Bitcoin (BTC) has been on the rise since the Federal Reserve cut interest rates last Wednesday. It is currently trading at $63,509, up nearly 10% over the past week.

With increasing demand and improving market sentiment, the coin could reach a two-month high of $69,000. This analysis explores the key factors driving the potential upside.

Bitcoin Miners Could Be Key

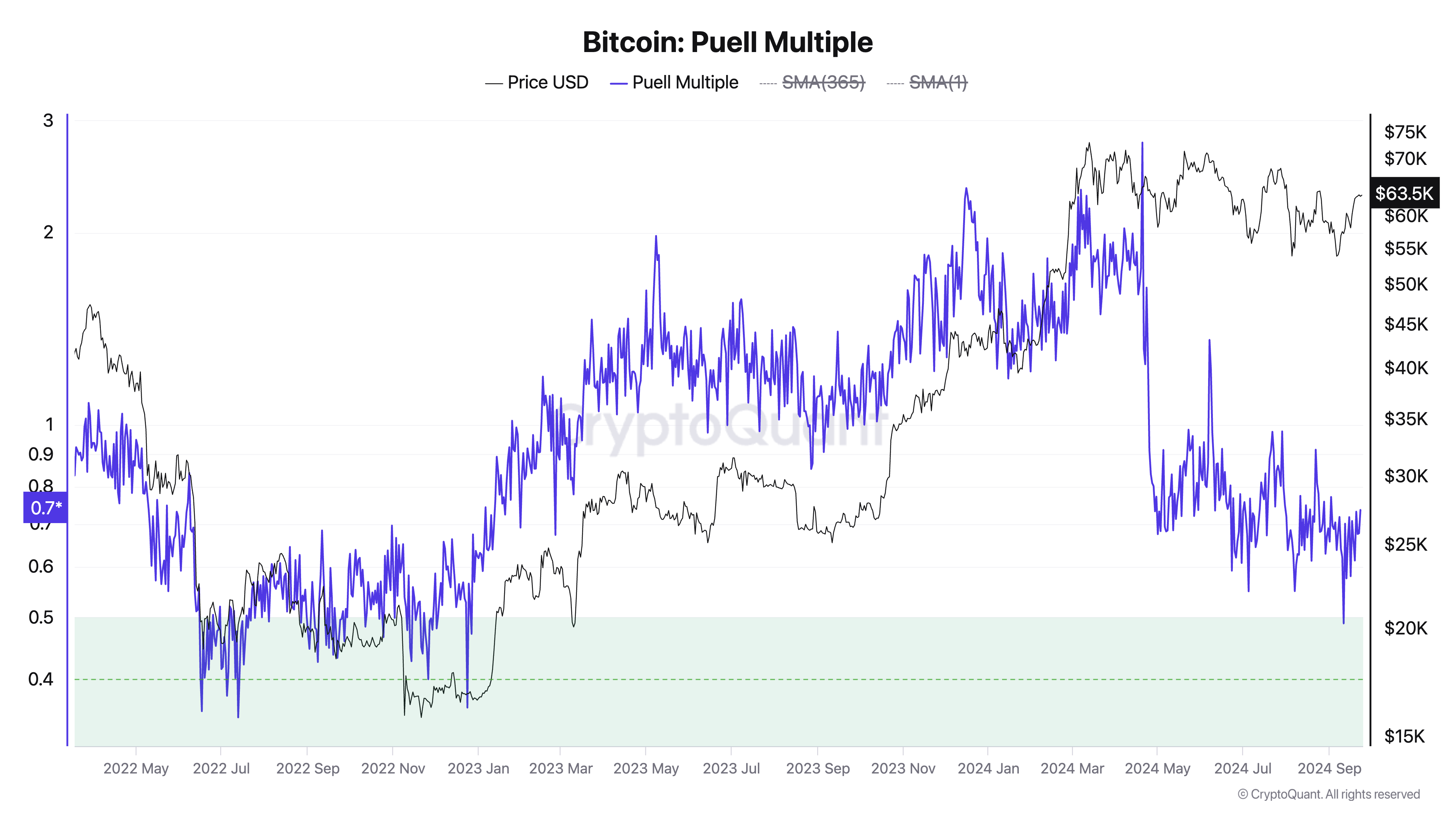

According to BeinCrypto’s Bitcoin Fuel Multiple Analysis , the coin could be ready for a long-term rally. For the first time since the end of the 2022 bear market, the indicator, which measures miner profitability, has reached the 0.5 “green zone.”

