Author: Edward Bolingbroke, Anya Andrianova, Bloomberg; Translated by: Baishui, Jinse Finance

Debate is intensifying over the size of the Federal Reserve's expected interest rate cut in November, with traders increasing bets on futures closely tied to the central bank's move as officials begin to weigh their next move.

On Tuesday, weaker-than-expected U.S. consumer confidence data made investors more inclined toward a second straight half-point rate cut at the Nov. 7 decision. As a result, it essentially became a coin toss in the swaps market, choosing between another outsize rate cut and a more standard quarter-point rate cut.

Swap traders are currently pricing in a total of about three-quarters of a percentage point in the Fed’s two remaining rate cuts this year, the second of which will be announced on Dec. 18, meaning one of the meetings will see a half-basis point cut.

“We are increasingly leaning toward a 50 basis point cut,” said Nathan Thooft, senior portfolio manager at Manulife Investment Management in Boston. “While we haven’t officially changed our stance, the cuts this year are two quarter-point cuts — one in November and one in December.”

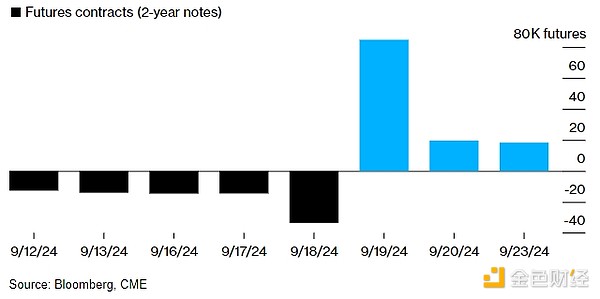

Positioning data show that interest rate markets have begun preparing for November 7 since the Fed's decision last week. Open interest in two-year Treasury futures has increased significantly. The number of positions held by traders for December 2024 Treasury maturities has climbed to about 4.4 million contracts, the highest level so far. Bets on December futures linked to the secured overnight financing rate (SRR) have also increased significantly.

However, traders are not currently placing large bets in one direction amid mixed signals from policymakers about the November meeting. That’s different than before the Fed’s half-percentage point rate cut on Sept. 18, when futures bets favored a cut that big.

Change in open interest in U.S. two-year Treasury futures

Traders close positions ahead of the Fed meeting and then add risk after the meeting.

On Tuesday, Fed Governor Michelle Bowman said the central bank should cut rates at a "measured" pace after two officials the day before downplayed the chances of a half-percentage point cut. Meanwhile, Austan Goolsbee of the Chicago Fed said rates need to be lowered "substantially."

Meanwhile, in cash Treasuries, bullish momentum ahead of last week’s Fed meeting remains intact , with JPMorgan’s Treasury clients holding a steady net long position in the week ended Sept. 23. The benchmark 10-year Treasury yield rose about 12 basis points to about 3.73% during the period as bond markets sharply increased curve steepening trades following the Fed’s rate cuts.

Here is an overview of the latest positioning indicators in interest rate markets:

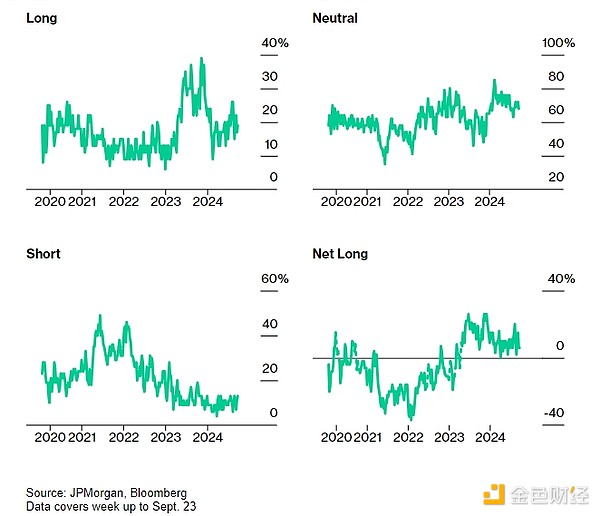

JPMorgan Chase survey

In the past week, JPMorgan Chase's direct long and short positions in Treasury bonds increased by 2 percentage points, while net long positions remained unchanged at 6 percentage points. The direct short position of all clients is currently the highest in a month.

JPMorgan Chase Treasury Department Full Customer Positioning Survey

Clients' outright long positions rose to the highest level since December.

