Author: Sharanya Sahai

Compiled by: TechFlow

The past year has seen a significant increase in the launch of new Layer 2 (L2) solutions due to technological advancements, the development of unique market entry strategies, focus on specific use cases, and strong community engagement. While this development is exciting, the main challenge remains how to scale these blockchains in a more cost-effective manner. Running application chains has become a key solution as application chains are able to manage the operational costs of blockchains through various measures in a modular infrastructure stack.

While L1-specific initiatives such as Ethereum have significantly reduced transaction costs on blockchains, there is a strong push from major rollups and infrastructure providers to further increase scalability and unlock use cases that are currently too expensive to execute on-chain.

We can categorize and analyze these developments in terms of a) L1 initiatives, b) L2 initiatives, and c) modular infrastructure initiatives, all of which are meaningfully lowering the barriers to entry for on-chain transactions.

Recently, we have seen several upgrades to Ethereum, such as EIP 1559 and 4844, which have reduced costs and improved scalability.

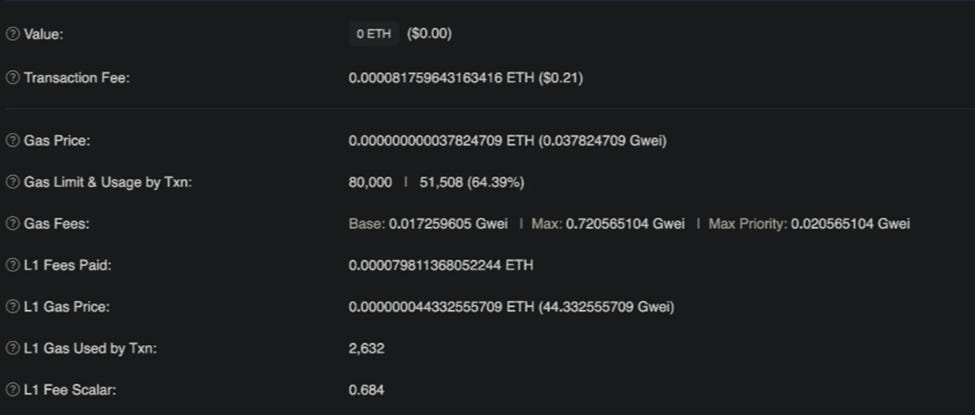

Let’s first look at L1 initiatives that have helped rationalize the cost of on-chain transactions on Ethereum in the form of EIP 1559 and EIP 4844 (Dencun upgrade). EIP 1559 introduced the concept of a base fee plus a tip/priority fee, as well as a dynamic pricing mechanism based on congestion, providing users with a better mechanism to estimate costs and trade based on their priorities and network congestion. EIP 4844 brings a new transaction type to Ethereum by introducing the concept of Blobs (Binary Large Objects). This provides L2 with an extremely cheap alternative to storing data in Blobs instead of expensive callData when settling transactions on L1.

Figure 1: The average gas price for base and priority fees on July 19th was 8 gwei. Source: Etherscan

The implementation of Blobs significantly reduces transaction costs, as the storage cost per byte is reduced while the capacity of each block is also expanded. Blobs do not compete with Ethereum transactions for gas like callData, and are not stored permanently, but are removed from the blockchain after approximately 18 days.

Blobs consist of 4096 field elements of 32 bytes each, and each block can contain up to 16 blobs, providing a maximum additional capacity of about 2MB (4096 * 32 bytes * 16 blobs per block). This can be achieved by starting with a lower capacity (currently 0.8MB, with a target size of 3 blobs per block, up to 6 after EIP 4844) and reaching capacity through multiple network upgrades in the future.

Considering the historical benchmark of 2-10KB of callData per block, EIP 4844 could theoretically achieve up to384x growth.

