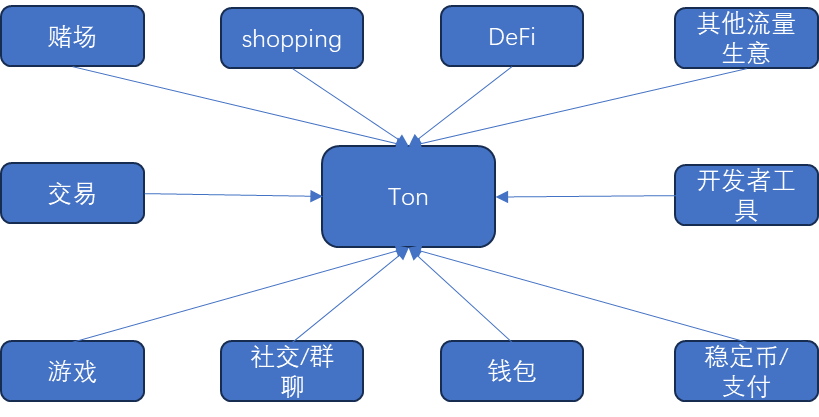

Below is the Ton ecosystem. Currently, games and social networking are hot. Currently, most of the game ecosystems are tapgames, i.e., tap-tap, match-3 and other rustic games. They mostly use HTML interface + crypto native economy + advertising fees for profit, but they have a large number of users and are currently hot-selling games. In the Ton ecosystem, games are still in a red ocean competition, but cross-border e-commerce, encrypted payment and other web2-oriented scenarios are relatively blue oceans.

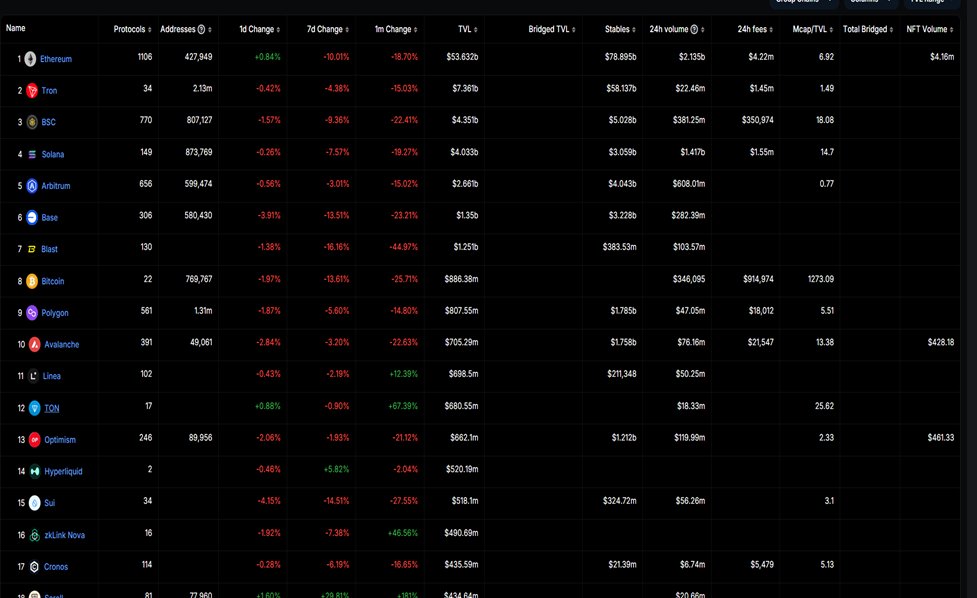

DeFi - TVL performance is not outstanding, after all, it is not a crypto native public chain

Ton's DeFi performance is relatively average, with an overall TVL of only 680 million, which is not even as good as midstream L2s such as Linea and Blast, but it also makes sense. Ton has not advertised itself as a crypto-native public chain since the first day of its development, so DeFi is not the focus of its ecological development.

Stablecoin/payment/wallet——priority strategy, payment ecosystem with web2 experience

Since 2017, Telegram has been exploring its own business model, whether it is payment services, advertising, or ICO financing that was paused by the US SEC, but the final result was not ideal. Last year, Pavel Durov revealed that the annual cost of maintaining the normal operation of Telegram is about US$630 million.

According to the Wall Street Journal, Telegram had accumulated $700 million in debt by April 2021. Therefore, since the beginning of 2021, Telegram has publicly issued excess bonds worth hundreds of millions of dollars several times, and in March this year, it also obtained $330 million in funds through the sale of bonds.

Telegram is often seen as the Web3 version of WeChat. From the perspective of active users, Telegram and WeChat are not much different. WeChat has about 1.2 billion active users, and Telegram has 900 million and is still increasing. However, they are very different in terms of profit methods. Payment is the main commercialization path of WeChat. Compared with WeChat, Telegram will also choose payment. However, since Telegram is not regulated and cannot obtain mainstream financial regulatory licenses, it only has the Web3 payment path, and its founder Pavel Durov entered the Crypto industry very early.

