A quick overview of important events this week (9/22-9/28)

- The latest U.S. economic data on Thursday night showed that Q2 GDP growth was slightly higher than expected, and the number of people claiming unemployment benefits hit a four-month low . U.S. stocks rose across the board. At the same time, Bitcoin also exceeded $65,500.

- Binance founder CZ is expected to be "released from prison early" on Friday , and the community is looking forward to his return.

- The popular TON game "Hamster Fight" officially launched token trading, which once caused network congestion, but user support seems to have declined.

- Harris' stance on cryptocurrency seems to have changed, saying that it is necessary to maintain the United States' dominance in the blockchain and support continued innovation in cryptocurrency.

- The central bank’s most ruthless housing crackdown in history was criticized for indiscriminate killing of innocent people . President Yang Jinlong said: Exclusion clauses will be raised within a month.

- Save the economy! The People's Bank of China lowered the reserve requirement ratio by 2% and "released RMB 1 trillion" into the market. A shares and Hong Kong stocks rose in consecutive days.

Changes in trading market data this week

Sentiments and Sectors

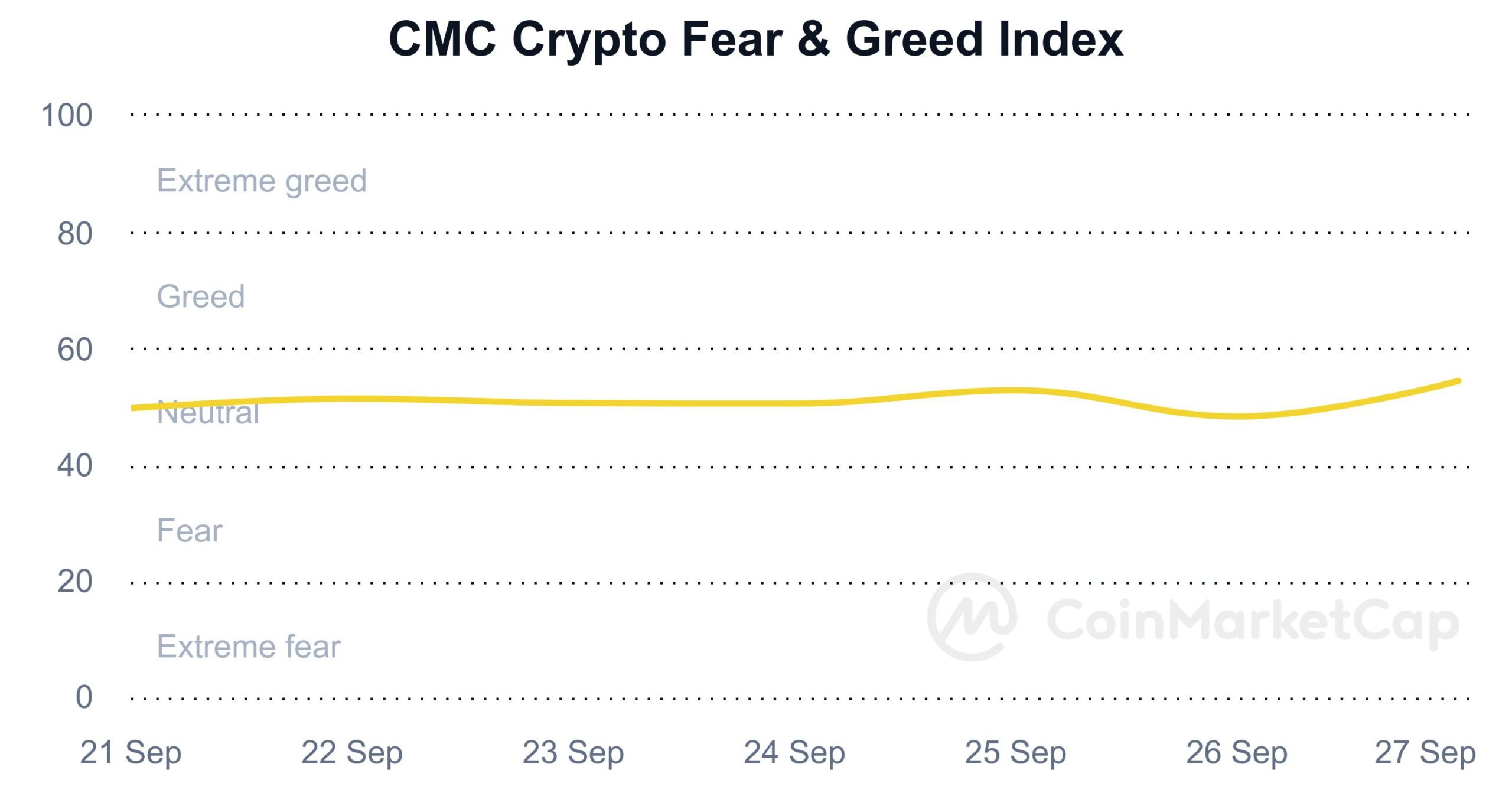

1. Fear and Greed Index

This week's market sentiment indicator rose from 49.76 (neutral) to 54.45 (neutral). Market sentiment has recovered in the "neutral range".

