Key points:

- Stablecoin flows have turned positive, bringing total supply to over $160 billion, close to all-time highs. This indicates improved market liquidity and more available funds in the crypto ecosystem.

- The stablecoin ecosystem continues to expand in terms of diversity, use cases, and risk characteristics, from fiat-collateralized, crypto-collateralized to interest-bearing and protocol-native stablecoins.

- As stablecoin collateral increasingly consists of USD equivalents and real-world assets (RWAs), changes in the interest rate environment may affect the profitability and attractiveness of various stablecoins.

introduction

In this edition of Coin Metrics’ State of the Network report, we explore the diverse stablecoin ecosystem, focusing on pegs, collateral composition, and sources of yield in a changing interest rate environment.

Stablecoin supply pushes to new highs

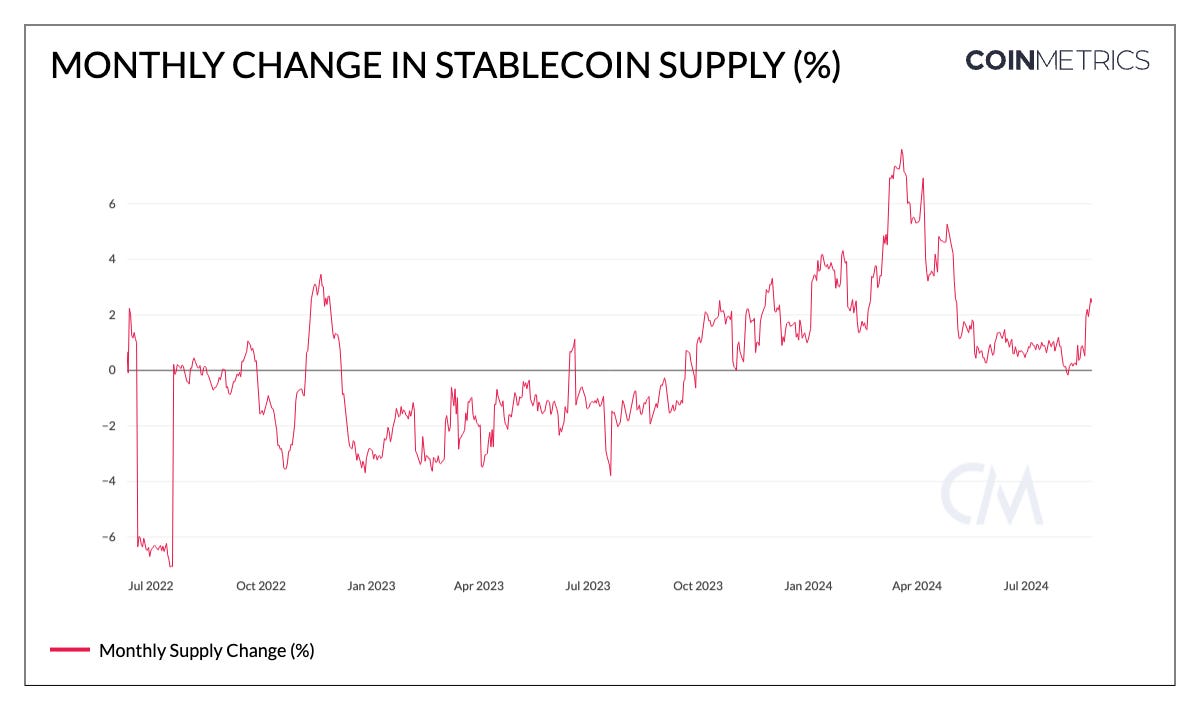

After a period of consolidation in the second quarter, the total stablecoin supply showed a positive growth trend in August, indicating increased liquidity and potential for capital inflows in the ecosystem. As shown in the figure below, the chart shows the monthly change in stablecoin supply.