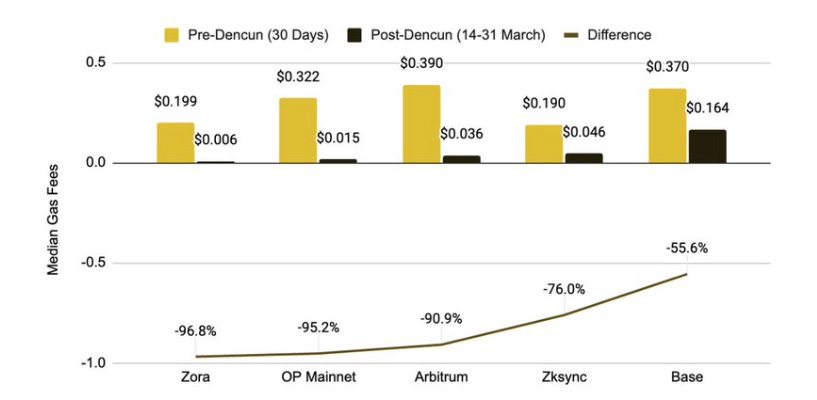

In fact, many L2 fees have been reduced by more than 90% after implementing EIP 4844 (see Figure 2). However, these upgrades alone are not enough to make Ethereum more scalable. In a world with thousands of rollups, transaction costs could soar as demand for storage space increases with on-chain mass adoption.

Figure 2: Median gas fees of major L2 networks decreased after EIP 4844 was implemented. Source: Binance

As L2 moves execution off-chain to reduce costs and maintain security, industry initiatives such as open source frameworks and revenue-sharing models are shaping a competitive “L2 stack war.”

In the last cycle, the emergence of rollups aims to significantly reduce the cost of on-chain operations by moving execution off the main chain, while still gaining security from the main chain by using various proof types. Optimistic rollups allow a single honest entity to submit a “fraud proof” to earn rewards by identifying misbehaving orderers, while ZK (zero-knowledge) rollups use zero-knowledge proofs to verify the correct updates of the L2 chain.

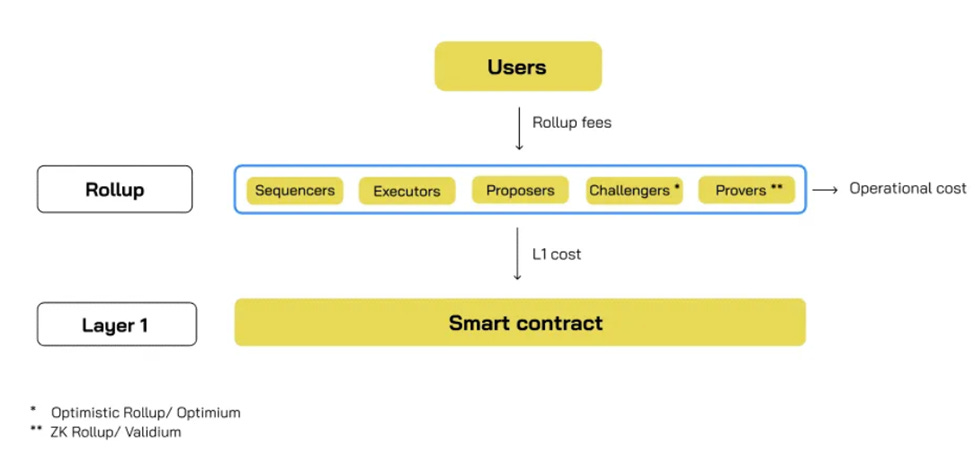

Rollup operators need to perform a variety of tasks, including:

Sequencing: Organize end-user transactions in sequence, group them, and occasionally publish batches of these groups to L1.

Execute: Store and execute operations, and update the rollup status.

Proposals: Proposers regularly update the rollup state root on Layer 1, which is critical to ensuring the blockchain remains trustless and verifiable by everyone.

State root challenge: Submit evidence of state root fraud and challenge the state root on Layer 1 (only applicable to optimistic Rollup).

Proofs: Generate verification for each state root update from rollup to L1 (only applicable to ZK Rollup).

Their revenue comes from transaction fees paid by users (sorter income) and potential MEV that can be extracted, although it should be noted that MEV has not yet been extracted as a strategic option. Their costs mainly come from L2 (operating costs) and L1 (data availability and settlement) costs (see Figure 3). Organizations that want to launch their own chain will ideally only do so if the expected transaction fees are higher than the planned costs.

Figure 3: Rollup business model, source: Exploring the Rollup ecosystem

Base layer networks such as Ethereum typically charge higher fees for compute and storage, as most nodes are required to sync and validate the chain. However, in a rollup, as long as there is an honest entity that can validate the chain, the chain is considered secure. Therefore, rollups charge lower fees for compute and storage, but higher fees for “packaging” transactions into batches and publishing them to L1. As a result, before the introduction of EIP 4844, L1 costs accounted for up to 98% of the L2 cost base (see Figure 4).

