Analysts have raised their price target for Bitcoin to $112,000 following increased inflows into exchange-traded funds (ETFs).

This increased activity indicates bullish sentiment among institutional investors and could push cryptocurrencies to new highs.

Bitcoin ETF inflows cause price increases

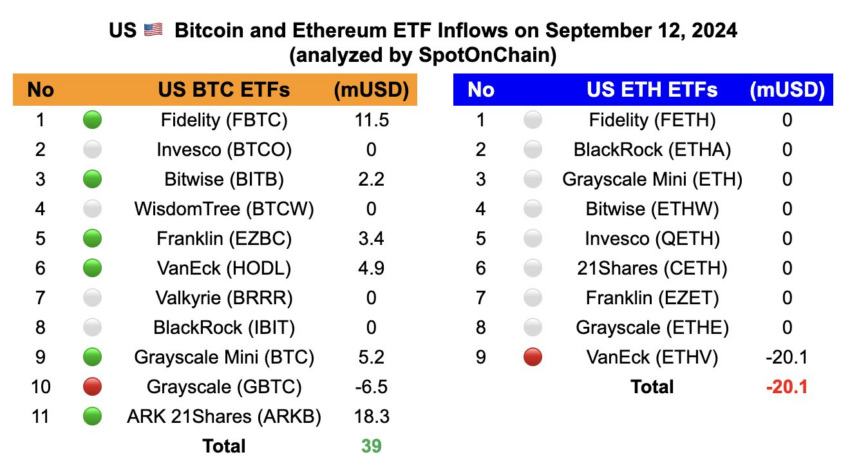

Analysts at SpotOnChain, a cryptocurrency on-chain analytics site, say the recent inflows into the Bitcoin spot ETF market are positive for the Bitcoin price outlook. On September 12 (local time), Bitcoin’s net inflows were $39 million, reversing previous weak trading volumes.

On the other hand , Ethereum ETFs recorded net outflows for the second day in a row. Grayscale’s ETHE experienced $20 million in outflows, while other US Ethereum ETFs saw no net inflows.

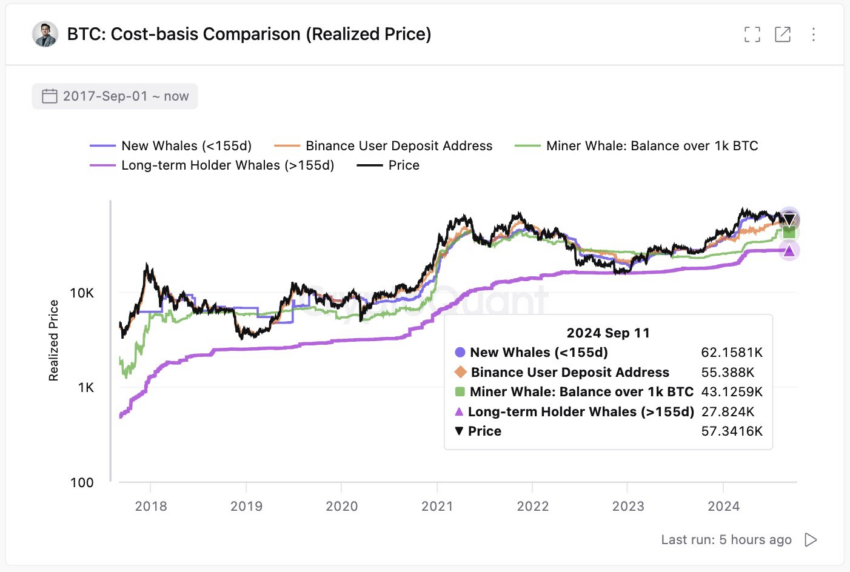

Positive inflows occur when the average cost of acquisition by Bitcoin ETF investors is higher than the price of Bitcoin. Ki-Young Joo, CEO of CryptoQuant, an on-chain analytics platform for cryptocurrencies, said that the acquisition cost of “new custody wallets/ETFs” is $62,000, while Bitcoin is trading at around $57,000.

According to Ark Invest researcher David Puell, these market conditions suggest the average ETF investor could see losses, but the historical perspective reinforces the potential for significant upside.

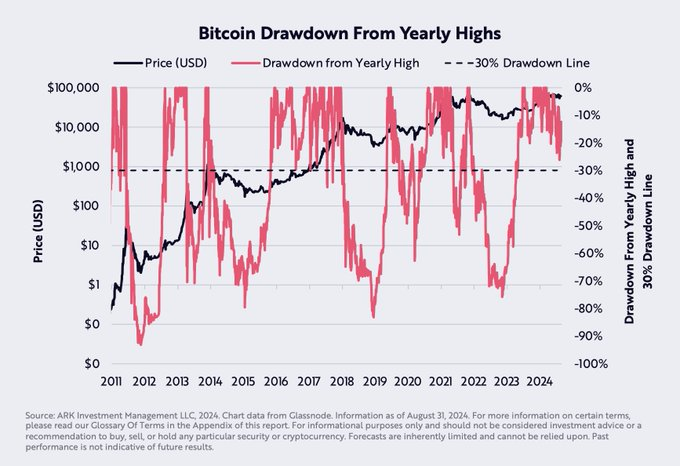

“When measuring the percentage decline in Bitcoin’s price relative to its yearly all-time high, the 2024 decline is historically associated with major bullish trends in Bitcoin, such as those seen in 2016 and 2017,” Puell said .

The combination of increasing ETF inflows, institutional accumulation, and historical patterns has led to a consensus among analysts that Bitcoin is poised for a major rally.

For example, Miky Bull raised his Bitcoin price target to $112,000, reflecting his confidence in the cryptocurrency’s potential to surpass previous highs.

“The first target for Bitcoin this year is $112,000. History has clearly shown its victory. Post-Halving in 2016 and Q4 2020 witnessed the start of a parabolic rally to the top of the cycle,” Bull confirmed .

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

His analysis points to Bitcoin’s cyclical price movements , particularly after halving events that involve a reduction in mining rewards, which are followed by significant price increases. The recent surge in ETF inflows could act as a catalyst that could impact investment and adoption.