By Arthur Hayes

TechFlow by: TechFlow

(Any opinions expressed in this article are the author’s personal opinions and should not be used as a basis for investment decisions or as a recommendation or suggestion to engage in investment transactions.)

This week has been a blast. If you missed the Token2049 conference in Singapore last week, I feel bad for you. Over 20,000 enthusiastic attendees showed their enthusiasm in a variety of ways. I’ve been to almost every night F1 race in Singapore since it started, but I’ve never seen the city so alive.

Token2049 had double the number of attendees from last year. I heard that some lesser-known projects were paid up to $650,000 to speak on some small stage.

The party was packed. Marquee is a club that can hold thousands of people. Imagine there were more than three hours of queues to get into the event. Every night a different crypto project or company booked the club. The booking fee for Marquee was $200,000, not including any drinks.

There are all kinds of events. Iggy Azalea invited a group of strippers from Los Angeles to create a pop-up "experience." Who would have thought that strippers would also understand how to operate in a volatile market?

Even Su Zhu, known as the "Randall of Crypto," can't resist the urge to "make money fly." Randall, why do you look so uncomfortable in this video? Losing money is your specialty. When you finally submit your assets to the bankruptcy court in the British Virgin Islands and resolve the lawsuit, I will be happy to host you in Magic City and teach you how to do it.

I'm thinking of asking Branson Cognac and Le Chemin du Roi to sponsor my next party, as 50 Cent said:

Every hotel was full, as were the mid-range restaurants, and when the 2024 data comes in, I suspect we’ll find that the crypto crowd brought more business to airlines, hotels, restaurants, conference venues, and nightclubs than any other event in Singapore’s history.

Thankfully, Singapore tries to remain geopolitically neutral, which means that as long as you believe in Satoshi, you can basically celebrate with your brothers and sisters.

The energy and enthusiasm of the crypto crowd contrasts with the dullness and boredom of the attendees at the traditional finance conference that the Milken Institute is hosting the same week. If you walk around the Four Seasons, where the conference is being held, every man and woman is dressed similarly, in drab business casual or formal attire. The attire and behavior of traditional finance is deliberately calm and unchanging. They want the public to think “nothing to see here”, while in reality, they are stealing human dignity through the inflation their institutions impose on the world. Volatility is their enemy, because when things start to move, the average person can look through the mirror and see the true depravity of their masters.

Today, we’re going to discuss cryptocurrency volatility and the lack of it in traditional finance. I want to explore how the elites print money to create a stable economy. At the same time, I want to show how Bitcoin can serve as a release valve for fiat money that is printed to suppress volatility to unnatural levels. But first, I want to illustrate the key point that short-term macroeconomic forecasts don’t matter by reviewing my record from November 2023 to now.

50-50

I’ve often been criticized by many of my readers and crypto keyboard warriors for poor judgment. So how have I fared on my big calls over the past year?

November 2023:

I wrote an article called Bad Gurl . In it, I predicted that US Treasury Secretary "Bad Girl" Yellen would issue more T-bills to drain funds from the US Federal Reserve's reverse repurchase program (RRP). The decline in RRP would inject liquidity into the market, driving risk assets higher. I think the market will weaken in March 2024, when the Bank Term Funding Program (BTFP) expires.

