Author: Simplicity Group

Compiled by: TechFlow

Recently, Binance's launch of different spot and contract products for Meme has been controversial.

Getting the currency listed on a key CEX is the biggest expectation of many people who hold the currency and wait for it to appreciate.

But in many cases, listing a coin is not something that can make money with just a qualitative analysis. When you enter and exit the market, what type of coin you hold, and many specific decisions determine the size of your final profit.

Therefore, you may want to know the answers to the following questions:

Does listing on Binance mean there will be a wealth effect? Do other CEXs have no wealth effect? How long does it take for the wealth effect to subside?

You should be aware of these issues.

Last week, investment research organization Simplicity Group (@SimplicityWeb3) conducted a detailed statistical and analysis of the performance of more than 30 tokens that have been listed on seven common CEXs, including Binance, OKX, Bybit, Kucoin, Coinbase, Gate and MEXC, one week after listing, using data to speak.

TechFlow has compiled the essence of this 60-page report and presented the key analysis to everyone.

Key conclusions

1. Price Trends

Most tokens experienced significant price increases within 24 hours of listing;

The pullback usually begins the next day;

Some exchanges that experienced smaller increases saw their token prices more stable at higher levels;

Exchanges that experience sharp increases often have their tokens experience severe pullbacks afterwards;

2. Differences between exchanges

Token price movements on some exchanges are strikingly similar, while others show greater variation;

Researchers are unsure of the exact reasons for this phenomenon;

3. The importance of exchange listing time

If an exchange lists a token a few hours or days later than other exchanges, the price performance on that exchange will tend to be worse;

4. Outliers

The number of outliers varies widely across exchanges;

This suggests that an exchange’s internal due diligence process is critical to the overall performance of the tokens it lists;

5. Main recommendations

An exchange’s reputation should not be tied directly to potential price performance;

Binance

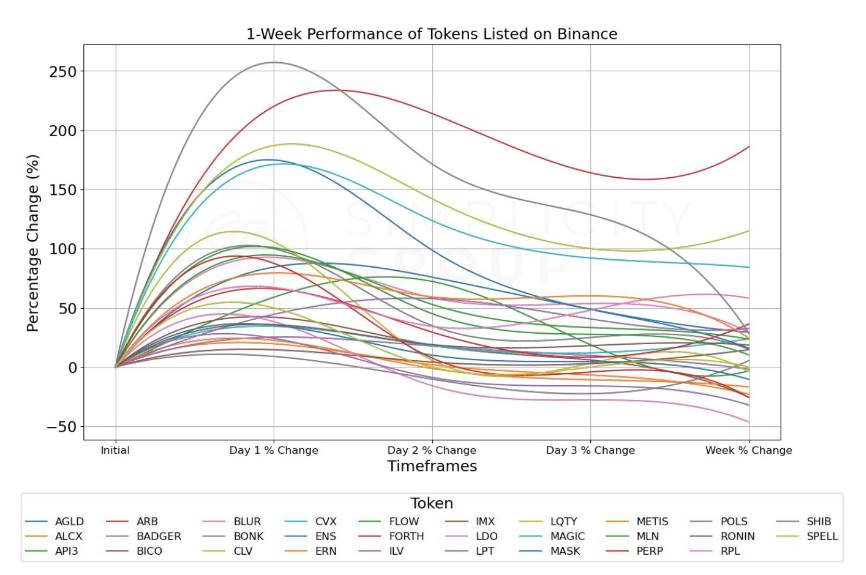

1. First-day performance

The vast majority of tokens saw significant gains on the first day of listing;

The average increase was about 66%, and some tokens even increased by more than 200%;

This phenomenon may be due to the high attention and investment enthusiasm when new coins are listed;

2. The next day's market

Price increases began to slow, and some tokens experienced pullbacks;

The range of gains and losses widened, ranging from -15% to +214%;

This may reflect that some investors began to take profits, while new investors also entered the market;

3. Trends from the third day to one week

Price fluctuations gradually become more moderate;

The price changes on the third day ranged from -27% to +164%;

By the end of the week, most tokens were still seeing positive growth, with a median gain of around 15%;

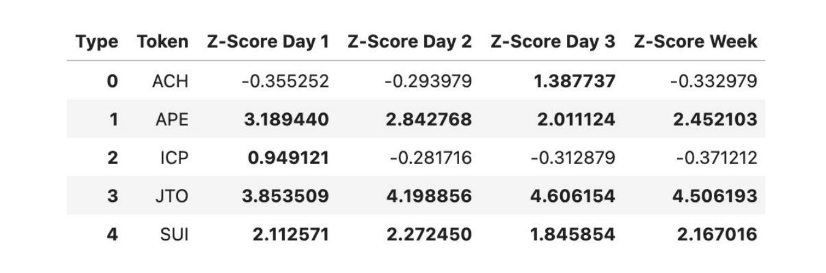

4. Tokens with unusual performance

A few tokens such as BONK, APE, ICP, JTO, and SUI showed unusually large price fluctuations;

The performance of these tokens deviates significantly from the average and the reasons behind this may need to be analyzed separately;

