Andrew Vranjes, Head of International and Vice President of Blockdaemon, said that regulators in Hong Kong could approve Staking for spot Ethereum ETFs this year, as the region continues its efforts to become a crypto hub.

Vranjes’ team is working closely with Hong Kong-based crypto spot ETF issuers to develop viable Staking solutions, in discussions with local regulators and has made significant progress with the possibility that regulators could approve Staking “within certain structures and boundaries.”

Vranjes explained that the Blockdaemon team is “in very thorough communication” with customers and regulators through “detailed documentation.”

Despite the initial hype surrounding Hong Kong-based spot cryptocurrency ETFs , their performance has been relatively underwhelming compared to their U.S. counterparts. Many industry experts believe that the potential Staking feature for spot Ethereum ETFs could give these products a competitive edge.

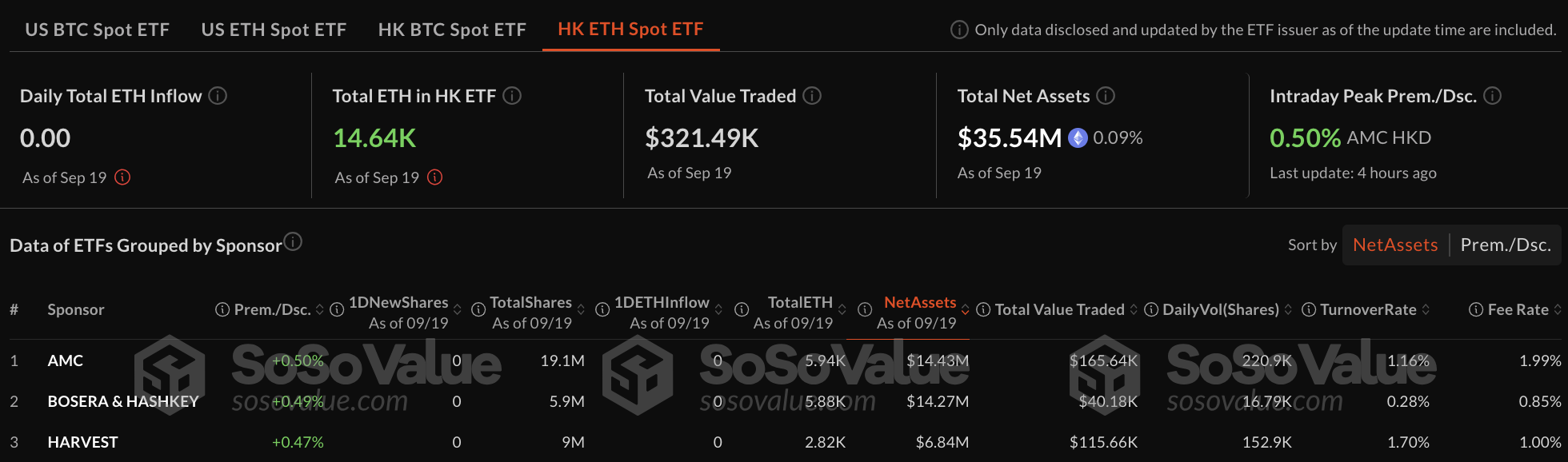

Spot crypto ETF inflows in Hong Kong are relatively small compared to their U.S. counterparts. For example, the total volume of three Hong Kong-based Ethereum spot ETFs was just $390,000 on Monday, with zero daily inflows, while nine U.S.-based ETFs recorded $129 million in volume and $9.5 million in daily net outflows, according to data from SosoValue.

Source: SosoValue

“I wouldn’t be surprised if we see announcements of Ethereum Staking for ETFs in Hong Kong before it happens in the US,” Vranjes concluded.

Join Telegram: https://t.me/tapchibitcoinvn

Follow Twitter (X): https://twitter.com/tapchibtc_io

Follow Tiktok: https://www.tiktok.com/@tapchibitcoin

Itadori

According to The Block