As concerns about the global economic recession and the ignition of war in the Middle East gradually increase in the investment market, everything from the stock market to the currency market has been bloodbathed today. The liquidation amount of the centralized exchange (CEX) reached as high as 1.06 billion U.S. dollars, and the total amount of various DeFi protocols also More than $350 million in loan and leverage liquidations occurred.

( Is war in the Middle East about to break out? Stock market massacre, Bitcoin fell to 52K )

Table of contents

ToggleCEX liquidated $1 billion in a single day, and bulls suffered heavy losses

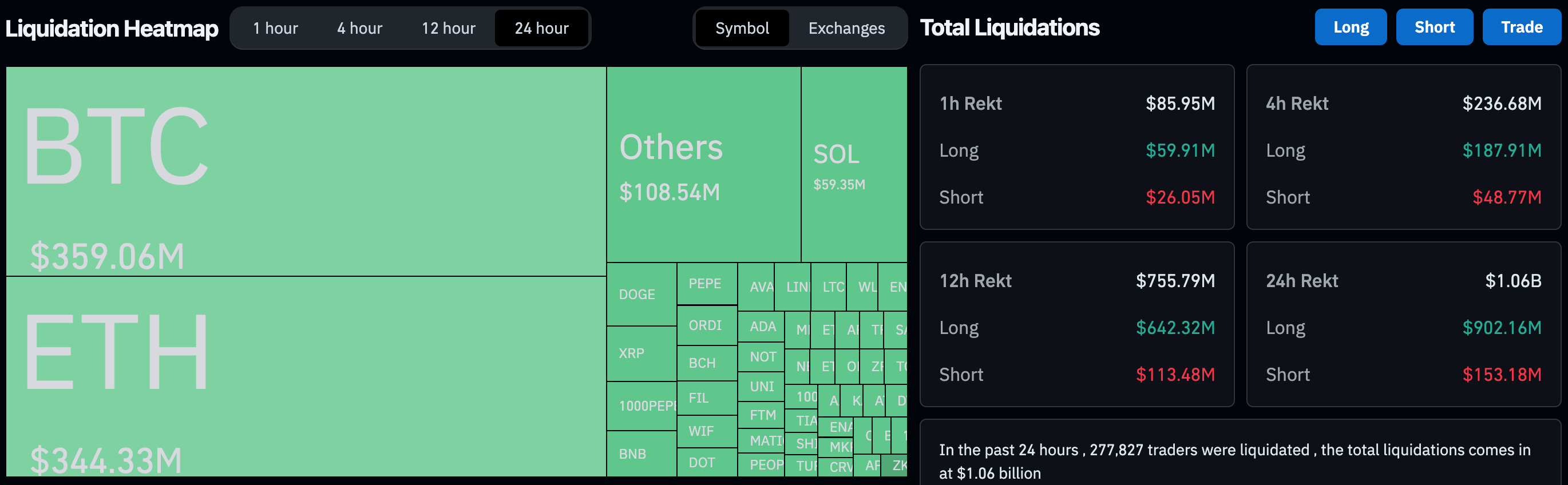

CoinGlass data shows that CEX’s futures liquidation amount in the past 24 hours exceeded $1.06 billion, of which approximately $900 million was long positions and short positions accounted for only $153 million.

It is reported that Bitcoin and Ethereum traders, as the main liquidation targets, have endured more than US$700 million in liquidations, and the largest liquidation occurred in Huobi HTX’s BTC-USD contract, worth US$27 million.

