Source: Chainalysis; Translated by: Deng Tong, Jinse Finance

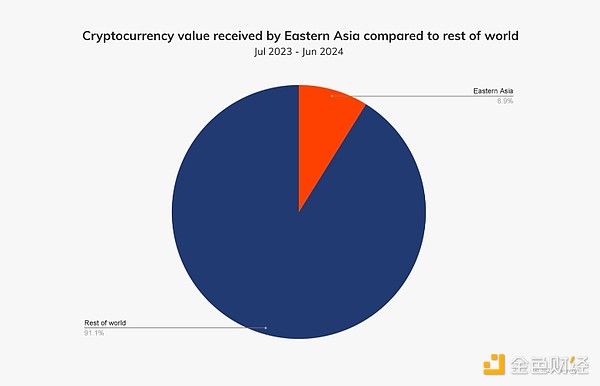

East Asia is the sixth-largest cryptocurrency economy in the world this year, accounting for 8.9% of global value between July 2023 and June 2024. The region has captured more than $400 billion in on-chain value during the same period.

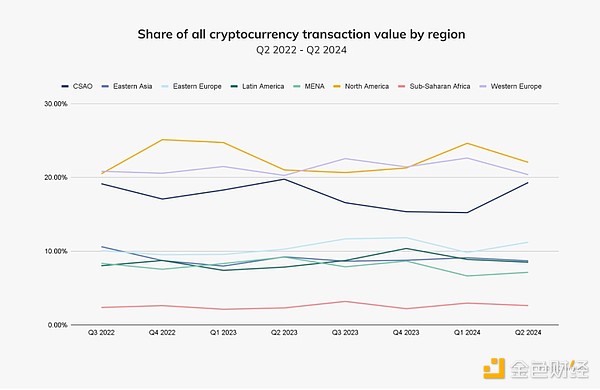

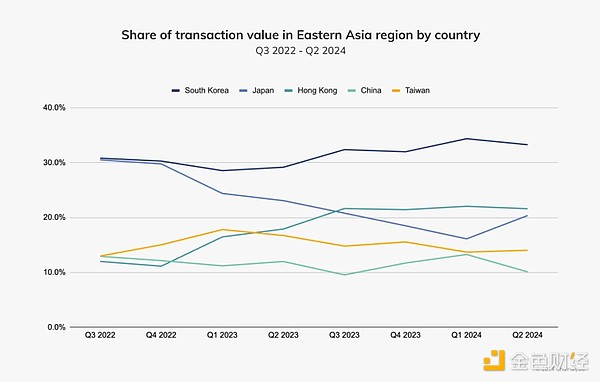

East Asia’s share of cryptocurrency transaction value remained relatively stable during the study period, with no significant fluctuations.

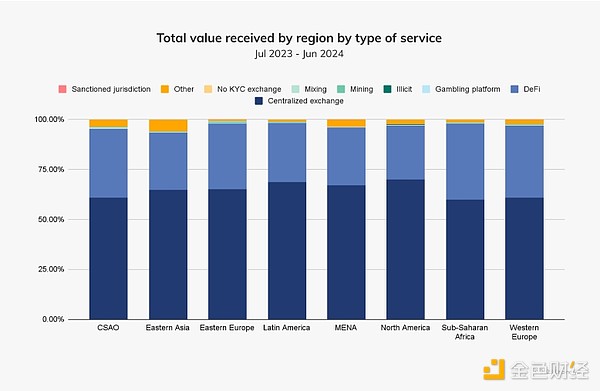

Similar to all other regions in this report, centralized exchanges are the most popular service category in East Asia, accounting for 64.7% of cryptocurrency value.

East Asia’s share of cryptocurrency transaction value remained relatively stable during the study period, with no significant fluctuations.

Similar to all other regions in this report,

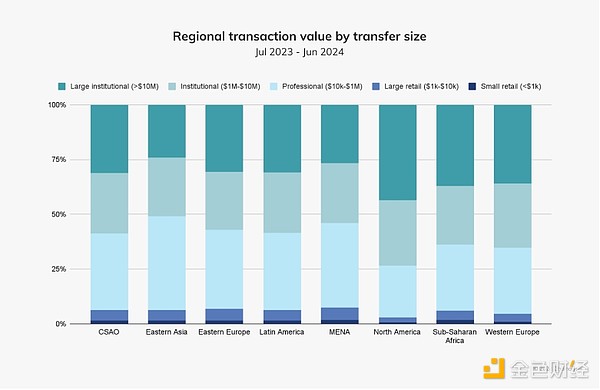

Much of this activity was driven by large transfers from institutions and professional investors. Notably, East Asia had the largest share of professional-sized transfers than any other region examined in this report.