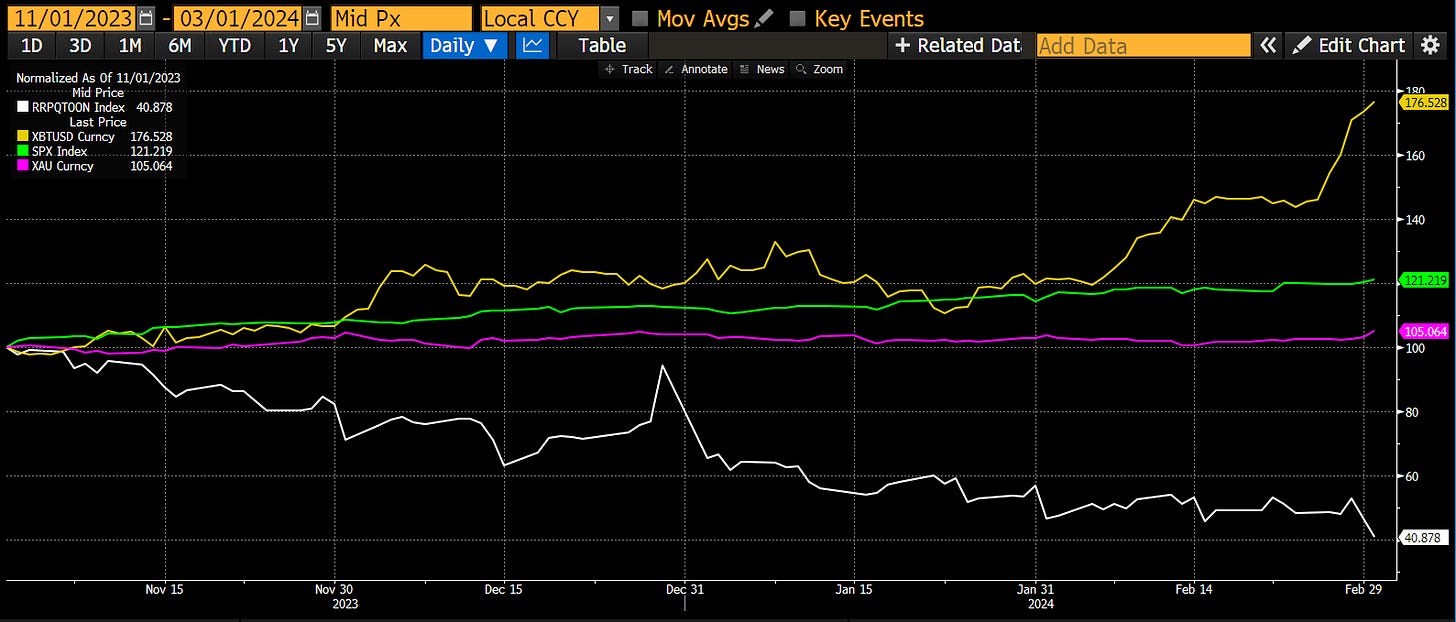

From November 2023 to March 2024, the Reverse Repurchase Program (RRP, white) fell 59%, Bitcoin (gold) rose 77%, the S&P 500 (green) rose 21%, and gold (red) rose 5%. The base of each dataset is 100.

+1 for victory.

After carefully reading the US Treasury's Quarterly Funding Announcement (QRA), I decided to add more cryptocurrency exposure. Looking back, this decision was very correct.

March 2024:

In my article Yellen or Talkin , I speculated that the Bank Term Funding Program (BTFP) would not be renewed because it was clearly inflationary. I argued that simply allowing banks to use the discount window would not be enough to avoid another non-TBTF US banking crisis.

The expiry of BTFP had no material impact on the market.

Loss item +1.

I lost some money on Bitcoin put options.

April 2024:

In my article Heatwave , I predicted that US tax season would cause crypto prices to fall as USD liquidity was drained away. Specifically, I said that between April 15th and May 1st, I would pause adding any additional crypto exposure.