Source: Coin Metrics Network Data Professional Edition

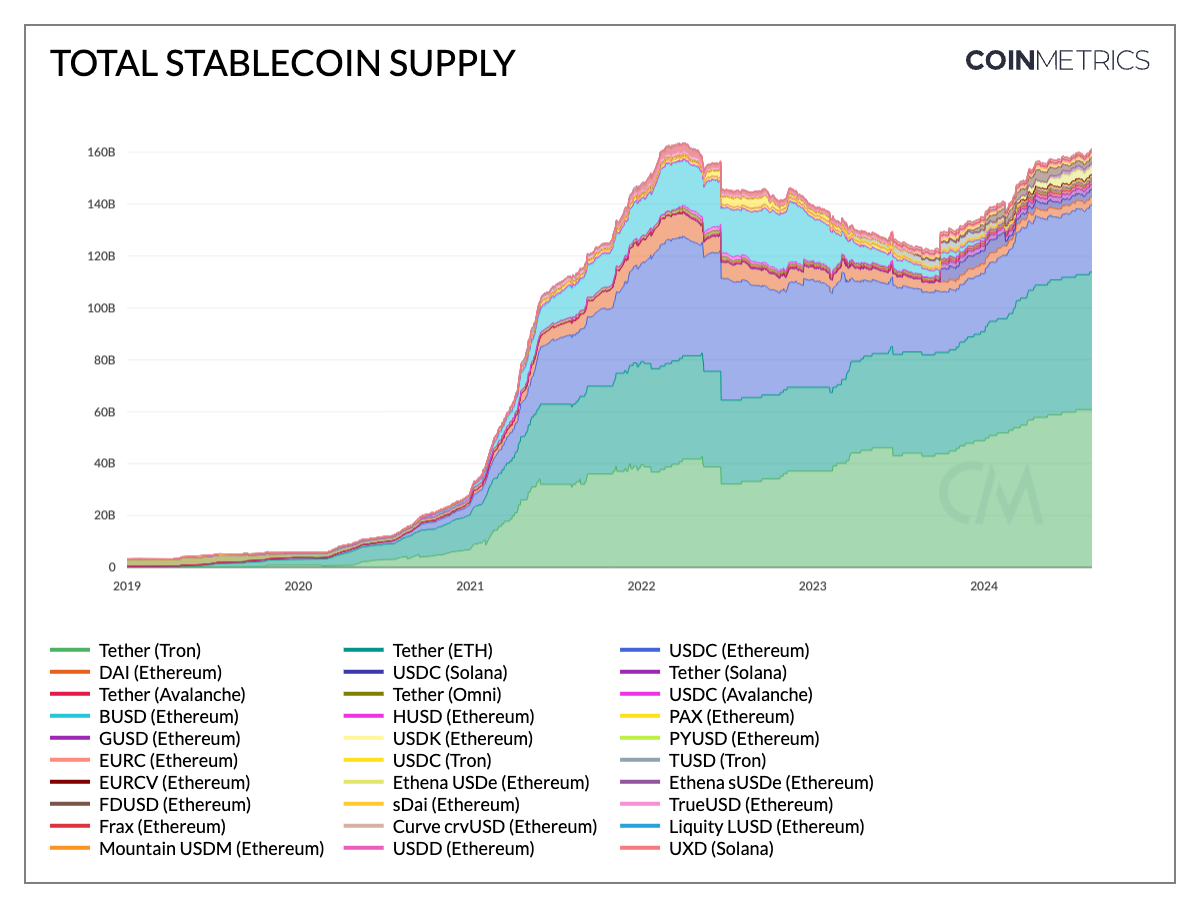

Thus, approaching $161 billion, the total stablecoin supply is once again close to a new all-time high. Tether maintains over 70% market share, with USDT on Ethereum growing 28% and USDT on Tron growing 26%, with a total supply of $119 billion for the year, distributed across multiple networks including Solana and Avalanche. Meanwhile, Circle’s USDC supply has grown to about $34 billion, expanding on Solana and Ethereum’s Layer-2 networks such as Base. While DAI’s supply has fallen to about $3.1 billion, sDAI (Savings DAI), a tokenized version of DAI deposited in Maker’s DAI Savings Rate, has grown to $1.34 billion.

Emerging stablecoins also gained traction: First Digital USD (FDUSD) on Ethereum grew 56% in August to $3.07 billion, while Ethena’s USDe ($2.96 billion) and sUSDe ($1.16 billion) combined reached $4.12 billion. Notably, PayPal’s PYUSD grew rapidly on Solana, surpassing its $364 million supply on Ethereum, bringing the total supply to $1 billion.

