At 2 a.m. the previous night, the Federal Reserve's September interest rate meeting ended as scheduled. The rate cut was finalized. It was not a rate hike, not unchanged, not a 25bp cut, but a big cut at the first opening, a direct 50bp rate cut! Half of the people guessed wrong. The "spiritual kneeling tribe" and "smart people" who insisted that there would be no rate cut were almost swollen in the face.

Only one director voted against the 50bp rate cut because he wanted only a 25bp cut. Fed Chairman Powell succeeded in convincing the majority of voters.

With his back against the marble wall and his face toward the sky, he was probably thinking, "Looking back on this day in the future, will I be the one who saved America from collapse and turned the tide?"

By the early morning, BTC surged to 62k.

Powell's operational performance in this unexpected 50bp rate cut is undoubtedly near-perfect. Now that he has decided to raise the white flag, he should do it in a cooler way.

Jiaolian has continuously sent out signals of a 50bp interest rate cut in recent internal references:

- [“ 9.18 Teaching Chain Insider: Keep a close eye on the Federal Reserve tonight ”]:

"For Fed Chairman Powell, it seems that a direct 50bp cut is the best option, which can minimize the risk of insufficient rate cuts."…

"Friends who often read Jiaolian articles should remember that when we review the past few collapses of the US stock market, we cannot say that the collapse was caused by the interest rate cuts, but rather that the Federal Reserve reacted too slowly and cut interest rates too slowly."…

"If the Fed could learn a little from history, it should have decisively chosen to cut interest rates by 50bp this time."

The probability of a 25bp rate cut is 35%, and the probability of a 50bp rate cut is 65%.

- [“ 9.16 Teaching Chain Insider: Crypto Crisis and Liquidity Bull Market ”]:

“(Sam said) Fed officials need to cut rates by 50 basis points to prevent a potential labor market recession and be ready to do more.”…

"It may be right to cut interest rates in a precautionary manner. This will prevent the Fed from reacting too slowly every time."…

“Maybe Powell thinks so too. But it depends on whether he can convince the other directors.”

The probability of a 25bp rate cut is 41%, and the probability of a 50bp rate cut is 59%.

"There is growing expectation that the Fed may act more aggressively when it starts cutting rates next week."

The probability of a 25bp rate cut is 50%, and the probability of a 50bp rate cut is 50%.

"There is growing market expectation that the Fed may take more aggressive action when it starts cutting rates next week."

The probability of a 25bp rate cut is 59%, and the probability of a 50bp rate cut is 41%.

…

By tracking the internal information of the teaching chain, one can clearly perceive the macro situation and grasp the changes in the path of the Fed's interest rate cut.

Obviously, the turning point occurred on September 13-15. Because just the day before, on September 12, in [“9.12 Teaching Chain Insider: 665 consecutive days of insisting on hoarding 1 BTC every day”], the monthly inflation and initial jobless claims data were still guiding the market to expect a small interest rate cut of 25bp (85% probability) rather than a large interest rate cut of 50bp (15% probability).

Let’s review who Wall Street institutions guessed correctly and incorrectly:

Correct guess (guess 50bp) : JPMorgan Chase (Source: 9.12 Internal Reference), UBS (Source: 9.16 Internal Reference)

Wrong guesses (guess 25bp) : Bank of America, Goldman Sachs, Morgan Stanley, Barclays, Citigroup (Source: 9.18 Internal Reference)

Those who guessed wrongly (guessing that there will be no interest rate cut or even an increase) : Some experts, KOL, KOLs and frogs in the well on the Chinese Internet... Haha, this is unique!

Readers who have been following Jiaolian earlier should have sensed that the Fed was going to surrender in September from the interpretation of the conclusion of the July interest rate meeting in Jiaolian’s article on August 1, “The Federal Reserve Raises the White Flag — Ten-Year Agreement #28 (ROI 51%)” .

At that time, the Federal Reserve took the initiative to find a way out for itself and changed its focus from inflation to inflation and employment.

At that time, the probability of not cutting interest rates had been reduced to zero.

On August 14, [“ 8.14 Education Chain Insider: US PPI fell short of expectations, BlackRock said the Fed will cut interest rates in September ”] reported that BlackRock expects the Fed to cut interest rates at the September interest rate meeting.

On August 22, Jiaolian reported the minutes of the Fed’s July interest rate meeting in [“ 8.22 Jiaolian Internal Reference: It turns out that the Fed was ready to surrender ”], which revealed that “the Fed had seen the data long ago and was ready to cut interest rates. The committee members were already discussing whether to cut by 25bp or 50bp.”

Then soon on August 24, Powell gave a speech at the Jackson Hole Annual Meeting, revealing his intention to start cutting interest rates in September. This was carefully interpreted by Jiaolian in the article "Powell Confirms, BTC Soars" on August 24.

