Author: Marco Manoppo, Primitive Ventures; Translated by: 0xxz@ Jinse Finance

Note: Dovey Wan, founder of Primitive Ventures, commented on this article: My mental model of "restaking": technically, it is similar to the PoS version of merged mining; economically, it is a smart way of rent-seeking on the chain; commercially, it is a regular arbitrage game that effectively acts as an ICO distribution for pre-release projects.

Lately, I’ve been thinking a lot about the future of restaking, as it’s been a major factor driving the market over the past 18 months.

For simplicity, I may refer to EigenLayer or AVS when describing the broader concept of restaking in this article, but I use the term to encompass all restaking protocols and services built on top of them, not just EigenLayer specifically.

The concept of EigenLayer and re-staking opens Pandora’s box.

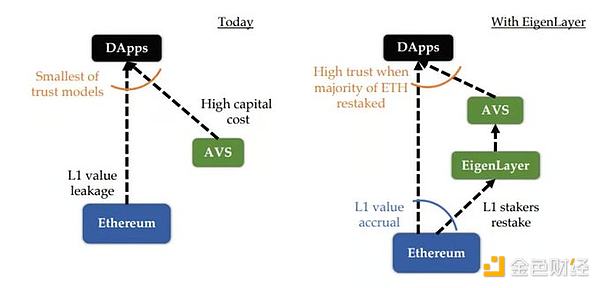

Conceptually, expanding the economic security of a highly liquid and globally accessible asset is a good thing. It allows developers to build on-chain applications without having to launch an entirely new ecosystem for their project-specific token.

Source: EigenLayer's Whitepaper

The premise is that ETH is a blue chip asset that:

1. It makes sense for the Builder to use its economic security when building a product because it enhances security, reduces costs, and enables the product to focus on its core functionality.

2. Provide excellent product experience for end users

But 18 months after the EigenLayer white paper was released, the re-staking landscape has changed.

We now have Bitcoin re-staking projects like Babylon, Solana re-staking projects like Solayer, and multi-asset re-staking projects like Karak and Symbiotic. Even EigenLayer is starting to roll out permissionless token support, allowing any ERC-20 token to be permissionlessly added as a re-staking asset.

Source: EigenLayer's Blog

The market has signaled that all tokens will be re-staked.

It’s no longer about scaling the economic security of ETH. The real key to restaking lies in issuing a new type of on-chain derivative → the restaking token (and the liquid restaking token that comes with it).

Furthermore, with the rise of liquid staking solutions, such as the Tally protocol, it is clear that future re-staking will cover all crypto tokens, not just L1 assets. We will see stARB being re-staking as rstARB, and now rstARB being wrapped as wrstARB.

So, what does this mean for the future of cryptocurrency? What happens when economic security can be extended from any token?

Re-staking supply and demand dynamics

Two factors determine whether to re-stake the future.

In the crypto space, two things are always true:

1. People want more benefits

2. Developers want to create tokens

People want more benefits

From a supply perspective, the restaking protocol has the best PMF.

We’ve learned from our Wall Street predecessors that cryptocurrencies are quickly becoming a perverse market that is constantly seeking greater risk. An example? Event news derivatives markets are already on Polymarket.

The way re-stakers earn more is due to services built on top of the Re-staking Protocol (AVS). Ideally, developers would choose to build on top of the Re-staking Protocol and incentivize re-stakers to allocate the re-staked assets to their projects. To do this, developers might share part of the revenue or provide rewards to re-stakers in the form of native tokens.

Let's do some simple math.

Data as of September 7, 2024.

Currently, $10.5 billion worth of ETH is being re-staked on EigenLayer.

We assume that most of these re-staked ETH are LST. Therefore, they have generated 4% annualized returns, and they hope to gain more returns through re-stacking.

To earn an additional 1% APY per year, EigenLayer and its AVS would need to create $105 million in value. This does not take into account slashing and smart contract risks.

