MARA (formerly Marathon Digital), the world’s largest listed Bitcoin mining company by market value, continues to increase its Bitcoin holdings as part of its “comprehensive HODL” strategy.

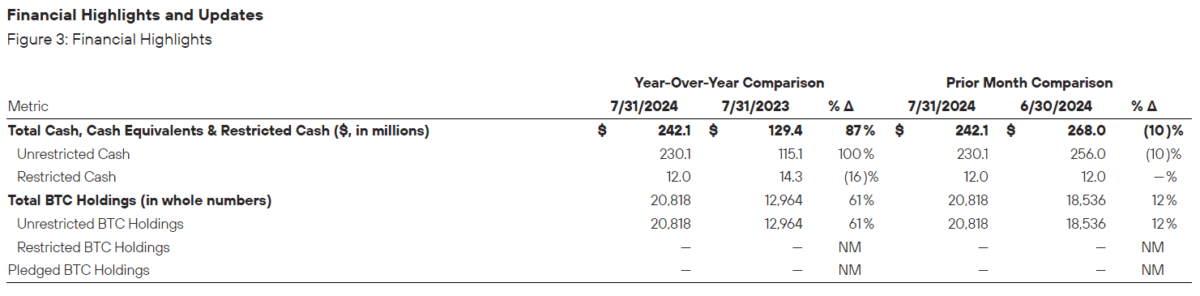

According to MARA’s July Bitcoin production and mining operations update announced on Tuesday (6th), the company increased its holdings of a total of 2,282 Bitcoins in July. Calculated based on the Bitcoin trading price of US$56,950 before the deadline, the value of these Bitcoins Valued at nearly $130 million. This brings MARA’s Bitcoin holdings to 20,818 BTC, worth approximately $1.18 billion.

According to previous reports by Zombit, MARA announced on July 25 that it had purchased an additional US$100 million worth of Bitcoin and would adopt a comprehensive “HODL” strategy for its Bitcoin financial policy to retain all Bitcoin mined in its operations. coins and make strategic open market purchases on a regular basis.

MARA Chairman and CEO Fred Thiel said at the time that the adoption of a comprehensive HODL strategy reflected the company's confidence in the long-term value of Bitcoin. "We believe that Bitcoin is the best financial reserve asset in the world."

The Bitcoin halving in April this year forced mining companies to adjust their operating strategies to cope with the decline in revenue. MARA sold 390 Bitcoins in May and announced Kaspa ($KAS) mining operations in June to diversify its revenue. MARA’s recent strategy shift represents a positive development.

Monthly Bitcoin production increased by 17%

In addition to buying Bitcoin, MARA also increased its Bitcoin production to 692 BTC in July, a monthly increase of 17%. According to Thiel, the company’s block wins have also increased by 27% in the past month. He wrote in the announcement:

"Last month's BTC production increased by 17% compared to June, reaching 692 BTC, and our average operating hash rate (computing power) increased by 5% over the same period, reaching 27.5 EH/s. With the global hash rate Offline due to lower BTC prices, we will continue to mine aggressively and use all the mining economics-related tools at our disposal to achieve maximum production capacity.”

According to the announcement, MARA holds a total value of nearly $1.6 billion in Bitcoin, cash and cash equivalents.