…

Even earlier, on September 5, 2023, a year ago, in [“ 9.5 Jiaolian Internal Reference: The Game of Dollar and U.S. Bonds & Deduction of the Approval Time of Spot ETF ”], Jiaolian talked about that U.S. Treasury Secretary Yellen issued more bonds in August 2023, over-financed, and promised to repurchase the over-issued U.S. bonds in 2024. Therefore, Jiaolian gave the reasoning in the internal reference on September 5 last year that Powell would cut interest rates in the middle of 2024 or the third quarter, that is, from June to September, to cooperate with Yellen's repurchase. September is the "deadline" of this time window.

…

Using copper as a mirror, you can adjust your clothes and appearance; using people as a mirror, you can understand gains and losses; using history as a mirror, you can understand the rise and fall of things.

The purpose of teaching the chain is to carefully track and review with everyone, just to learn from the gains and losses of others. Others pay the tuition, and I learn the experience. This is much more economical than paying the tuition to learn useful experience, isn't it?

As mentioned above, those who guessed wrong this time can be divided into two categories: one category is extremely wrong, that is, they are certain that there will be no interest rate cut and that interest rates will continue to rise; the other category is those who believe that the rate will be cut by 25bp first.

…

Why does the first type of outrageous mistake occur? After reading the recent timeline just reviewed above, anyone with a discerning eye can see that people who make this type of mistake are simply sitting in a well and watching the world, closing their eyes and ears, and not caring at all about what stage and situation the world situation has developed to, right?

That’s right. The reason for this kind of mistake is to close yourself off and refuse to open your eyes to the world.

However, in this age of Internet development and information overload , what they close is not their eyes, but their hearts. It is not that they cannot see with their eyes, but that they are unwilling to admit it from the bottom of their hearts.

A deeper analysis reveals that the reasons for this narrow-minded view can be divided into several different situations: one is those who take the funds and fight the public opinion war for their masters; the second is those who are in spiritual kneeling, and feel heartbroken when they see their masters are about to kneel; the third is those who overestimate the strength of their opponents, thinking that the United States will not give up until it reaps this round, and thus voluntarily surrender.

Regarding the first type of erroneous views, Jiaolian has published many articles to refute them.

For example, in the September 15th article “The Last Battle of the Federal Reserve” , Jiaolian wrote:

"The most important thing for the Federal Reserve now is to ensure that the interest rate cut and the U.S. economy are implemented safely at the same time.

"Some people are upset that the Fed failed to achieve its strategic goal in one fell swoop during this round of rate hikes. However, the situation is stronger than people. The 38th parallel cannot be crossed, no matter how many American soldiers and American-made artillery shells are sent. So they had to sign and admit defeat.

"In Anglo-Saxon culture, there is no such thing as refusing to surrender. If you can't win, you just surrender. It's common.

"September is the 38th parallel for the Federal Reserve."

For example, in the article “Powell unexpectedly said that BTC could reach 100,000” on July 12, Jiaolian described:

"High interest rates that lasted only two years were enough to make some people who admired the strong feel like they could not get up from their knees, thinking that the dollar could remain "strong" in this way. Unfortunately, the great America is old and frail, and has to rely on diapers to solve physiological problems. It is no longer the strong young man who could urinate three meters away against the wind. So they can only take aphrodisiacs, continue to overdraw their weak bodies, stand behind others to show off their hardness, but dare not get down to fight with real swords and guns; at the same time, they hire online water armies to swipe the screen all day long, shouting "awesome", "really hard", "really powerful", bragging, and providing themselves with some emotional value.

"Powell was like Li Dequan, the chief eunuch beside Emperor Kangxi, with a clear mind. "Your Majesty, you can't turn over the cards tonight!"

"To think that the strength of the dollar is determined by the Federal Reserve is as naive as to think that a man's hardness is determined by his brain."

…

As for the people or institutions who made the second type of error of guessing a mild rate cut of 25bp, they obviously still have some brains compared to the fools who made the first type of error.

The logic behind a moderate interest rate cut is mainly due to the concern that when economic data is still acceptable, a sudden and sharp interest rate cut will cause the market to over-interpret the Fed's intentions, exacerbating concerns about an economic recession, and leading to a reflexive panic sell-off.

In [“ 9.16 Teaching Chain Insider: Crypto Crisis and Liquidity Bull Market ”], Teaching Chain also said, “This may be one of the factors that restrict the Fed from cutting interest rates sharply.”

The U.S. stock market has also demonstrated the above logic with actual actions. In the article "U.S. Stock Market Threatens to Die" published on August 3, Jiaolian wrote, "People's fear of economic recession still overwhelms the joy of the Federal Reserve's upcoming interest rate cut. On Friday, U.S. stocks closed down across the board..."

"The financial game between China and the United States, which was jokingly called "hypoglycemia vs. hypertension" by netizens, has finally ended. After 15 years of hard work, the dawn is about to come. The offshore RMB has suddenly appreciated against the US dollar, and the USD/CNH has broken through the 7.2 mark. Indistinctly, the charge has been sounded. The loud sound of the horn tore through the thick darkness. The sky in the east is turning pale."