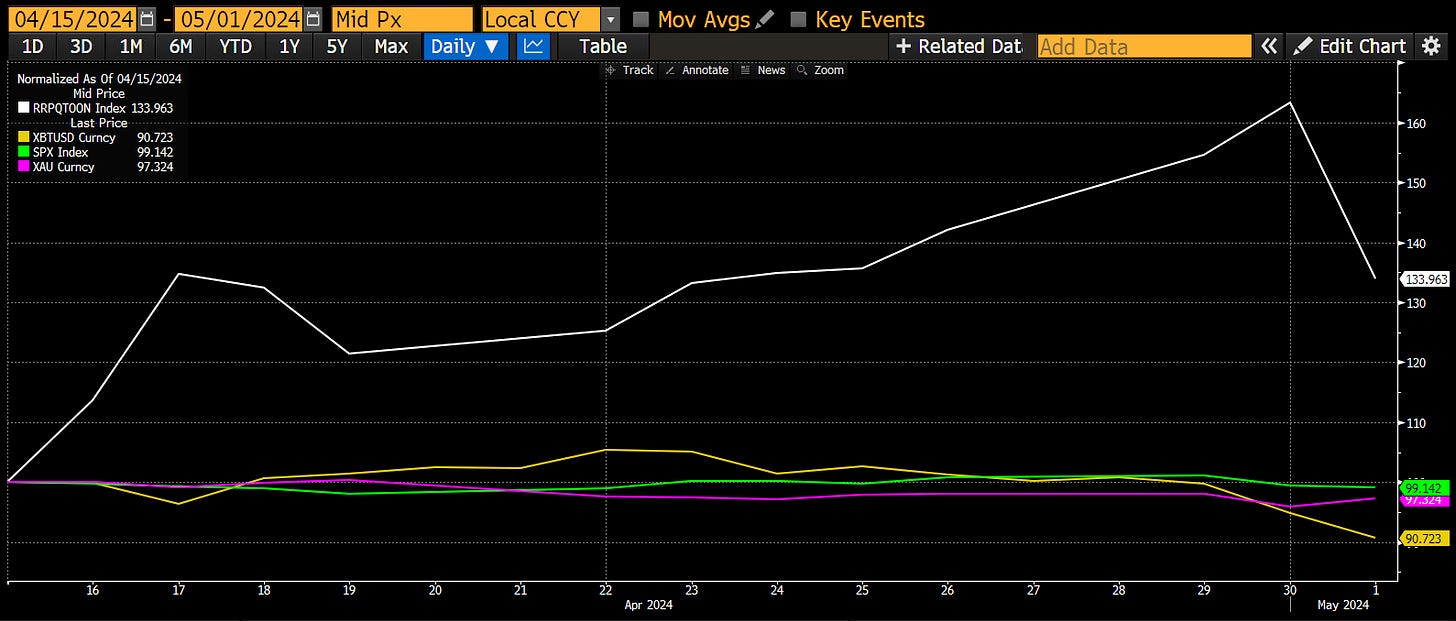

From April 15 to May 1, the Reverse Repurchase Program (RRP, white) rose 33%, Bitcoin (gold) fell 9%, the S&P 500 (green) fell 1%, and gold (magenta) fell 3%. The base for each dataset is 100.

+1 for victory.

May 2024:

As I head off to the northern hemisphere summer holidays, I publish my Mayday article based on several macroeconomic factors. I have the following forecasts:

Did Bitcoin hit a local low of around $58,600 earlier this week? Yes.

What is your price prediction? Bitcoin is expected to rise above $60,000 and then fluctuate between $60,000 and $70,000 until August.

Bitcoin fell to a low of around $54,000 on August 5th, due to a pullback in the USD-JPY carry trade. I was wrong by 8%.

Loss item +1.

During this period, Bitcoin’s price ranged from approximately $54,000 to $71,000.

Loss item +1.

I did add some exposure to “Altcoin” during the summer weakness. Some of the coins I bought are currently trading below the price I bought them at, while some are higher.

June and July 2024:

When Japan's fifth largest bank admitted its huge losses on foreign currency bonds, I wrote an article titled Shikata Ga Nai discussing the importance of the USD-JPY exchange rate. I predicted that the Bank of Japan (BOJ) would not raise interest rates because it would endanger the banking system. However, this assumption proved to be too naive. On July 31, the BOJ raised interest rates by 0.15% and initiated a fierce USD-JPY carry trade retracement. I followed up on the mechanics of the USD-JPY carry trade retracement in a subsequent article Spirited Away .

While USD-JPY proved to be the most important macroeconomic variable, I was wrong about the Bank of Japan (BOJ). The policy response did not go as I predicted. Rather than providing dollars through central bank swap lines, the BOJ assured the market that it would not raise interest rates or adjust money printing policy if these measures would lead to increased market volatility.

Loss item +1.

August 2024:

Two major events occurred this month: the release of the US Treasury’s QRA for the third quarter of 2024, and Powell’s turn on employment data at Jackson Hole.

I predicted that Yellen's re-issuance of T-bills would provide USD liquidity to the market. However, after Powell's turn, he confirmed the September rate cut, and these two forces were in opposition to each other. Initially, I thought that the net issuance of T-bills would increase liquidity because it would reduce the reverse repurchase agreement (RRP) to zero, but then the yield on T-bills fell below the RRP level, and I predicted that the repurchase agreement (RPP) would rise and drain liquidity.

I did not anticipate that Powell would cut rates before the election, risking an explosion of inflation as voters go to the polls.

Loss item +1.

RRP (reverse repurchase agreement) balances increased directly after the Jackson Hole meeting and re-entered the upward track. Therefore, I still think this will be a slight drag on liquidity as Treasury bill (T-bill) yields continue to fall and the market expects the Fed to cut interest rates further at the November meeting.

The results are yet to be determined; it is too early to tell if I am right.

