Source: The Rich Man’s Surplus

The Federal Reserve’s July interest rate meeting ended.

Maintain the federal funds target rate unchanged at 5.25%-5.50%, reduce holdings of U.S. Treasuries by $25 billion per month and MBS by $35 billion per month, which is consistent with the June interest rate meeting resolution and market expectations.

Compared with the interest rate meeting statement in June, this Fed statement has the following differences:

1) The employment situation that was originally assessed as strong has now become moderated;

2) The description of inflation has changed from "high" to "somewhat high", which is the first time since January 2024;

3) Regarding the Federal Reserve’s dual mandate, it has changed from “highly attentive to inflation risk” to “attentive to both sides of its dual mandate.”

To sum up briefly, what the Federal Reserve means is:

Employment is starting to slow and inflation is also declining, and we are considering our dual mandate and there is a possibility of a rate cut at the next meeting.

However, please note that although the Fed acknowledged the possibility of a rate cut in September, it still emphasized data dependence and other words, such as this sentence:

"It would not be appropriate to lower the target range for interest rates until there is greater confidence that inflation is moving sustainably towards 2%."

But I feel like the market didn't seem to hear it.

After the interest rate meeting, U.S. Treasury yields fell, the Nasdaq 100 index closed up 3%, and the S&P 500 index also rose 1.6%. The Treasury yields fell, and the entire market seemed to be celebrating the upcoming interest rate cut by the Federal Reserve.

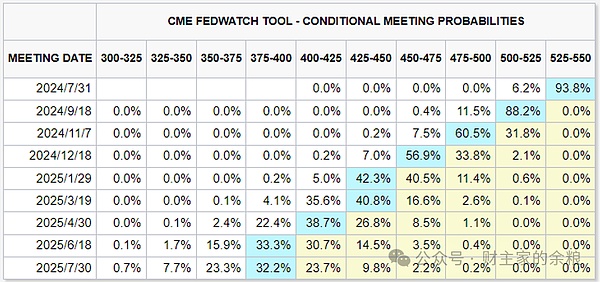

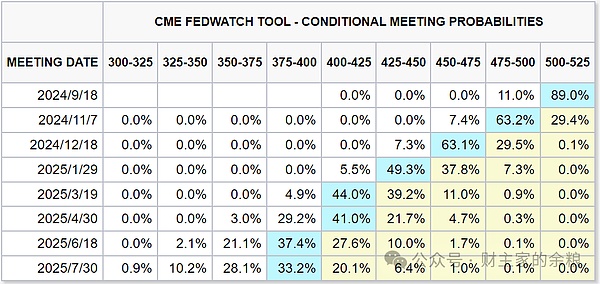

In fact, as early as a week ago, the market had already begun to price in a 100% interest rate cut.

For example, last Friday, CME's interest rate futures showed that the probability of the Federal Reserve cutting interest rates in September was 100%.

Now, after the interest rate meeting, the market believes that the Fed will take a dovish stance and the expectation of a rate cut is 100%.

In the financial market of the United States, the interest rate futures market had already priced in a 100% interest rate cut in September last week. Now it has been reconfirmed that the interest rate cut will be 100% in September. As a result, the stock market will still take the opportunity to surge...

Thinking back, similar situations have occurred many times in the U.S. financial market before:

Originally, the market had anticipated a certain monetary policy of the Federal Reserve, and then the stock market rose, pricing in this expectation;

Then, the market expects the probability of the Fed's policy to be 100%, and then the stock market rises again, pricing in 100%;

Then, the market expects the Fed's policy to be "set in stone", and then the stock market rises again, and the pricing is set.

Finally, the Federal Reserve confirmed the implementation of the policy, and then the stock market rose again and the pricing policy was implemented.

We don’t know, and we can’t ask. What is the difference between this 100%, and what is set in stone, and the implementation of the policy?

However, as an investor, I am always skeptical about things like this 100%.

After all, this interest rate cut is not Newton's classical mechanics about the earth revolving around the sun. How can it be 100% certain if it happens in two months?

What's more, Newtonian mechanics has long been overturned at the microscopic level. Quantum mechanics is the real truth, and "Schrödinger's cat" is the real norm. How can the market casually price in a 100% interest rate cut in September?

What's more, Powell has been emphasizing at the recent interest rate meeting that he is data-dependent and needs to see the performance of data in the next two months, whether it is inflation or employment. What if there is a certain deviation?

The Federal Reserve clearly stated that "it is not appropriate to lower the target interest rate range until there is greater confidence that inflation will continue to move toward 2%." Why did the market turn a deaf ear to it?

As we all know, in the past two weeks, the great eight technology stocks (Apple, Microsoft, Google, Nvidia, Amazon, Facebook, Tesla, and Netflix), which had been rising every day and every month for more than a year, have actually begun to fall continuously; at the same time, small and medium-cap stocks that have been falling for more than a year have begun to rise.

Under such circumstances, large-cap technology stocks in the U.S. stock market surged again last night. Does this mean that as long as the Federal Reserve hints at a rate cut, the great technology will be back?

I don't think so.

No matter what the circumstances, the Federal Reserve itself has not made a 100% commitment to a rate cut, but the market insists that there will be a 100% rate cut in September. As an investor, I always think that this is problematic.