Source: Coin Metrics Network Data Professional Edition

Competitive adoption

Diversified mortgage methods

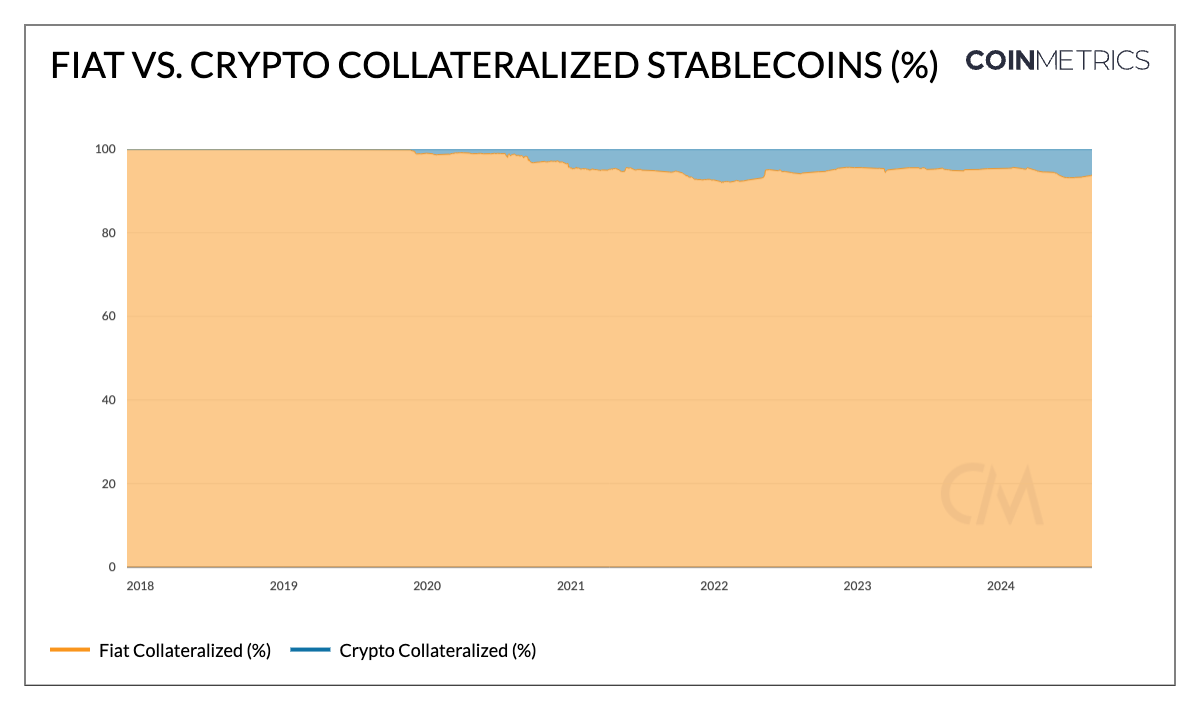

In order to improve its practicality as a store of value, various asset compositions or collateral methods have emerged in the stablecoin ecosystem, affecting the risk characteristics, operational characteristics and regulatory prospects of these products. More than 90% of the circulating stablecoin supply is collateralized by fiat currencies, such as Circle's USDC, Tether's USDT and PayPal's PYUSD, which are backed by US dollars and cash equivalent assets, linking their stability to the traditional financial system.

Others, such as MakerDAO's DAI and sDAI, offer alternatives to traditional units of account, backed by a basket of crypto assets and real-world assets (such as private credit loans or government bonds). 45% of DAI is backed by crypto assets and 40% is collateralized by real-world assets.

