Ripple's XRP has seen decreased trading activity over the past 24 hours, resulting in a 2% price drop and a 12% decrease in trading volume.

If the altcoin breaks below the uptrend line it has maintained since September 6, it could drop by another 18%.

Ripple Derivatives Traders Exit the Market

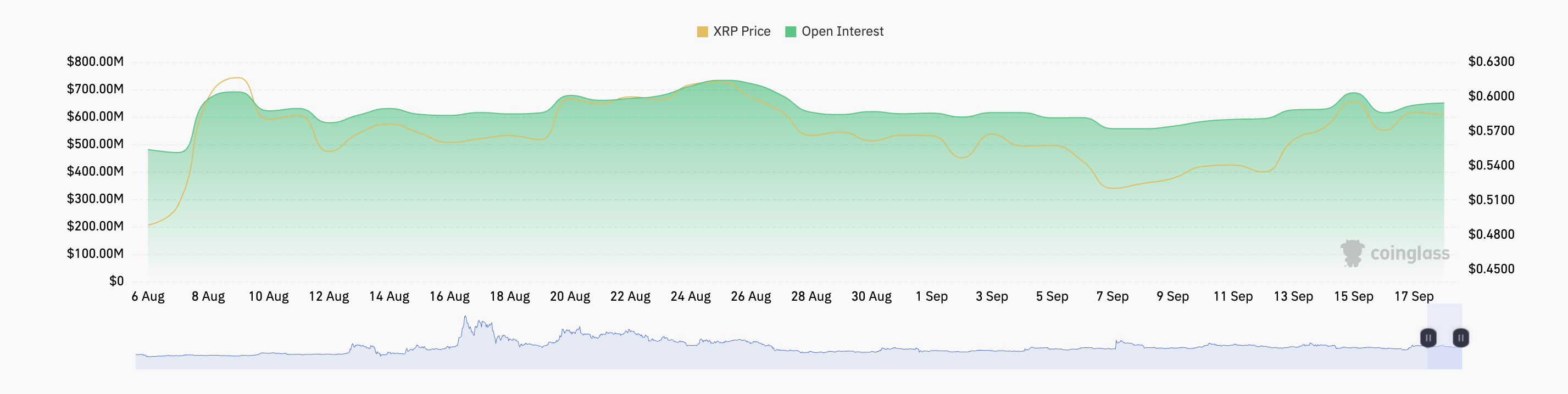

Ripple's price decline has also impacted the derivatives market over the past 24 hours. According to data from cryptocurrency derivatives data platform Coinglass, trading volume for XRP derivatives has fallen by 22% during this period.

A decrease in trading volume indicates that traders are opening and closing positions less frequently. This leads to reduced liquidity. Low liquidity makes it difficult for market participants to execute trades at their desired prices.

Additionally, XRP's open interest decreased by 2% to $634 million. This typically indicates a decline in interest in the asset or a lack of confidence in the current trend.

Read more: XRP ETF Explained: What It Is and How It Works

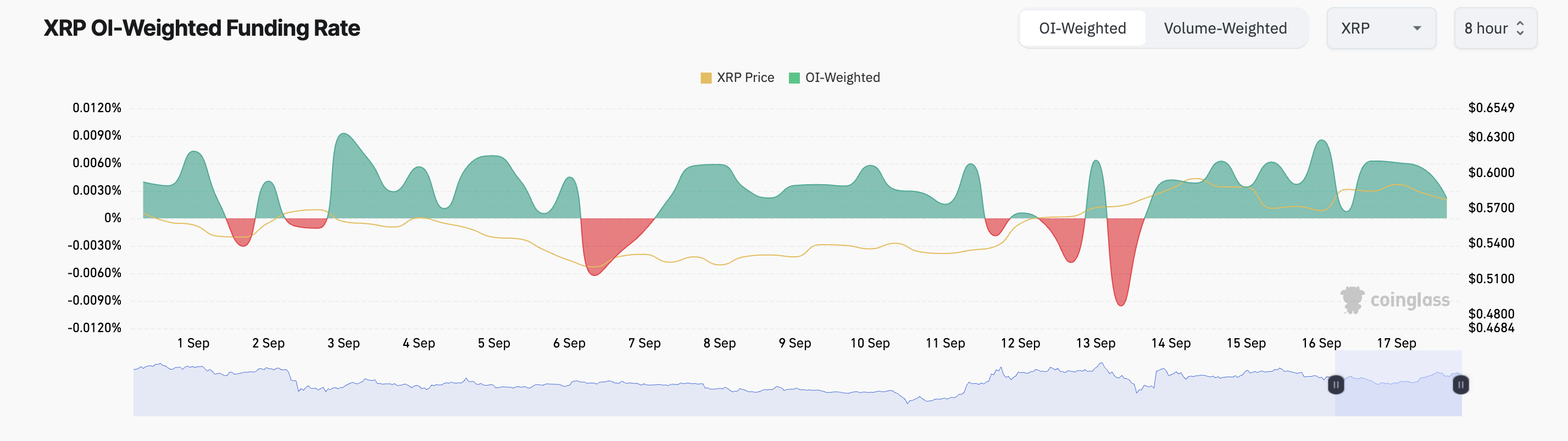

Interestingly, while some traders have liquidated their positions, those remaining in the market are demanding long positions due to XRP's positive funding rate . The token's funding rate is currently 0.0022%.

When an asset's funding ratio is positive, demand for long positions is higher than for short positions.

XRP Price Prediction : Risks Increase If Uptrend Breaks

XRP is currently trading at $0.57 and is attempting to break below the uptrend line. If selling pressure intensifies, even bullish investors will be unable to defend this level, potentially pushing XRP to $0.45. This represents an 18% decline from its current value.

Read more: Ripple (XRP) Price Prediction 2024/2025/2030

However, if XRP reverses its current trend and begins a rally , it will likely retest the $0.60 support level. If this move succeeds, the uptrend will be confirmed, and the token's price will likely rise to $0.65.