Table of Contents

ToggleU.S. presidential election polls

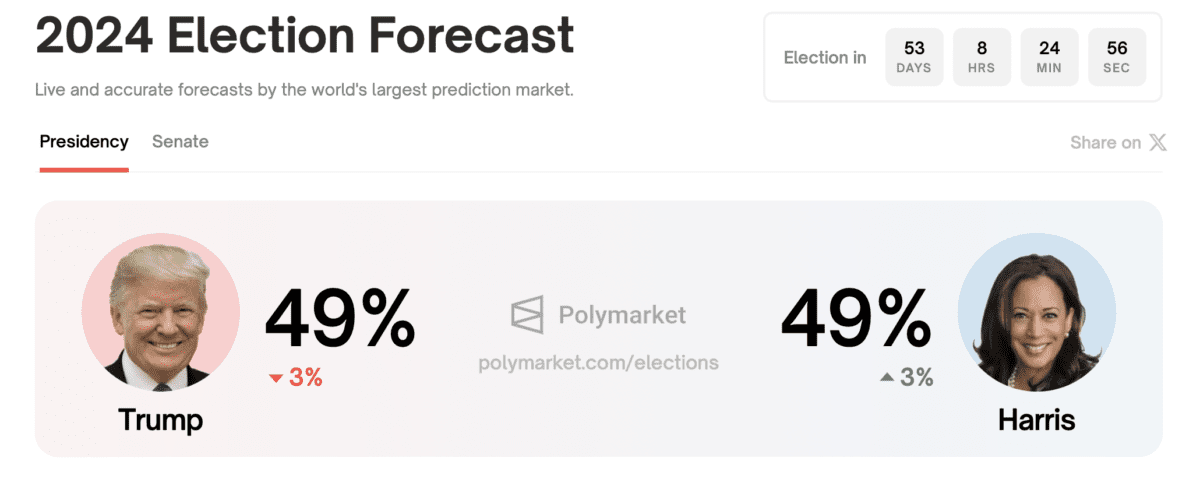

After the presidential debate between US Vice President Harris Harris and former President Donald Trump, election polls have once again become a hot topic. Currently, He Jinli has a slight advantage in many polls. The New York Times showed that Harris's winning rate was 49%, compared to Trump's 47%; data from Project FiveThirtyEight and ABC showed that Harris' winning rate was 47%, compared to Trump's 44.3%. On Polymarket, the world's largest prediction market, Harris and Trump have the same chance of being elected, 49%.

Although election polls are the main method of predicting elections in most countries, some analysts recently pointed out that for the United States, paying attention to changes in the stock market may be more accurate in predicting the election results.

Stock Market Predicts Election Results

According to a report in Fortune magazine. The accuracy of election polls is actually not stable. Nathaniel Rakich, senior election analyst at FiveThirtyEight, reviewed hundreds of U.S. election polls since 1998 in 2023 and found that the polls were only 78% accurate, and in 2022, this figure even dropped to 72%.

Relatively speaking, the performance of the S&P 500 Index from August to October has been more accurate in predicting the outcome of the US presidential election since 1984. Data shows that there have been 10 U.S. presidential elections in the past few years. When the blue chip index rose during this period (August to October), the ruling party always won; while when the S&P 500 fell, it indicated that the opposition party will win.

Data show that this year the S&P 500 Index has still maintained a slight increase from August to the present.

In a client note, Comerica Bank's chief investment officer John Lynch and senior analyst Matthew Anderson explained the correlation between the stock market and the election results:

"Stock market performance reflects overall economic sentiment. When voters are satisfied with the direction of the economy, they tend to support the current administration, and when dissatisfied, they are more likely to vote for change."

However, Lynch and Anderson point out that while strong stock market performance throughout the run-up to an election is closely correlated with victory for the ruling party, victory is not always guaranteed. For example, in 1976 and 1980, despite the S&P 500 rising 14.1% and 13.4% respectively, the then-ruling party still lost elections and faced high inflationary pressures in both years.

Another election predictor to watch

John Lynch and Matthew Anderson believe that economic sentiment is one of the main reasons why stock market performance is correlated with the election outcome of the ruling party, so there is another election predictor worth paying attention to: the misery index.

The Misery Index combines the seasonally adjusted unemployment rate and the annual inflation rate to measure the economic stress of the average American. The higher the index value, the greater the pain consumers face in terms of rising prices and employment difficulties.

Since 1980, the three-month moving average of the misery index between August and October has accurately predicted the outcome of presidential elections. When the index falls, the ruling party usually wins; when it rises, it predicts a defeat for the ruling party.

The latest misery index in August was 6.73%, which is lower than the Biden administration's high of 12.66% in July 2022, but slightly higher than June's 6.57%.

John Lynch and Matthew Anderson said:

"If this rule remains in effect this election, there would be about 15 basis points of room for adjustment in the misery index for Democrats. However, an unexpected increase in the unemployment rate in July may affect Vice President Harris' victory. opportunity poses a potential threat.”