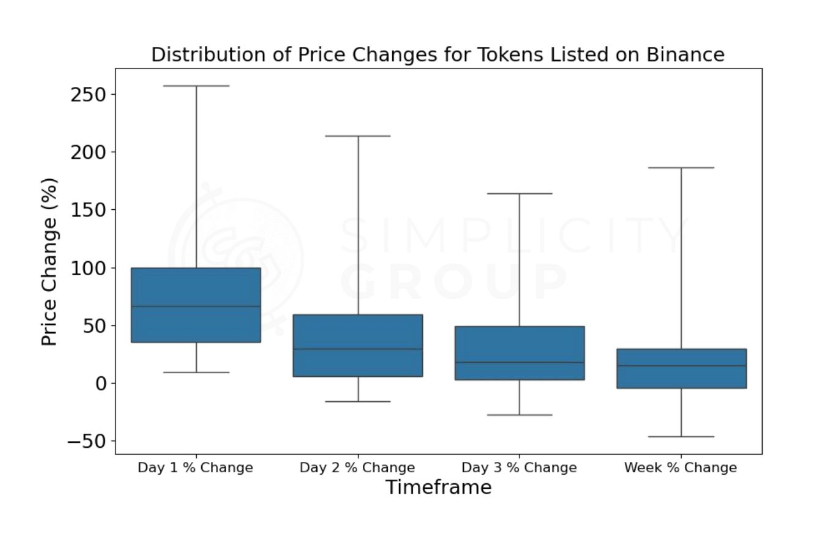

5. Price change distribution

The price change on the first day of listing was the most dramatic, with a median increase of 66.15%;

In the following days, the magnitude and range of price changes gradually narrowed;

This shows that the market's valuation of new coins is gradually becoming more rational;

6. Overall trend observation

Tokens listed on Binance generally show a trend of "rising first and then stabilizing";

High initial gains after listing are often difficult to sustain, but most tokens can still maintain positive growth after a week;

After experiencing violent fluctuations in the early stages, prices gradually stabilized;

7. Investor Implications

There may be short-term profit opportunities in the early stages of listing, but this is also accompanied by high risks;

The token price may experience large fluctuations within a week after listing, so investors need to be prepared

For long-term investors, it may be necessary to wait for prices to stabilize before making a decision;

Bybit

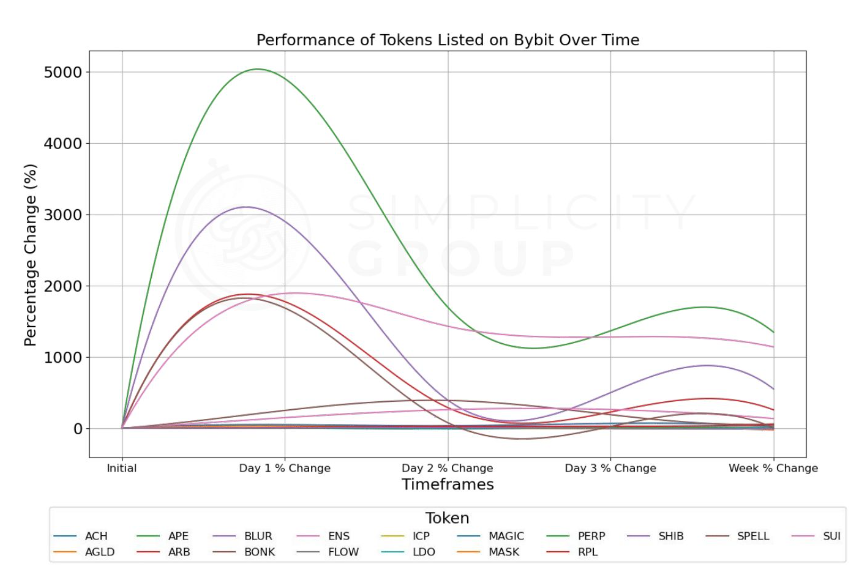

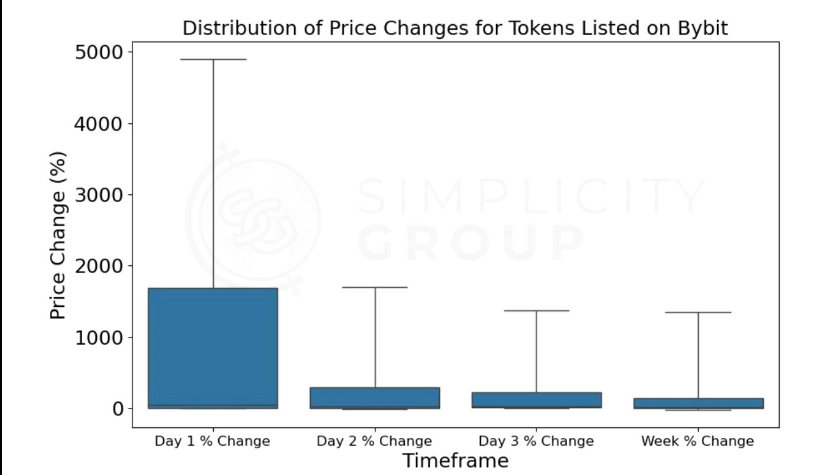

1. First-day performance

The average increase was as high as 806.34%, but this figure was significantly affected by a few extremely outstanding tokens;

The median increase was 45.71%, which is more representative of the performance of typical tokens;

25% of the tokens have increased by more than 1685.71%, showing the amazing performance of some tokens;

The highest increase was 4900%, and the lowest increase was 0.94%, with huge performance differences;

2. The next day's market

The price increase slowed down significantly, with the average increase falling to 273.04%;

