Bitcoin ( BTC ) Miners have taken a cautious approach, selling some of their coins for profit. On- chain data shows Miners balances have been falling steadily since early September.

When Miners start selling, this is often XEM as a negative sign. This begs the question: what do the coin holders know?

Miners sell Bitcoin for profit

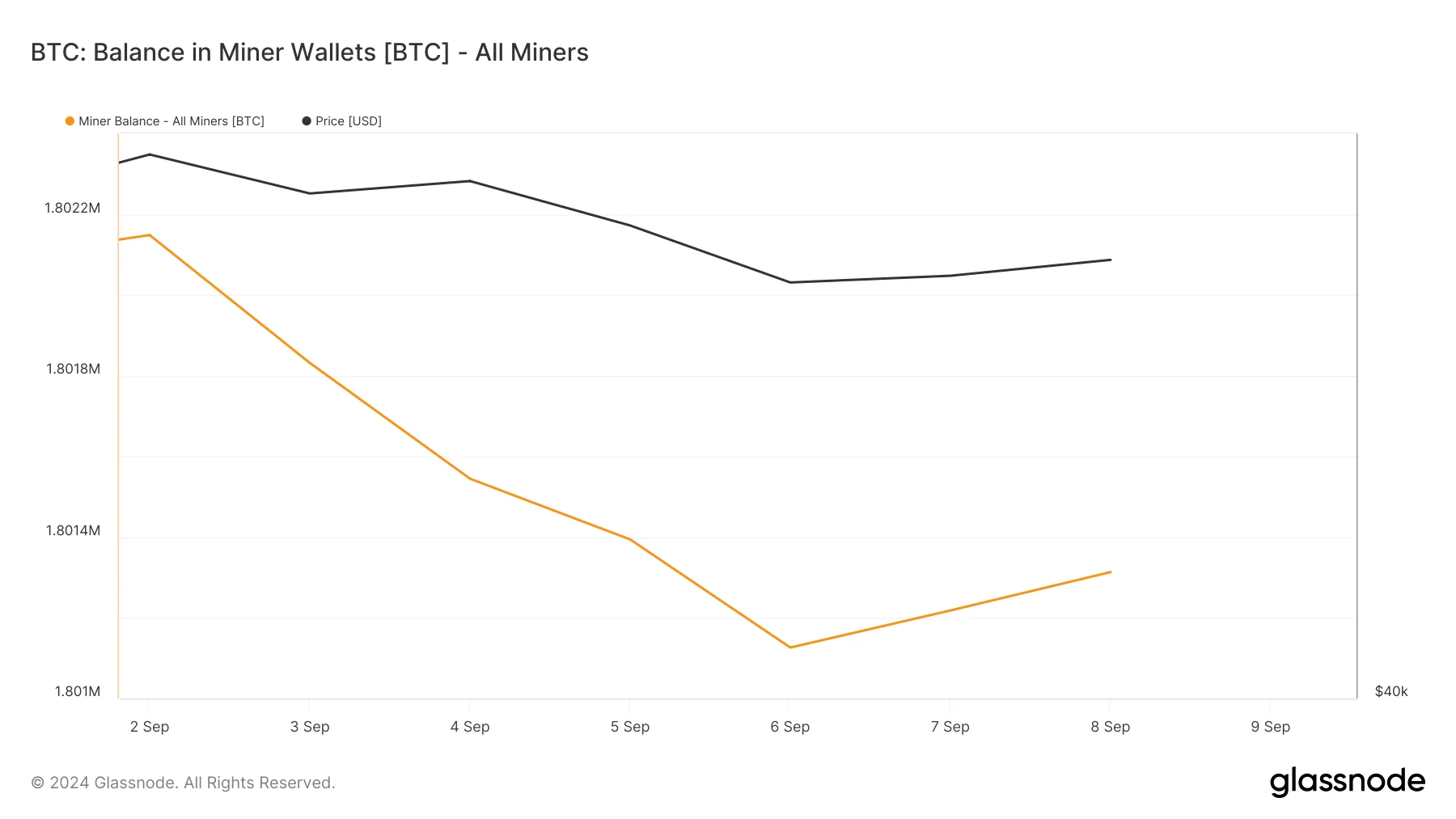

Data from Glassnode shows a steady decline in Bitcoin Miners balances since September 2. The index tracks the total number of coins held by Miners on the BTC network. Currently, there are 1.8 million BTC, worth about $99 billion at current market prices, held in Miners addresses.

A drop in Miners balances typically indicates that they are selling their coins, often due to low profitability. However, this selling comes despite a surge in Miners ' total revenue from transaction fees and block rewards.