Source: Coin Metrics Network Data Professional Edition

Alternative pricing units

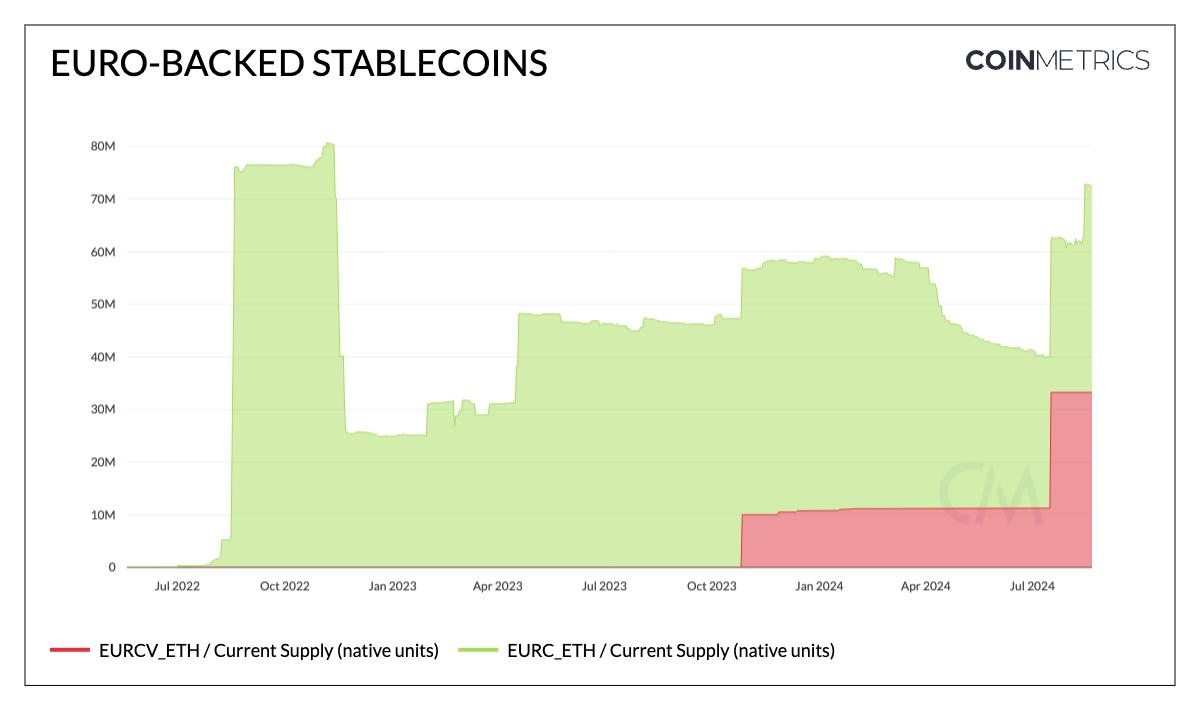

Due to the dollar’s status as a global reserve currency and its widespread demand in emerging markets, the supply of dollar-pegged stablecoins far exceeds that of other units of account. However, not all stablecoins are pegged to the dollar. With the EU’s progress on Markets in Crypto Assets (MiCA) regulations, the adoption of euro-backed stablecoins has been boosted. With a current supply of around 40 million, Circle’s EURC is the only euro-pegged stablecoin that complies with MiCA regulations. As more institutions launch alternative pegged assets, such as Societe Generale’s EURCV wholesale stablecoin, alternative pegs may leverage on-chain infrastructure to expand the foreign exchange market.

As various jurisdictions develop their digital asset regulatory frameworks, stablecoins pegged to local currencies can facilitate transactions for individuals and businesses within and beyond regional economies while complying with regulatory requirements.

Source: Coin Metrics Network Data Professional Edition

Utility and Scaling in Decentralized Finance (DeFi)

