According to data, long-term investors may be better off choosing Bitcoin than gold during a stock market sell-off.

On August 5, global stock markets fell into panic. Japan's Nikkei average fell 12%, its worst performance since 1987. The S&P 500 closed down 3%.

Unfortunately, Bitcoin did not perform much better, plummeting 14.52% from August 2 to August 5. This sharp correction has raised many questions in the media: Why did Bitcoin fall in times of crisis? Can Bitcoin really be used as a hedge asset?

Out of curiosity, I decided to dig deeper into the historical data.

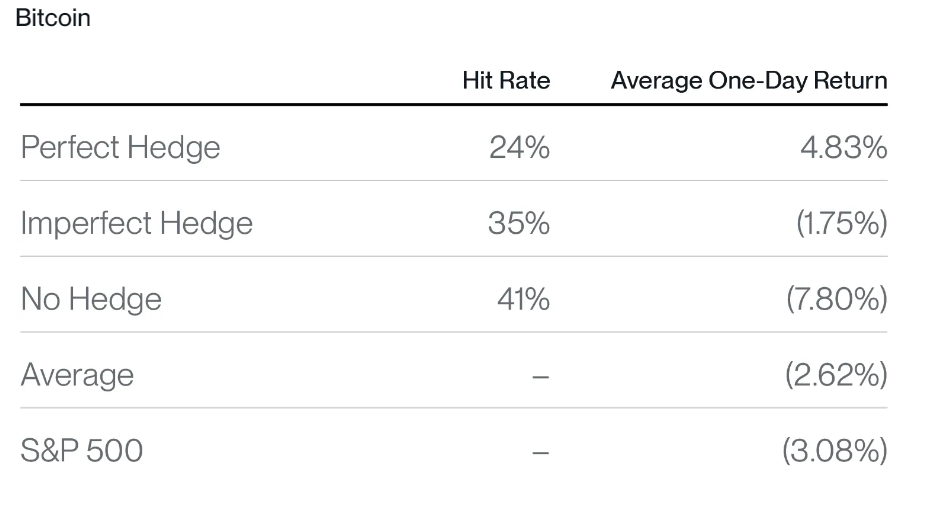

Specifically, I analyzed how Bitcoin and gold reacted to daily declines of 2% or more in the S&P 500 over the past decade. I grouped their returns into three categories, based on how each asset performed on the day the S&P 500 fell:

- Perfect Hedge – Assets Providing Positive Returns

- Partially hedged – assets providing negative returns but outperforming the S&P 500

- Unhedged – asset returns underperform the S&P 500

The results I found were more mixed than is often reported.

Is Bitcoin a short-term hedge? Not really.

First, the bad news about Bitcoin: Data suggests that Bitcoin is not a reliable short-term hedge. In fact, its daily returns appear to have no correlation with the performance of the stock market.

On days when the S&P 500 fell sharply, Bitcoin acted as a hedge 59% of the time, either rising significantly or falling less than the stock market. But the other 41% of the time, it fell more than the index.

Unfortunately, when this happens, it tends to be bad: On days when the stock market drops 2% or more, Bitcoin loses an average of 7.80% on bad days.

This shows that not all one-day pullbacks are created equal. There are different reasons why a stock might drop 2% on a given day. The data shows that some reasons can cause Bitcoin to rise sharply, while others can cause it to fall sharply, and there are no hard and fast rules.

If you’re looking for a reliable one-day hedge against a sharp stock market correction, Bitcoin is not a good choice.

Source: Bitwise Asset Management with data from Bloomberg. Data from January 1, 2014 to August 9, 2024.

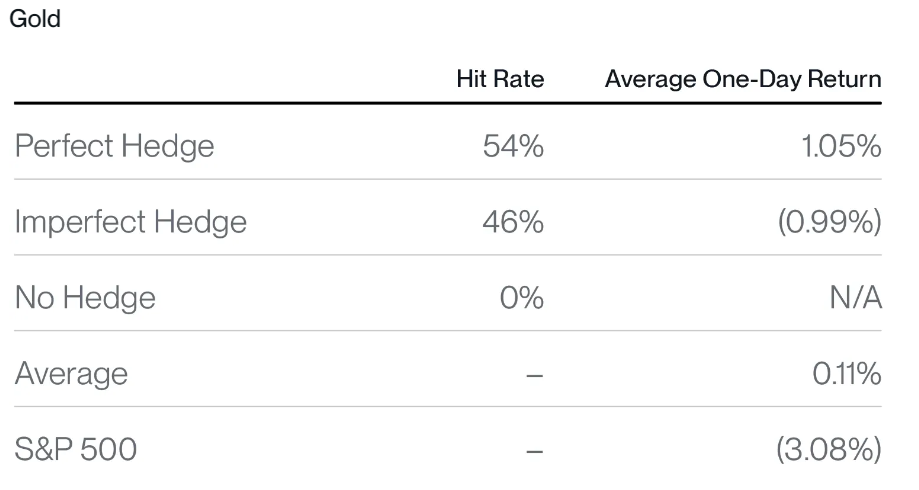

Source: Bitwise Asset Management with data from Bloomberg. Data from January 1, 2014 to August 9, 2024.