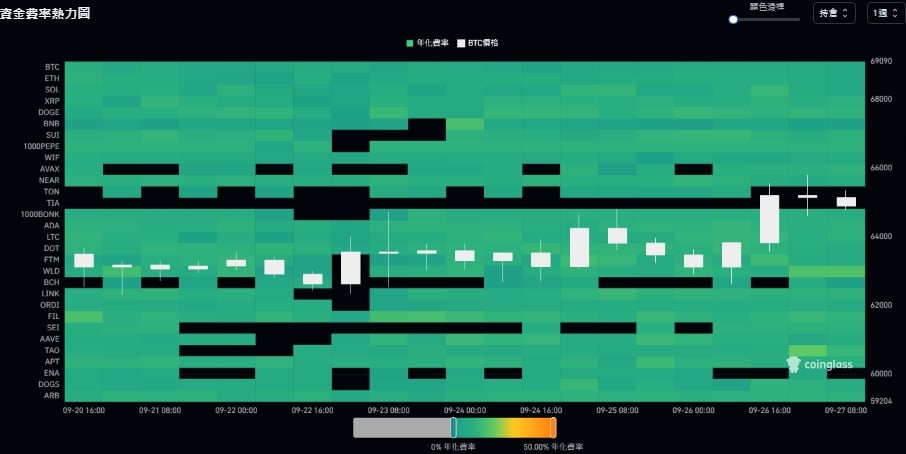

2. Funding rate heat map and long premium

The funding rate heat map shows the changing trend of funding rates for different cryptocurrencies. The color ranges from green with zero rate to yellow with 50% positive rate. Black represents negative rate; the white K-line chart shows the price fluctuation of Bitcoin. , in contrast to the funding rate.

This week, the Bitcoin funding rate reached a maximum of 10.27% and a minimum of 2.21% . There was no negative funding rate this week, and the leverage usage rate increased significantly. Especially after September 24 , market volatility intensified and leverage operations increased significantly.

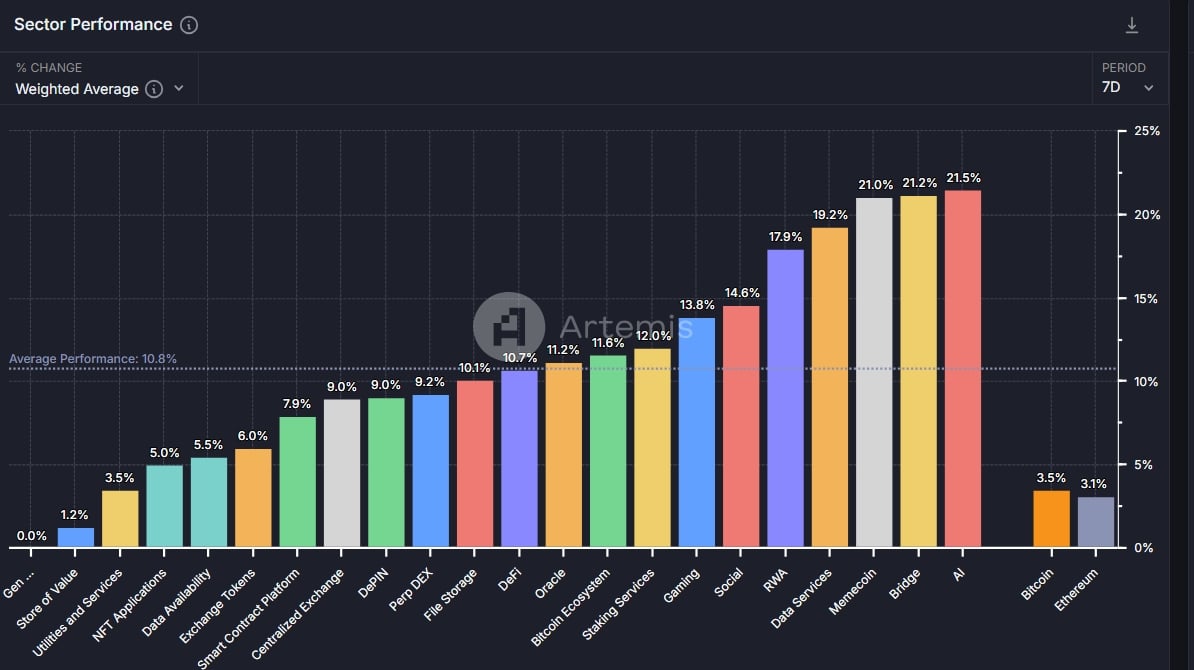

3. Sector performance generally rose

According to Artemis data, the average increase in the blockchain sector this week was 10.8% , with AI, cross-chain bridges, and meme coins occupying the top three gains at 21.5%, 21.2%, and 21% respectively. Bitcoin and Ethereum increased by 3.5% and 3.1% this week.

The three worst performing areas are: utilities and services (3.6%), NFT applications (5.2%) and data availability (6%) .