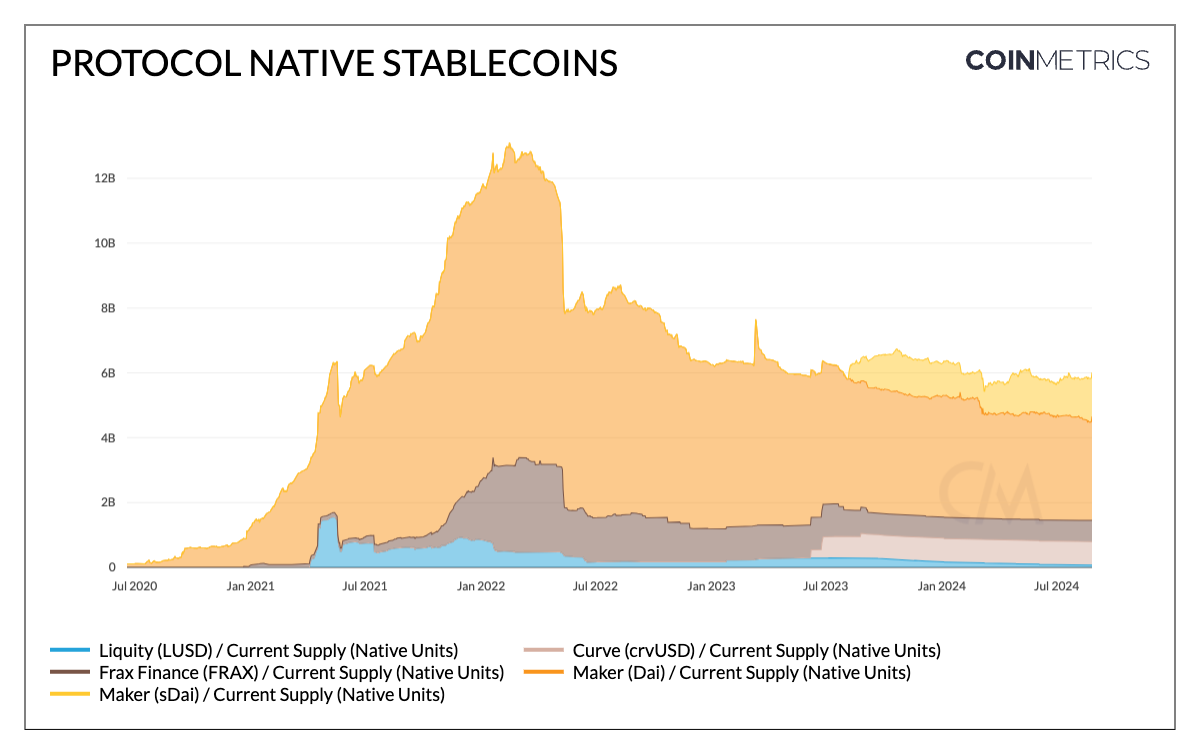

Stablecoins have become a synergistic part of the business model and functionality of decentralized finance (DeFi) protocols. After Maker's success with DAI, many DeFi protocols launched native stablecoins for their ecosystems. The price stabilization mechanisms and operations of these native stablecoins are adapted to their respective ecosystems, including Aave's money market protocol (GHO), Curve Finance's decentralized exchange (crvUSD), and collateralized debt protocols such as Maker & SparkLend's DAI and Liquity's LUSD.

They facilitate a wide range of financial services such as payments, lending, trading, liquidity provision, and yield strategies. A large amount of traditional stablecoin supply also exists in Ethereum smart contracts: 27% of USDC, 20% of USDT, and especially more than 50% of PYUSD as stable collateral on lending protocols and quote pairs on decentralized exchanges (DEXs). In addition, with the popularity of tokenized treasuries and real-world assets such as BlackRock's BUIDL and Mountain Protocols USDM, DeFi protocols have begun to incorporate traditional financial assets into their ecosystems, narrowing the gap between DeFi and traditional finance (TradFi).

