Amid market volatility and whale activity, Solana price is showing signs of potential recovery, with the key support level of $140 crucial for future SOL price stability.

Solana (SOL) price has been trending in a sideways market lately, with slight gains. Its price has seen some volatility over the past few days. Similar to other cryptocurrencies, Solana has also seen a small market rebound, signaling a possible improvement in investor sentiment.

Solana Price Whale Transfers 8 Million Tokens: Is SOL Ready to Breakout?

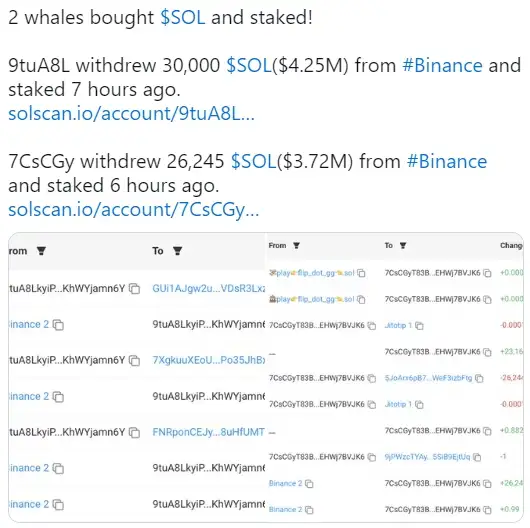

The latest update from on-chain analytics firm Lookonchain shows that Solana market activity is high. On August 22, two cryptocurrency investors (with addresses “9tuA8L” and “7CsCGy”) jointly transferred 56,245 SOL from Binance [BNB], worth about $8 million.

The former account transferred 30,000 soles, while the latter account transferred 26,245 soles. This significant purchase shows that these investors are taking advantage of the current favorable buying conditions despite the overall bearish market sentiment.

Data from analytics platform Santiment highlights the fluctuations in these metrics. The chart shows two lines: green represents the price of Solana, and red represents the whale stablecoin holdings. It can be seen that periods when whale holdings increase coincide with increases in Solana prices.

In the absence of an immediate increase in Solana’s price, the amount of stablecoins held by whales appears to have increased dramatically.

This may indicate that investors are in a preparation phase, which may hint at an upcoming market transaction. The impact of whales through large-scale stablecoin transactions is worth continuing to observe.

Source - Santiment

Solana’s price has seen significant volatility over the past 24 hours. The Altcoin has been hovering between a high of $144.81 and a low of $140.93, indicating a volatile market. As of reporting time, SOL price is hovering at $144, up slightly by 0.85% on the day.

Over the past month, Solana prices have seen a significant decline, with a cumulative drop of 20.26%, and a further drop of 1.70% in the past week alone, continuing the downward trend.

Can Solana Hold the $140 Level Amid Volatility?

The layer 2 cryptocurrency is struggling to break the $150 mark. If buyers step up their efforts, Solana price prediction could reach $200 and possibly even $250 in the upcoming rally.

The Moving Average Convergence Divergence (MACD) indicator is converging slightly below the zero line, suggesting weak bearish momentum. The MACD line is slightly above the signal line, suggesting a possible shift or stabilization in momentum in the near term.

Moreover, the Relative Strength Index (RSI) is at 49. This value indicates that SOL/USDT is neither overbought nor oversold, supporting a balanced market environment without an immediate directional bias. As the broader market cues are already negative, this pullback could exacerbate the pessimistic atmosphere surrounding Altcoin prices. After breaking out of the bullish zone, the Relative Strength Index (RSI) is back below the neutral line, and the decline suggests that the buying momentum is unsustainable and therefore weakening. As long as the RSI is below the neutral line, the possibility of recovery remains slim.

Solana Price Chart: Source | TradingView

The critical support level of $140 is crucial to stabilize the Solana price. On the downside, an increase in selling pressure could push the price below this point. If this downward trend continues, the SOL value could fall further to $120.

In simple terms

At present, whales have transferred 8 million SOL tokens. The sharp increase in the number of stablecoins held indicates that investors are in the preparation stage, which also implies that trading activities will increase in the future. Technical indicators and market fluctuations indicate that market sentiment has warmed up, which also supports its upward trend in the short term. In the long run, the market is not clear, but with the actions of whales and the increase in buyers, it will continue its upward momentum.