Re-Pledge Agreement: EigenLayer $EIGEN Token to List on Binance Exchange

EigenLayer, the third-largest locked position in the Ethereum DeFi ecosystem, has grown more than 10 times in the past year, with its current TVL reaching $12 billion. The $EIGEN token it issued will be available for claiming on September 23 and will be listed on the Binance exchange at 13:00 (UTC+8) on October 1.

Binance will list EigenLayer (EIGEN) and add a seed label for it

The current over-the-counter price of the $EIGEN token has surpassed $4, so let's explore the potential of the $EIGEN token, its upside potential, and whether it has the potential to bring the next wave of on-chain hype to the Ethereum ecosystem.

Key Data of the $EIGEN Token, Ranking Not Even Top 300 at Listing?

$EIGEN is one of the most highly anticipated tokens to be listed on Binance recently, and it is also the first token to be listed after Binance CEO CZ's release from prison, naturally generating a lot of market heat. It is also the first non-TON ecosystem token to be listed, as previous Binance listings of $DOGS, $CATI, and $HAMSTR failed to gain traction, so where does the opportunity lie for $EIGEN?

$EIGEN Token Claim Website: https://claims.eigenfoundation.org/

• Total Supply of $EIGEN Token: 1.67 billion

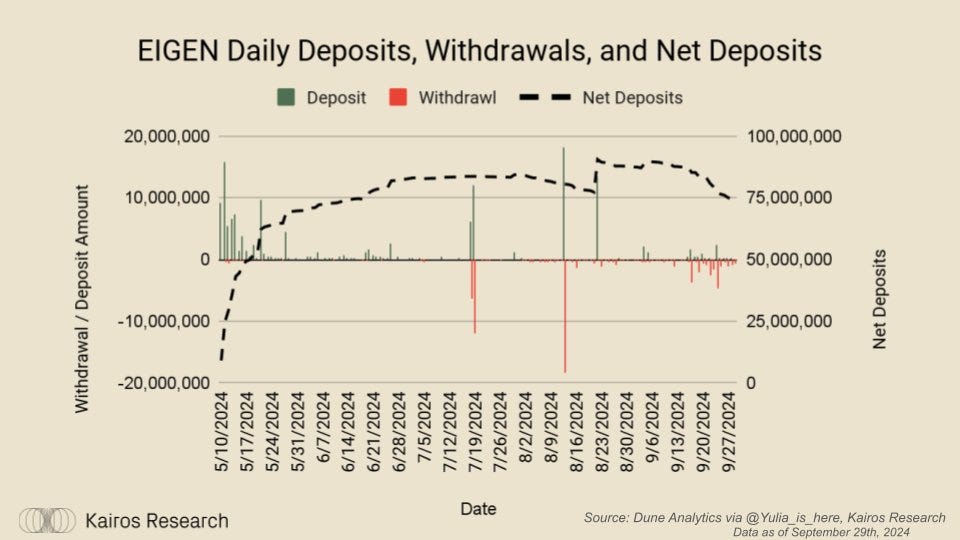

• Theoretical Circulating Supply of $EIGEN: 200 million (11.95%), the sum of the first and second season's stakedrop

• Actual Circulating Supply of $EIGEN: 114 million

• Actual Tradable Volume of $EIGEN: 40.43 million (only 2.42%!)

A total of about 114 million $EIGEN tokens have been claimed over the two seasons, and it is worth noting that nearly 64% of these tokens have already been staked into EigenLayer.

Research firm Kairos Research states that the circulating supply ratio of $EIGEN at the time of listing will be much lower than most people expect, and if calculated based on the over-the-counter price of $4 per $EIGEN, the market capitalization at listing may not even be among the top 300 tokens, with the potential for significant price volatility. Traders should be aware of the trading risks.

As for the concern about large-holder dump, node operators will not be able to start claiming $EIGEN tokens until October 6, and the window will close in March 2025.