The median increase dropped to 27.37%, indicating that most tokens were unable to maintain their high first-day gains;

The price change range expanded, with the lowest being -9.51% and the highest still reaching 1698%;

Volatility remains high, but lower than the first day;

3. Trends from the third day to one week

On the third day, the average increase further dropped to 234.88%, with a median of 25%;

One week later, the average increase was 207.56%, and the median dropped to 16.96%;

Price fluctuations have gradually become more moderate, but still remain relatively high;

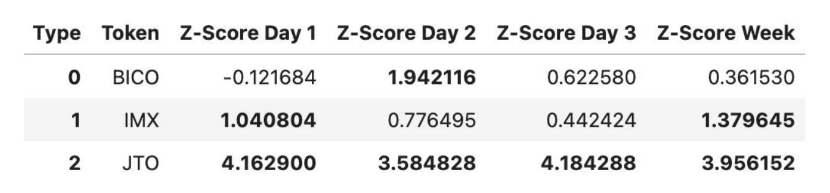

4. Tokens with unusual performance

JTO performed the best, maintaining an abnormally high Z-score (used to analyze price anomalies compared to other tokens, the same below) throughout the observation period;

IMX also performed well, especially on the first day and after a week;

BICO saw a significant peak on the second day, but then fell back;

5. Price change distribution

The first day saw the most dramatic price changes, with most tokens (the middle 50%) seeing increases between 4.6% and 1685.7%;

In the following days, the magnitude and range of price changes gradually narrowed;

By the end of the week, 75% of tokens were still experiencing positive growth, showing an overall positive trend;

6. Overall trend observation

Tokens listed on Bybit generally show a trend of "opening high and closing low", but still maintain a high level;

The high growth rate in the early stage of listing is difficult to sustain, but most tokens can still maintain positive growth after a week;

Price volatility has decreased over time, but remains higher than in regular markets;

7. Investor Implications

There may be huge short-term profit opportunities on the first day of listing, but the risks are also correspondingly higher;

Investors need to be wary of large price fluctuations in the short term;

For long-term investors, it may be necessary to wait for prices to stabilize before making a decision;

8. Data limitations

The analysis is based on a limited sample of 17 tokens and may not fully represent all tokens listed on Bybit;

The abnormal performance of some tokens (such as JTO and IMX) significantly affected the overall data, and the average value needs to be interpreted with caution;

The data of some tokens are missing, which may affect the comprehensiveness of the analysis;

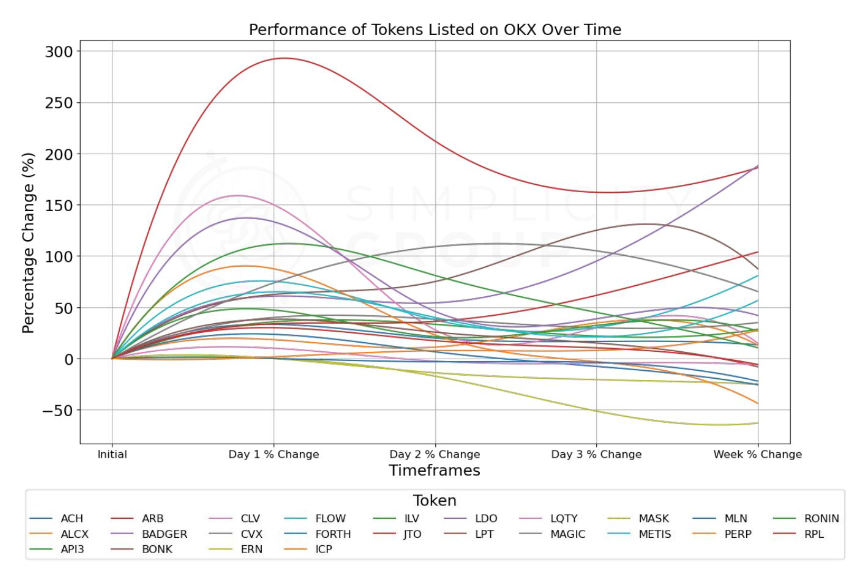

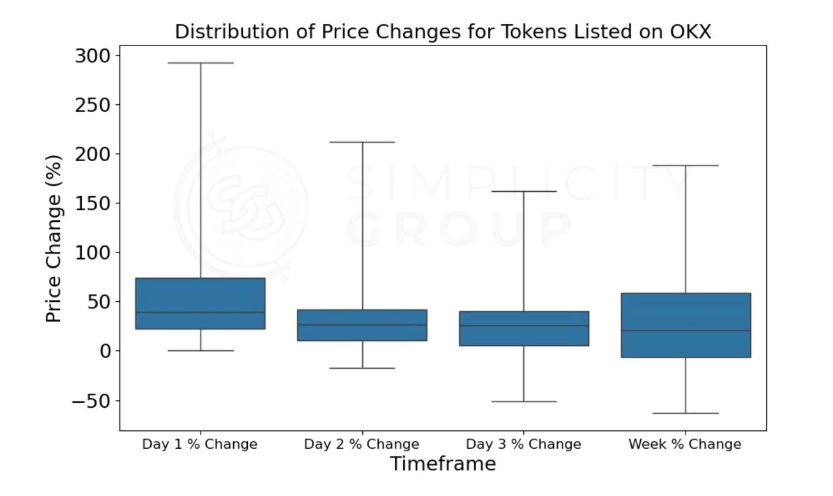

OKX

1. First-day performance

The average increase was 59.33%;