It’s clear that the r/r of restaking isn’t worth it just to increase APY by 1%. I’d say it needs to be at least double, around 8%+ , for the risk to be worth it for capital allocators. This means the restaking ecosystem needs to create at least $420M in value per year.

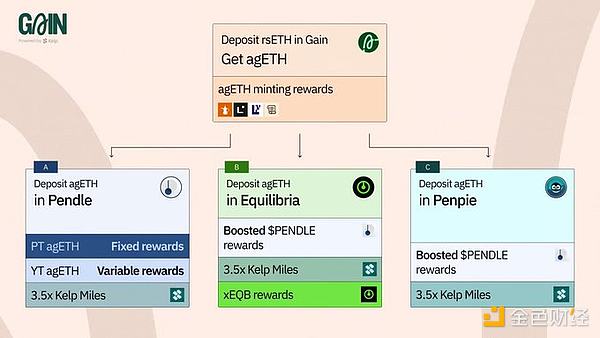

Source: KelpDAO

Currently, the huge returns we see from restaking are sponsored by the upcoming EIGEN token and points programs for the liquidity restaking protocol (examples above) - the actual income returns (or projected income) are tiny in comparison.

Now imagine a scenario where there are 3 re-staking protocols, 10 liquidity re-staking protocols, and 50+ AVS. Liquidity will be fragmented; developers (and in this case, consumers) will be burdened with the options they have, rather than having confidence in the options presented. Which re-staking protocols should I align with? Which assets should I choose to enhance the economic security of my project? And so on.

Therefore, either the amount of re-staked ETH needs to increase significantly, or we need the printing press (also known as native token issuance) to run at full speed.

TLDR: Staking protocols and their AVS will need to stake a lot of capital in the form of tokens to keep the supply side alive.

Developers want to create tokens

On the demand side, the re-pledge protocol believes that it is cheaper and safer for developers to use re-pledged assets to support their applications rather than using their own application-specific tokens.

While this may be true for some applications that require a lot of trust and security (such as bridges), the reality is that the ability to issue your own tokens and use them as an incentive mechanism is the key to unlocking any crypto project, whether it is a chain or an application.

Using re-hypothecation assets as a complementary feature of your product can provide additional benefits, but it should not guide the core value proposition of your product, nor should it be designed in a way that cannibalizes the value of your own token.

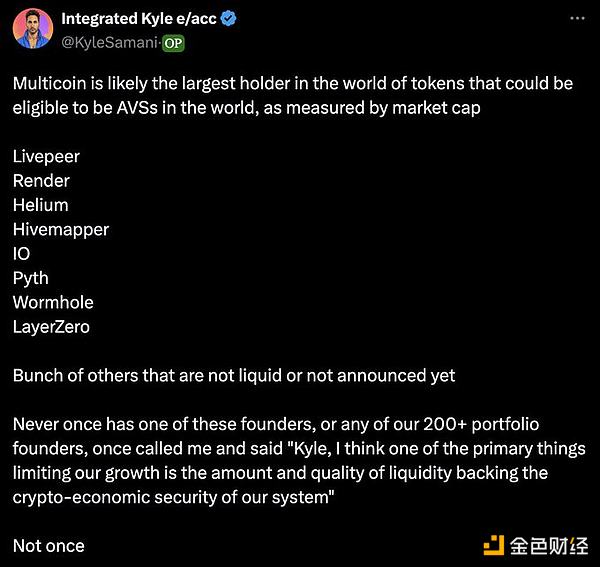

Some, like Multicoin’s Kyle, take an even stronger stance and argue that economic security is not a significant factor in driving product growth.

To be honest, his point is hard to refute.

I have been in the cryptocurrency industry for 7 years and I have never heard any of my industry friends who are advanced crypto users and store the majority of their net worth on-chain tell me that he chose one product over another because of the economic security behind it.

From an economic perspective, Luca from M^0 wrote an excellent article explaining how it may even be cheaper for projects to use their native tokens than ETH due to market inefficiencies.

