After weeks of caution, Bitcoin (BTC) traders are shaking off their fears and increasing their trading activity. This new momentum has revived market confidence following the Federal Reserve’s decision to cut interest rates by 50 basis points (0.50%).

Bitcoin has surpassed $61,000 for the first time in nearly a month, suggesting a potential rally is looming.

Reactivation of Bitcoin trading activity

The Federal Reserve’s 50bp rate cut is expected to boost investment in riskier assets like Bitcoin, a trend that has already begun with a positive sentiment shift.

The fear that had been dominating the market shifted to neutral on Wednesday after the rate cut. This shift indicates renewed confidence. In a neutral situation, investors typically re-enter the market gradually, increasing volume and contributing to price increases.

Read more: Bitcoin Halving History: Everything You Need to Know

Bitcoin is currently trading at $61,967. It briefly reached $62,501 on Thursday morning, but has since fallen slightly. Volume is up 12% over the past 24 hours, reaching $46 billion.

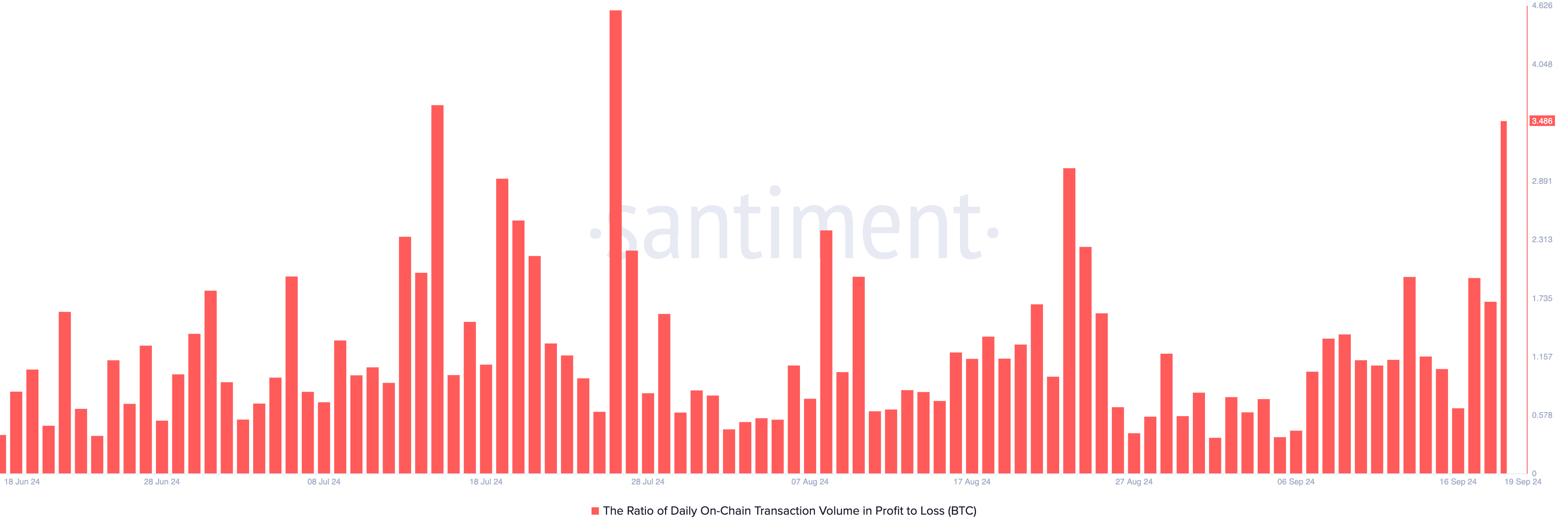

As Bitcoin hit its highest level in almost a month, most trades on Thursday were profitable. According to BeInCrypto, the profit-to-loss ratio for BTC trading volume reached 3.48, the highest since July. That means that for every losing trade, 3.48 trades were profitable.

Despite Bitcoin’s positive price action, the Bitcoin spot ETF has seen its first net outflows after four consecutive days of inflows. Outflows from the fund reached $53 million on Wednesday, according to a SoSoValue report.

BTC Price Prediction: Could Lead to $64,000

Bitcoin’s recent price rally has taken it above the important resistance level of $61,388. It is also trading above the 20-day exponential moving average (EMA), indicating that buying pressure is outweighing selling activity.

This rally is notable, but Bitcoin is likely to retest this resistance level. Since early August, when the support floor turned into resistance, BTC has only managed to break above it once. Each rally attempt has been met with strong selling pressure, leading to a downtrend. If the retest fails, Bitcoin will look for support around $54,302.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

However, if the retest is successful and BTC breaks through the resistance , the uptrend will be confirmed and Bitcoin could target $64,312.