What was the biggest single-day crash in the cryptocurrency market?

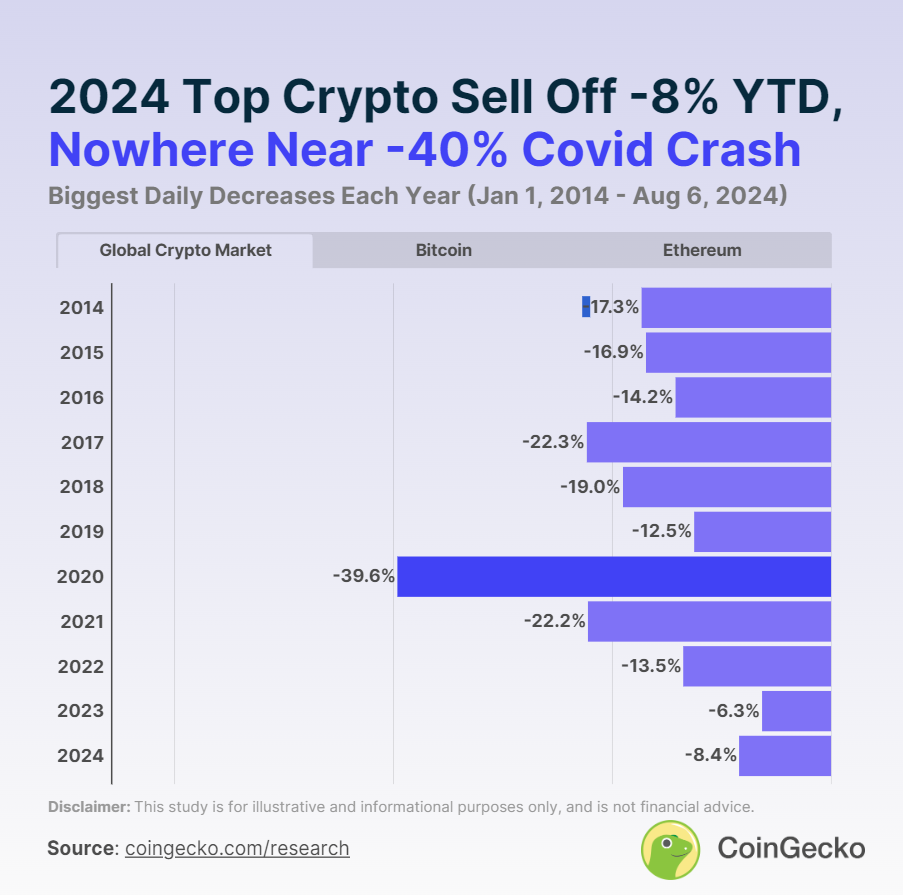

The most severe adjustment in the global cryptocurrency market in the past decade was a 39.6% plunge on March 13, 2020 due to the COVID-19 pandemic. The massive sell-off caused the total market value of cryptocurrencies to plummet from $223.74 billion to $135.14 billion in one day.

In comparison, the largest cryptocurrency market sell-off so far this year was much smaller at -8.4% and occurred on March 20, 2024. Likewise, while the most recent decline saw four consecutive days of declines, causing the total cryptocurrency market capitalization to shrink from $2.44 trillion on August 2 to $1.99 trillion on August 6, none of these declines were large enough to be considered a market correction.

(The methodology for this article defines a market capitalization correction or decline as a drop of 10% or more, as referenced by Investopedia, and is based on the daily year-on-year DoD . In this study, the cutoff is extended to -9.95% because in some cases percentages are also rounded to 1 decimal place, which would cause these numbers to be considered as -10.0%. )

In fact, cryptocurrencies have not experienced a single-day market crash since the FTX crash in November 2022.

Bitcoin also recorded its largest price correction of -35.2% DoD on March 13, 2020, as global uncertainty caused crypto investors to flee risk assets overnight, while Ethereum recorded the second largest price correction of -43.1% DoD on the same day.

The second largest cryptocurrency pullback occurred on September 14, 2017, when the total cryptocurrency market capitalization experienced a -22.3% pullback, falling from $136.55 billion to $106.14 billion. This coincided with Bitcoin’s third largest price pullback of -20.2% on the same day. This pullback came on the back of relatively strong performance throughout the year, with both the cryptocurrency market and Bitcoin recovering quickly the next day, highlighting the high volatility of cryptocurrencies.

How long will the cryptocurrency correction last?

Over the past decade, the longest cryptocurrency correction lasted only 2 days at most. From 2014 to date, the global cryptocurrency market has experienced 3 such consecutive corrections. These occurred in early 2018, when the cryptocurrency market cooled down after reaching new highs, and in late 2022, due to the FTX crash and contagion:

- January 16 (-11.8%) to 17 (-13.4%), 2018

- February 5 (-10.3) to 6 (-19.0%), 2018

- November 9 (-10.1%) to 10 (-13.5%), 2022

That said, crypto markets have also seen corrections that occurred one after another but not consecutively. For example, during the 2022 Terra Luna crash, the total crypto market cap fell 12.0% DoD on May 10, briefly stabilized the next day, but then fell another 11.0% DoD on May 12.

Meanwhile, Bitcoin has only seen two consecutive multi-day cryptocurrency corrections. The first was in early 2015, amid regulatory issues and adverse developments including the hack of the Bitstamp centralized cryptocurrency exchange. Bitcoin’s next 2-day price correction occurred during the debate over the proposed Bitcoin Unlimited fork.

Notably, two of Bitcoin’s longest price corrections were related to issues with the specific asset, rather than broader cryptocurrency developments:

- January 13 (-17.5%) to 14 (-22.3%), 2015

- March 17 (-11.8%) to 18 (-10.4%), 2017

Ethereum, on the other hand, has experienced 6 consecutive price adjustment days to date. While Ethereum’s first two longest price adjustments occurred in the early days of the asset, the third price adjustment in June 2016 was the result of The Dao hack. Ethereum’s subsequent 2-day price adjustments coincided with global cryptocurrency sell-offs during the 2018 bear market and the 2022 FTX crash.

- October 30, 2015 (-10.5%) to 31, 2015 (-12.9%)

- February 16 (-17.9%) to 17 (-14.3%), 2016

- June 17 (-24.9%) to 18 (-27.3%), 2016

- February 5 (-11.4%) to 6 (-18.0%), 2018

- November 20 (-15.4%) to 21 (-12.6%), 2018

- November 9 (-15.0%) to 10 (-17.9%), 2022

How many days does the cryptocurrency adjustment period last?

Since 2014, cryptocurrencies have experienced 62 days of market corrections, accounting for 1.6% of this period. The average correction of the cryptocurrency market on these days was -13.0%, which is only 3 percentage points higher than the technical threshold for market corrections.

In 2018, cryptocurrencies experienced 18 market corrections, an all-time high and double the number seen in 2017 (9 days). The frequency of cryptocurrency market corrections in 2018 was likely due to the bearish conditions of volatility at the time, as cryptocurrencies cooled off from the bull run that had brought the asset class greater mainstream acceptance.

It is worth noting that despite the challenging macroeconomic environment, the cryptocurrency market is still consolidating and gradually recovering, so there is no adjustment in cryptocurrency prices in 2023. Bitcoin and Ethereum also did not see any price adjustments last year.

While neither the global cryptocurrency market nor Bitcoin has experienced any correction days so far this year, it remains to be seen whether this will remain the case for the rest of 2024. On the other hand, Ethereum has already experienced 2 days of price corrections this year, -10.1% on March 20 and -10.0% on August 6, 2024.