September 2024:

When I left the Patagonia Mountains, I wrote an article , Boom Times … Delayed , and gave presentations at Korea Blockchain Week and Token2049 in Singapore predicting that markets would react negatively if the Fed cut rates. Specifically, I argued that a narrowing of the USD-JPY spread would lead to further yen appreciation and reignite the unwinding of carry trades. This would cause a fall in global markets, including cryptocurrencies, and ultimately require more money printing to get Hamti Dunti back together.

The Fed cut rates while the Bank of Japan (BOJ) kept rates unchanged, which narrowed the interest rate differential; however, the yen depreciated against the dollar and risk markets outperformed.

The loss term increases by +1.

result:

2 correct predictions

6 wrong predictions

So that's a .250 batting average. That's pretty poor for the average person, but as the great Hank Aaron said, "My motto has always been to keep swinging. Whether I'm in a slump, feeling down, or having trouble off the field, the only thing to do is keep swinging." Aaron had a career batting average of .305 and is considered one of the best baseball players of all time.

Despite many losses, I was still profitable overall.

Why?

Big Assumptions

When I write these macro articles, I try to predict specific events that will lead to policy responses from our corrupt people in power. We know that they cannot handle any kind of financial market volatility because the entire post-Bretton Woods 1971 trade and financial system is overleveraged. We - I mean both the puppets of traditional finance and the followers of Satoshi Nakamoto - all agree that when things get bad, the "Brrrr" button is pressed. This is always their policy response.

If I can predict the triggers in advance, I’ll feel better about myself and maybe I can get some extra profit by getting ahead of time, but as long as my portfolio benefits from printing fiat currency to dampen the natural fluctuations of human civilization, it doesn’t matter if I’m wrong on every event-driven prediction as long as policy responds as expected.

I’ll show you two charts to help you understand the sheer volume of fiat needed to suppress volatility at historically low levels.

Volatility

Starting in the late 19th century, the elites who controlled global government struck a deal with the common people. If the common people surrendered more and more freedoms, the "smart" people who ran the country would create a calm universe by suppressing entropy, chaos, and volatility. As the decades progressed, and the role of government became more important in the lives of every citizen, it became very expensive to maintain the increasing appearance of order as our knowledge of the universe increased and the world became more complex.

Previously, books by a few authors were seen as the authoritative source of truth about the workings of the universe. They killed or ostracized anyone who practiced science. But as we freed ourselves from the constraints of organized religion and thought critically about the universe we inhabit, we realized that we knew nothing and that things were much more complicated than you would have believed from reading books like the Bible, Torah, and Koran alone. So people flocked to politicians (mostly men, a few women) who replaced priests, rabbis, and imams (always men) with a promise of a secure way of life and a framework for understanding the workings of the universe. Yet, every time volatility spikes, the response is to print money and cover up the various problems that exist in the world to avoid admitting that no one knows what the future will hold.

Just like when you push an inflatable ball under water, the deeper you push the ball, the more energy required to maintain its position increases. The distortions on a global scale are so extreme, especially for the American hegemony, that the amount of money printing required to maintain the status quo is growing rapidly every year. That is why I can confidently say that the amount of money printing required between now and the final system reset will far exceed the total amount that has been printed from 1971 to date. It is just the laws of mathematics and physics.