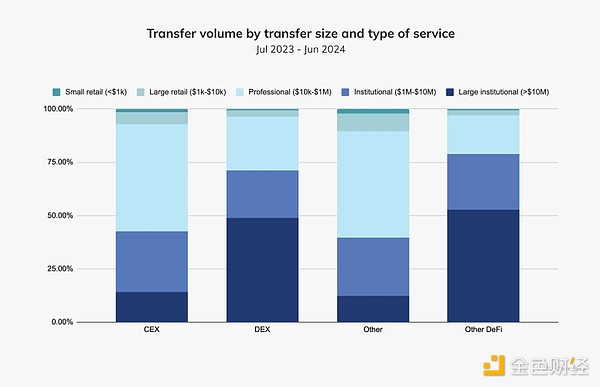

The services used by professional investors contrast sharply with those used by institutional investors. As shown below, professional investors mainly use centralized exchanges (CEX), while institutional investors use decentralized exchanges (DEX) and other decentralized services (DeFi). We speculate that institutional investors often seek investment strategies that exploit market inefficiencies; DEXs generally offer more arbitrage opportunities than CEXs due to their wide range of asset coverage.

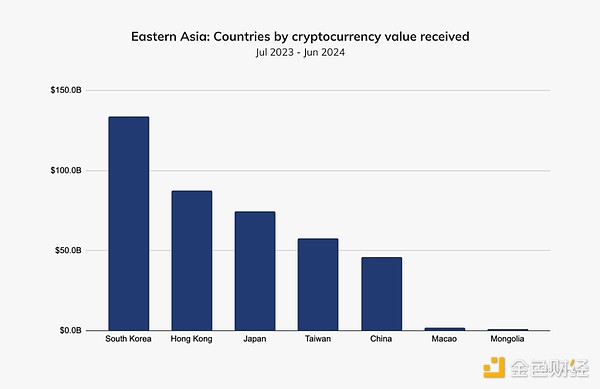

East Asia accounts for five of the top 50 regions in the world with the highest cryptocurrency adoption rates: South Korea (19), China (20), Japan (23), Hong Kong (29), and Taiwan (40). Below, we will explore in detail the factors driving cryptocurrency adoption in these countries.

South Korea remains the largest market in East Asia

South Korea received approximately $130 billion worth of cryptocurrencies during the study period, leading the East Asian region.

South Korea has also been steadily increasing its share of East Asia’s transaction volume since the first quarter of 2023. We spoke to the head of one of South Korea’s top cryptocurrency exchanges, who speculated that several factors have contributed to this growth: “Distrust in the traditional financial system has led investors to seek cryptocurrencies as alternative assets. With the adoption of blockchain by major companies such as Samsung and large enterprises in the region committed to greater transparency and efficiency in their operations, the public’s perception of cryptocurrency as a viable investment option has been further solidified.”

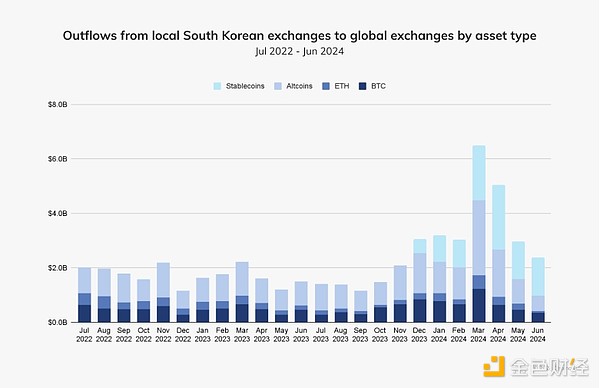

A director at another South Korean exchange gave us more insight into these trends: “As a top IT nation, South Korea has made digital asset trading easy through mobile apps and PCs. Ordinary people have shown growing interest in cryptocurrencies, especially after Bitcoin surpassed $70,000 in January 2024.” This uptick in trading activity is evident in many places — more specifically Altcoin and stablecoins. Altcoin, the currencies that South Koreans primarily use to trade against the Korean Won (KRW), have seen the highest outflows on global exchanges compared to any other crypto asset . The chart below shows that the increase in stablecoin outflows starting in December 2023 coincides with the listing of USDT on major South Korean exchanges such as Coinone and Bithumb.