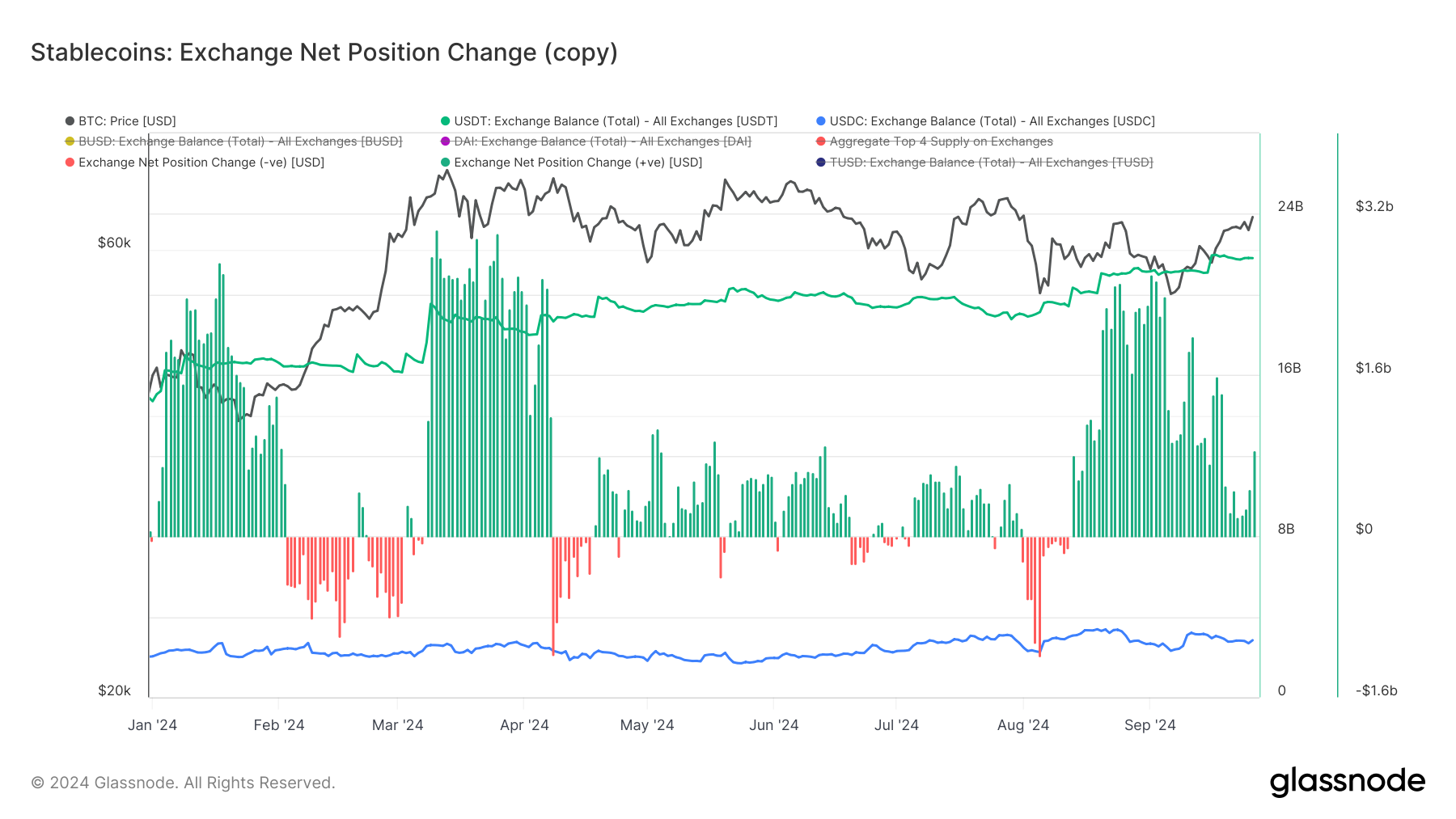

market liquidity

1. Total cryptocurrency market capitalization and stablecoin supply

Data on the total market value of cryptocurrency this week showed that it rose from US$2.21 trillion to US$2.29 trillion , an increase of US$80 billion, and the total market value increased by approximately 3.62% .

The total stablecoin supply, an important indicator of market health and liquidity, increased this week from $159.46 billion to $160.38 billion , an increase of $920 million, or approximately 0.58% .

2. Increased potential purchasing power within the exchange

Data this week shows that while stablecoin inflows into exchanges have slowed, net inflows increased significantly between September 25 and 26 . This shows that market participants expect that the market may be volatile and more funds are prepared to trade.

Bitcoin Technical Indicators

1. Bitcoin spot ETF net inflow of funds

This week, Bitcoin ETF funds inflowed $704.6 million, showing continued inflows of market funds.