Source: Coin Metrics Network Data Professional Edition

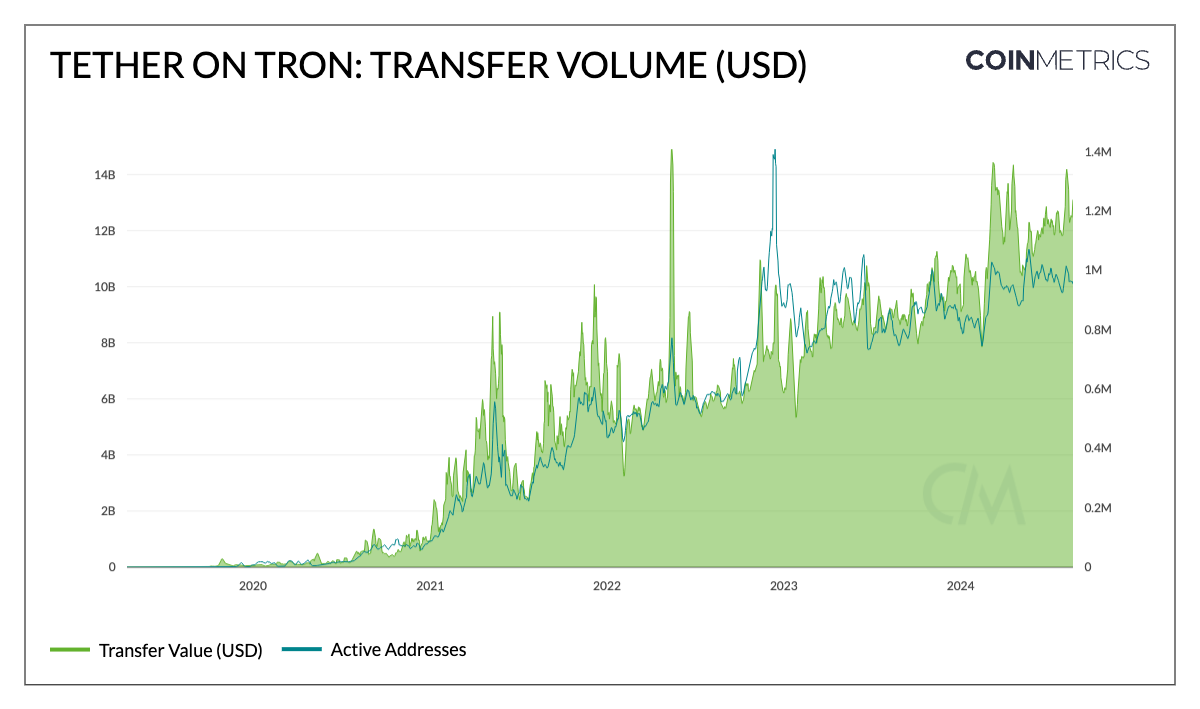

Tether’s Product-Market Fit on Tron

Tether (USDT) on the Tron network is an example of a stablecoin that has successfully established product-market fit. It has shown strong adoption and usage as a medium of exchange and store of value. Among many metrics, it not only has the largest current supply of 118 billion, with ~6.1 billion on Tron and ~5.3 billion on Ethereum (plus Solana and Avalanche), but also has the highest transfer volume and number relative to other stablecoins. Tether on Tron has a record (adjusted) transfer volume of nearly $14 billion and close to 1 million active addresses.

This usage is driven by Tron’s low transaction fees, enabling low-value payments and remittances, while USDT’s deep liquidity across exchanges facilitates trading activity as a quoted asset. As such, it provides a means to protect savings, seek economic stability, and democratize access to banking infrastructure, enabling peer-to-peer transactions for a variety of purposes, especially in emerging markets.

Source: Coin Metrics Network Data Professional Edition

Low fees on Layer-2 networks like Solana and Ethereum, combined with the distribution of businesses like Coinbase and simplified access through smart wallets or point-of-sale systems, provide an opportunity for stablecoins to establish a solid foundation on these networks and around the world.