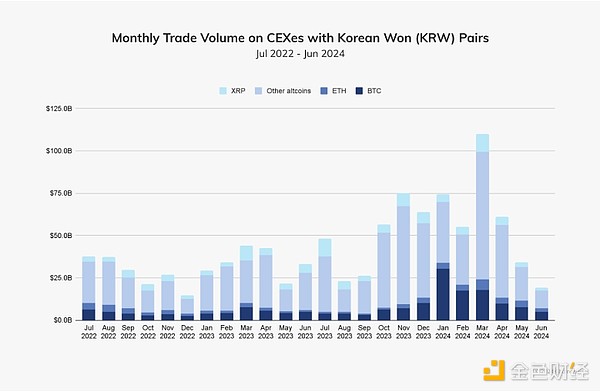

After Altcoin, Bitcoin (BTC) is the second most traded cryptocurrency, alongside the South Korean won.

“Ripple has been very popular in South Korea since 2017, when it was expected to replace the SWIFT international remittance system,” the head of the second exchange noted, referring to the international messaging system used for international payments and settlements. “We believe the reason for this popularity is that Ripple’s transfer speed is very fast, about two seconds, and its unit price is relatively low compared to BTC and ETH.”

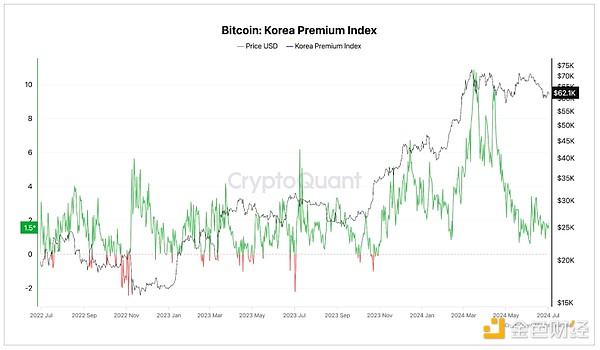

In terms of actual trading strategies, Koreans appear to frequently use local exchanges to transfer funds into and out of global exchanges, which offer diversified assets, arbitrage opportunities, margin, and exit channels. The amount of funds transferred from these local exchanges to global exchanges is highly correlated with the Korea Premium Index, indicating the presence of arbitrage opportunities.

The head of the first exchange explained: "The Kimchi premium refers to the phenomenon that the price of cryptocurrencies in the Korean market is higher than the global market. This is mainly because the domestic demand in South Korea is higher than the global market. The Kimchi premium fluctuates depending on market conditions and regulatory changes, which makes it a popular phenomenon among traders. " It is worth noting that in March 2024, when Bitcoin hit an all-time high, the Kimchi premium soared.

The aforementioned strong interest in Altcoin and diverse trading opportunities bode well for South Korea’s future as a regional leader in cryptocurrency innovation. As we’ll explore later, this interest, along with supportive regulatory frameworks in other regions, could further accelerate cryptocurrency’s rise to prominence in East Asia.

Hong Kong may ultimately influence China’s reopening of its cryptocurrency market

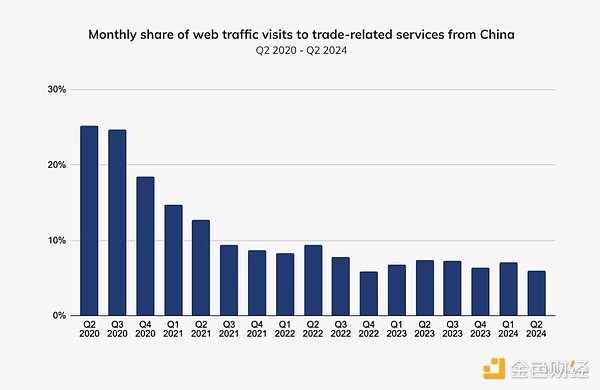

As we have explored in previous years, China’s relationship with cryptocurrency has been turbulent, marked by multiple crackdowns and regulatory changes. Despite being an early hub for cryptocurrency mining and trading, the Chinese government has imposed increasingly tight restrictions on unlicensed cryptocurrency activity due to concerns about financial stability, fraud, and capital flight. These actions led to widespread restrictions on cryptocurrency-related business activity in China in 2021, and undoubtedly led to a decline in overall cryptocurrency-related web traffic visits to trading-related services from China starting in mid-2020.