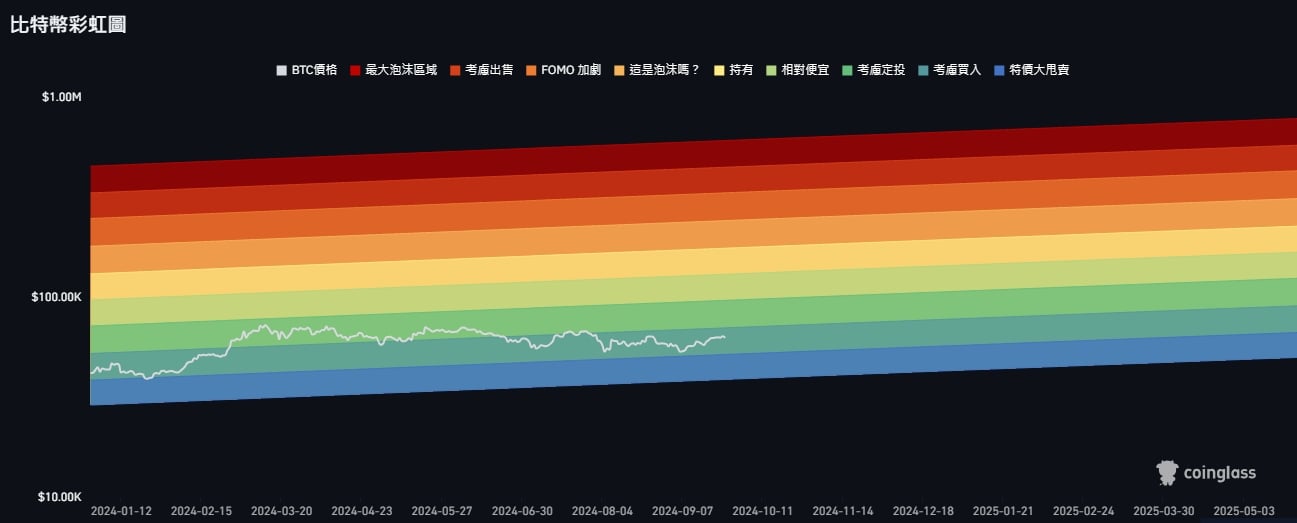

2. Bitcoin Rainbow Chart

The Bitcoin Rainbow Chart shows that the current price of Bitcoin is in the " Consider Buying " range ($65,400), close to the "Consider Buying" stage ( $70,000 ).

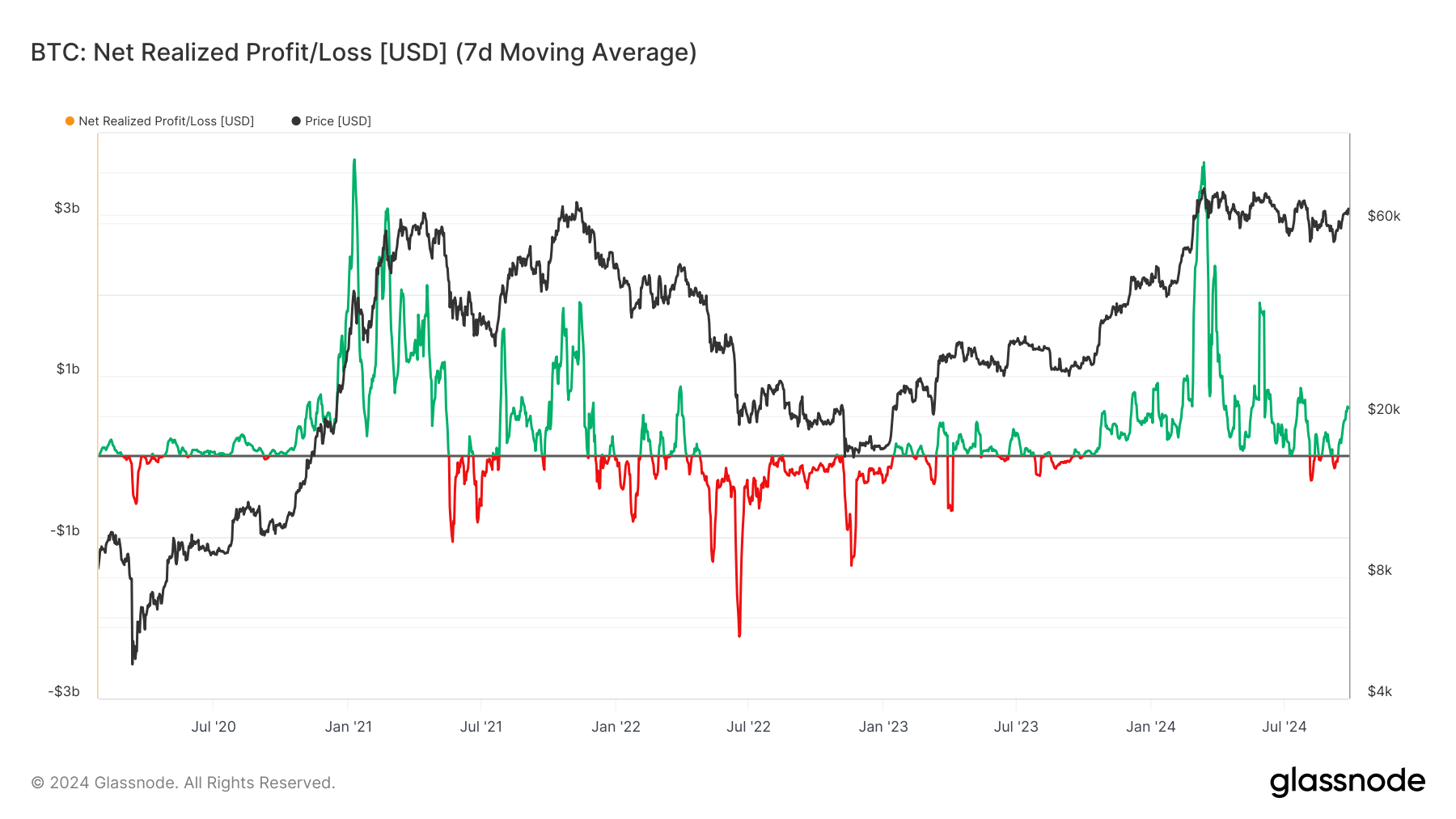

3. Bitcoin net profit and loss performance

Bitcoin's realized net profit and loss indicator shows that the current market conditions have recovered, and the proportion of profits and losses is generally similar to last October .