The median increase was 39.13%, which is more representative of the performance of typical tokens;

25% of the tokens have increased by more than 74.06%;

The highest increase was 292%, and the lowest increase was 0%, with obvious performance differences;

2. The next day's market

The price increase slowed down, with the average increase falling to 36.94%;

The median gain dropped to 26.85%, indicating that most tokens had difficulty maintaining their first-day gains;

The price change range expanded, with a minimum of -17.20% and a maximum of 212%;

Volatility still exists, but is lower than on the first day;

3. Trends from the third day to one week

On the third day, the average increase further dropped to 32.98%, with a median of 25.91%;

One week later, the average increase was 32.52%, and the median dropped to 20.95%;

Price fluctuations gradually became milder, but still maintained relatively stable positive growth;

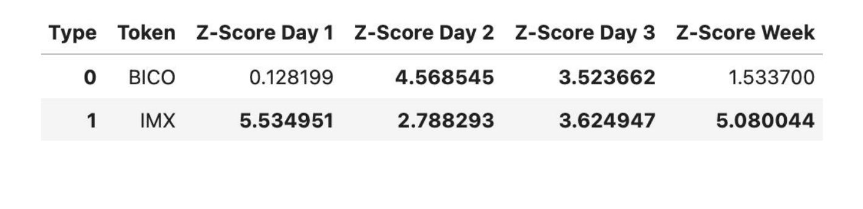

4. Tokens with unusual performance

IMX performed the best, maintaining an exceptionally high Z-score throughout the observation period;

BICO saw a significant peak on the second day, but then fell back;

BLUR also showed higher volatility but still within the statistically normal range;

5. Price change distribution

The price changes on the first day were relatively concentrated, with 75% of the tokens increasing by less than 74.06%;

In the following days, the magnitude of price changes gradually decreased;

By the end of the week, more than 75% of tokens still maintained positive growth, with the highest increase reaching 187.97%;

6. Overall trend observation

The tokens listed on OKX show a relatively stable growth trend;

Although the initial increase in the coin listing is not as extreme as Bybit, it is still considerable;

Price volatility decreases over time, showing better stability;

7. Investor Implications

There are profit opportunities on the first day of listing, and the risk is relatively low;

Investors need to pay attention to price fluctuations in the short term, but the overall fluctuation is smaller than Bybit;

For long-term investors, tokens listed on OKX may offer more stable growth opportunities;

8. Data limitations

IMX performed particularly well, with a first-day increase of more than 100,000%;

Tokens such as IMX, AGLD, APE, BICO, BLUR, SUI, ENS, and SHIB were removed due to abnormal performance, which may affect the analysis of extreme cases;