Regardless, Hong Kong has become the cryptocurrency hub of Greater China, and the regulators’ openness to cryptocurrencies and decisiveness in developing a regulatory framework have further boosted institutional adoption. Hong Kong is not an independent country, but a special administrative region of China with a unique legal and regulatory framework. Its unique status allows it to be more flexible in promoting financial innovation, which is why we treat it separately from mainland China in this report.

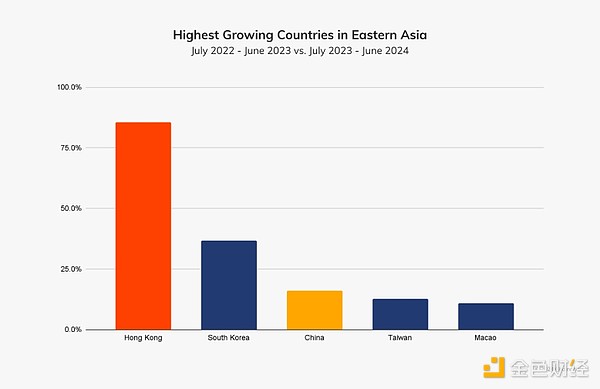

Not surprisingly, Hong Kong had the highest year-over-year growth in East Asia at 85.6%, ranking 30th in the world on our Global Crypto Adoption Index.

Below, we take a look at some of the latest trends in mainland China and Hong Kong.

User attention turns to

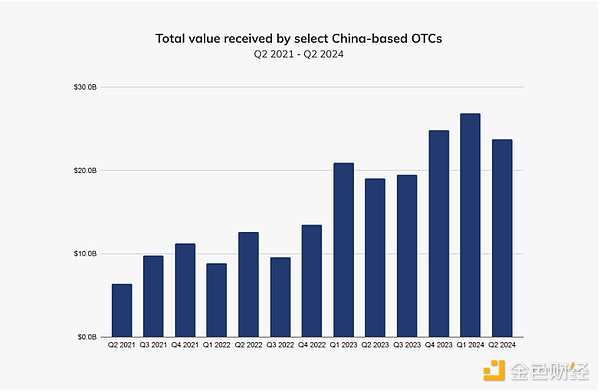

After the Chinese government shut down access to major cryptocurrency exchanges in 2021, users began looking elsewhere.

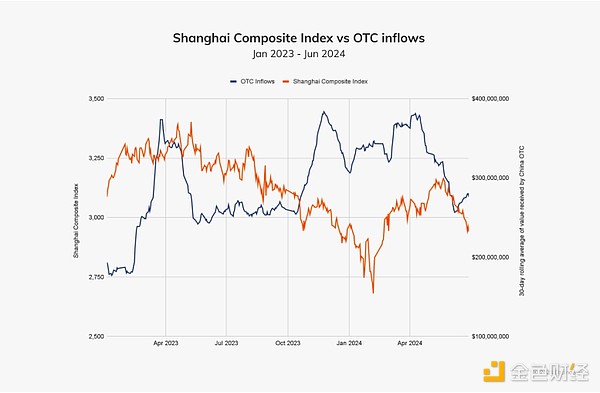

The same pattern holds true when we look at the relationship between inflows into cryptocurrency OTC trading and declines in the Shanghai Composite Index, which measures stocks traded on the Shanghai Stock Exchange.

