background

The crypto market hit a freezing point in 2022, and began to recover in Q4 of 2023. In 2024, Bitcoin also broke through the high of $69,000 in the previous bull market. As the market recovers, in addition to paying attention to the performance of the currency price, we believe that the overall financing situation of the crypto market is also crucial.

The prosperity of financing activities represents the driving force of industrial development and will be reflected in :

Promoting technological innovation: Financing is an important driving force for technological innovation. Financial support for the research and development and application of new technologies can promote technological progress in the entire industry.

Market confidence indicator: Venture capital represents investors’ expectations for the prospects of the crypto market. If the overall financing amount and number decrease, it can be seen that external investors are becoming more conservative or even pessimistic about the market prospects.

The positive flywheel effect brought about by financing activities is particularly obvious :

Increase in financing cases: The large influx of funds attracted more investors and venture capital, driving the emergence of more financing cases.

Attracting new startup teams: As financing opportunities increase, more startup teams and companies are attracted to the crypto market to invest in developing new technologies and applications.

The overall ecology has improved: the emergence of new technologies and applications has improved the market ecology, bringing more diversity and innovation.

Increased investor interest: A favorable market ecology and continuous technological innovation have attracted more investor interest and further enhanced market confidence.

In this article, WOO X Research will review the overall financing situation in 2024, and then look at the trends of some well-known VC investment sub-sectors. Finally, we will predict the future potential sectors based on the financing data.

2024 Overall Financing Situation

Financing amount and number: It can be seen that the overall financing market began to pick up in November 2023. The number of financings in a single month in 2024 basically remained above 120 (July has not yet ended), and the monthly financing amount fell between 70 billion and 100 billion. Both the amount and the number of financings have shown significant growth compared to 2023.