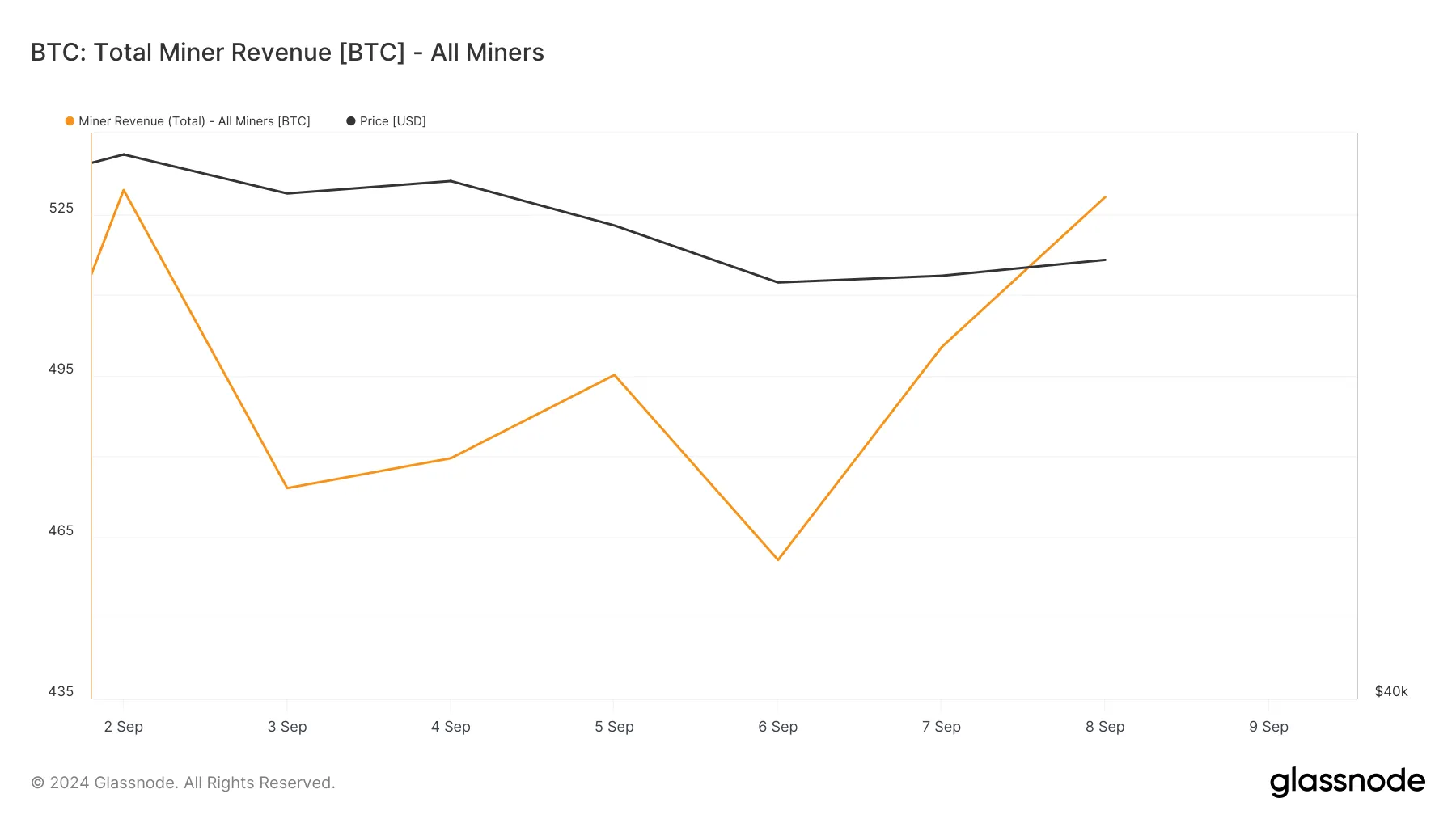

According to Glassnode, total Miners revenue has increased by 15% over the past 2 days, even though the value of Bitcoin continues to decline. Currently trading at $55,659, BTC has lost nearly 5% of its value over the past 7 days. This suggests that although Miners are earning more, they may be selling coins due to general market concerns .

A simple explanation for the increased coin distribution among BTC Miners as their revenue increases is that they are taking profits. With BTC struggling to break above the $60,000 mark, Miners may be selling some of their coins to secure liquidation or cover operating costs.

FOLLOW US ON FACEBOOK | TELEGRAM | TWITTER

Disclaimer: All content on this website is for informational purposes only and does not constitute investment advice. Readers should conduct their own research before making any investment decisions. We are not responsible, directly or indirectly, for any damages or losses arising in connection with the use of or reliance on any content you read on this website.