Wen token? Let’s face it, regardless of whether they are de facto securities or not, project specific tokens with some form of governance function, utility, economic or scarcity claim are viewed by investors as a proxy for the success or fame of the project. Even without any remaining financial or control claim, the sentiment is the same. In an industry as small as crypto, tokens are often more tied to narrative or expected changes in liquidity than cash flow. No matter how we look at it, it is clear that the equity proxy market is far from efficient in crypto and how higher than reasonable token prices translate into lower than reasonably expected project capital costs. Lower capital costs often come in the form of lower dilution in venture capital rounds or higher valuations compared to other industries. It can be argued that native tokens are actually cheaper to build than ETH due to market inefficiencies across capital.

Source: Dirt Roads

To be fair, EigenLayer seems to have anticipated this situation, as it designed its dual re-staking system. Now, its competitors are even using their marketing angle of supporting multi-asset re-staking as a differentiator.

If future re-staking means all tokens will be re-staked, what is the real value of the re-staking protocol to developers?

I think the answer is insurance and enhancement.

The future of multi-asset rehypothecation: fragmentation of choice

If projects want to improve their products and differentiate themselves, then restaking will be a complementary feature improvement for projects to integrate.

Insurance: It provides additional assurance that the product offered will work as advertised because there is more capital to cover it.

Enhancement: The best strategic move for a re-staking protocol is to reshape the entire narrative and convince builders that the default mode should be to include some elements of re-staking technology in any product because it will only make everything better.

Oh, you’re an oracle vulnerable to price manipulation? What if we’re also an AVS?

Whether end users care about this remains to be seen.

All tokens will compete to become the preferred re-staking asset as this gives them perceived value and reduces selling pressure. AVS will have multiple types of re-staking assets to choose from, depending on their risk appetite, incentive rewards, specific functionality, and the ecosystem alignment they want to have.

This is no longer about core economic security, but about insurance, rehypothecation and politics.

What remains clear is that with all tokens being re-staked, AVS will have plenty of options.

Which assets should I use for economic security, what political alliances do I want to build, and which ecosystem is best suited for my product?

Ultimately, this decision comes down to what provides the best functionality for my product. Just as applications are deployed on multiple chains and eventually become app chains, AVS will ultimately leverage the economic security of the assets and ecosystems that benefit the most, sometimes even multiple of them.

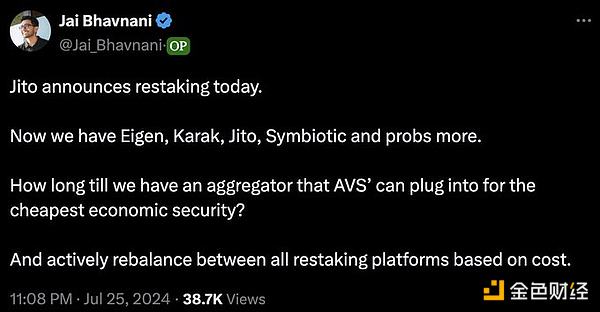

This tweet from Jai perfectly summarizes how most builders feel about restaking returns.

We have already seen some projects such as Nuffle working to address this problem.

in conclusion

Crypto Twitter likes to think in absolutes. The reality is that restaking will be an interesting fundamental concept that expands developer options and impacts on-chain markets by issuing a new type of derivative, but it is not the second coming of Jesus.

At the very least, it allows crypto asset holders with higher risk appetite to earn additional returns while expanding technology options and reducing engineering overhead for developers. It provides developers with complementary features and creates a new derivatives market for on-chain asset owners.

Many assets will be re-collateralized, giving developers a lot of choices before deciding which re-collateralized assets to integrate. Ultimately, developers will choose the re-collateralized asset ecosystem that best benefits their product, just as they would when deploying a new chain, and sometimes they will choose multiple ones.

Tokens will compete for use as rehypothecation assets, as new derivative markets for rehypothecation assets will benefit tokens, giving them wider usability and perceived value.

This was never about economic security, but about insurance, rehypothecation and politics.