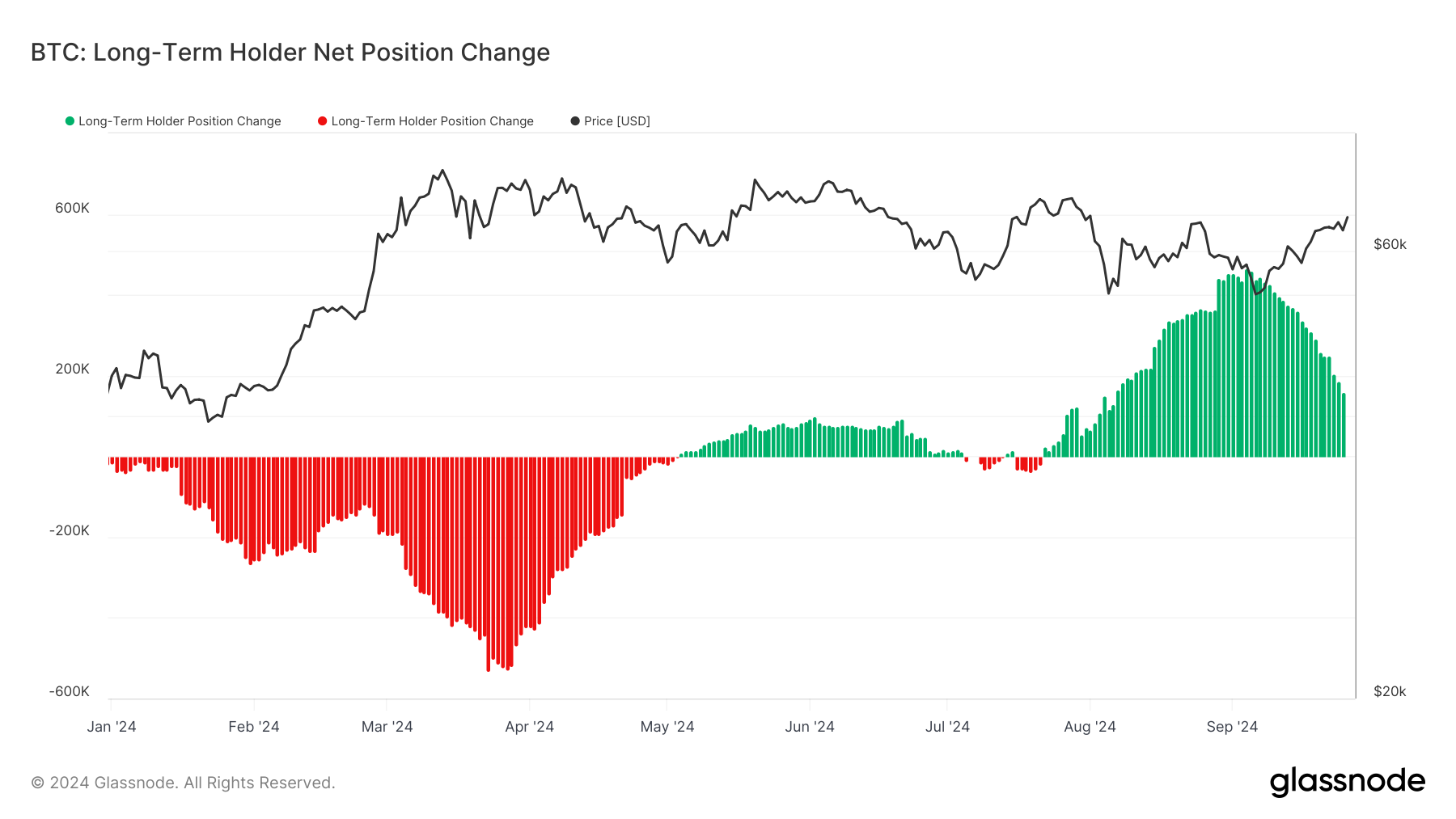

4. The continued decline in the number of long-term Bitcoin holders

According to on-chain data , the net position of long-term holders (LTH) has maintained a decreasing increase over the past seven days, showing that the market’s long-term confidence in Bitcoin has not been broken.

Starting from the end of July, the net position of long-term holders has obviously turned from negative to positive. Especially from mid-August to September, the increase gradually expanded, showing that long-term holders are continuously accumulating Bitcoin positions.