Since the beginning of this year, Ton has begun to focus on the stablecoin strategy, introducing USDT to the Ton chain and providing subsidies. Users who have passed KYC (including mainland China, Singapore, etc.) can stake USDT through TG's official wallet Ton space. Ton officials have given 50% APY and a maximum reward of 3,000U/two months to attract deposits, and the interest is paid in Ton currency.

After two months of development, the issuance of Ton USDT has rapidly increased from 100 million to 500 million. Ton USDT can be transferred directly to friends through the wallet, just like transferring money to friends through WeChat. In addition, the money can be withdrawn, which is completely different from traditional on-chain payments.

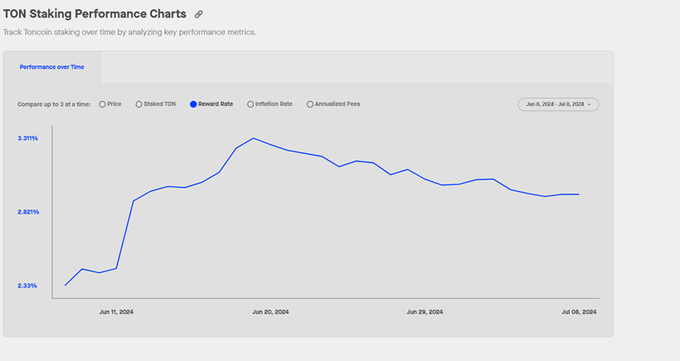

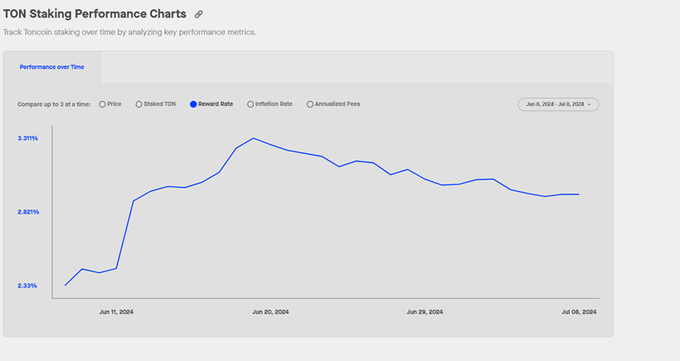

Normal non-Ethereum public chains usually have a staking ratio of more than 50% and offer higher APY to attract miners. However, Ton’s staking ratio and reward ratio are relatively low. I guess it’s because:

1. Most of the chips are still in the hands of Ton foundation/early miners;

2. There are very few chips circulating in the market, and the few chips and the number of pledgers need to be screened again;

3. Reward ratio = inflation + gas fee. Ton’s gas fee is relatively low (0.005*7=0.035U), which only means that the network activity is actually lower than expected (this may be because most of the popular ton ecological projects currently only have the expectation of issuing coins and have not yet been fully launched on the chain). Ton’s inflation is only 0.3%-0.6%, which means that most of the income from Ton staking comes from Ton gas fee, which is different from the measures taken by large public chains such as Solana.

Catizen

Catizen is a project made by an early web2 game team. Before that, they made a project called tap fantasy in 2021, which is an idle H5 game on Facebook. Catizen is an idle synthesis game for raising kittens. Two low-level kittens are synthesized into high-level kittens. The higher the level of the cat, the higher the output. Users can use extra crypto tokens or U to buy additional functions to speed up the output of kittens.

Catizen's in-game revenue has exceeded 10 million US dollars, which was achieved within about two months after the game was launched. In June, the total number of Catizen users exceeded 20 million, the DAU was about 2 million, the on-chain users exceeded 700,000, and the paying users were about 500,000. The on-chain user conversion rate remained at around 10%, and more than 50% of active users were paying users. Based on this, Catizen will gradually launch its own mini-game platform in the future and build itself into Telegram 4399/Steam.

Hamster Combat

Hamster Combat is the most popular tap game on TG. Players earn coins by hanging up/clicking the screen/completing tasks, and consume coins to form a better team to get more coins. The overall focus is on hanging up and cultivating. Hamster is very malignant - you earn one coin for each tap, and you need to click 1,000 times for 1,000 energy. You need to wait for the automatic reply before you can click again. There are 6 opportunities to instantly restore energy every day; fission is also done well; the passive income from hanging up is only valid within three hours of exiting the game, and you need to re-enter the game after the timeout. Hamster is very popular in the Middle East and Southeast Asia, which is very similar to the logic of gamefi in the past. But it is worth noting that Hamster has not issued tokens at present, which means that users only get "points" instead of real tokens. They are more like the party of hair. Hamster's income comes from advertising and importing new customers to exchanges. It is rumored that the daily advertising income is millions of dollars, and the paying group is the exchange.

The other ecosystems are relatively small, so I won’t go into detail, just look at the pictures. For the tracks that the official has personally participated in, third parties may not have much chance to participate in them.