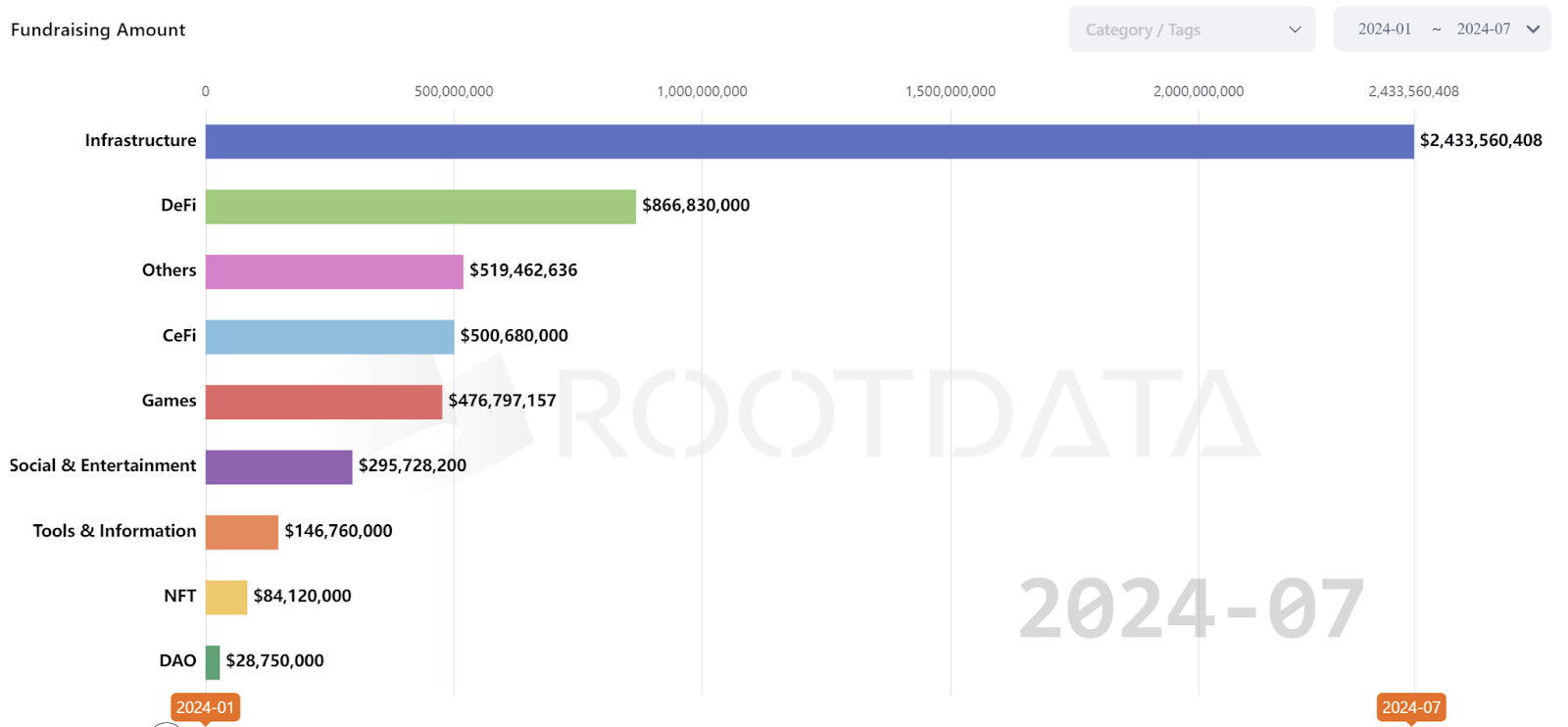

Track performance: Infrastructure is the most popular among investors, with a total of $2.4 billion raised, far exceeding the second-place DeFi of $860 million. It can also be seen that VCs have little interest in DAO and NFT, ranking the last two in terms of financing amount.

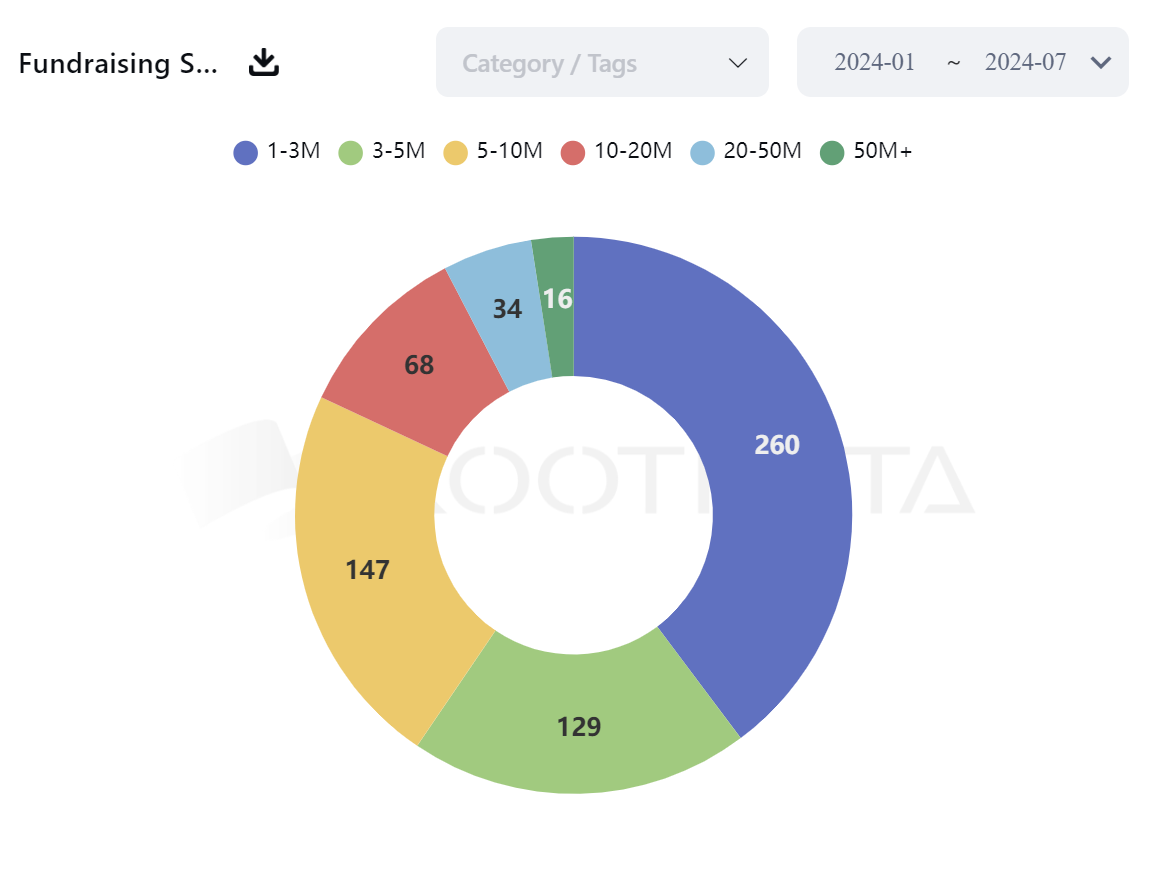

Single financing scale: 1 million to 3 million scale accounts for 40% of the highest, followed by 5 million to 10 million with 22%. The financing scale of 3 million to 5 million has decreased compared with 2023, and the decrease is in the range of 1 million to 3 million and 5 million to 10 million, which also means that the middle range of the financing amount of 2024 projects has decreased, which is more differentiated.