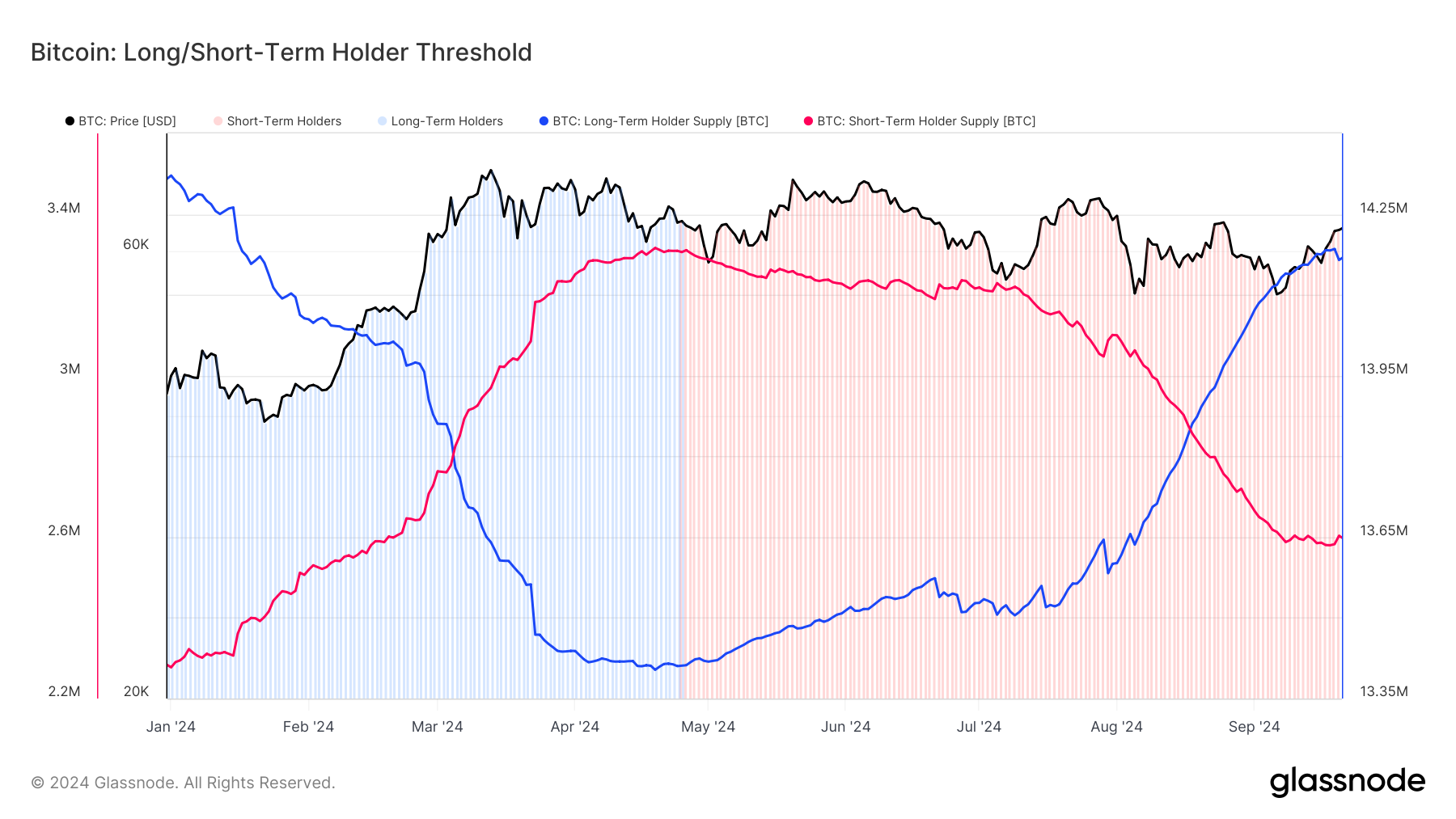

5. The short-term purchasing power on the Bitcoin chain is active

According to on-chain data , the activity of short-term holders (STH) has rebounded since September 19 , which coincides with the simultaneous rise in prices, indicating that the market's long-term confidence remains strong. At the same time, the supply to long-term holders fell slightly, which may be due to profit-taking by some holders.

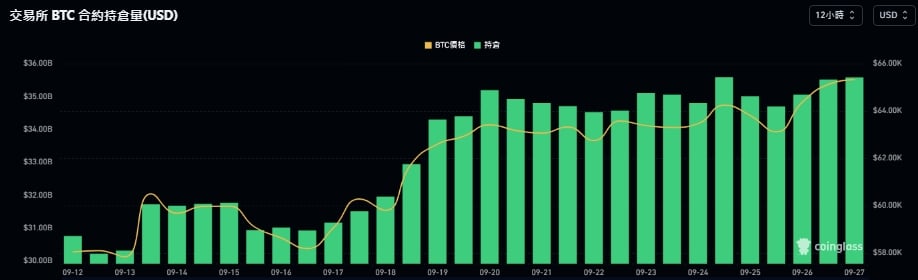

6. Bitcoin contract positions hit a new short-term high

According to data , contract positions on Bitcoin exchanges have shown a steady upward trend this week, increasing from US$3.1 billion to nearly US$3.6 billion , indicating that market sentiment is biased toward bullishness. The increase in contract holdings indicates that investors have increased demand for Bitcoin contracts and are optimistic about future price trends.

Binance, as the exchange with the largest open interest, has a contract holding of $7.79 billion , while the CME exchange has a holding of $9.86 billion , showing the high level of participation of institutional investors.

