Author: Flow, SwissBorg researcher; Translation: 0xjs@ Jinse Finance

The summer of 2020, dubbed the “Summer of DeFi,” has been an incredible period for the crypto industry. For the first time, DeFi is no longer just a theoretical concept, but one that works in practice. During this period, we have witnessed a surge in popularity for several DeFi primitives — DEX (decentralized exchange) Uniswap, lending protocol aave, algorithmic stablecoin Sky (formerly MakerDAO), and many more.

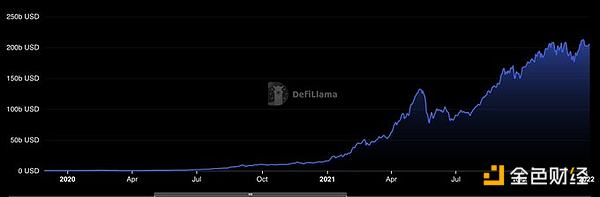

Subsequently, the total locked value (TVL) in DeFi applications has grown significantly. From about $600 million at the beginning of 2020, TVL rose to more than $16 billion by the end of the year and reached an all-time high of more than $210 billion in December 2021. This growth was also accompanied by a strong bull market in the DeFi field.

Source: DeFi Llama

Source: DeFi Llama

We can say that there are two main catalysts behind the “Summer of DeFi”:

1) DeFi protocols have made breakthrough progress, enabling them to scale and provide clear use cases.

2) The Fed begins an easing cycle during which it slashes interest rates to stimulate the economy. This floods the system with liquidity and incentivizes people to seek more exotic yield opportunities because traditional risk-free rates are very low. These are perfect conditions for DeFi to thrive.

Source: Federal Reserve Bank of St. Louis

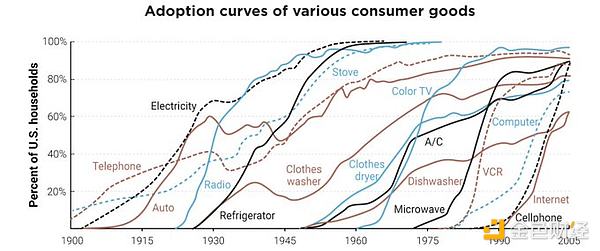

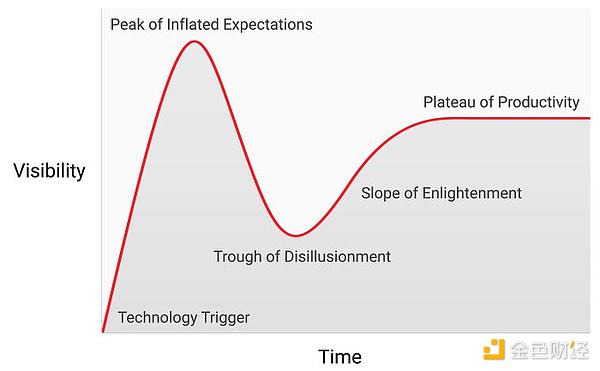

However, like many new disruptive technologies, DeFi adoption has followed a familiar S-curve path, often referred to as the Gartner Hype Cycle.

At a macro level, the situation is this: At the start of the “Summer of DeFi,” early buyers had a strong belief in the transformative nature of the technology they were investing in. For DeFi, the idea was that it could fundamentally change the current financial system. However, as more people entered the market, enthusiasm peaked and buying became increasingly driven by speculators who were more interested in making a quick profit than in the underlying technology. After this peak of excitement, prices fell, public interest in DeFi waned, and we faced a bear market followed by a long period of stagnation.

However, there are good reasons to suggest that this boring stagnant phase is not the end of DeFi, but the beginning of the real journey towards mass adoption. During this period, developers continue to develop, and the number of firm believers slowly grows. This lays a solid foundation for the next iteration of the Gartner Hype Cycle, which may bring more adopters and a larger scale.

DeFi renaissance

As of this writing, this situation seems poised to fuel a DeFi renaissance. Similar to the catalysts behind the last DeFi Summer, we currently have: a new generation of more mature DeFi protocols being built; healthy and growing DeFi metrics; the arrival of institutional players; and a Fed easing cycle underway. Once again, this is the perfect environment for DeFi to thrive.

To get a clearer picture, let's analyze these components:

Towards DeFi 2.0

Over the years, DeFi protocols and applications have grown from the initial hype wave of 2020. Many of the issues and limitations faced by the first iterations of these protocols have been resolved, resulting in a more mature ecosystem. This is the rise of what we now call the DeFi 2.0 movement.

Some key improvements include:

Better user experience

Cross-chain interoperability

Improve financial structure

Improve scalability

Enhanced on-chain governance

Improved safety

Proper risk management

Additionally, we are seeing some new use cases emerge. DeFi is no longer just about trading and lending as it was in the early days. New trends like re-staking, liquidity staking, native yields, new stablecoin solutions, and tokenization of real-world assets (RWA) are making the ecosystem more active. But what’s even more exciting is that we are also seeing new primitives being built as we speak. The latest that caught my attention are on-chain credit default swaps (CDS) and fixed-rate/term loans built on top of existing lending infrastructure.

Healthy and growing DeFi metrics

Since the end of 2023, we have witnessed a resurgence in DeFi activity as a new wave of DeFi protocols emerged.

First, looking at the total locked value (TVL) in the crypto ecosystem, we observe that momentum is starting to pick up after a long period of stagnation. From $41 billion in October 2023, TVL has nearly tripled, reaching a local high of $118 billion in June 2024 before stabilizing to around $85 billion today. While this is still below the all-time high (ATH), it is still a significant upward trend. There are good reasons to suggest that this could be the first wave of a long-term upward trend in TVL.