Investment situation of top VCs

This article selects A16Z, Coinbase Ventures, Binance Lasbs, Pantera Capital and Dragonfly as reference objects.

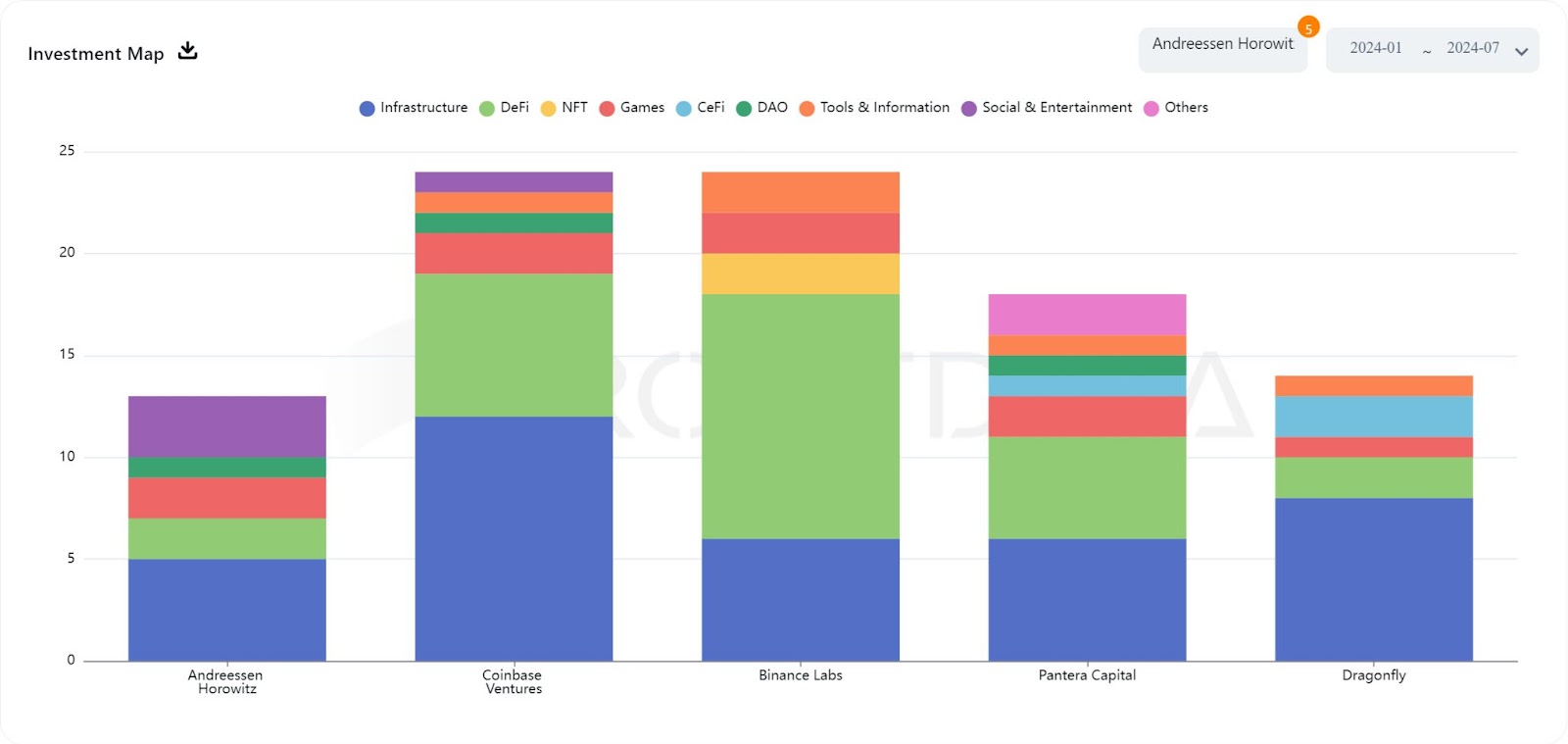

The following conclusions can be drawn from the above data:

A16Z (Andreessen Horowitz): Mainly invests in infrastructure, DeFi and games, and also has some investments in NFT and social entertainment.