Exhibit 4: Fee breakdown of a typical transaction on Optimism prior to EIP 4844 Source: Biconomy

OP Stack and Arbitrum Orbit , other mature L2s including Polygon ( Polygon CDK ), ZK Sync ( ZK Stack ) and Starkware ( Madara Stack )

Figure 4: Fee breakdown of a typical transaction on Optimism before the introduction of EIP 4844. Source: Biconomy

In addition to optimization at the basic level, L2 is also actively promoting further cost reduction. These initiatives are the Layer 2 initiatives we mentioned at the beginning of the article, which can be mainly divided into two categories - industry alignment or company alignment.

Industry-aligned initiatives include open-sourcing L2 technology stacks (rollup frameworks) to allow new players to build their own chains. Although this wave of initiatives is led by optimistic rollups through the launch of OP Stack and Arbitrum Orbit , other mature L2s, including Polygon ( Polygon CDK ), ZK Sync ( ZK Stack ), and Starkware ( Madara Stack ), have also driven mass adoption by offering or announcing the open source of their proprietary technologies.

Initiatives aligned with the companies include efforts by these chains to accrue value to their tokens, either through direct revenue/profit sharing models, or through indirect effects of expanding the ecosystem. Optimism’s Superchain vision, Arbitrum’s scaling plans , Polygon’s aggregation layer , ZK Sync’s elastic chains are all examples of such initiatives. While the specifics of these initiatives may differ, their common theme is a ubiquitous interconnected network that provides enhanced interoperability and communication between multiple rollups, and improves capital efficiency through critical infrastructure in the form of a shared base layer (e.g., data availability, shared bridges, aggregation proofs, only for ZK chains). This addresses the current issues of fragmented liquidity and lack of interoperability between rollups in the Ethereum ecosystem. However, these technology stacks also allow individual chains to remain uniquely customized based on their needs on parameters such as block time, extraction cycle, finality, token usage, gas limits, etc., thereby eliminating the disadvantages of public chains such as high gas costs and latency due to traction of other applications.

While these independent ecosystems focus on growth and adoption, we have begun to see more established players, such as Optimism and Arbitrum, achieve profitability.

Optimism charges participants who want to be part of its Superchain a fee of 2.5% of overall sorter revenue or 15% of sorter profit (i.e. sorter revenue minus settlement and data availability costs for L1). Arbitrum charges 10% of sorter profit to participants who use its stack to launch L2. ZK rollup stacks, including Polygon CDK and ZK Stack, are currently free to use, but as they develop and gain traction, sustainable economic models may be built in.

The official “L2 stack war” has begun, with major ecosystems vying for key projects to join through unique strategies (see Figure 5). Optimism announced $22 million in grants to Superchain builders, with retroactive airdrops to them based on usage and participation, while ZK Sync provided $22 million to bring Lens from Polygon to its stack. Arbitrum allows anyone to use its stack for free as long as they launch as an L3 chain on Arbitrum (an L3 chain is a chain that uses L2 as a settlement layer instead of Ethereum) because it benefits from increased L3 activity, and these L3 chains will eventually pay Arbitrum for settlement costs during their lifetime.

Figure 5: Distribution of projects using the L2 stack across the ecosystem

RaaS and alternative settlement and data availability solutions redefine blockchain’s cost structure, and future innovations in modular infrastructure are expected to bring even more savings.

Despite the support of these technology stacks, running a blockchain still requires a lot of operational overhead, manpower, expertise, and resources. Developers who want to attract on-chain end users do not want to be distracted by dealing with the operation and maintenance of chain infrastructure, and they would rather focus on core business activities.

The emergence of this problem has led to a rapid increase in RaaS (Rollup as a Service) providers, who work with developers to simplify the complexity of chain operations by leveraging the mature L2 frameworks/stacks discussed earlier. Services provided by these providers include node operations, software updates, infrastructure management, and products such as sorting, indexing, and analytics. RaaS providers have adopted different strategies in their competition for market share, with some aligning with specific L2 ecosystems and others taking a framework-agnostic approach and providing integration across all ecosystems. Conduit and Nexus Network are aligned with optimistic rollups (such as Optimism and Arbitrum), while Truezk , Karnot , and Slush focus on ZK chains. Meanwhile, Caldera , Zeeve , Alt Layer , and Gelato provide integration across optimistic and ZK rollups.

