The Nigerian Securities and Exchange Commission (SEC) plans to initiate enforcement actions against businesses and individuals involved in unregulated cryptocurrency trading.

Emomotimi Agama, director general of the Nigerian SEC, has announced that they will take action against entities attempting to provide crypto services without proper regulation, according to a report by local news agency Nairametrics on September 9.

Emomotimi Agama – Director General of SEC Nigeria

Agama stressed that these measures are consistent with the SEC’s commitment to protecting investors, including those involved in the cryptocurrency industry. He stated:

“We will certainly initiate enforcement actions against anyone who wants to operate in this market without the intention of being regulated. For those who do not want to comply with the rules, we will not allow them to operate in our space.”

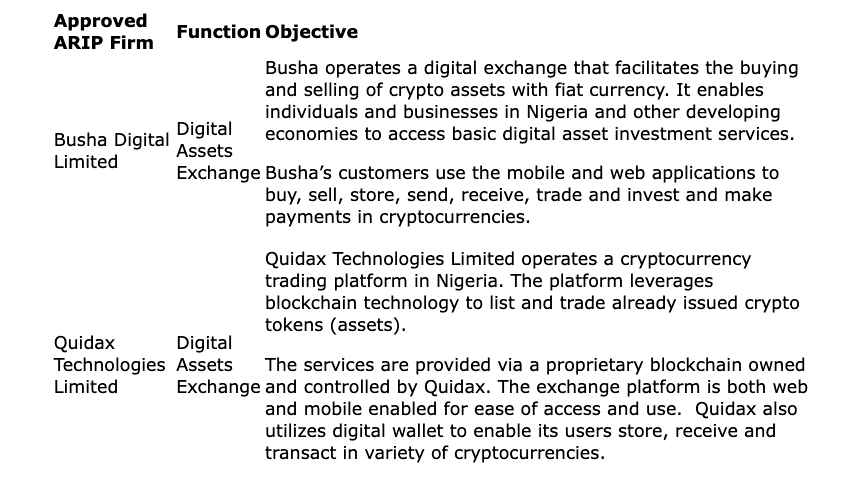

The SEC’s statement comes about two weeks after Nigeria’s securities regulator granted its first provisional operating licenses to two local cryptocurrency exchanges, Busha Digital and Quidax Technologies, on August 29.

While there are several other digital asset-related businesses in Nigeria that are approved by the SEC, Busha and Quidax are currently the only two exchanges officially supervised by the agency, according to the agency’s website.

Source: SEC Nigeria

According to Agama, the recent decision to approve Busha and Quidax in Nigeria is due to the growing interest in digital assets among young Nigerians. Therefore, there is a need for a clear regulatory framework to protect investors while encouraging innovation.

He mentioned that the SEC’s crypto oversight will include examining Anti-Money Laundering and Counter-Terrorism Financing protocols.

Industry observers agree that Nigeria’s approach to regulating cryptocurrency trading has been somewhat unclear and inconsistent despite emerging as one of the world’s largest crypto markets.

In early 2021, the Central Bank of Nigeria (CBN) imposed a blanket ban prohibiting all financial institutions from providing services to domestic exchanges. A year later, the Nigerian SEC released a regulatory framework targeting exchanges.

In late 2023, the CBN officially lifted the ban on cryptocurrency trading but later introduced new regulations to restrict peer-to-peer trading in the national currency, naira, in May 2024.

Global exchanges like Binance have also faced action from Nigerian regulators.

Despite Binance announcing its withdrawal from Nigeria in March 2024, local law enforcement has not released its executives, including Binance’s head of financial crime compliance Tigran Gambaryan.

Gambaryan has been in custody for more than six months since his arrest in February while awaiting a court decision on his bail, which is expected in October.

Join Telegram: https://t.me/tapchibitcoinvn

Follow Twitter (X): https://twitter.com/tapchibtc_io

Follow Tiktok: https://www.tiktok.com/@tapchibitcoin

Dinh Dinh

According to Cointelegraph