Coinbase Ventures: The investment areas are diverse, with DeFi and infrastructure as the focus, and it is also involved in tools and information, social entertainment and DAO.

Binance Labs: Most investments are concentrated in DeFi and infrastructure, followed by social entertainment and games.

Pantera Capital: Mainly focuses on DeFi and infrastructure, and also invests some funds in NFT and other fields.

Dragonfly: The investment scope is wide, with infrastructure, DeFi, NFT, and tools and information accounting for a large proportion.

As with the initial observation of the overall financing situation in 2024, the investment focus of these five top VCs is still infrastructure and DeFi. Let’s take stock of their investment projects:

A16Z: A total of 13 external investments, three of which were lead investments (Friends With Benefits, EigenLayer, Espresso System).

The project that received the highest amount of funding among the investment projects was the Web 3 social application Farcaster, which raised $150 million in its Series A round and was valued at $1 billion.

It is worth mentioning that although A16Z did not lead the investment in Farcaster in the A round, it played the role of Farcaster in the 2022 seed round.

Coinbase Ventures: 24 external investments, including two lead investments (El Dorado, WITNESS)

The project that received the highest amount of funding among the investment projects was the infrastructure platform Conduit, which raised $37 million in its Series A round with the goal of providing toolkits for developers.

Binance Labs: 24 external investments. The lead investors prefer to contact the project parties on their own and invest alone. Most of the time, the amounts are not disclosed, and they rarely invest together with other teams.

It was disclosed among the investment projects that the project that received the highest amount of financing was Ethena, which raised US$14 million in the expansion seed round.

Other separately invested projects include: Catizen, Zircuit, Infrared, Rango, Aevo, Movement, BounceBit, StakeStone, Cellula, Derivio, Babylon, RENZO, NFPrompt, Puffer Finance, Shogun, BracketX Protocol, and Memeland, which account for the vast majority. More than 80% of the projects have not yet issued coins. If they issue coins, they are expected to have the opportunity to be listed on Binance in the future.

Pantera Capital: 18 external investments, 9 of which were led, with a lead rate of 50% in 2024. The project that received the highest amount of funding among the investment projects was the open source AI model Sentient, which raised $85 million in the seed round and aims to compete directly with OpenAI.

Dragonfly: 14 external investments, 11 of which were led by Dragonfly, with a 79% lead rate in 2024, the highest among the five investment institutions. The project that received the highest amount of financing was Polymarket, a betting project praised by even Vitalik, which raised $45 million in the B round.

Looking at the investment projects of the above five VCs, only three projects were jointly invested by two investment institutions:

Neynar: Farcaster’s development platform

Investors: A16Z, Coinbase Ventures

Investment round: Series A

Investment amount: US$11 million

Investment date: May 30

Nexus: A modular zkVM project

Investors: Dragonfly, Pantera Capital

Investment round: Series A

Investment amount: US$25 million

Investment date: June 10

Morph: L2 combining optimistic & ZK techniques

Investors: Dragonfly, Pantera Capital

Investment round: Seed round

Investment amount: US$20 million

Investment date: March 20

It is worth noting that Binance Labs did not co-invest in the same project with the other four investment institutions.

Potential sectors expected: intention-centric, modular blockchain, parallel EVM

The total market value of the global cryptocurrency market is about 2.5 trillion US dollars. It still occupies a very small share, even less than NVDIA, which shows that the overall growth potential of the cryptocurrency market is still large. This article repeatedly mentions infrastructure and decentralized finance as the preferred investment tracks for VCs because these two tracks are the underlying logic of the development of the crypto market.

Infrastructure means supporting the development of the entire ecosystem, usually has a longer life cycle, and can bring relatively stable returns; DeFi is the cornerstone of overall market liquidity. If high liquidity can be created, it will attract more liquidity and form a positive flywheel effect.

Currently, the price performance of coins in the infrastructure and DeFi tracks is far inferior to that of meme coins. The reason can be attributed to the fact that the current market has not yet cut interest rates, there is a lack of liquidity, and the rise of meme coins is more of a vote of opposition to bad VC coins. However, truly excellent projects will still remain in the market, and the fact that the coin price is not rising now does not mean that it has no value.

From the perspective of infrastructure, we are optimistic about the three tracks of intention-centric, modular blockchain, and parallel EVM. The common point of these three is that they try to solve the existing blockchain technology problems: intention-centric improves the user experience, modular blockchain can break the Blockchain Trilemma, and parallel EVM breaks through the traditional EVM processing speed limit.

Let us ignore the short-term noise and follow the long-term development of the crypto market.