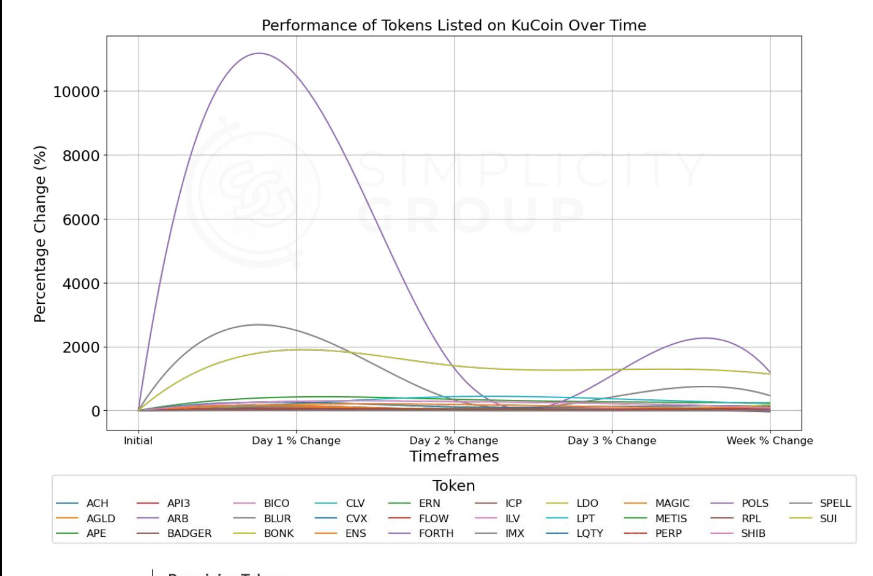

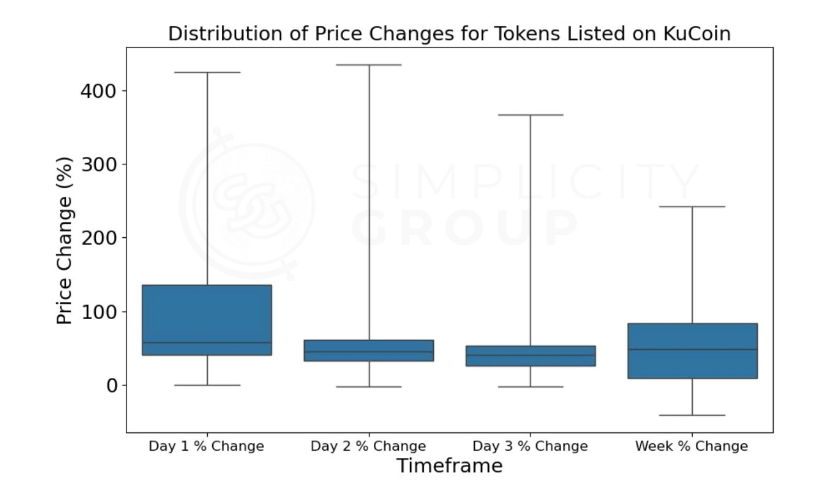

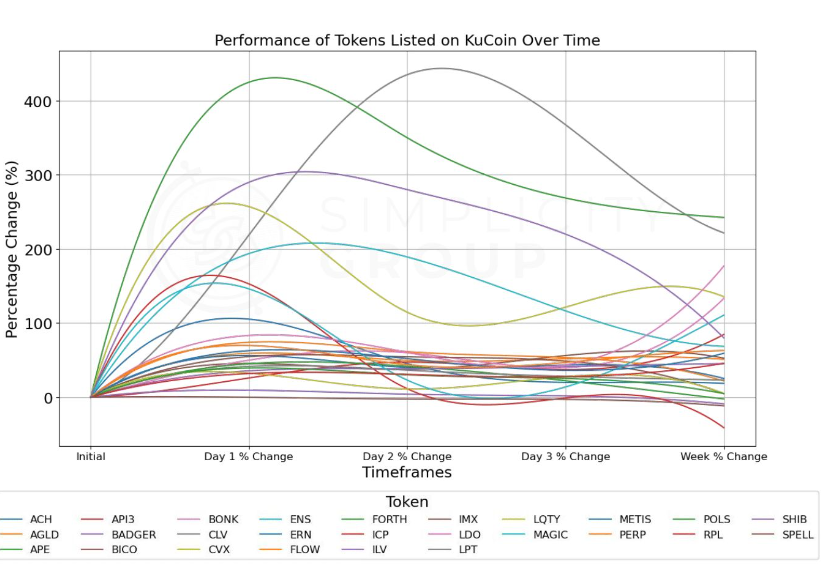

Kucoin

1. First-day performance

The average increase was 100.27%, and the median increase was 57.76%, which is more representative of the performance of typical tokens;

25% of the tokens have increased by more than 135.95%;

The highest increase was 425%, and the lowest increase was 0%, with significant performance differences;

2. The next day's market

The price increase slowed down, with the average increase falling to 82.54%;

The median increase dropped to 44.58%, indicating that most tokens had difficulty maintaining their high first-day gains;

The price change range expanded, with a minimum of -2.47% and a maximum of 435.14%;

Volatility remains high, but lower than the first day;

3. Trends from the third day to one week

On the third day, the average increase further dropped to 67.59%, with a median of 40.68%;

One week later, the average increase was 61.96%, and the median dropped to 48.49%;

Price fluctuations have gradually become more moderate, but still remain relatively high;

4. Tokens with unusual performance

MASK performed exceptionally well on the first day, with a Z-score of 5.47;

JTO performed well after the second day, with a Z-score consistently above 5;

These outliers significantly affect the overall data distribution;

5. Price change distribution

The price changes on the first day were the most dramatic, with tokens between 25% and 75% increasing by between 39.98% and 135.95%;

In the following days, the magnitude of price changes gradually decreased;

By the end of the week, 75% of tokens were still trading above 83.50%;

6. Overall trend observation

Tokens listed on KuCoin generally show a trend of "opening high and closing high";

The high growth rate in the early stage of listing is difficult to sustain, but most tokens can still maintain considerable positive growth after a week;

Price volatility has decreased over time but remains high;

7. Investor Implications

There are huge short-term profit opportunities on the first day of listing, with an average increase of more than 100%;

Investors need to be wary of large price fluctuations in the short term, especially a possible correction the next day;

For long-term investors, prices remain high after a week, which may provide a good holding return;

8. Data limitations

The analysis involves 26 tokens. Some tokens with abnormal performance (such as MASK and JTO) significantly affect the overall data, so the average value needs to be interpreted with caution.

The analysis after removing some outliers may underestimate the probability of extreme situations;

Coinbase

1. First-day performance

The average increase was 24.41%; the median increase was 3.90%, indicating that most tokens had relatively modest increases;

25% of tokens have increased by more than 16.68%;

The highest increase was 268.36%, and the lowest increase was 0%, with significant performance differences;

2. The next day's market

The price increase increased slightly, with the average increase increasing to 26.21%;

The median increase rose to 5.96%, indicating an improvement in overall performance;

The price change range expanded, with a minimum of -31.51% and a maximum of 209.16%;

Volatility remains high, but is more dispersed than on the first day;

3. Trends from the third day to one week

On the third day, the average increase dropped to 10.87%, with a median of -0.15%;

One week later, the average decline was 1.87% and the median decline was 4.36%;

Price fluctuations are gradually becoming more moderate, but the overall trend is downward;

4. Tokens with unusual performance

ACH performed outstandingly on the third day and one week later, with Z-scores of 3.64 and 5.06 respectively (the larger the index, the more abnormal the price is compared with other currencies);

CLV performed well on the first and third days, with Z-scores of 2.26 and 3.63 respectively;

SHIB performed abnormally in the first two days, with a Z-score close to 5;

5. Price change distribution

The price changes on the first day were the most dramatic, with 25% to 75% of the tokens increasing by between 1.28% and 16.68%;

The next day, the price range widened, with 25% to 75% of tokens increasing between -0.52% and 17.98%;

