By: Sunny Shi, Enterprise Research Analyst, Messari

Last weekend, fears of a massive withdrawal of the $1 trillion yen carry trade caused Bitcoin to briefly fall below $50,000 for the first time since February. On Thursday, less than a week after the crisis, Bitcoin was back above $60,000.

Despite being a cornerstone asset in cryptocurrencies, BTC is still much more volatile than stock indices. We can attribute Bitcoin’s high beta reflexivity to:

Leverage penetration in cryptocurrencies is high due to futures trading. During the drop below $50,000, crypto traders saw over $1 billion in liquidations. On Thursday, nearly $100 million in BTC shorts were liquidated during the rally to $62,000.

Bitcoin lacks cash flow. Long-term equity managers typically trade on a P/E or free cash flow basis, which gives them the comfort of “buying the dip.” Fundamental investors have no reason to sell if macro-driven flows do not impact their company’s earnings potential. In contrast, Bitcoin’s valuation has no basis.

Cryptocurrencies have a weak institutional base. Retail investors were primarily net sellers of stocks on August 5, while institutions were buyers. Typically, institutional holders with established capital are less likely to sell for risk and panic. In more mature markets, the diversification of investor investment horizons contributes to stability.

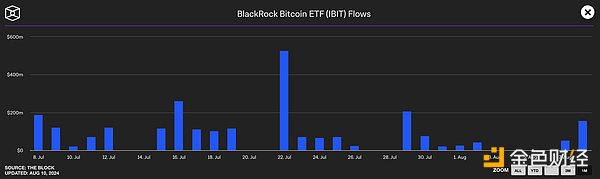

Things may be starting to change for Bitcoin. It’s worth noting that BlackRock’s Bitcoin ETF IBIT has only seen one day of outflows.

BlackRock contributed more than $200 million in net inflows to Bitcoin ETFs last week. This doesn’t mean BlackRock will never start selling, but for now, the asset manager is choosing to accumulate Bitcoin.

The trend could suggest that BlackRock, unlike retail investors, operates with a longer-term perspective.

These developments are largely supportive of the crypto asset class, and continued growth in Bitcoin held by ETFs may be just what we need to escape the never-ending cycle of violent booms and busts. The “baby boomers” may finally save us.