How Stablecoins Perform in a Changing Interest Rate Environment

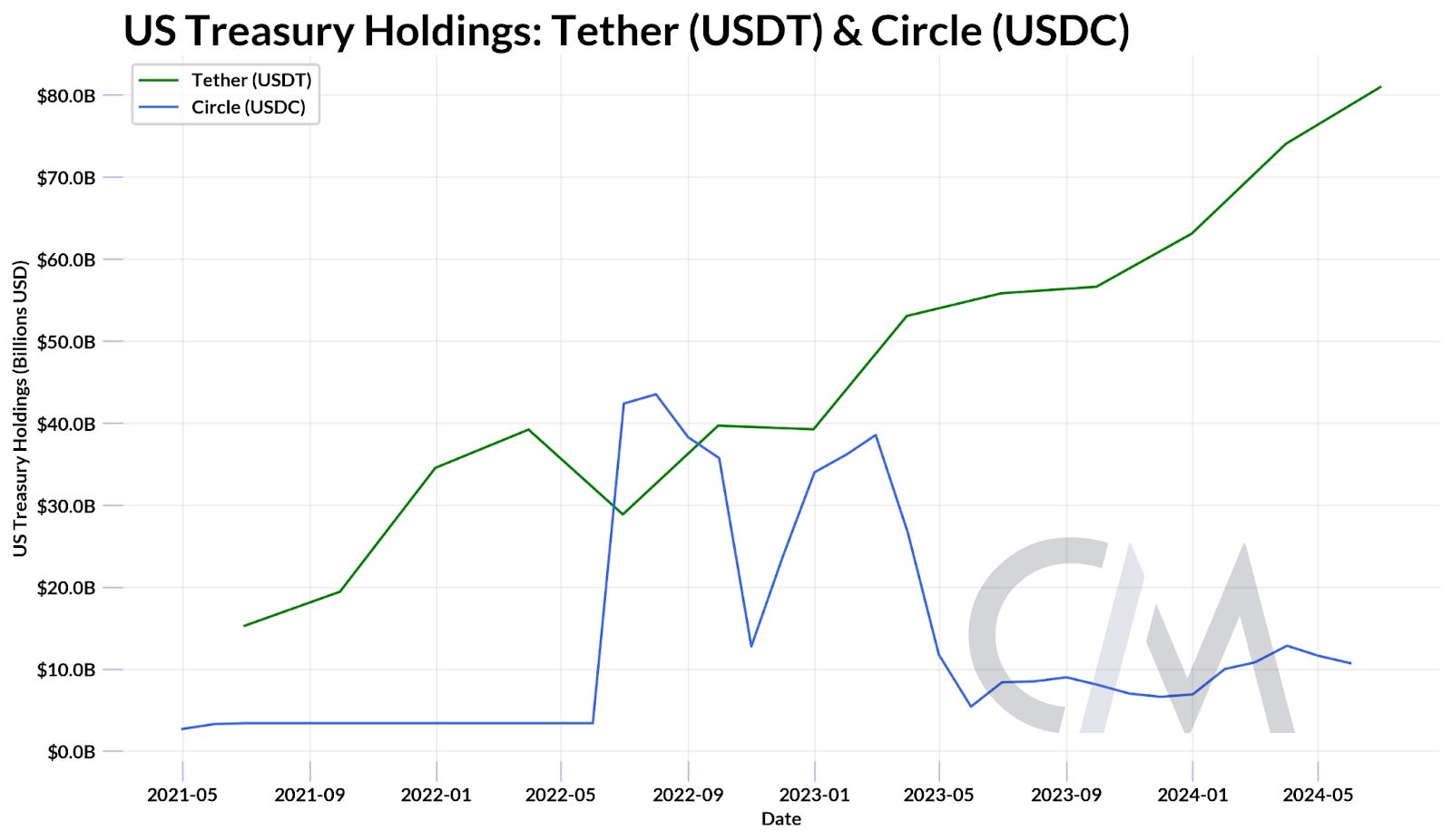

Stablecoins are primarily backed by the U.S. dollar or equivalents such as cash or treasury bonds. Most traditional stablecoins (such as USDT, USDC, PYUSD) retain the interest generated by their collateral rather than passing it on to token holders. Tether’s second quarter report proves this, reporting that part of its profits came from

Direct and indirect holdings of U.S. Treasuries brought in $5.4 billion, with holdings of U.S. Treasuries hitting a new high of $97.6 billion. This puts Tether’s holdings of U.S. Treasuries ahead of Germany, the UAE, and Australia, and ranks 18th among countries holding U.S. debt.