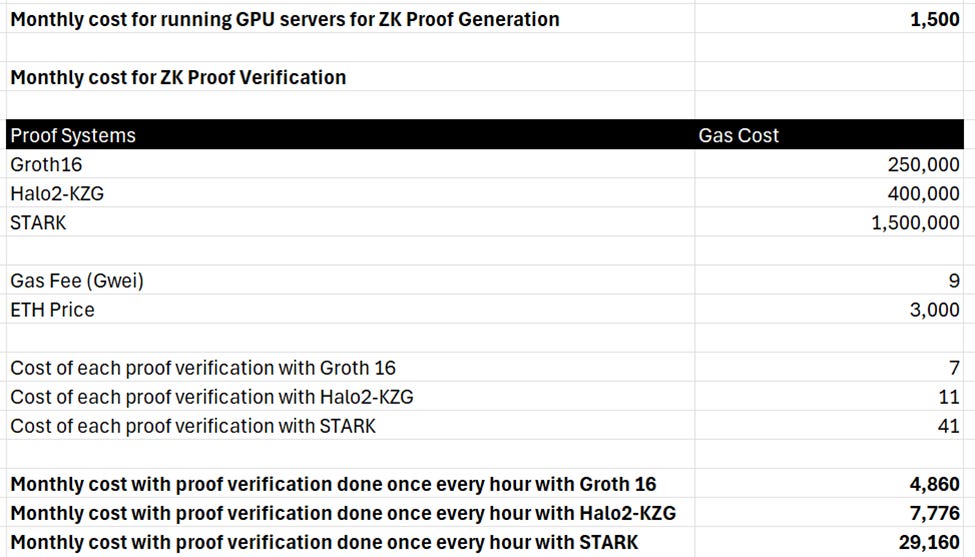

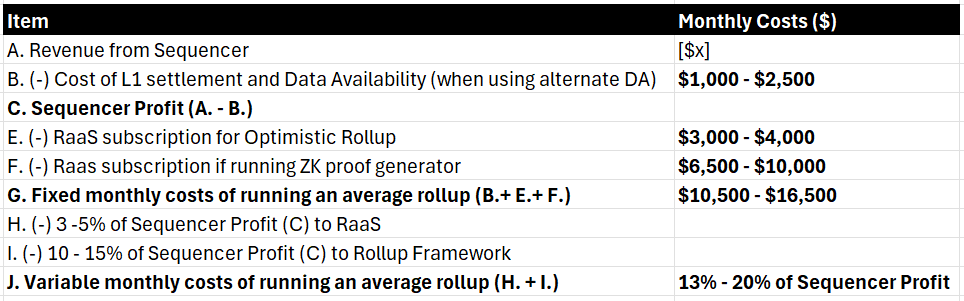

The typical business model for these providers involves charging a fixed fee and a portion of the orderer profits. The monthly subscription fee for running optimistic rollups is typically between $3,000 and $4,000, while running ZK rollups can double to $9,500 to $14,000 due to the intensive computation required to generate ZK proofs and the extremely high proof verification costs (see Figure 6 for details). In addition, a 3-5% orderer profit share is levied so that incentives between RaaS providers and rollups are aligned, allowing them to reap financial benefits as these chains gain momentum.

Caldera is exploring a different model with its Metalayer vision of charging only a 2% variable orderer profit share, with no fixed costs, and aims to enable inter-chain interoperability by using Caldera in both the optimistic and ZK stacks.

Figure 6: Cost of ZK proof verification Source: Nebra

It is important to note that due to the dynamic nature of the industry and the team efforts in ZK in particular, subscription fees from RaaS providers may be further reduced. Additionally, due to the lack of a strong consumer Web3 business, large consumer-facing applications may negotiate more favorable economic sharing agreements with infrastructure providers, so initial pricing may not be uniform across applications.