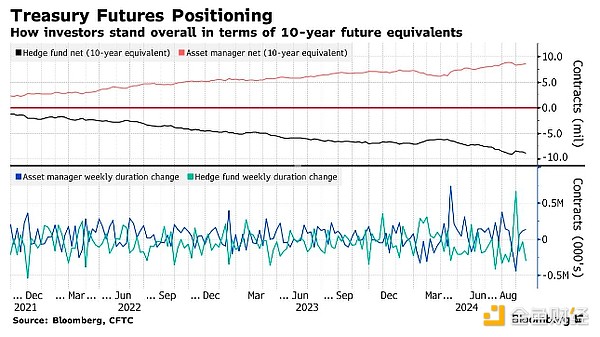

Asset managers, hedge funds long SOFR futures

Asset managers and leveraged funds remain net long in SOFR futures, a sign they are positioning for further rate cuts.

Data from the Commodity Futures Trading Commission showed that in the week ending September 17 (the day before the Fed cut interest rates), asset managers increased their risk by about $2 million for every basis point increase in their net long positions, while hedge funds closed about $2.6 million of long SOFR futures positions for every basis point increase.

In Treasury futures, asset managers increased their net long position by about 135,000 10-year Treasury futures equivalent contracts during the reporting week, while hedge funds increased their net short position by nearly 300,000 10-year Treasury futures equivalent contracts.

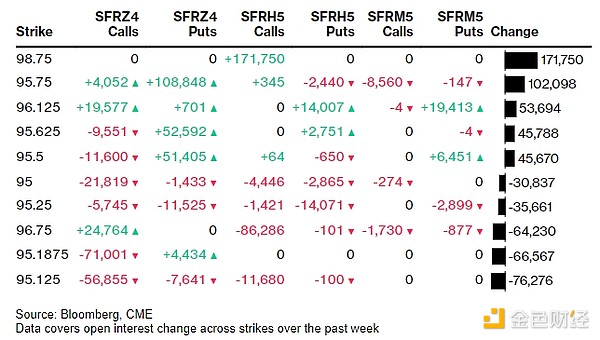

Most Active SOFR Options

The 98.75 SOFR strike has been one of the most active options over the past week. This is due to a large amount of dovish positioning in the Mar25 call options through the SFRH5 97.75/98.75 2x3 call spread, of which about 80,000 long positions have been formed. Additional positioning has been added in the 95.75 strike following recent inflows, including buyers of the SFRZ4 96.00/95.75 1x2 put spread, with the Dec24 put options rising sharply.

Most Active SOFR Option Strike Prices

Weekly net change between top 5 and bottom 5 SOFR option strike prices

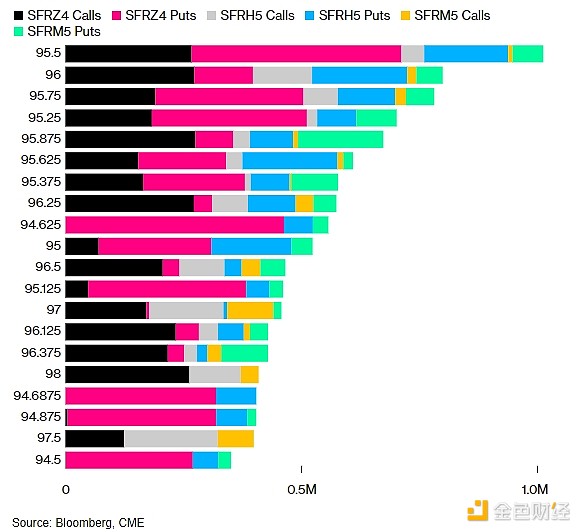

SOFR Options Heat Map

The 95.50 strike remains the highest level among SOFR options through June 2025, with a large number of Dec 24 calls and puts occupying this level. There have been some recent outright purchases of the Dec 24 95.50 puts that have increased open interest at this strike. There has also been some increased downside activity over the past week, including the SFRZ4 95.625/95.50 put spread at 1 and the SFRZ4 95.5625/95.4375 put spread at 1.

SOFR Options Open Interest

Top 20 open SOFR options positions for the December 24, March 25, and June 25 periods.

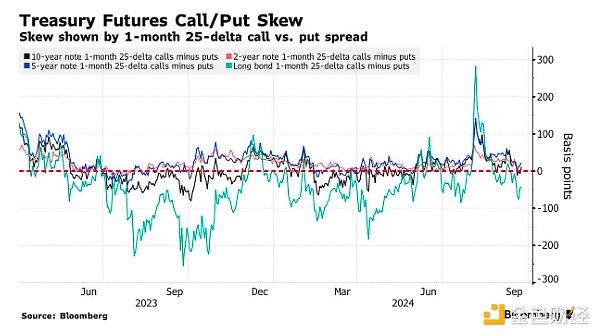

Option premiums remain close to neutral levels

The premium paid to hedge the market continued to hover around neutral levels in the past week across the front-end to intermediate-term bond range, after surging to a call premium a few weeks ago as traders expected the market to continue to rise. At the long end of the curve, premiums began to rise to hedge against selling, which is reflected in the negative skewness of the long-term bond call/put spread as traders expect the curve to steepen.