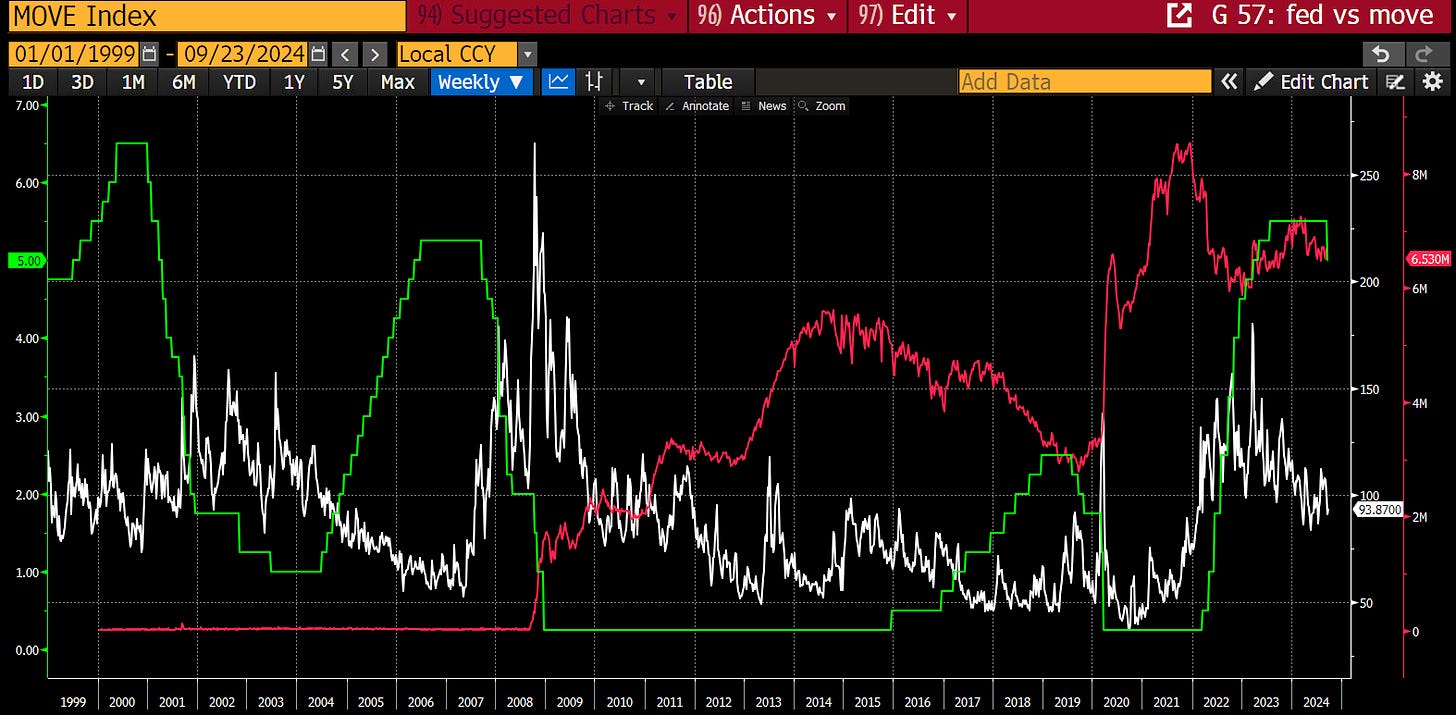

The first chart I will show you is the MOVE Index (white), which measures the volatility of the US bond market in relation to the Fed Funds Cap Rate (green). As you know, I believe that volume is more important than price, but in this case, using price paints a very clear picture.

You may remember the rise and collapse of the tech bubble in 2000. As you can see, the Fed popped the bubble by raising interest rates until problems arose. Volatility in the bond market surged in 2000 and 2001 after the 9/11 attacks. Once volatility rose, the Fed cut interest rates. After volatility fell, the Fed thought it was time to normalize interest rates, however, they popped the subprime housing market again, leading to the 2008 Global Financial Crisis (GFC). Interest rates were quickly cut to zero and remained there for nearly 7 years to suppress volatility. It was time to normalize interest rates again, and then COVID happened, which caused the bond market to collapse and volatility to surge. The Fed therefore cut interest rates to zero. Inflation stimulated by COVID has ignited the bond market starting in 2021, leading to increased volatility. The Fed raised interest rates to curb inflation, but had to stop at the non-"too big to fail" banking crisis in March 2023. Finally, the current Fed easing cycle has occurred during a period of increased volatility in the bond market. If 2008 to 2020 is considered “normal,” current bond market volatility is close to double our comfort level.

Let's introduce an indicator of the dollar amount. The red line is an approximation of total bank credit, which consists of excess bank reserves and other deposits and liabilities (ODL) held by the Fed, which is a good indicator of commercial bank loan growth. Remember from basic economics class that it is the banking system that creates money by extending credit. As the Fed conducts quantitative easing (QE), excess reserves increase, and as banks extend more loans, ODL also grows.

As you can see, 2008 was a major turning point. The financial crisis was so huge that the scale of the credit money outpouring overshadowed what happened when the tech bubble collapsed a little after 2000. No wonder our Lord and Savior Satoshi Nakamoto created Bitcoin in 2009. Since then, the total amount of bank credit has never fully diminished. This fiat credit cannot be eliminated or the system will collapse under its own weight. Moreover, in every crisis, banks must create more and more credit to suppress volatility.