By the end of the week, 75% of tokens had fallen by no more than 6.20%;

6. Overall trend observation

The performance of tokens after listing on Coinbase showed a trend of “rising first and then falling”;

The initial increase in the price of the coin was relatively mild, which may be related to Coinbase's delayed listing strategy;

Price volatility has decreased over time, but the overall trend has turned downward;

7. Investor Implications

There are profit opportunities on the first and second days of listing, but the increase is more moderate than on other exchanges;

Investors need to be wary of short-term price fluctuations, especially the potential decline after the third day;

For long-term investors, the price after one week is generally lower than the listing price, so careful evaluation is required;

8. Coinbase’s uniqueness

Coinbase’s delayed listing strategy may be to minimize volatility and comply with regulatory requirements;

This strategy may cause the initial price of tokens on Coinbase to be higher than other exchanges, affecting short-term performance;

The case of the APE token shows that Coinbase’s delay in listing can cause its price performance to differ significantly from other exchanges;

9. Data limitations

This analysis is based on a sample of 31 tokens. Some tokens with abnormal performance (such as ACH, CLV and SHIB) significantly affect the overall data and need to be interpreted with caution.

Coinbase’s delayed listing strategy may result in some data not being fully comparable;

Gate.io

1. First-day performance

The average increase was 82.88%; the median increase was 39.46%, indicating that most tokens had significant increases;

75% of tokens increased by more than 14.19%;

The highest increase was 538.89% and the lowest was 0%, with huge performance differences;

2. The next day's market

The price increase has slowed down, with the average increase falling to 33.18%;

The median increase fell to 10.35%, indicating a pullback in overall performance;

The price change range expanded, with a minimum of -67.00% and a maximum of 440.00%;

Volatility remains high, but lower than the first day;

3. Trends from the third day to one week

On the third day, the average increase dropped to 17.44%, with a median of 9.50%;

One week later, the average increase was 0.54% and the median decrease was 6.35%;

Price fluctuations are gradually becoming more moderate, but the overall trend is downward;

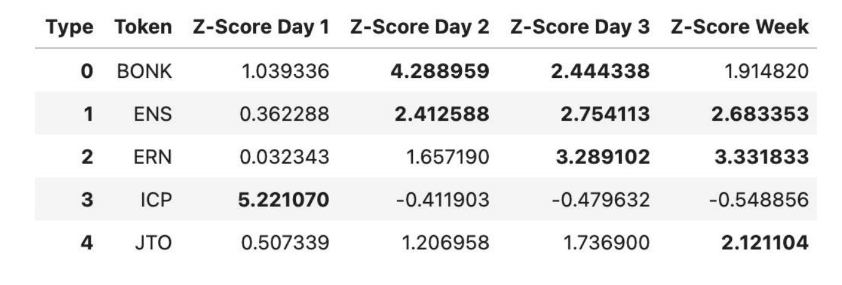

4. Tokens with unusual performance

ICP performed exceptionally well on the first day, with a Z-score of 5.22;

BONK performed well on the second day with a Z-score of 4.29;

ERN performed well on the third day and one week later, with Z-scores of 3.29 and 3.33, respectively;

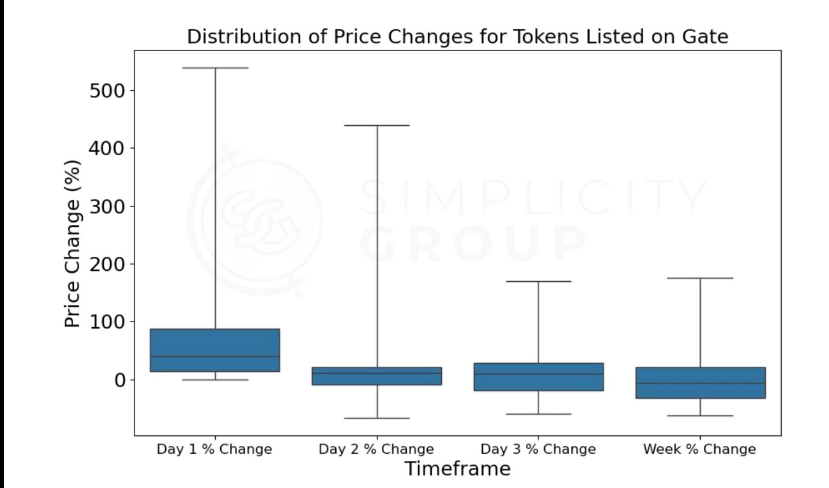

5. Price change distribution

The price changes on the first day were the most dramatic, with the 25% to 75% tokens increasing by between 14.19% and 87.06%;

The next day, the price range narrowed, with 25% to 75% of tokens increasing between -9.01% and 20.65%;

By the end of the week, 75% of tokens had fallen by no more than 20.62%;

6. Overall trend observation

The performance of Gate.io’s tokens after listing showed a trend of first rising and then falling;

The initial gains after listing were very strong, but then quickly fell back;

Price volatility has decreased over time, but the overall trend has turned downward;

7. Investor Implications

There are huge short-term profit opportunities on the first day of listing, with an average increase of more than 80%;

Investors need to be wary of large price fluctuations in the short term, especially a significant pullback that may occur the next day;

For long-term investors, the price after one week is generally close to or lower than the listing price, so careful evaluation is required;