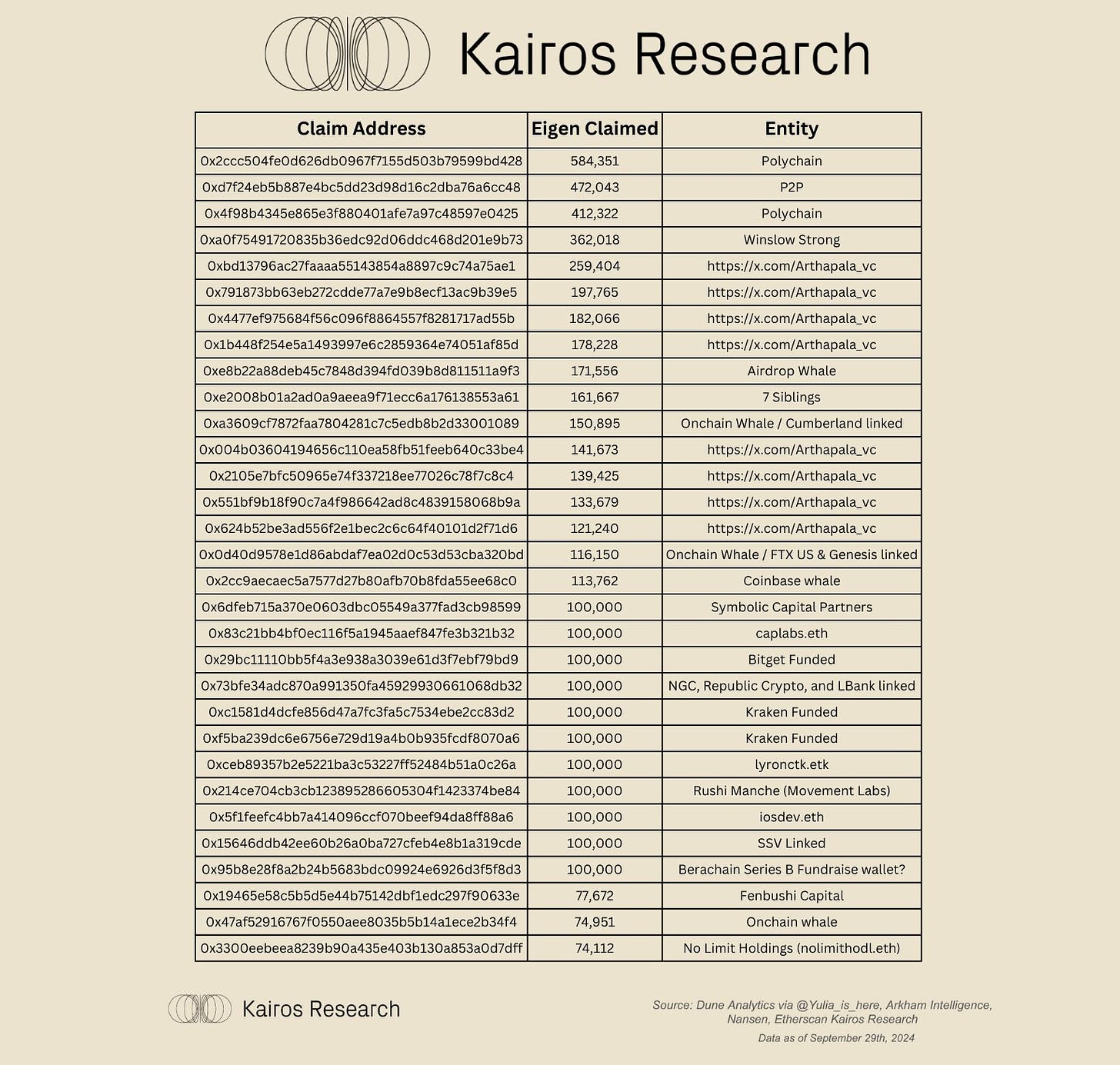

Who Are the $EIGEN Whales? Let's Analyze the Institutional List

Kairos has analyzed the $EIGEN whales on-chain through Dune, Etherscan, and Arkham, and as mentioned earlier, the initial circulating supply of $EIGEN is extremely low, so these potential token dumps may have a certain impact on the market, which should not be taken lightly!

Classified as follows:

Re-Pledge Track Insiders: Swell, Eigenpie, Stakestone, Rockx

Whales Injecting Funds Through Exchanges Such as Bybit, CB Prime (Coinbase Institutional), Binance, Hashkey, Bitget, and Trading Platforms Like Matrixport, and Market Makers Like Galaxy Digital

Investment Institutions: Arthpala Ventures, ParaFi Capital, Fenbushi Capital, Polychain

Node Operators: StakeFish, Rockx (Bederock Development Team), P2P

What is the Re-Pledge Protocol EigenLayer?

EigenLayer is a middleware built on Ethereum, and it is also a secondary Stake protocol.

Secondary Stake means that the ETH staked in the Beacon Chain and the Stake in the Liquid Stake Derivative (LSD) services are "re-staked" to generate additional revenue and higher security.