When Bitcoin’s Fuel Multiple is above 4, the market is said to be in the “red zone” and miners are making significant profits. This often signals a market peak and is characterized by increased selling pressure that causes prices to fall.

Read more: Bitcoin Halving History: Everything You Need to Know

Conversely, when the coin’s Fuel Multiple enters the “green zone,” mining profitability is significantly lower than usual. This phase often leads to a price increase, as miners are forced to reduce or stop their activities due to unprofitable conditions. The resulting decrease in BTC supply increases its value.

This was confirmed by CryptoQuant contributor Darkfost in a recent blog post .

“Historically, reaching the green zone has been followed by price increases. Conversely, reaching the red zone has been preceded by market declines,” the analyst noted.

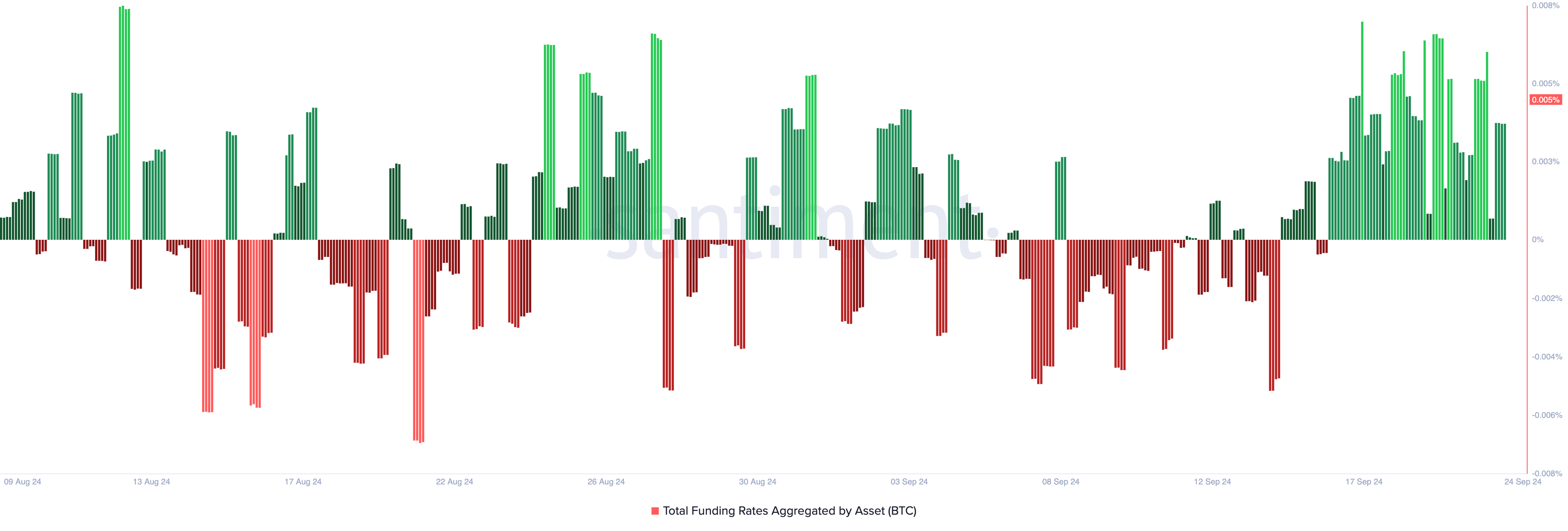

Bitcoin’s positive funding rate is another bullish indicator since September 15, suggesting that the price could continue to rise. The coin currently has a funding rate of 0.005%.

A positive funding ratio indicates that most traders expect prices to rise, which leads to increased demand for long positions.

BTC Price Prediction: If History Repeats Itself, $69,000 Is Imminent

If history repeats itself and the Bitcoin Fuel Multiple reading is valid, Bitcoin is likely to have an uptrend and could rally towards the $67,078 resistance level. A successful break above this level could see Bitcoin reach $69,000, where it was last seen in July.

Read more: Bitcoin Halving History: Everything You Need to Know

However, if the expected accumulation period does not materialize and selling pressure intensifies instead, the price of Bitcoin could fall to $54,672.