Important technical indicators of Ethereum

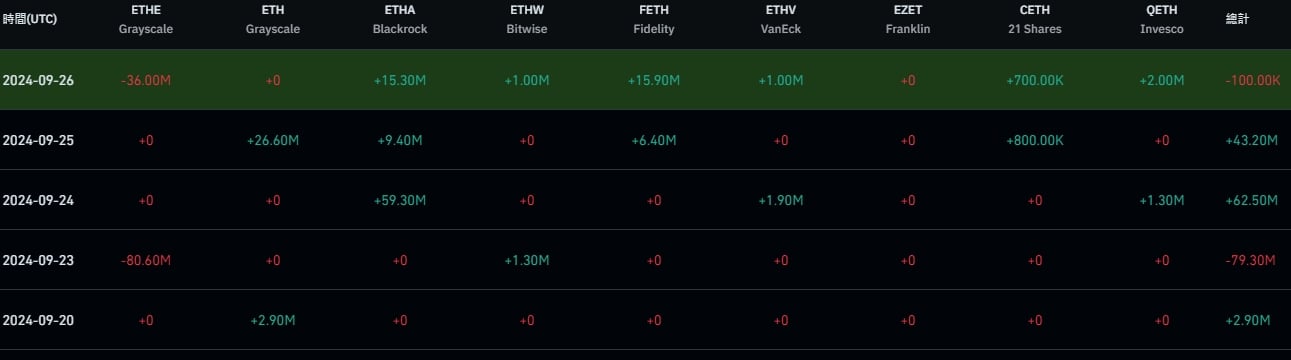

1. Ethereum spot ETF funds continue to experience net outflows

The net inflow of Ethereum ETF funds this week was US$29.2 million , of which the inflow of US$62.5 million reached the top three historical highs in mid-week. The market performance still needs further observation.

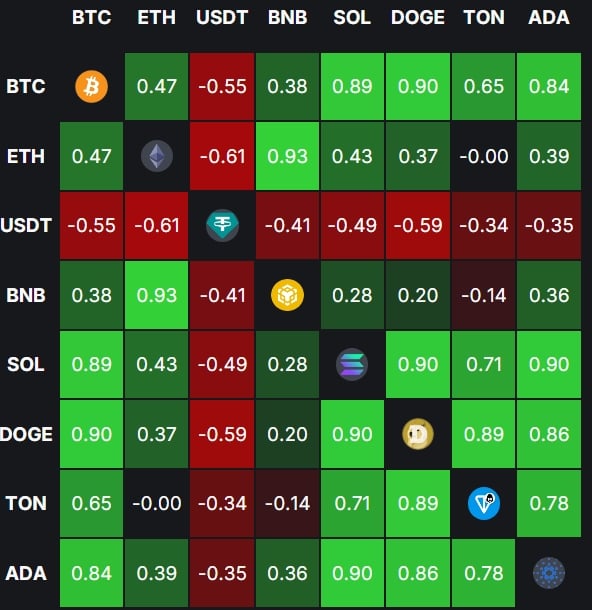

2. Bitcoin Correlation

Data this week shows that the correlations between BTC and ETH and SOL are 0.47 and 0.89 respectively. Compared with last week, the correlation between BTC and ETH has dropped significantly. The correlation between ETH and BNB remains at a high level of 0.93.

Negatively correlated or uncorrelated assets (such as BTC and USDT, ETH and TON) can be used as hedging tools or risk hedging assets during market fluctuations.

Market analysis news this week

1. Save the economy! The People's Bank of China lowered the reserve requirement ratio by 2% and "released RMB 1 trillion" into the market. A shares and Hong Kong stocks both rose.

Today's press conference of the State Council of China was a rare gathering of the three major financial regulatory giants. Pan Gongsheng, the governor of the People's Bank of China, announced four key points at the conference, including lowering the reserve requirement ratio by 2% and injecting approximately RMB 1 trillion into the financial market, which will be reduced for 7 days. The reverse repurchase operation interest rate is 0.2%, and the existing mortgage interest rate is also reduced. ( continue reading )

2. Great benefits! SEC approves BlackRock Bitcoin ETF "options trading", Bitwise is optimistic about restarting the violent bull market

The U.S. Securities and Exchange Commission has approved asset management company BlackRock to list and trade Bitcoin spot ETF options on Nasdaq under the trading code "IBIT". Investors can increase their investment exposure to Bitcoin at lower costs and conduct transactions in a more flexible way. ( continue reading )

3. BlackRock sets the tone: Bitcoin is more like a "safe haven asset", Plan B calls for BTC to see 1 million magnesium next year and it will become a laughing stock

Robbie Mitchnick, BlackRock's head of digital assets, said that Bitcoin should not be viewed as a "risk asset" and emphasized its characteristics as a global decentralized asset, making it closer to a "safe haven asset." Meanwhile, PlanB predicts that Bitcoin will reach an all-time high of $1 million by the end of 2025. ( continue reading )

4. Arthur Hayes admits his mistake: The yen is weak, Bitcoin is performing well, it’s time to trade shit meme coins

BitMEX co-founder Arthur Hayes admitted on Twitter on the 23rd that his previous prediction at the Token 2049 conference was wrong, warning that the market may face collapse due to the U.S. Federal Reserve’s interest rate cut decision, and said it was time to trade some meme coins . ( continue reading )

5. Bitcoin RSI indicator triggers bull market signal, analyst: BTC will see $85,000 by the end of the year

Crypto analyst Titan of Crypto predicts that Bitcoin is expected to surge by 35% to $85,000 by the end of the year, while senior analyst Peter Brandt predicts that the ratio of Bitcoin to gold will rise by more than 400% by 2025. ( continue reading )

Cryptocurrency regulatory status in various countries

1. Exaggeration! South Korea revealed that several military officers mortgaged military secrets and borrowed loan sharks to speculate in cryptocurrency

The South Korean Ministry of National Defense recently confirmed that a number of military officers were suspected of using high-level military secrets as collateral to borrow loan sharks to purchase cryptocurrency. Most of the officers involved were young officers in their 20s and 30s because they were eager to invest in cryptocurrency but were unable to Obtain loans from commercial banks and instead provide military passwords as collateral to underground banks. ( continue reading )