Although gold performs better, it also has limitations:

Gold's performance was mixed: On days when the S&P 500 fell sharply, it provided positive returns 54% of the time, but the average gain was just 1.05%. This makes it challenging to use as an effective short-term hedge: You have to hold a lot of gold to have a substantial impact on your overall portfolio. If you have 5% of your portfolio in gold, a 1% gain will have little effect on your traditional 60% stock portfolio. Another 46% of the time, gold fell an average of 0.99%, exacerbating the portfolio's losses.

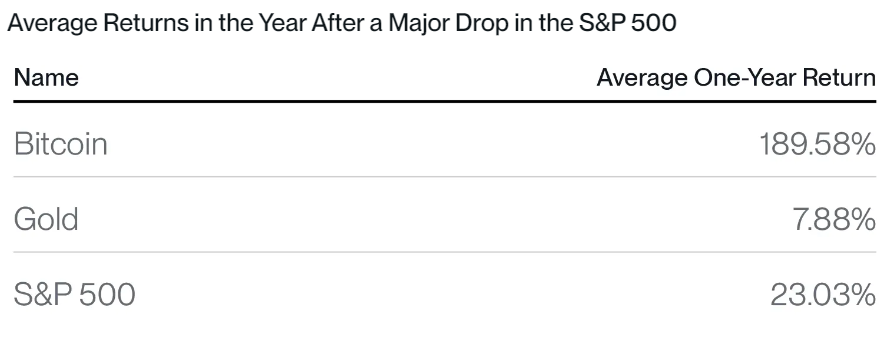

Fortunately, most of us don’t invest for one day’s performance, but for the long term. So how do these two assets perform as a long-term hedge against these one-day shocks?

Has Bitcoin historically been a long-term hedge? Absolutely.

The performance of the two assets over the year tells a completely different story. In the year following a 2% or greater decline in the stock market, gold returned an average of 7.88%, far below the rebound performance of stocks. However, Bitcoin made up for its volatility, with an average return of 189.68%.

Source: Bitwise Asset Management with data from Bloomberg. Data from January 1, 2014 to August 9, 2024.

This dynamic makes sense. Gold is a trusted asset that many people instinctively flock to in short-term panics. But its mature status means it underperforms over longer periods of time. Bitcoin, on the other hand, has strong store-of-value properties due to its limited supply and reduced issuance, but it is still in its early stages of adoption. As a result, it still has elements of a risk asset in its one-day reaction to market pullbacks, but with significantly higher returns over the long term.

Over the past decade of returns, the record is very clear: buying Bitcoin when the market pulls back has always paid off.

Will Bitcoin Outperform Again?

The simplest criticism of this analysis is that past performance is no guarantee of future performance. While this time may be different, the 12-month outlook for Bitcoin I have seen is one of the most bullish.

Consider the following potential drivers:

- Spot Bitcoin ETP Inflows : Since January, inflows into Bitcoin ETPs have exceeded $17 billion, outstripping new supply and driving Bitcoin to new all-time highs earlier this month. These inflows do not include some of the largest players. Last week, Morgan Stanley became the first investment bank to approve a Bitcoin ETP on its platform. We expect others, such as Merrill Lynch, UBS, and Wells Fargo, to follow suit.

- Regulatory tailwind : A bipartisan coalition in Congress has passed three cryptocurrency bills through the House this year. The industry is on the verge of gaining regulatory clarity as the Republican Party includes cryptocurrency in its official 2024 platform and the Harris campaign reassesses its stance.

- Fed rate cuts : The European Central Bank, Bank of England and others have already started cutting rates. As U.S. inflation eases and weaker economic data raises recession fears, the Fed must catch up. Fed funds futures already price in a rate cut at the September meeting.

Are we out of the woods yet? Probably not yet. Investors remain on edge as market volatility sparked by the unwinding of yen carry trades. Add to that uncertainty over the U.S. presidential election, signs of a global economic slowdown, and the threat of an Iran-Israel conflict, and there could be more turbulence ahead. However, the next time stocks sell off, you’ll know which asset is doing well as a long hedge.

Risks and Important Information

Investment Advice; Risk Warning: Before making any investment decision, each investor must conduct an independent review and investigation, including the merits and risks of the investment, and make an investment decision based on this - including determining whether the investment is suitable for the investor.

Crypto assets are digital representations of value that serve as a medium of exchange, unit of measure, or store of value, but they do not have legal tender status. Crypto assets are sometimes exchanged for dollars or other global currencies, but they are not currently backed or guaranteed by any government or central bank. Their value is determined entirely by market supply and demand forces and is more volatile than traditional currencies, stocks, or bonds.

Crypto asset trading carries significant risks, including extreme market price volatility or flash crashes, market manipulation, and cybersecurity risks and the risk of loss of principal or entire investment. In addition, crypto asset markets and exchanges are not regulated with the same controls or customer protections as stock, options, futures or forex investments.

Crypto asset trading requires in-depth knowledge of the crypto asset markets. When attempting to profit from crypto asset trading, you must compete with traders around the world. You should have appropriate knowledge and experience before trading large amounts of crypto assets. Crypto asset trading can result in large and immediate financial losses. Under certain market conditions, you may find it difficult or impossible to quickly close a position at a reasonable price.

The opinions expressed in this article reflect an assessment of the market environment at a particular time and do not constitute a forecast of future events or a guarantee of future results, and may change with further discussion, refinement and revision. This article is not intended to provide, and should not be relied upon as, accounting, legal or tax advice or investment advice. You should consult an accounting, legal, tax or other advisor regarding the matters discussed in this article.