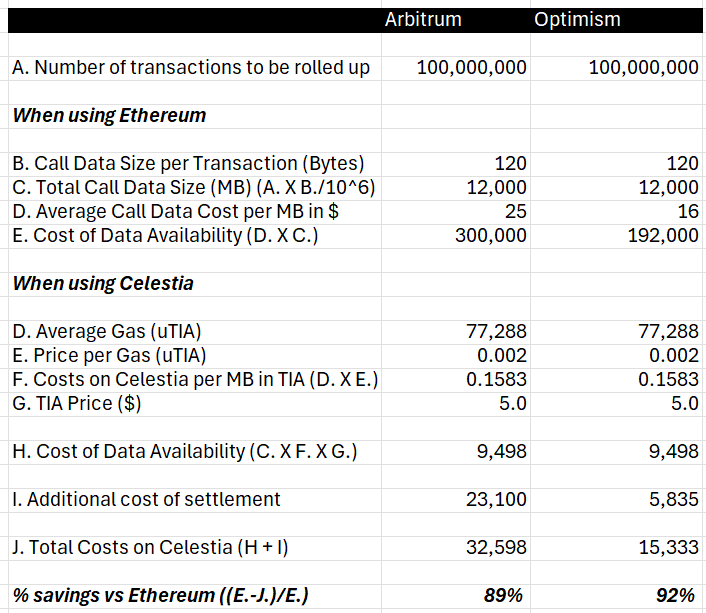

As mentioned earlier, the largest expense for rollups is L1 costs, including fees for data availability and settlement. A standard rollup processing 100 million transactions can have L1 costs as high as $25,000 per month, making L1 settlement only feasible for the largest or most heavily used chains in the ecosystem. The need for alternative settlement and data availability solutions has prompted participants focusing on these layers to optimize cost and performance. In terms of data availability, Ethereum alternatives include Celestia , Near , EigenDA , and the mature L2 discussed earlier aim to be the settlement layer for rollups, which can be classified as L3. These participants have reduced the settlement and data availability costs of rollups by orders of magnitude. Figure 7 roughly shows the cost savings if rollups publish callData to Celestia instead of Ethereum. It is worth noting that the cost savings increase exponentially with the increase in transaction volume.

Figure 7: Cost savings of rollups using Celestia versus Ethereum Source: Lenses

In addition to the data availability cost, there is an additional settlement cost, namely that Celestia publishes a pointer on Ethereum to trace back to the relevant blocks on Celestia, thereby ensuring the ordering and integrity of the data published on Celestia.

The development of specialized players in alternative data availability and RaaS providers in the modular infrastructure stack is collectively referred to as modular infrastructure initiatives. Within this category, there are other verticals exploring further cost optimization, including shared ordering (e.g. Espresso , Astria , Radius ), proof aggregation (e.g. Nebra , Electron ), and others. These are currently in the early stages of development, and it is expected that costs will continue to decline as the industry matures.

Despite the significant reduction in the cost of on-chain operations, Web2 founders still need to conduct a thorough cost-benefit analysis before deciding to launch their own chain.

Web2 founders need to carefully evaluate the cost-benefit of launching their own chain, because although on-chain costs are reduced, these costs may still refer to Web2 standards. The total cost of running a chain depends on the specific usage requirements of each chain, but we can roughly estimate the cost of an average optimistic or ZK chain processing 2 million transactions per month when using alternative data availability solutions, as shown in Figure 8.

Figure 8: Example of cost structure for rollups

Despite various optimizations at the industry and chain level, the required monthly capital investment still includes a total cost of $10,500-$16,500 for ZK rollups and $4,000-$6,500 for optimistic rollups, in addition to up to 20% of sorter profits once the chain becomes profitable.

The three broad categories of initiatives highlighted in this article are key to driving industry adoption, with the ultimate goal of closing the cost and convenience gap between decentralized applications and Web2. For developers, it is critical to conduct a cost-benefit analysis of independent chains versus building on existing chains based on end-user demand, product priorities, performance metrics required for use cases, and existing market appeal.

We recognize the need to build solutions that close the cost and performance gap between Web3 and Web2 infrastructure, as society’s preference for decentralized systems is not yet strong enough to drive widespread Web3 adoption. This challenge remains a major bottleneck to blockchain mass adoption, and we look forward to meeting founders innovating in this space!

We thank Dr. Ravi from Zeeve, Mayank from Nexus Network, Raghu from Rabble, Rafael from Numia, Apoorv from Karnot, Shumo from Nebra, Garvit from Electron, and Yush from Lysto for generously sharing their valuable insights which have been incorporated into this article.

Hashed Emergent may have invested in or may in the future invest in companies mentioned in this article. The content of this article is for informational purposes only and should not be considered investment advice. Please conduct your own research before making any investment decisions.