Bitcoin may not be having an Uptober with a bang, but there are still plenty of reasons to be bullish on its price.

Bitcoin prices once again surpassed $60,000 in the fourth quarter, with September marking its best month in a decade.

BTC price action has been in line with that of the U.S. stock market, with an impressive rebound from early August lows.

Can the good times continue with a classic “Uptober”?

August BTC price crash canceled

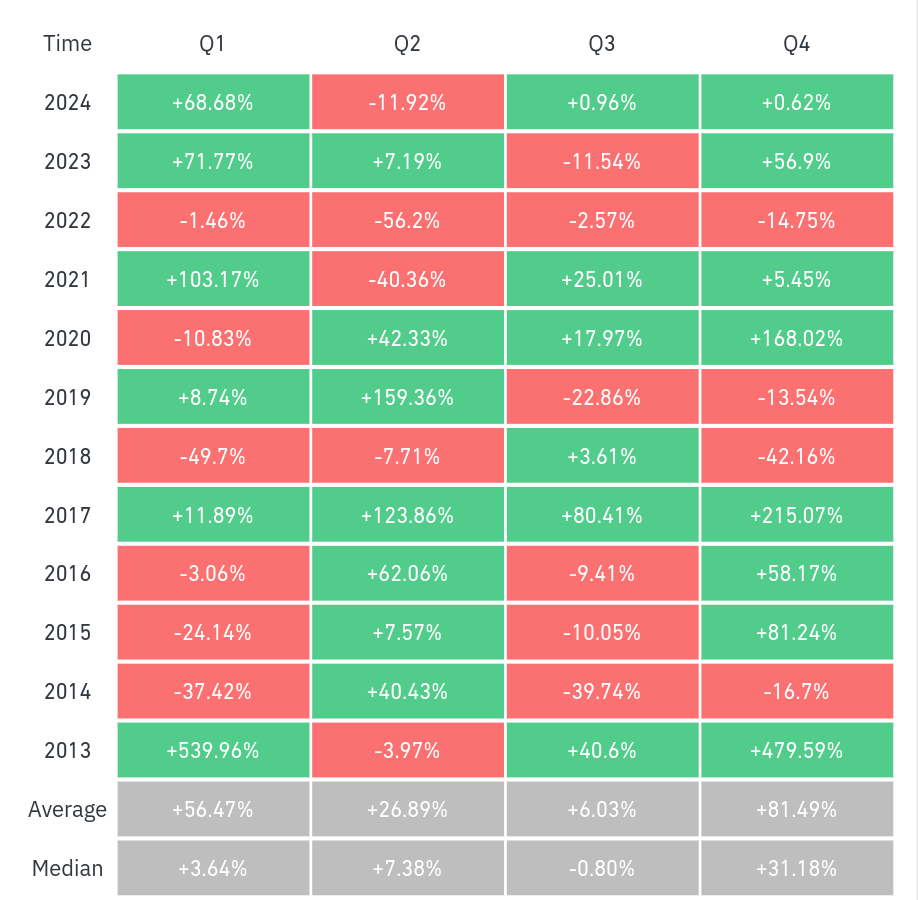

Bitcoin’s third-quarter performance might not look that impressive at just 0.96%, but its rebound from six-month lows is noteworthy.

BTC/USD quarterly returns (screenshot). Source: CoinGlass

From a quarterly perspective, BTC/USD has seen virtually no volatility regardless of volatility catalysts, thus providing an unimaginably stable store of value.

However, in the third quarter, the price of Bitcoin fell below $50,000, reaching its lowest level in six months at the time.

The BTC price crash that began in early August due to macroeconomic turmoil centered on Japan took only a few weeks to subside. The market fully offset its impact by the September monthly close.

A similar situation occurred in the U.S. stock market, where share prices even hit record highs as they returned to normal levels.

“As the third quarter came to a close, both stocks and Bitcoin have outperformed expectations, breaking out of the usual September slump,” trading team QCP Capital concluded in its latest bulletin to Telegram channel subscribers on September 30.

QCP noted that the S&P rose 5.1% in the third quarter, its best performance since the late 1990s.

“This equity-led rally could be tested as traders reassess current high valuations when third-quarter earnings are released in mid-October,” the agency acknowledged.

“We expect Bitcoin to benefit from any equity market pullback as it is a risk-on asset amid global monetary easing.”

“Uptober” is here

Looking ahead, expectations for risk assets are indeed high – based on historical precedent, the month of October, informally known as “Uptober,” should bring a big rally.

As far as Bitcoin is concerned, the average gain in October was close to 23%, Cointelegraph reported.

BTC/USD monthly return rate (screenshot). Source: CoinGlass

BTC/USD monthly return rate (screenshot). Source: CoinGlass

QCP went on to say in a separate announcement: “Similar growth would take us over 78,000, breaking a new all-time high.”

Meanwhile, skeptics need to face the more than six-month consolidation period that Bitcoin’s price has been in since hitting an all-time high in March and the block subsidy halving in April. Analysts believe that this has been long enough and history suggests it’s time for a breakout.