"We don't want the U.S. to really collapse, but to stage a collapse. Once the collapse is staged, the U.S. stock market will be on the verge of collapse, the U.S. economy will go into recession, and it will have a "hard landing" and fall to pieces. Once the Federal Reserve gets scared, it will stop using high interest rates and quickly cut interest rates."

"Don't be so foolish as to believe in the nonsense that "the U.S. stock market will collapse if the Fed cuts interest rates." This is simply confusing cause and effect and confusing right and wrong. It is obvious that the U.S. stock market is on the verge of collapse, and the Fed has no choice but to cut interest rates and release money to save the market."

Powell is taking a risky move. The conventional thinking is to moderately cut interest rates to appease market sentiment. The reverse thinking is, if market sentiment can be appeased, can interest rates be cut more boldly?

A moderate rate cut is for face, while a large rate cut is for substance.

If you want face, you may lose substance. If you can keep face and then want substance, does that mean you have both?

Powell is no fool. He would rather suffer than save face.

In the article "Smashing the Final Fantasy of Rate Cuts and Collapses" published on August 25, Jiaolian reviewed several major "rate cut-collapse" models in the past. In 2001, the U.S. stock market collapsed first, and the Fed cut interest rates belatedly. In 2007 and 2019, the Fed learned its lesson and cut interest rates in advance, but failed to prevent the U.S. stock market from collapsing after the rate cuts.

If you see the rooster crow and then the sun rises, then you think that the rooster crows because of the sunrise. Isn't that a big fool? The sunrise is the cause of the rooster crows, not the other way around.

Powell is no fool. He knows very well that the lessons of the past are that interest rate cuts were too late, too slow, or not strong enough.

At the press conference after the interest rate meeting, Powell emphasized that the U.S. economy is resilient and there is no risk of recession.

This is a strategy that seeks to save both face and substance: in action, cut interest rates by 50bp to gain substance; verbally, reassure the market that the economy will not go into recession and not to worry, thus saving face.

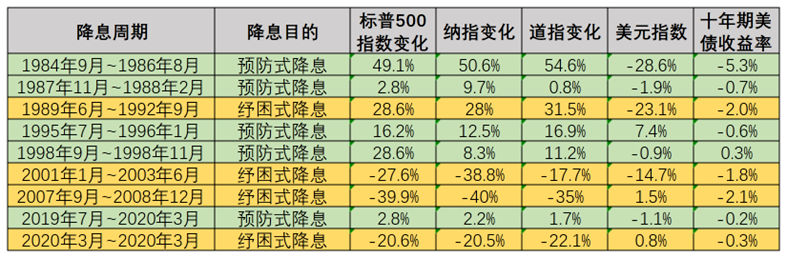

Meike.com compiled a chart showing the performance of U.S. and Chinese stocks, the U.S. dollar and 10-year U.S. Treasury bonds during past interest rate cut cycles.

It is clear from the table that preventive rate cuts have successfully turned the tide, while bailout rate cuts have repeatedly failed. Not all rate cuts are accompanied by market crashes. But almost all rate cuts will lead to a depreciation of the US dollar.

As the teaching chain pointed out in the September 2nd article “The Fed’s Dilemma” :

"If the Fed does not cut interest rates, it will only accelerate the penetration of RMB. If the Fed cuts interest rates, it will make a strategic mistake. The flooding of US dollars will inevitably suffer a significant depreciation without the necessary conditions of harvesting and recovering, thus damaging the foundation of the US dollar's credit.

“The Art of War says that victorious troops win first and then go to battle, while defeated troops go to battle first and then seek to win.

"If the Fed cuts interest rates in September, it will be taking a military risk, a typical example of fighting first and then winning, and will bring serious consequences of strategic failure to the US dollar.

"However, it is clear that the willpower of Fed Chairman Powell and other board members can no longer support the current high interest rates."

…

Regarding the outlook for the future market, Jiaolian has already elaborated on this in recent or earlier articles:

Short-term outlook : "Macro liquidity is about to enter a re-expansion cycle" (article on August 19, 2024). The dollar circulation began to reverse, and liquidity withdrew from the United States. Powell needs to lead the Federal Reserve to ease faster and more significantly in order to timely fill the liquidity vacuum left after the withdrawal of liquidity and avoid market collapse.

Mid-term Outlook : "After the financial defeat, the US dollar may be forced to flow into the crypto market" (2024.8.29 article). When the US dollar retreated, it was cut off by the RMB. Now it may not be so easy to go back. BlackRock has been prepared for this and has already laid out a plan to open up a channel from the US dollar to the crypto market (BTC ETF).

Long-term Outlook : "Three-way split, BTC worth 3 million US dollars" (article on October 21, 2023). Last year, Jiaolian made a "new Longzhong Strategy" and pointed out the three-step strategy of BTC towards world currency: electronic gold -> three-way split -> world currency. 1 million -> 3 million -> 10 million. At present, all of us are witnessing the formation of the three-legged tripod of BTC: USD: RMB.