8. Gate.io’s uniqueness

The initial performance of the tokens on Gate.io was very strong, but they also face significant downside risk;

About 29.4% of tokens are classified as outliers, indicating that the performance of tokens on Gate.io varies greatly;

After removing the outliers, the performance of the remaining tokens is closer to the "average" level, but the probability of extreme situations may be underestimated;

9. Data limitations

The original sample contains 34 tokens, but the analysis is mainly based on the 24 tokens after removing outliers;

The presence of a large number of outliers may cause the analysis results to not fully reflect the actual situation;

It is necessary to consider that Gate.io may have special listing strategies or market characteristics that affect the performance of tokens;

MEXC

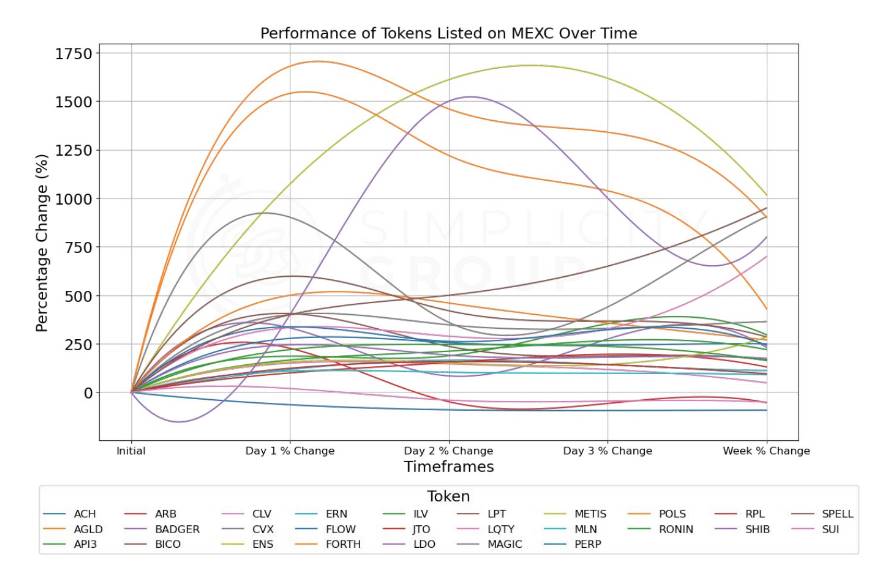

1. First-day performance

The average increase was 405.09%; the median increase was 277.90%, indicating that most tokens had significant increases;

75% of the tokens increased by more than 153.32%;

The highest increase was 1680.0%, and the lowest decrease was 64.0%, with huge performance differences;

2. The next day's market

The price increase fell slightly, with the average increase falling to 390.49%;

The median increase dropped to 236.67%, but remained high;

The price change range expanded, with a minimum of -90.0% and a maximum of 1610.8%;

Volatility remains high, but slightly lower than the first day;

3. Trends from the third day to one week

On the third day, the average increase dropped to 376.98%, with a median of 266.63%;

One week later, the average increase was 330.83%, and the median dropped to 242.50%;

Price fluctuations gradually slowed down, but the overall increase remained high;

4. Tokens with unusual performance

BLUR performed exceptionally well on the first day, with a Z-score of 3.35;

BONK performed well on the third day with a Z-score of 3.84;

IMX performed well after one week, with a Z-score of 4.44;

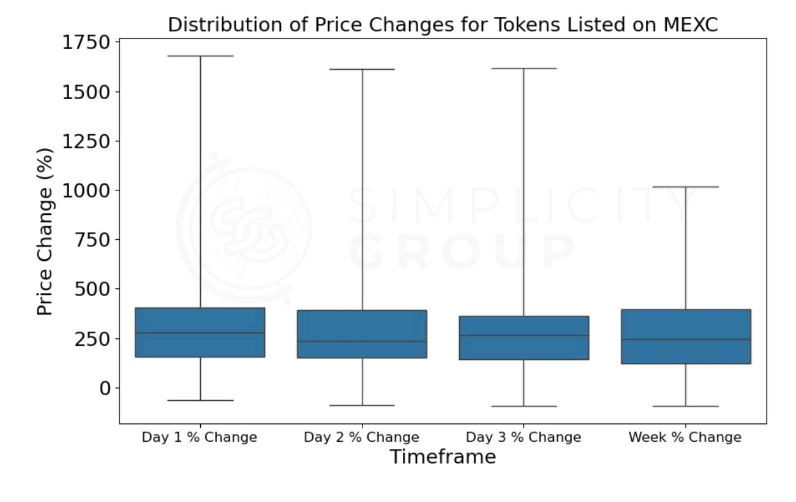

5. Price change distribution

The price changes on the first day were the most dramatic, with tokens between 25% and 75% increasing by between 153.32% and 402.98%;

The price range narrowed slightly on the second day, with the 25% to 75% of tokens increasing between 152.28% and 390.00%;

By the end of the week, 75% of tokens were still up more than 121.33%;

6. Overall trend observation

The token performance after MEXC listing showed a continuous strong upward trend;

The initial increase in the price of the coin was extremely strong, but then it fell back slightly but still remained high;

Price volatility has decreased over time, but has remained significantly higher overall;

7. Investor Implications

There are huge short-term profit opportunities on the first day of listing, with an average increase of more than 400%;

Investors need to be wary of large price swings in the short term, but the overall trend is strong;

