"BTC, riding the tailwind... next target, $65,000"

On-chain data supporting BTC bullishness captured

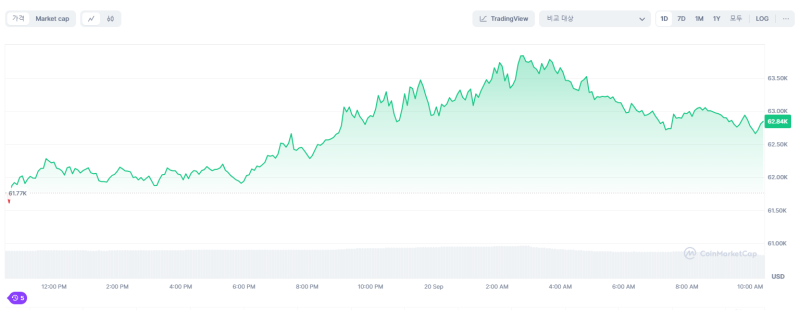

The Federal Reserve announced a rate cut of about 50bp after the Federal Open Market Committee (FOMC) meeting held on the 18th (local time), and Bitcoin broke through $63,000 on the 19th.

Ali Martinez, a famous cryptocurrency expert, wrote on his X account on the 18th, "If Bitcoin closes above $61,500 on the 18th, it will be a sign of a resumption of the bull market," adding the hashtag "Uptober." Uptober is a term that refers to Bitcoin's bull market, which has historically shown an upward pattern every October.

Another cryptocurrency expert, Jelle, wrote on his X account on the 19th that "Bitcoin's 3-day bullish pattern is in progress," adding that "Bitcoin appears to be heading toward $65,000."

He continued, "If Bitcoin surpasses the $65,000 mark, the foundation for the resumption of the greatest bull market in history will be laid," and emphasized that "the uptober is approaching quickly."

As Bitcoin breaks through $63,000, on-chain data predicting a bull market emerges.

On-chain analytics platform IntoTheBlock points out that 71% of current Bitcoin holders are long-term investors who have held Bitcoin for more than a year. According to IntoTheBlock’s data, only about 5% of holders entered the market looking for short-term profits.

Cryptocurrency expert Matipati attached Binance's Bitcoin futures market data and pointed out that there is a large amount of bearish (short) betting on Bitcoin at $70,000. If Bitcoin reaches $70,000, the liquidation amount will be approximately $21 billion (approximately 27.9447 trillion won), and the Bitcoin spot price after the liquidation will be approximately $66,000.

Bitcoin is trading at around $62,840 as of 10:30 am on the 20th, according to CoinMarketCap.

Reporter Kwon Seung-won ksw@