I could show a similar chart showing FX volatility versus government debt levels, central bank balance sheets, and bank credit growth for USDCNY, USDJPY, EURJPY, etc. They wouldn't be as clear as the one I just showed. The US hegemon cares about bond market volatility because that's the asset that backs the global reserve currency, the dollar. All other allies, vassals, and enemies care about the volatility of their currencies versus the dollar because it affects their ability to trade with the world.

reaction

All of this fiat money has to go somewhere, and Bitcoin and cryptocurrencies are the release valve for that flow. The fiat money needed to dampen volatility will flow into cryptocurrencies. Assuming the technology of the Bitcoin blockchain is sound, Bitcoin will always benefit from the elites continuing to try to break the laws of physics. There has to be a balancer; you can’t create something from nothing. Bitcoin happens to be the most technologically sound way to balance the profligate behavior of the ruling elite in this modern digital world.

As an investor, trader, and speculator, your goal is to acquire Bitcoin at the lowest cost. This could mean pricing your hourly labor in Bitcoin, using excess cheap energy for Bitcoin mining, borrowing fiat currency at low interest rates and buying Bitcoin (call Michael Saylor), or using a portion of your fiat savings to buy Bitcoin. The volatility between Bitcoin and fiat currencies is your asset, don't waste it by using leverage to buy Bitcoin that you plan to hold for the long term.

Are there any risks?

Profitably speculating on short-term price movements is extremely difficult. As you can see from my record, my success rate is 2 in 6. If I had moved my entire portfolio long and short every time I made a call, Maelstrom would probably be bankrupt by now. Randall and Kyle Davies are right; there is indeed a super cycle in the elite suppressing volatility. They have no patience and instead borrow fiat to buy more Bitcoin, and as the cost of fiat funding changes (which always happens), they get caught and lose everything. However, not all is lost - I have seen pictures of Randall throwing lavish parties at his mansion in Singapore. Don't worry though - it's in the names of his children to avoid being seized by the bankruptcy court.

Assuming you don’t abuse fiat leverage, the real risk is that volatility will rise back to its natural level when the elites can no longer suppress it. At that point, the system will reset. Will it be a revolution like in Bolshevik Russia, where the capitalist class holders are completely wiped out, or will it be more common, where one group of corrupt elites is replaced by another and the suffering of the masses continues under a new “ism”? In any case, everything will fall, and Bitcoin will fall less relative to the ultimate asset, energy. Even though your overall wealth has decreased, you have still outperformed others. Sorry, nothing in the universe is risk-free. Security is just an illusion, sold by scammers eager for you to vote on election day.

Trading strategies

USA

Based on the Fed's historical response to "high volatility", we know that once they start cutting rates, they usually keep going until rates are close to 0%. In addition, bank credit growth must also accelerate in tandem with rate cuts. I don't care how "strong" the economy is, how low unemployment drops, or how high inflation gets, the Fed will continue to cut rates and more dollars will be released into the banking system. No matter who wins the US presidential election, the government will also continue to borrow as much as it can to keep the support of the civilian population until the foreseeable future.

European Union

The unelected bureaucrats of the EU are destroying their economies in a suicidal way, rejecting cheap and abundant Russian energy and dismantling their energy production capacity in the name of "climate change", "global warming", "ESG" or other nonsense slogans. The economic depression will be responded by the European Central Bank lowering the euro interest rate. Governments will also start forcing banks to lend more to local businesses so that they can provide jobs and rebuild the deteriorating infrastructure.

China

As the Fed cuts rates and U.S. banks extend more credit, the dollar will weaken. This allows the Chinese government to ramp up credit growth while keeping the dollar-yuan exchange rate stable. The Chinese president’s main concern about accelerating bank credit growth is the pressure on the yuan to depreciate relative to the dollar. If the Fed prints money, the People’s Bank of China (PBOC) can print money, too. This week, the PBOC rolled out a series of rate cuts throughout the monetary system. This is just the beginning; the real “big move” will come when banks extend more credit.

Japan

If other major economies are now easing monetary policy, there will be less pressure on the Bank of Japan (BOJ) to raise rates quickly. BOJ Governor Kazuo Ueda has made it clear that he will normalize rates. However, since other countries have lowered rates to his low levels, he does not need to catch up so quickly.

The moral of the story is that the global elite are once again suppressing volatility in their countries or economic blocs by lowering the price of money and increasing the money supply. If you are already fully invested in crypto, sit back, relax, and watch the fiat value of your portfolio go up. If you have extra fiat, hurry up and put it into crypto. As for Maelstrom, we will push projects that have delayed launching tokens due to poor market conditions to speed up. We want to see those green candlesticks in our Christmas stockings. And the brothers at the fund want a good 2024 bonus, so help them out!