Author: Vince Quill, CoinTelegraph; Translated by: Baishui, Jinse Finance

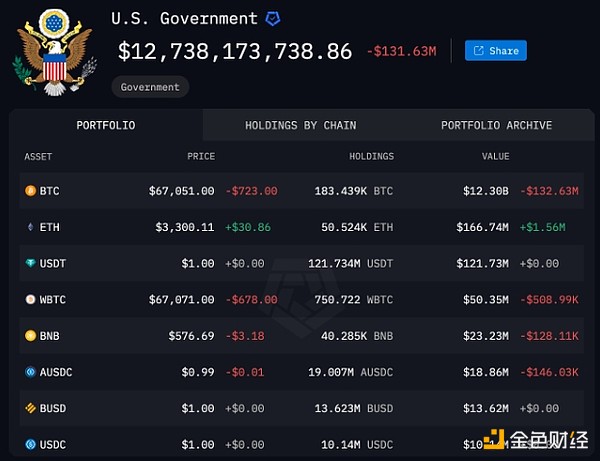

As of this writing, the U.S. government still holds over 183,000 Bitcoins, valued at approximately $12 billion, making it the largest geopolitical owner of the decentralized currency.

According to Arkham Intelligence data, the US government also holds 50,000 Ethereum, 121 million USDT, 40,000 BNB and more than $10 million in USDT.

The most recent transaction from a wallet controlled by the U.S. government occurred on July 29, with an amount close to 28,000 BTC, but the identity of the wallet that controls the recipient is currently unknown.

Cryptocurrency held by the U.S. government. Source: Arkham Intelligence

Bitcoin as a Strategic Reserve Asset for the United States

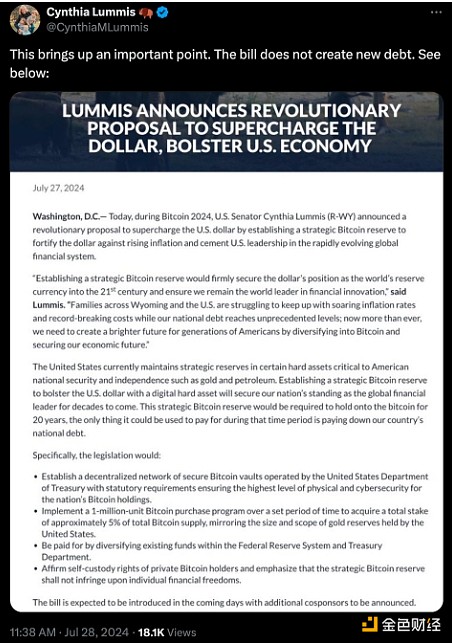

On July 27, the final day of the Bitcoin 2024 conference in Nashville, Tennessee, Senator Cynthia Lummis announced the introduction of legislation to designate Bitcoin as a strategic reserve asset for the United States.

The Wyoming lawmaker proposed a plan to buy 5% of the total supply of Bitcoin and hold the digital commodity as a treasury asset.

Source: Cynthia Lummis

Former President Donald Trump has also hinted at building a strategic reserve of Bitcoin. In his keynote speech at the Bitcoin 2024 conference, the Republican presidential candidate pledged not to sell any Bitcoin held by the U.S. government. Trump said he wants the Bitcoin industry to thrive in the United States and does not want to undermine blockchain innovation through excessive regulation.

Independent presidential candidate Robert Kennedy Jr. has similarly pledged to sign an executive order to transfer the bulk of Bitcoin held by the U.S. government to the Treasury Department and purchase 500 BTC per day until the U.S. owns 4 million BTC.

Not everyone believes the era of BTC strategic reserves is coming

Ari Paul, CIO of BlockTower Capital, believes that there is a low chance that Bitcoin will become a strategic reserve asset for the United States. He said that by 2028, the odds of this happening are 10:1.

The executive explained that the presidential candidate’s informal announcement not to sell U.S. Bitcoin holdings is not enough to establish an official strategic reserve fund.