Mt. Gox appears to be moving funds from cold storage in preparation for distribution to creditors, with outflows approaching 100,000 BTC on July 16.

Bitcoin prices fell more than 3% on July 16 as what analysts called “FUD” involving defunct exchange Mt. Gox resurfaced.

Bitcoin prices fell more than 3% on July 16 as what analysts called “FUD” involving defunct exchange Mt. Gox resurfaced.

BTC/USD 1-hour chart.

BTC/USD 1-hour chart.

Source: TradingView Mt. Gox Bitcoin outflows cause price to drop below $6,000

Data from Cointelegraph Markets Pro and TradingView show that BTC prices are under pressure after hitting $65,000 on Bitstamp.

As Mt. Gox’s BTC was moved between wallets associated with its recovery program, the price slipped.

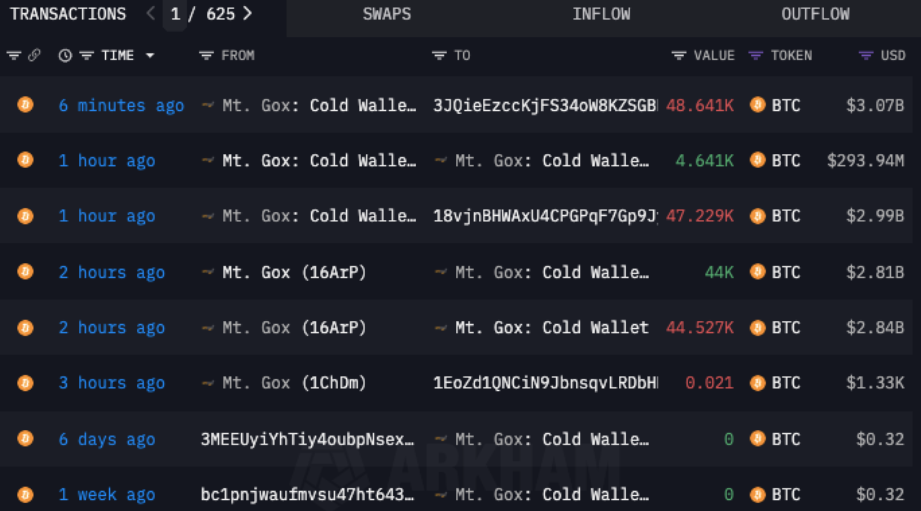

According to crypto intelligence firm Arkham, the amount involved totaled approximately 92,000 BTC (about $5.7 billion) in outflows from Mt. Gox’s cold wallets, representing approximately two-thirds of the exchange’s total holdings.

Mt. Gox cold wallet transaction (screenshot). Source: Arkham

On-chain analysis platform Look Into Bitcoin responded on X (original Twitter): “Mt. Gox transferred $44,527 BTC ($2.84 billion) to an internal wallet 5 minutes ago, and may be preparing for repayment.”

Similar events around Mt. Gox have had an adverse impact on prices , with the market fearing a massive BTC sell-off as a result. Mt. Gox is currently issuing refunds to creditors who lost funds when it was hacked and shut down more than a decade ago.

However, some believe these concerns are out of touch with reality.

“This is the next Bitcoin FUD,” popular cryptocurrency investor and YouTuber Quinten Francois wrote on X Reactions .

As Cointelegraph reported , the sell-side pressure that has spooked the market in recent weeks has also come from the German government, whose confiscated BTC stockpile has now been depleted.

BTC Price Approaches Key “Bull Trend Line”

The flurry of concerns has derailed bitcoin’s best run in months.

Related: BTC price hits all-time high in July? 5 things to know about Bitcoin this week

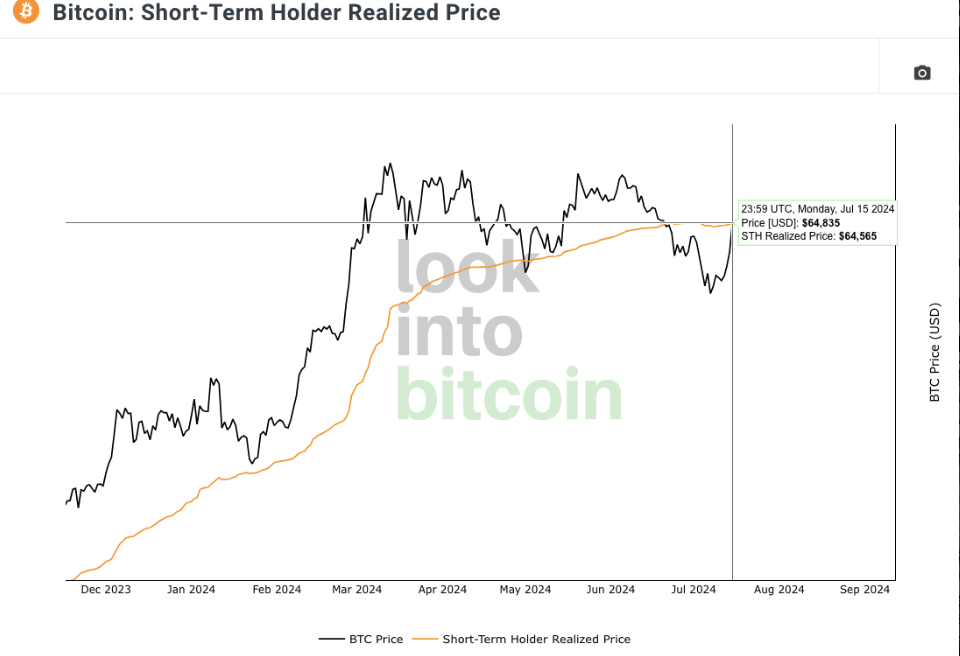

The last time BTC/USD reached $65,000 was on June 21, a significant level that serves as the cost basis for short-term Bitcoin holders .

Speculators' cost basis, also known as realized prices, has traditionally served as support during bull markets and was last breached in August 2023 .

As of July 15, the cost basis for short-term holders of Look Into Bitcoin was $64,835.

Bitcoin short-term holders realized price (screenshot). Source: Look Into Bitcoin