Spot Bitcoin ETFs have been a magnet for institutional investors since their launch in the US market in January 2024. These ETFs allow for direct Bitcoin investment into portfolios, bypassing the challenges of direct purchase and safe storage.

The market response has been overwhelmingly positive, with more than 1,000 institutional investors participating in just two 13F filing periods. 13F filings are mandatory quarterly reports for institutional investment managers.

BlackRock's Bitcoin ETF Has 661 Institutional Holders

Eric Balchunas, a senior analyst at Bloomberg, discussed the phenomenal growth of Bitcoin ETFs. Furthermore, he compared them to conventional ETFs, which often struggle to attract significant institutional attention initially.

BlackRock’s iShares Bitcoin Trust (IBIT) is particularly notable. The fund boasts 661 institutional holders, with 20% of its shares held by large institutions and advisors. Balchunas predicts that number could double next year.

Furthermore, a significant shift has been observed among top US hedge funds. 60% of these funds now hold Bitcoin ETFs, a sharp increase from the beginning of the year.

Notably, none of these funds sold their holdings in the second quarter; many increased their holdings. Large firms such as Citadel Investments, Millennium Management, Mariner Investment and Fortress Investment were among those that increased their holdings.

The appeal of Bitcoin ETFs extends beyond hedge funds. Notably, 13 of the top 25 investment advisors in the United States report exposure to Bitcoin through these ETFs. Firms like Cambridge Associates and Hightower Advisors are gradually increasing their investments, signaling broader institutional confidence in Bitcoin’s value.

The support of these institutions is transforming the perception and utility of cryptocurrencies. Following the launch of the Bitcoin ETF, the Ethereum ETF was also introduced, attracting more traditional investments into the cryptocurrency space.

The impact of these ETFs on the cryptocurrency market is undeniable. This growth is reflected in the sharp increase in the number of Bitcoin millionaires, which has jumped 111% to 85,400 globally, according to a report by Henley & Partners.

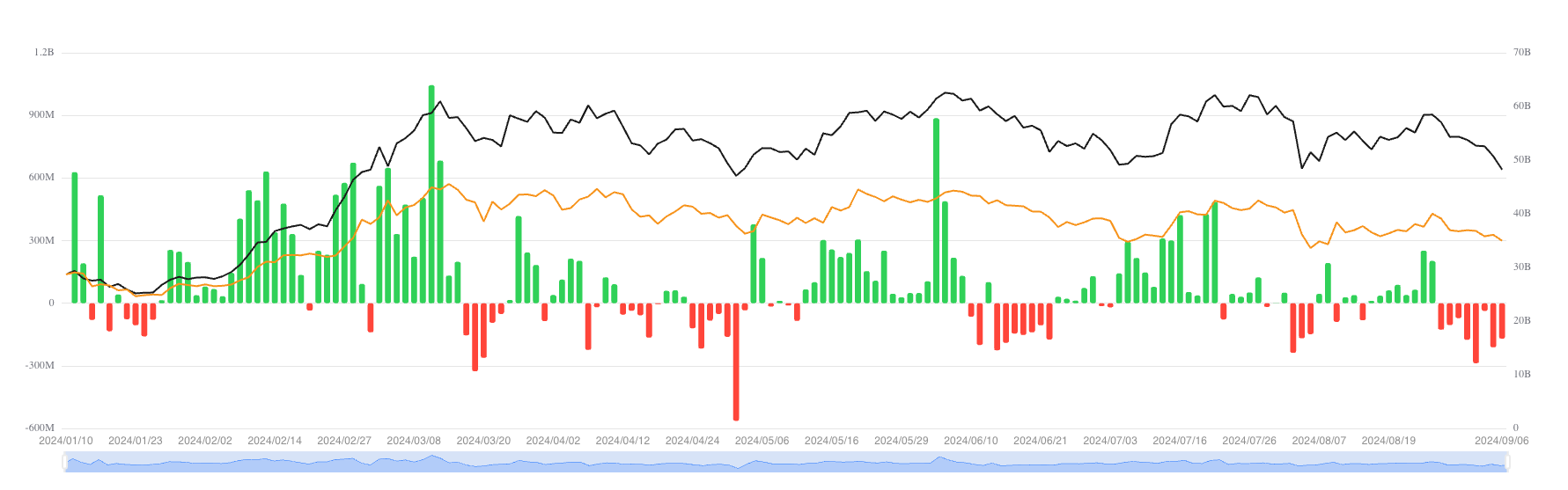

Despite these gains, however, challenges remain. U.S. Bitcoin ETFs have experienced their longest chain of outflows since their launch, with investors pulling about $1.2 billion from the funds in eight days through early September.

The trend highlights the current risk-off sentiment in the market as a whole. Balchunas, however, remains optimistic.

Bitcoin ETFs have seen a “little” amount of outflows. $287 million outflows in 1 month = 0.5% of AUM and $787 million in 1 week = 1.5%. In other words, nearly 99% of investors are holding on once again.

FOLLOW US ON FACEBOOK | TELEGRAM | TWITTER

Disclaimer: All content on this website is for informational purposes only and does not constitute investment advice. Readers should conduct their own research before making any investment decisions. We are not responsible, directly or indirectly, for any damages or losses arising in connection with the use of or reliance on any content you read on this website.