Author: Scott Garliss, CoinDesk; Translated by: Baishui, Jinse Finance

The case for the Federal Reserve to cut interest rates is becoming increasingly compelling.

Central bank policymakers got another important clue about economic growth this week when the U.S. Bureau of Labor Statistics (BLS) released its Consumer Price Index (CPI) data for August on Wednesday morning.

The data is important because it is one of the last key growth data the Fed receives before its monetary policy meeting on September 17-18. The CPI reading comes on the heels of last Wednesday's weak Beige Book survey and Friday's disappointing job growth data. In other words, if inflation growth is weak enough, it could tempt the central bank to take an increasingly dovish (inclined to lower interest rates) stance.

This morning, the annualized headline inflation growth rate fell to 2.5% in August, compared to 2.9% in July. This is the lowest result since the 2.6% growth in March 2021. This means that the Fed is approaching its 2% target. This change will support future rate cuts. This will support stable economic growth and long-term gains for Bitcoin and Ethereum.

But don’t just take my word for it, let’s look at what the data tells us…

Each month, the Federal Reserve Banks of Dallas, Kansas City, New York, and Philadelphia contact manufacturers in their regions to assess business levels. They ask questions about new orders, backlogs, inventories, lead times, and employment. Survey respondents say whether business is increasing, decreasing, or staying the same. The data is then compiled into a composite index.

The results are important because the regions covered by these central banks account for about 25% of the nation's economic output. So by measuring what happens there, we can get a sense of what's happening across the country.

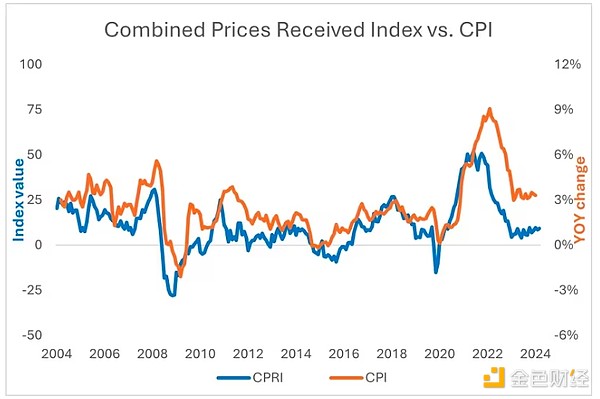

The number we care about most is the "Prices Received" reading. It tells us how much customers are willing to pay manufacturers for their finished goods. So, it's similar to the CPI. However, these numbers are released before the Bureau of Labor Statistics releases its monthly indicators.

So by looking at regional manufacturing data we can get a sense of inflation growth before official data is released. From what I can see, prices have fallen in August…

As you can see in the chart above, my proprietary inflation indicator (the "CPRI") began to roll over in October 2021. This was about eight months earlier than the CPI. Then, as you can see on the right side of the chart, the CPRI has been stable above the breakeven point since July of last year. This change has caused the CPI to gradually move lower.

But it's not just the lack of movement in prices that convinces me that inflation is still slowing. Take a look at this chart of gasoline prices...

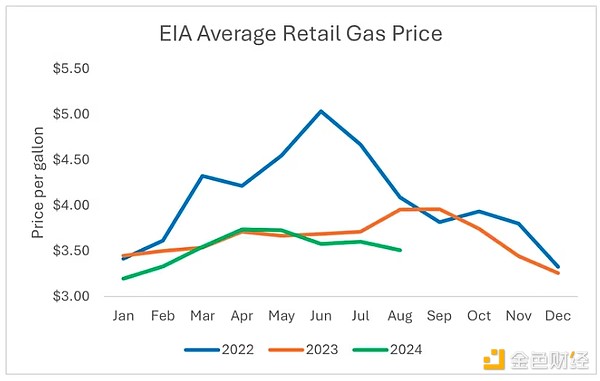

According to the U.S. Energy Information Administration (EIA), the average retail price per gallon of gasoline was $3.51 in August, compared to $3.60 in July. That’s a drop of about 3%. More importantly, the price in August 2023 was $3.95. In other words, you and I are paying 11% less to fill up our tanks than we did a year ago.

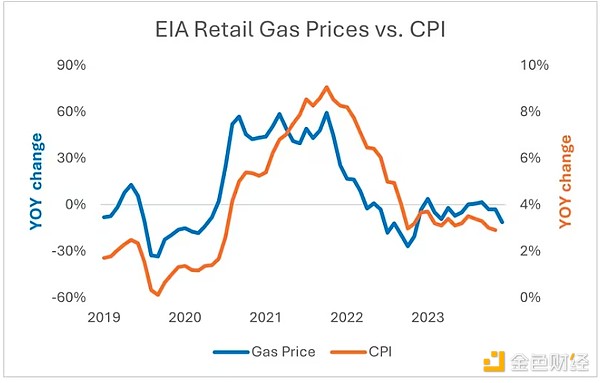

Now look at how closely inflation is related to retail gasoline prices…

Gasoline prices account for about 4% of the overall CPI figure. It can be considered a measure of economic activity because it is something that many people use on a daily basis. In other words, if demand is high, prices should rise, while reduced purchases should cause prices to fall.

The annualized change in gasoline prices in August was even larger than the 3% drop in July. When the July CPI results were released, inflation fell below 3% for the first time since 2021. This means that when the August results are released, gasoline prices should be a bigger drag on the headline inflation data.

Now, while core PCE (released later this month) is the Fed's preferred inflation measure, CPI remains a driver of stock market sentiment. Today's result was in line with Wall Street expectations of 2.5%. This result supports the case for our central bank to cut interest rates, perhaps by as much as 50 basis points.

This change will depress the value of our currency and push up the price of risky assets denominated in US dollars. This will support the long-term stable rise of cryptocurrency investments such as Bitcoin and Ethereum.