For long-term investors, prices are generally still above the listing price a week later, showing continued market interest;

8.MEXC’s Peculiarities

The initial performance of tokens on MEXC was extremely strong, and this strength lasted for a long time;

Even after a week, most tokens still maintain significant gains, indicating that MEXC may have a unique market environment or user base;

Tokens on MEXC have shown more sustained upward momentum compared to other exchanges;

9. Data limitations

The analysis is based on a sample of 27 tokens, and some tokens (such as SHIB) may have outliers due to data processing issues and need to be interpreted with caution;

The extremely high increase and duration may reflect the special market environment of MEXC, which may not necessarily apply to other exchanges;

Comprehensive comparison of various companies

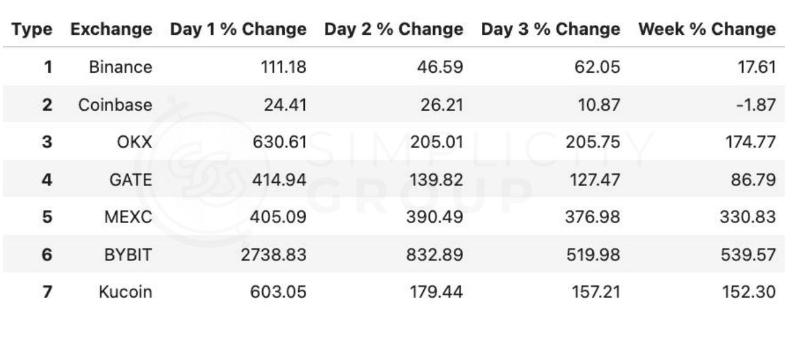

1. Overall performance ranking (average increase after one week)

ByBit (539.57%)

MEXC (330.83%)

Kucoin (152.30%)

OKX (174.77%)

GATE (86.79%)

Binance (17.61%)

Coinbase (-1.87%)

2. First day performance

ByBit performed the best, with an average increase of 2738.83%;

OKX and Kucoin followed closely with 630.61% and 603.05% respectively;

GATE and MEXC also performed strongly, at 414.94% and 405.09% respectively;

Binance and Coinbase performed relatively conservatively, at 111.18% and 24.41% respectively;

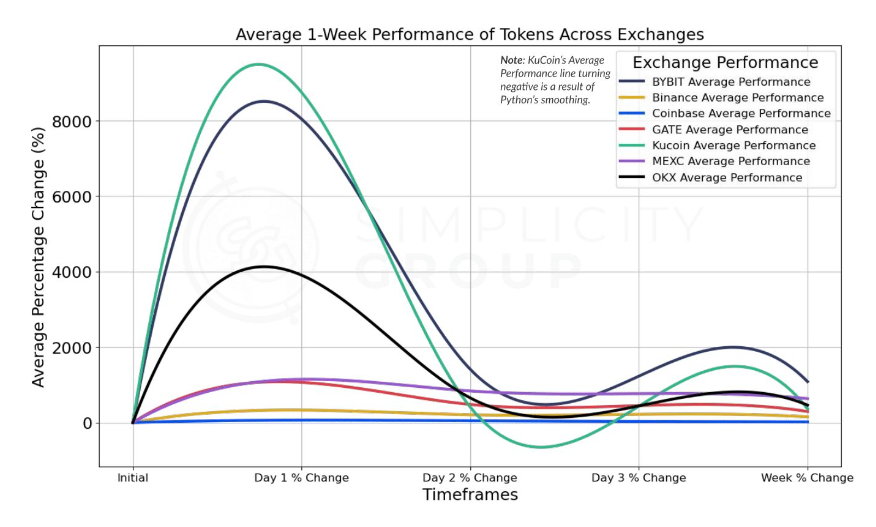

3. Price fluctuation trend

ByBit: The first day’s increase was extremely high, and then it fell back quickly, but it still remained high;

OKX and Kucoin: The first day saw a significant increase, followed by a large decline;

MEXC: The first-day increase was high, and the subsequent decline was relatively slow, maintaining a high level;

GATE: Showing a mild but sustained upward trend;

Binance and Coinbase: relatively small fluctuations and relatively stable trends;

4. Persistence

MEXC showed the best persistence, maintaining a high increase from the first day to one week later;

Although ByBit had the highest initial increase, it also fell the most dramatically;

OKX and Kucoin performed strongly in the early stages but found it difficult to maintain high gains;

GATE showed a stable mid-level performance;

Binance and Coinbase had smaller fluctuations, but their overall gains were limited;

5. Risk and volatility

ByBit shows the highest risk and volatility;

OKX, Kucoin, and MEXC also showed high volatility;

GATE is at a medium volatility level;

Binance and Coinbase have the lowest volatility and relatively less risk;

6. Special Observations

After removing outliers, the performance differences among exchanges are still significant;

ByBit’s extreme performance may reflect its unique listing strategy or user base;

MEXC excels in terms of sustainability;

Binance and Coinbase may be more likely to list mainstream tokens for the first time, so they are relatively conservative;

7. Investor Implications

Short-term speculators may be attracted by the high initial gains of ByBit, OKX, and Kucoin;

Medium-term investors may prefer MEXC due to its good sustainability;

Risk-averse investors may choose Binance or Coinbase;

GATE may be suitable for investors seeking to balance risk and return;

Note: All data in this article only represent the views of the original report author and do not TechFlow the views of TechFlow.

The original report in English can be read here :