Today, the Ethereum spot ETF began trading in the United States, taking an important step forward in the cryptocurrency market.

The Ethereum spot-backed exchange-traded fund saw trading volume reach $112 million in the first 15 minutes, according to Bloomberg ETF analysts Eric Balchunas and James Seipart.

Ethereum spot ETF debuts in the US

On July 22, the U.S. Securities and Exchange Commission (SEC) approved the final filing of Form S-1 for the launch of an Ethereum spot ETF. Funds from nine issuers, including Bitwise, flocked to major exchanges such as Nasdaq, the Chicago Board Options Exchange, and the New York Stock Exchange (NYSE).

Bloomberg ETF analyst James Seipart reported that the new fund has total assets of just under $10.3 billion.

“The starting asset levels for the Ethereum ETF launching today are as follows: The entire complex starts trading with just under $10.3 billion, almost all of which comes from assets on Ethereum,” he wrote .

Read more: Ethereum ETF explained: What it is and how it works

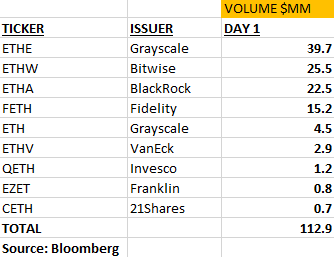

Meanwhile, Eric Balchunas has shown impressive early volume. He noted that the $112 million figure represents about 25% of the Bitcoin fund's first-day trading volume. Bitwise led the group with inflows of $25.5 million.

“A total of $112 million was traded in this group, which is a huge amount compared to a typical ETF launch, but the trading volume for the Bitcoin ETF on the first day was only about half the speed,” Balchunas said. “50% exceeded expectations.” level,” he said .

The launch of the Ethereum spot ETF in the United States shows that cryptocurrencies are gaining greater acceptance in mainstream financial markets. These developments are likely to attract more institutional and individual investors , which could lead to more innovation and growth in the sector.

Amidst the excitement of the spot Ethereum-ETF debut, Ethereum experienced volatility. The price of the second-largest cryptocurrency, which had been on the rise during the session, fell below $3,500. At the time of writing, Ethereum is trading at $3,444, according to BeInCrypto data.

“The price of Ethereum rose to $3,959 in late May before trading below $3,000 in early July. This shows that traders are relatively indifferent to the idea that the price of Ethereum will continue to rise this year. With the launch of this ETF, Ethereum has rebounded to 3,500, but we expect many people to take profits once the ETF is launched,” Markus Thielen, founder and CEO of 10x Research, told BeInCrypto.

Read more: Ethereum (ETH) price prediction for 2024/2025/2030

Either way, the strong initial trading volume shows high demand and interest in Ethereum-based financial products. Stakeholders will closely monitor how the market adapts to this new financial tool and observe its impact on Ethereum price dynamics.