2. The second phase of Hong Kong’s “Digital Hong Kong Dollar” is launched: exploring tokenized asset settlement, offline payment and diversified applications

The Hong Kong Monetary Authority announced on Monday (23) that it has officially launched the second phase of the digital Hong Kong dollar pilot program. 11 groups of selected institutions from different industries will jointly explore innovative use cases of digital Hong Kong dollars and tokenized deposits on three major themes. The three major themes include tokenized asset settlement, programmability and offline payments. ( continue reading )

3. Police lawyers join forces with the underworld! Yunlin uncovered a 140 million virtual currency fraud, and all 33 people were prosecuted

The Yunlin District Prosecutor's Office recently detected a major virtual currency fraud case. A criminal group colluded with unscrupulous lawyers and police officers to defraud a total of nearly 140 million yuan in cash and virtual currency. The investigation of the whole case was concluded on the 24th. According to the Fraud and Money Laundering Prevention Law, All 33 people involved in the case were prosecuted for multiple crimes including destroying evidence and leaking secrets, and the two police officers involved have been dismissed from their posts. ( continue reading )

Worldcoin, backed by OpenAI CEO Sam Altman, has repeatedly been investigated in many countries for illegally collecting personal information. Now Worldcoin has been fined 1.1 billion won by the South Korean authorities for illegally collecting the iris information of about 30,000 users in South Korea. Transferring data overseas violates South Korea's Personal Data Protection Act. ( continue reading )

Curve Finance recently considered removing TrueUSD (TUSD) from its crvUSD collateral list. This is due to TrueCoin, the issuer of TUSD, being accused by the U.S. Securities and Exchange Commission (SEC) of violating securities laws, involving breach of investment commitments and unregistered sales. ( continue reading )

Market focus next week

9/27 (Friday)

- United States: August core PCE price index (annual growth rate), previous value 2.6%

- United States: August core PCE price index (compared to previous month), previous value 0.2%

9/30 (Monday)

- China: Manufacturing PMI in September, previous value 49.1

- UK: Q2 GDP (compared to previous period), forecast 0.6%, previous value 0.7%

- UK: Second quarter GDP (annual growth rate), forecast 0.9%, previous value 0.3%

- Germany: Consumer Price Index CPI in September, previous value -0.1%

10/1 (Tue)

- United States: Federal Reserve Chairman Powell speaks

- Eurozone: Consumer Price Index CPI (annual growth rate) in September, the previous value was 2.2%

- United States: Manufacturing PMI in September, forecast 47.0, previous value 47.9

- United States: ISM Manufacturing PMI in September, previous value 47.2

- United States: JOLTS job openings in August, previous value 7.673M

10/2 (Wednesday)

- United States: Change in non-agricultural employment in September, previous value 99K

- United States: Crude oil inventories, previous value -4.471M

10/3 (Thursday)

- United States: Initial Jobless Claims

- United States: September services PMI, forecast 55.4, previous value 55.7

- United States: September ISM non-manufacturing PMI, previous value 51.5

10/4 (Friday)

- United States: Average hourly wages in September (compared to previous period), last value 0.4%

- United States: Nonfarm payrolls in September, previous value 142K

- United States: Unemployment rate in September, previous value 4.2%

Top 5 popular articles this week

1. The European Union strongly warns Apple: If it does not open the iOS system, it will be fined up to 20% worldwide.

Under the pressure of the new EU law "Digital Markets Act" (DMA), may Apple open up its closed and secure iOS and iPadOS operating systems? ( continue reading )

2. SBF girlfriend Caroline was sentenced to 2 years in prison and confiscated 11 billion US dollars. The judge: I have seen the most honest witness in my judicial career.

Caroline Ellison, the former CEO of FTX-affiliated fund Alameda Research, was sentenced today by a U.S. judge to two years in federal prison for her role in the collapse of the FTX cryptocurrency exchange. ( continue reading )

"It is essential for the fairness of our justice system to distinguish between masterminds and willing accomplices when we recognize when leniency is warranted."

3. Nintendo Switch 2 spy photos leaked: eight-inch screen, super Steam Deck performance, 400 mg, to be launched in Q2 next year

According to the latest news, Nintendo is about to launch a new generation of game console Switch 2, which will be equipped with a larger 8-inch screen and stronger performance upgrades. It will also have an improved magnetic module design for the Joy-Con handle. It is rumored that it will be released in March next year and will cost US$400. ( continue reading )

4.WSJ warns: Lehman Brothers could happen again, Fed rate cuts can’t save us

The Federal Reserve's interest rate cut triggered a rebound in the market, but Wall Street Journal writer Spencer Jakab warned everyone that this is very similar to the eve of the bankruptcy of Lehman Brothers in 2007, where stocks rose sharply immediately after the interest rate cut, but then led to a collapse. ( continue reading )

Many now see this as different from the freeze in credit markets in 1998, with global liquidity reserves now overflowing rather than empty as they were then.

5. Earn $200,000 after passing the trading license test? What are the unspoken truths behind Bump’s new film?

A video recently released by Taiwanese YouTuber "Haobang Bump" has sparked heated discussions in the crypto community. In the video, Bump introduced an "MCF Institutional Trader Certificate", saying that as long as anyone passes this certificate, the institution will A trading fund of US$200,000 will be provided to users who pass the test. Is this such a good thing? ( continue reading )