DeFi protocol liquidation amount hits annual high

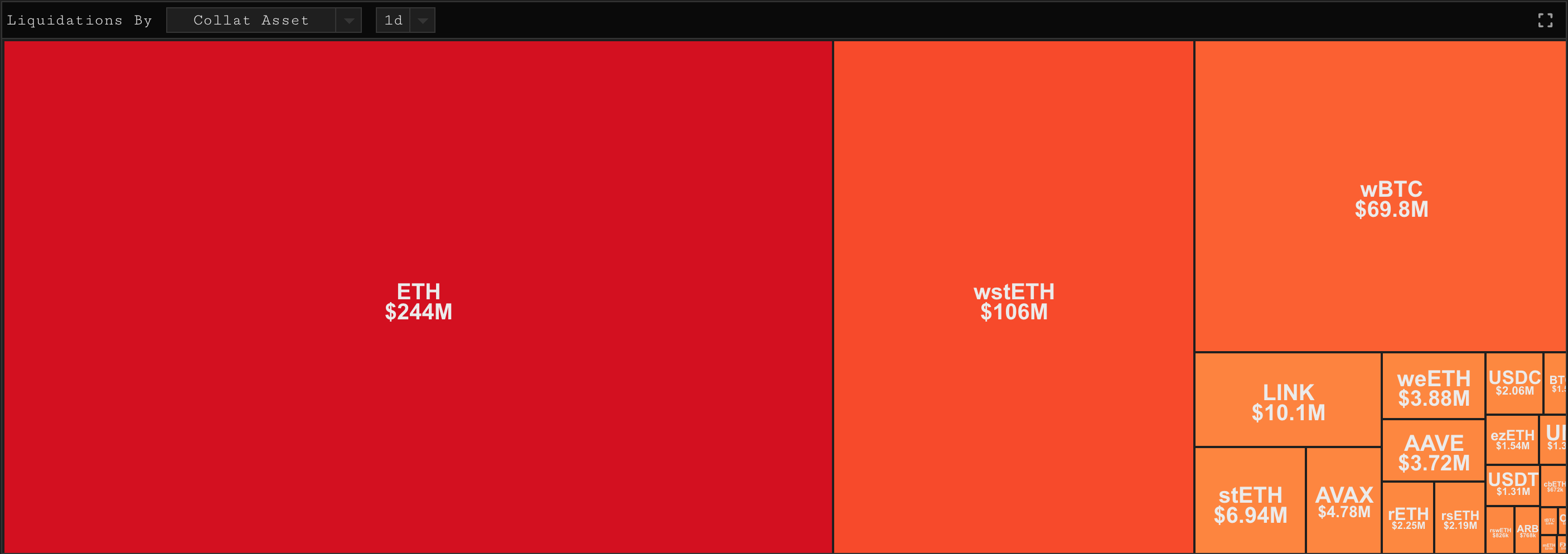

In addition, on-chain analysis team Parsec Finance also pointed out that the total liquidation amount of the DeFi protocol in the past 24 hours exceeded $350 million, setting a new yearly high.

It is reported that the liquidation mainly comes from the collateral liquidation of lending agreements and focuses on the following three assets:

- ETH: $244 million liquidated

- wstETH: $106 million liquidated

- wBTC: $69.8 million liquidated

Bitcoin dominance surges

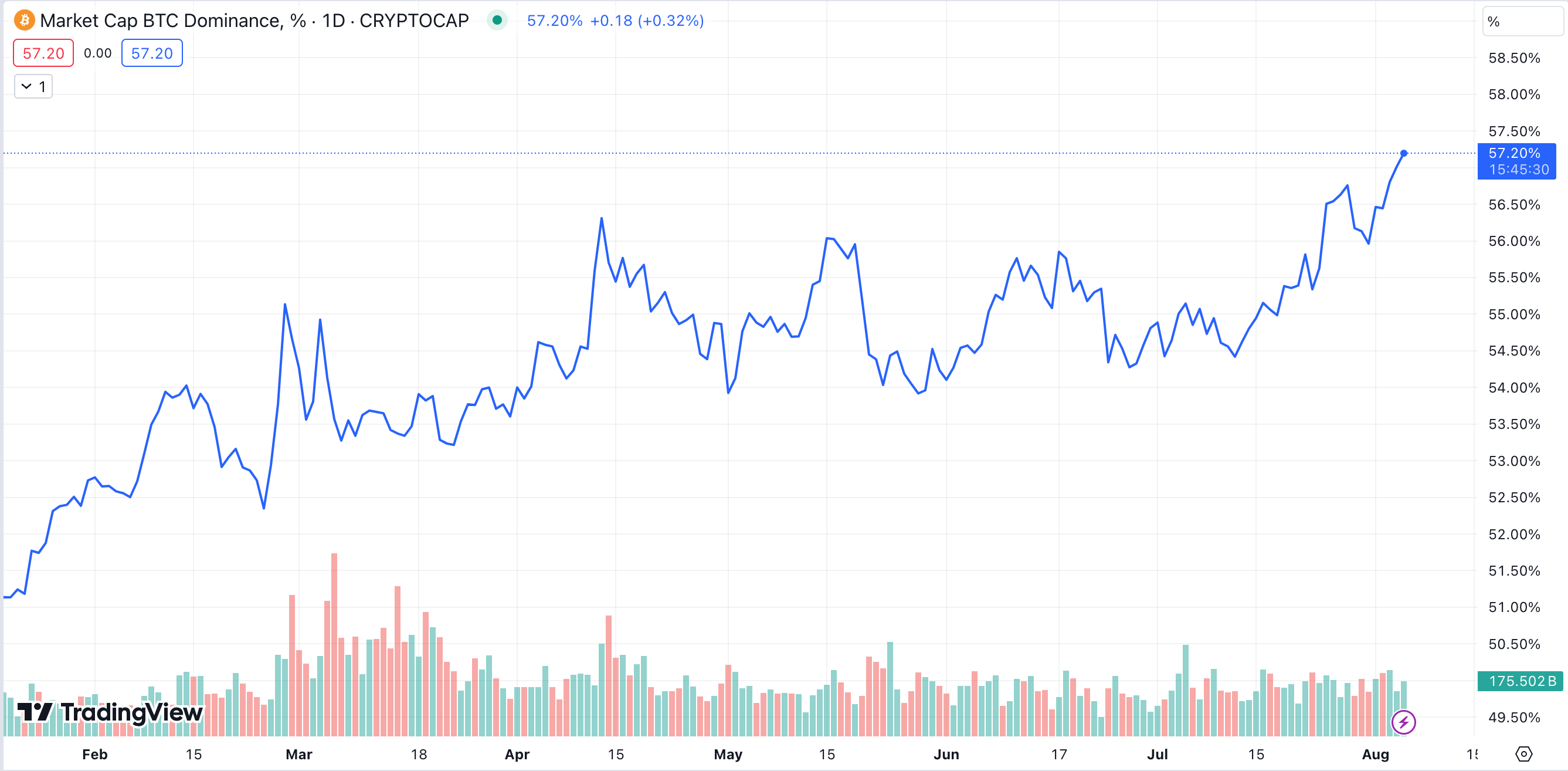

With growing tensions in the Middle East, potential global economic recession , and potential concerns about a hard landing of U.S. monetary policy , the Asian stock markets that opened first this morning and the 24-hour crypto market were the first to experience widespread massacres, including the Nikkei 225 Index and South Korea. The composite stock price index KOSPI once plunged more than 8%.

In addition, Bitcoin has so far fallen below US$52,800, and Ethereum has reached a six-month low of around US$2,300.

At this point, the increase in global demand for safe havens has also occurred in the crypto market, with Bitcoin’s market share (dominance) rising sharply this morning, reaching a new annual high of 57.2%.

Bitcoin spot ETF sees largest net outflow in three months

In addition, the U.S. Bitcoin spot ETF market also faced its largest net outflow in three months last Friday, amounting to $237 million.

SoSoValue data shows that despite the sharp increase in single-day outflows, the total transaction volume is not much different from usual times.

However, with bad news and market sentiment falling into gloom, the opening of US stocks tonight may also see a larger flight of ETF funds.