Source: DeFi Llama

Source: DeFi Llama

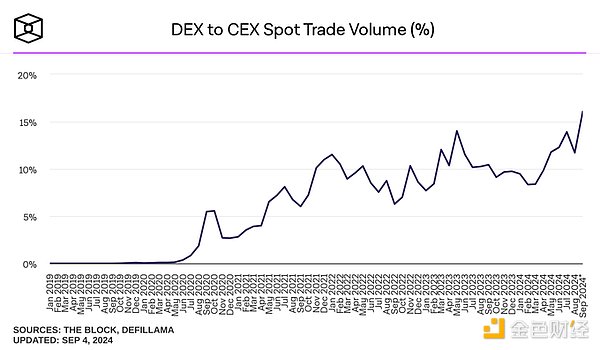

Another interesting metric is DEX to CEX spot volume , which measures the relative trading activity between centralized exchanges (CEX) and decentralized exchanges (DEX). Once again, we notice a positive long-term trend, indicating that more and more trading volume is moving on-chain.

Source: The Block

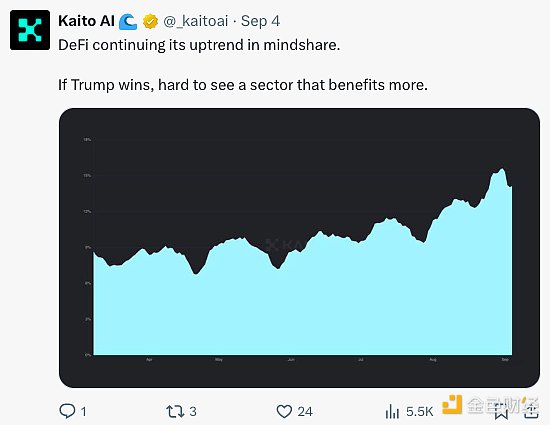

Last but not least, the market share held by the DeFi sector relative to the wider crypto ecosystem has been rising in recent months. In a market where everyone is vying for attention, DeFi is starting to make a splash again.

KaitoAI: DeFi continues to show an upward trend in mind share. If Trump wins, it is hard to see which industry will benefit more.

The arrival of institutional players

While the first wave of DeFi participants during the “Summer of DeFi” were mostly individuals trying to grasp the power of this new technology, a new wave of DeFi protocols has begun to attract several large traditional financial players to the DeFi space.

In March this year, BlackRock, the world's largest asset management company, launched its first tokenized fund on the Ethereum blockchain , the BlackRock USD Institutional Digital Liquidity Fund (BUIDL Fund), allowing investors to earn U.S. Treasury yields directly on the chain. BlackRock's first DeFi initiative has been a clear success, and the fund has attracted more than $500 million in assets under management.

Another notable example of growing institutional interest is PayPal’s PYUSD stablecoin , which recently reached a major milestone: just one year after its launch, its market cap exceeded $1 billion.

These examples suggest that the broader financial industry is finally beginning to acknowledge the value proposition of building financial systems on decentralized blockchain technology. To quote PayPal’s CTO: “If it can reduce my overall costs and bring me benefits at the same time, why not embrace it?” As more and more institutional players begin to experiment with this technology, we can say that this should become a powerful catalyst for the DeFi space.

Fed easing cycle underway

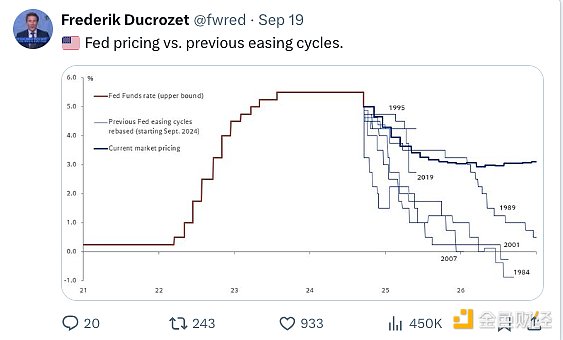

In addition to the above points, the current trend of US monetary policy is another potential catalyst for DeFi . In fact, we have just crossed a major inflection point in the economy. For the first time since the Fed began fighting inflation after the COVID-19 pandemic, the Fed cut interest rates by 50 basis points at the recent September FOMC meeting, which is a strong signal that a new round of easing cycle is underway. This is further supported by the expected trend of the federal funds rate.

The start of a new round of monetary easing cycle supports two key arguments for the DeFi bull market:

1) This easing cycle will inevitably increase liquidity in the system. Liquidity is a key element of financial markets, and excess liquidity is beneficial because it means more funds can enter the market. DeFi and the broader crypto market will inevitably benefit from this.

2) Falling federal interest rates will also mechanically increase the relative attractiveness of DeFi yields. In short, as traditional risk-free rates fall, investors will begin to seek other yield opportunities. This could lead to a market shift toward DeFi, which offers a wide range of attractive yields on stablecoins and other more exotic strategies - more secure and reliable than a few years ago.

Will history repeat itself?

All in all, there seem to be multiple factors converging to suggest a DeFi resurgence.

On one hand, we have witnessed the emergence of several new DeFi primitives that are more secure, scalable, and mature than they were a few years ago. DeFi has proven its resilience and has become one of the few areas in the crypto space with proven use cases and real adoption.

On the other hand, current monetary conditions also support a recovery in DeFi. Similar to the situation during the last DeFi summer, current DeFi indicators suggest that we may be at the beginning of a larger uptrend.

History doesn't repeat itself, but it always rhymes.