As time goes by, I become more and more bullish on this market.

Earlier this week I explained why I believed a market bottom had been seen from a timing and price perspective, but from a sentiment perspective things are developing in an extraordinary way.

There is nothing new or different about this crypto cycle, but everyone seems to have a brief memory loss about how these things are going. In fact, the current market sentiment is extremely similar to the sentiment before BTC price tripled in September 2023.

The prevailing mood in the market right now is despair and frustration as most people have nearly wiped out their money in the past five months and somehow think the market should have given them millions of dollars in returns. If you think this is what a bull market is like, donate your money to charity where it can at least make a bigger difference.

In fact, everything I'm going to discuss this morning is what we talked about last night in X spaces. Be sure to listen to that.

I’ll try not to expand on this in depth since it was already discussed last night, but there were a few pieces of news that caught my attention this week that I wanted to briefly mention.

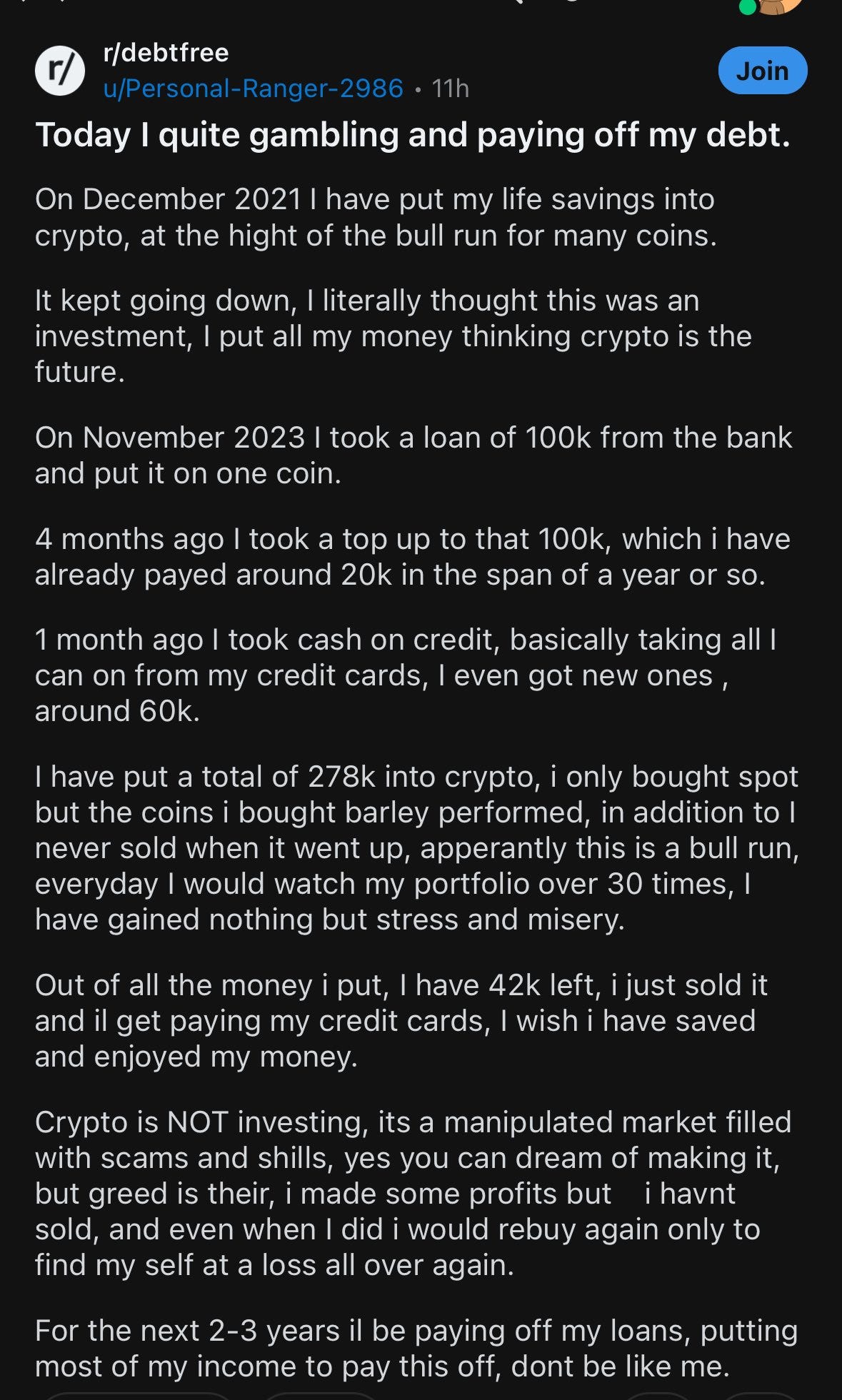

First up, a Reddit post I saw in my X-feed this morning.