Hong Kong’s supportive regulatory framework drives institutional adoption

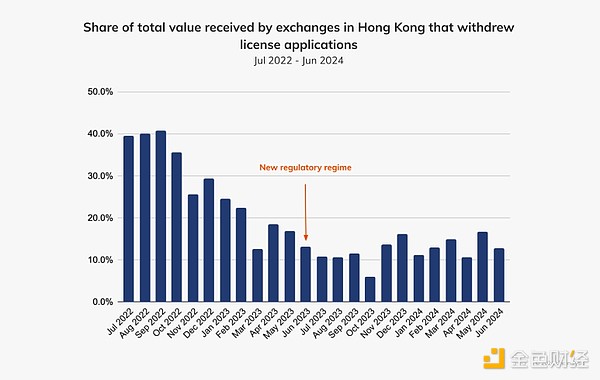

In June 2023, Hong Kong's securities regulator implemented a new regulatory regime for virtual asset trading platforms (VATP). The regime provides retail investors with a regulated path to cryptocurrency, but also sets strict prudential, consumer protection and anti-money laundering/counter-terrorist financing standards. Over the past year, regulators in Hong Kong have been working to implement this new regime.

May 31, 2024 marks the end of the transition period to this new regime, meaning exchanges can only operate in Hong Kong if they are licensed or “deemed” to be licensed. Local branches of several popular exchanges withdrew their licensing applications before May 31, and as a result had to stop offering trading services to Hong Kong residents. Given that they have been trading hundreds of millions of dollars in volume since 2022, these developments could trigger a shift to licensed or “deemed” exchanges, or a reduction in activity overall. As we can see below, the share of value captured by these exchanges has been steadily declining, with recent activity hovering around 10% to 15%.

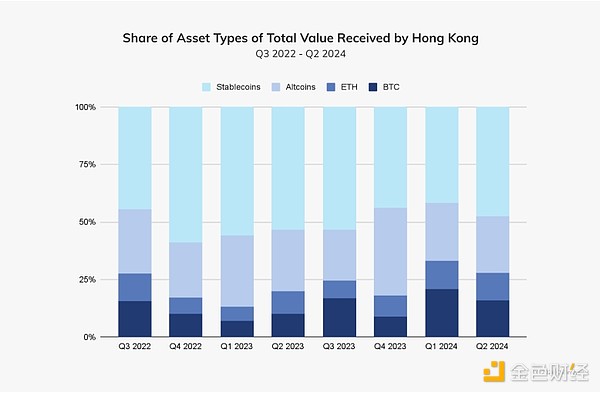

Stablecoins account for more than 40% of Hong Kong’s total quarterly value; this proportion is likely to grow as the Hong Kong Monetary Authority’s (HKMA) regulatory framework takes effect, as regulated stablecoins will be allowed to be sold to retail investors in Hong Kong.

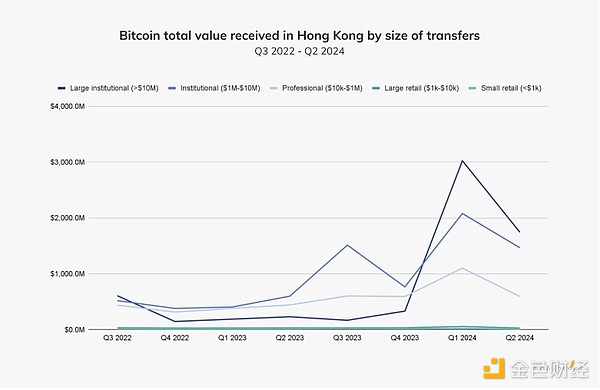

On April 30, 2024, Hong Kong’s financial regulator, the Securities and Futures Commission (SFC), approved three Bitcoin and three Ethereum-based spot Bitcoin ETFs to begin public trading. In the month leading up to this launch, we saw a significant increase in institutional Bitcoin transfers, many of which occurred on major exchanges that work with institutional-facing businesses.

Kevin Cui, CEO of OSL, a leading Hong Kong-based digital asset trading platform that provides institutional-grade cryptocurrency trading services, explained how these ETFs could impact the market. "As market conditions improve, we are seeing signs of growing institutional interest, which could lead to increased capital inflows in the near future. These ETFs not only provide a regulated path to investing in digital assets, but they are also fueling interest in directly holding BTC and ETH. This shift is significant as it signals a move away from traditional financial instruments toward more direct involvement in digital assets, reflecting a wider acceptance and understanding of their potential among the institutional investment community."