Source: Tether & Circle proof

Revenue Sources

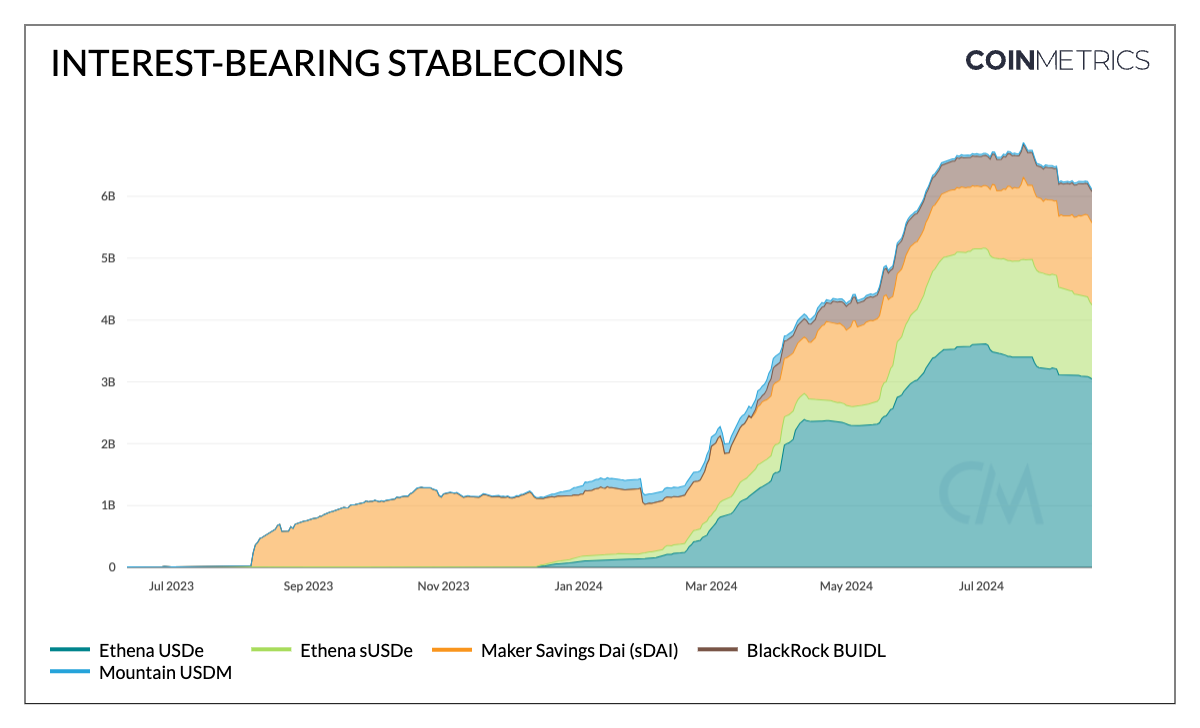

However, the rise in the federal funds rate and global interest rates since 2021 has created an opportunity cost for pure USD exposure. This has given rise to the rise of interest-bearing stablecoins, which are collateralized by short-term U.S. Treasuries, money market instruments, and other real-world assets (RWAs) and pass on the yield to holders.

For example, Mountain Protocol's USDM, whose yield comes from reserves composed of treasuries, accumulates interest through a rebase mechanism. Maker Protocol's Savings DAI (sDAI) takes a different approach, accumulating interest generated by DAI deposited in the DAI Savings Rate (DSR). This yield comes from a basket of real-world assets, crypto assets, and excess reserves that back DAI, and is implemented through the ERC-4626 treasury standard. These products are effectively like crypto savings accounts.

The integration of real-world assets with public blockchains also paves the way for institutional-grade products like BlackRock’s BUIDL, a tokenized money market fund issued by Securitize that uses a USDC redemption fund to provide a continuous 24/7 stablecoin exit channel. While tokenized treasury products rely on this off-chain source of yield, others like Ethena’s USDe generate yield through basis trades, including a neutral hedge combining a long position in ETH linked to the collateral and a short position in a perpetual futures contract.

Source: Coin Metrics Network Data Pro

However, Federal Reserve Chairman Jerome Powell hinted at possible rate cuts at the 2024 Jackson Hole Symposium, raising new questions about stablecoins in a low-interest rate environment. While fiat-collateralized stablecoin issuers may face the risk of declining profits due to the sensitivity of their business model to interest rates, and interest-bearing stablecoins may lose some appeal due to reduced returns, the shift in the risk environment could bring new capital inflows into the crypto ecosystem. This influx is driven by investors seeking to profit from lower borrowing costs and higher asset valuations, which may offset these effects by increasing demand for stablecoins as a medium of exchange.

in conclusion

The recent growth in stablecoin supply, approaching new highs, indicates increased liquidity and capital availability in the crypto ecosystem. As the ecosystem continues to evolve, we are witnessing stablecoins being optimized for different use cases and risk profiles, through diverse collateralization methods from real-world assets to crypto assets, and innovative approaches such as tokenized basis trading. As we look to the future, how to deal with regulatory hurdles and a low interest rate environment presents both opportunities and challenges that could reshape business models, user preferences, and the overall competitive landscape in this thriving space.