It's a bit long, but if you've listened to the content in that space, you'll know what I'm talking about. Basically, this person thinks that since we are in a bull market, he can just throw a bunch of money into the market and become an easy millionaire. But the reality is far from that.

We are indeed in a major bull market, but what this actually means is that the market will do everything it can to try to confuse you rather than directly make you a huge fortune.

Again, listen to that space, I don't know how many times I need to tell you, but this stuff about human behavior and psychology is extremely important. The market is extremely difficult to beat. When everyone is beating the market easily, it usually means the top has been reached.

The reality is that most people have lost money in crypto this year. Yes, they have, especially those who participated in the highly volatile Altcoin market. In fact, the Altcoin market is down this year. And in a market that often sees 70-90% corrections, this means you have to have excellent entry timing to make a profit. If you entered the market after October, then you are likely to lose money this year. So don't feel bad, most people are in the same situation.

But that also brings us to the scope and stage of the current market. I have personally experienced the horrors I am about to tell you about, so I know this is true of the market today.

What the market is doing here is draining away all of everyone's gains and available capital so far and making them feel like they can't make money in this space. The guy in the picture above is an example of this. He put almost everything in and is now giving up and blaming the market instead of his own greed. Once people like him completely capitulate or lose all their money, the market will take off like a rocket.

This is the harsh reality of how markets work. It has happened before and it is clearly happening again now. As I can see in the timeline, the same was true of market sentiment last year when everyone thought crypto was dead in September 2023. I was there, I made the trade. I remember clearly speaking to the top trader at the world’s largest financial research publication. He traded billions of dollars a day on Wall Street and told me near the bottom that crypto was dead.

As long-time readers, you know we called the low on that buy point at the time.

Today, we are all bullish again. But let me tell you why I think this cycle has just begun and is far from over. Some news released this week went unnoticed by most, but for those astute investors who followed us and knew how to read the subtext, the market became more bullish than ever.

Look at this headline that appeared in my feed this morning.

Even better, here’s a quote from the article, “We are currently in a heated arms race where more and more issuers want to push the envelope on volatility because the market demand exists to do so.”

In other words, risk appetite on Wall Street is exploding. The ETF specifically mentioned in the article is the leveraged Microstrategy ETF. Funds everywhere have failed to outperform this market and are looking to take on more risk to catch up. This risk-taking only breeds more risk-taking and spreads throughout the market.

But it’s not just Wall Street that’s turning up the volume on this mania we’re about to enter. Both presidential candidates are also adding fuel to the fire.

This week, both Trump and Harris put forward aggressive proposals to address the housing affordability crisis.

Trump has proposed building whole new cities on federal land, while Kamala has proposed giving $25,000 to first time homebuyers. These plans would not be possible without massive credit creation and saddle people with debt at the worst possible time. Like clockwork, the cycle always finds a way to complete itself. Long time readers know the key role of the real estate cycle in all of this.

Trump has proposed building whole new cities on federal land, while Kamala has proposed giving $25,000 to first time homebuyers. These plans would not be possible without massive credit creation and saddle people with debt at the worst possible time. Like clockwork, the cycle always finds a way to complete itself. Long time readers know the key role of the real estate cycle in all of this.

All of this news comes on the back of what has already been an impressive week for cryptocurrencies.

We’ve seen the Trump family get directly involved in their own projects. We’ve seen Democrats work with billionaires to actively promote pro-crypto policies. We’ve seen Russia legalize cryptocurrency payments and mining. We’ve also seen Mastercard launch a crypto debit card in partnership with one of the most widely used cryptocurrency wallets to make purchases directly from your crypto account.

So, I’m not saying if these things are good or bad. If you ask me, I don’t give a shit. I don’t believe for one moment that these people have our best interests at heart. But I do know that the stage is set for the biggest crypto bull run we’ve ever seen.

With the stock market once again soaring and cryptocurrencies stagnating, market participants are more frustrated than ever. This example from Reddit proves this, and it is likely very real to most market participants. The collapse of prices and the delay in time will drain their hopes and capital until a true bull run unfolds.

Don't fall into this trap. Listen to the space we did yesterday. It's more important than ever that you understand these things because it's not enough to just be in a bull market, as you can see from the performance over the last five months. You need to read the subtext before the market to really get an edge.