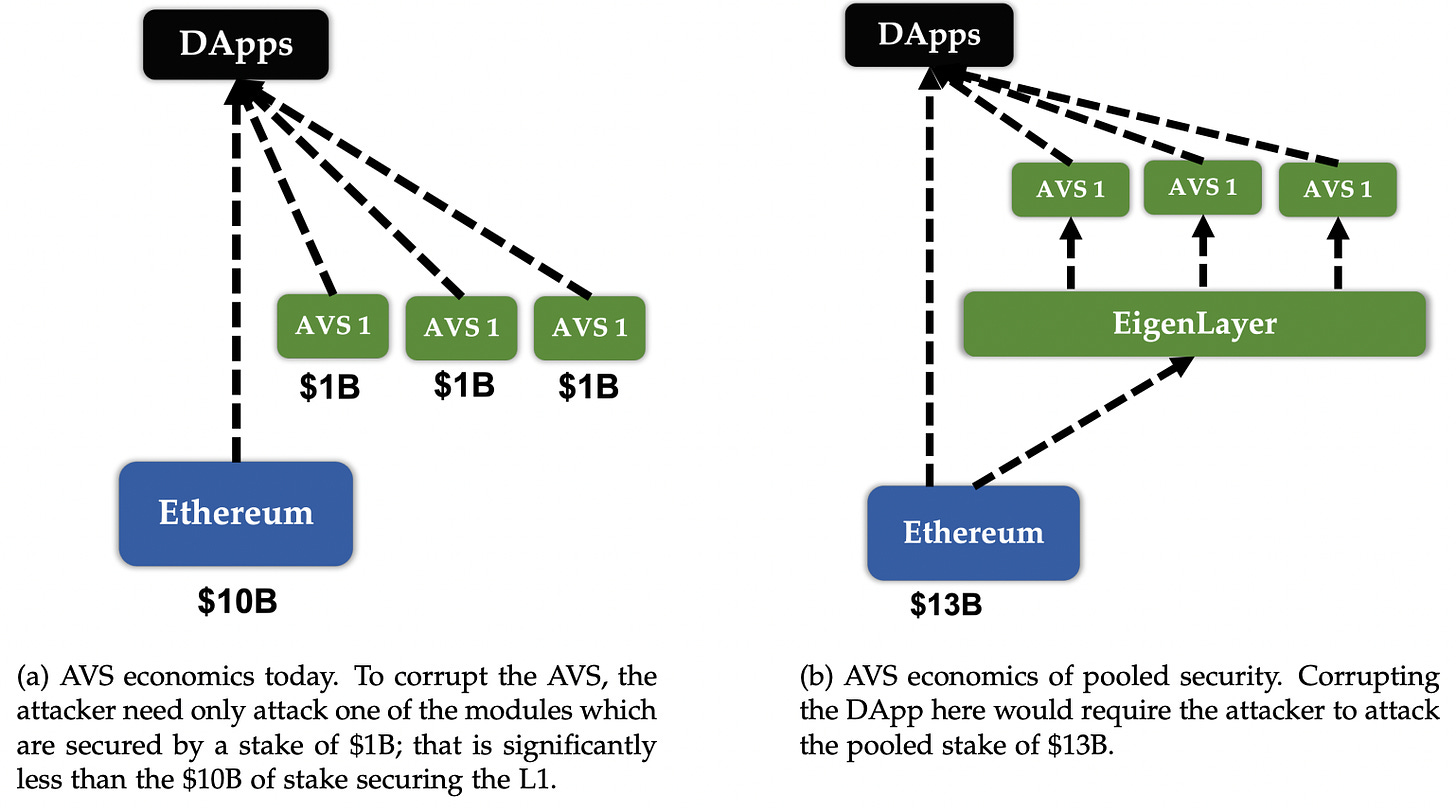

What Problems Does EigenLayer Solve? Critical Security Issues and Maintenance Costs

The middleware (such as oracles, cross-chain bridges, side chains, etc.) on the Ethereum network, as well as non-EVM applications, often require self-operated nodes for verification, which is known as Active Verification Service (AVS). This has a higher maintenance cost, and the security is not built on top of Ethereum, so the protocols themselves are responsible for it.

For attackers, the cost is relatively low, as they only need to break through one by one, so the underlying layer does not fully realize its security.

Image Source: EigenLayer Whitepaper

The assets re-staked on EigenLayer serve to verify the security of the middleware of other protocols, replacing the original security mechanism of the protocols, including oracles, side chains, cross-chain bridges, and more.

Re-Staking can help these protocols reduce the costs they pay for security, while enjoying the security of Ethereum.

The most important operational cost, the AVS architecture, can help teams save nearly 70% of their operational costs, so for protocols, using EigenLayer is cheaper and more secure.

After the $EIGEN Listing, What Events Will Affect the Token Price? The Future Ecosystem of EigenLayer

Low Initial Circulating Ratio, High Price Volatility

Although the market capitalization of $EIGEN after listing may not be high, with a fully diluted market capitalization of nearly $6.5 billion, it is not low. Compared to the leading re-pledge track EtherFi, $ETHFI had a shocking $8 billion FDV shortly after its listing. If the market heat returns, with the low initial circulating supply, $EIGEN has a very good chance of surpassing the $10 billion level, which could then ignite the on-chain heat of the Ethereum ecosystem.

Regarding the subsequent upside potential of $EIGEN, many KOLs have also conducted analyses on this.