Stablecoin inflows hit about 213 trillion

BTC sideways movement, investor profits and losses at their lowest

"After a boring chapter, a big change may come"

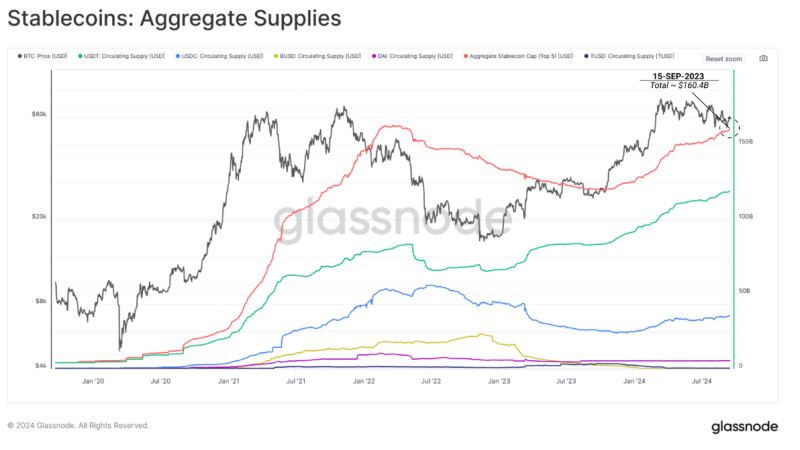

Glassnode reported in a report published on the 20th that stablecoins deposited in centralized exchanges (CEXs) reached approximately $160.4 billion (approximately KRW 213.4764 trillion), approaching an all-time high.

Stablecoins are used as base currencies for cryptocurrency trading on global cryptocurrency exchanges, and are interpreted as liquidity flowing into the cryptocurrency market itself.

“The increase in stablecoin supply foreshadows a future buying spree for cryptocurrencies,” Glassnode wrote, adding that “there is tension between the current lukewarm market and potential future demand.” It went on to emphasize that “the influx of stablecoins foreshadows high market volatility.”

Glassnode pointed out that Bitcoin's price has not changed much for about 6 months, and thus the 'Sell-Side Risk Ratio', which is measured through investors' profits and losses, has reached its minimum. The sell-side risk ratio changes dynamically according to the price changes of the asset, and especially soars when investors incur large profits or losses.

The fact is that the number of investors who lost or gained money has reached an all-time high as the price of Bitcoin has been in a rather boring market for a long time, with the price moving sideways.

A domestic cryptocurrency official explained, "The increased inflow of stablecoins means that chips are starting to enter the casino, and the data showing that the short-run risk level has reached its minimum can also be interpreted to mean that the casino has not hit the jackpot yet."

Reporter Kwon Seung-won ksw@