Author: Pedro M. Negron Source: IntoTheBlock Translation: Shan Ouba, Jinse Finance

This week, we explore Bitcoin’s growing dominance in the cryptocurrency market. We examine the key factors driving investor interest in Bitcoin, including the impact of Bitcoin ETFs and market stability. We highlight challenges facing Ethereum, such as its declining ETH/BTC ratio and low profit margins, while also discussing the rise of stablecoins and their expanding role in the market.

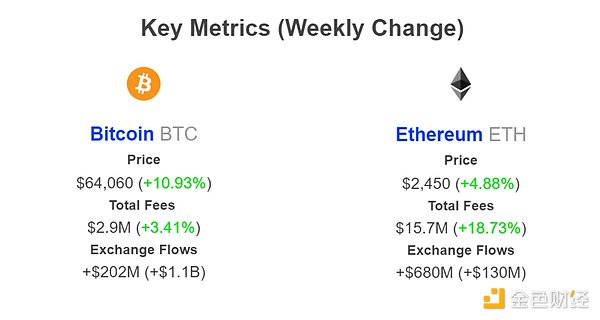

Network Fees — The total amount of fees spent to use a particular blockchain. This tracks the willingness and demand to use Bitcoin or Ethereum.

Bitcoin’s weekly fees have finally started to rise after two weeks of continuous declines, hitting their lowest point in a year and a half.

Net Exchange Flows — Net inflows minus outflows of a particular cryptoasset into and out of centralized exchanges

Prior to the Fed’s announcement this week, both BTC and ETH saw large inflows into exchanges.

Bitcoin Dominance in 2024

Bitcoin is trading near $63,000, up 4.5% in the past 24 hours, following the Federal Reserve's 50 basis point rate cut. Despite the rate cut, skepticism remains, leading to mixed views on the sustainability of the cryptocurrency's rally. ETH continues to underperform, trading at a 40-month low against Bitcoin in 2024. This shift in preference for Bitcoin has been driven by the launch of Bitcoin ETFs, which have seen large inflows, while Ethereum ETFs have seen net outflows. Some traders believe the trend reflects a broader market preference for Bitcoin's stability over Ether's high-risk, high-yield potential.

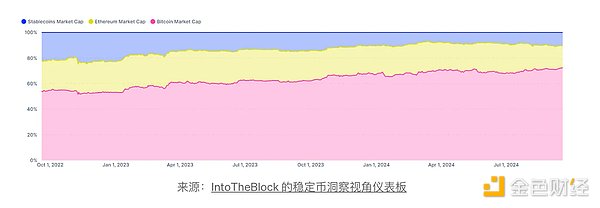

73% Market Cap Dominance — When combined with ETH and stablecoins, BTC’s dominance has been steadily rising, up 6% year to date.

The ETH/BTC ratio has fallen below 0.04, its lowest level since April 2021, reflecting that demand for Ether is decreasing as investors shift their preference toward Bitcoin.

ETH is up 0.2% from its January 1 levels, while Bitcoin is up about 43% in 2024.

Furthermore, the total market capitalization of stablecoins increased its market share at the expense of Ethereum, growing from 7% to 10% of the total market capitalization of BTC, ETH, and stablecoins.

$118 billion — This marks a new all-time high for USDT’s market cap, which has been the main driver of stablecoins taking market share from ETH over the past six months.

The market capitalization of USDC, the second largest stablecoin after USDT, has increased from $24 billion to $35 billion so far this year, further driving the overall growth of the stablecoin market capitalization.

Even amidst the sideways markets of recent months, the market capitalization of stablecoins has steadily grown, indicating growing investor confidence in the cryptocurrency space.

As traditional institutions increasingly adopt blockchain technology, stablecoins have become an important bridge between the two worlds.

63% of ETH holders are in profit — the lowest percentage of profitable holders so far this year.

Although only 63% of addresses are currently in profit, 82% of total ETH trading volume is still in profit. This means that 58.27 million of the 120 million ETH were purchased in the range of $1,900 to $2,350.

In addition, most stablecoins are issued on the Ethereum blockchain, and more than 60% of DeFi assets are locked on the Ethereum blockchain.

Finally, Ethereum is in the lead with the most active developers and the largest user base.

Bitcoin continues to dominate in 2024, helped by the launch of Bitcoin ETFs and a shift in investor preference for Bitcoin's stability to Ethereum. ETH has been struggling, with the ETH/BTC ratio at its lowest level since 2021, and ETH holders have made a smaller profit compared to Bitcoin. Meanwhile, stablecoins, led by USDT and USDC, have steadily gained market share, further shaping the changing dynamics of the crypto market.