“BTC has been trading in the 60k-70k range for 8 months. Will October be the month we finally see a big breakout?” QCP asked.

"The market is considering this possibility, especially with the US election approaching. Spot ETF inflows continue to remain positive, and perpetual fund funding is approaching the levels of the first quarter bull market."

Institutional interest in bitcoin is becoming increasingly evident, as measured by inflows into U.S. ETFs and other products, while there are even signs that retail investors are returning to the market.

Easing, stimulating and liquid

Fueling the trend in risky assets is increasingly accommodative financial policy by central banks around the world, now including in the United States and China.

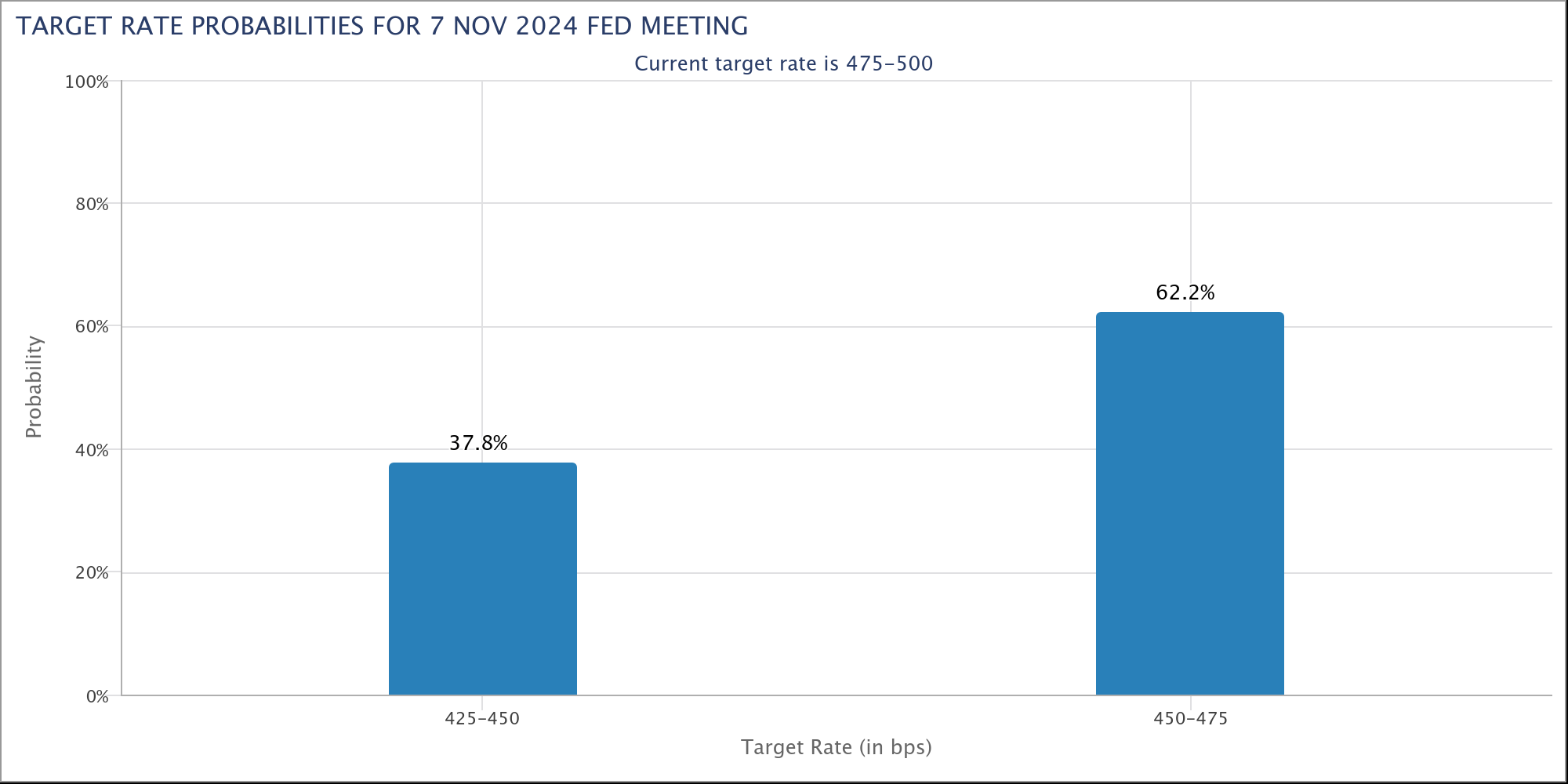

In September, the Fed unexpectedly cut interest rates by 0.5%, and according to data from the CME Group's FedWatch tool, the market is eagerly awaiting another rate cut from the Fed in November.

The probability of the Fed's target interest rate. Source: CME Group

The probability of the Fed's target interest rate. Source: CME Group

Meanwhile, China's massive stimulus package continued to boost risk appetite.

"In just a few days, China has shrugged off serious recession fears to post its biggest one-day gain in stocks since 2008," trading resource firm Kobeissi Letter wrote in response to X.

“The stimulus was so strong that brokerage firms collapsed due to excessive demand.”

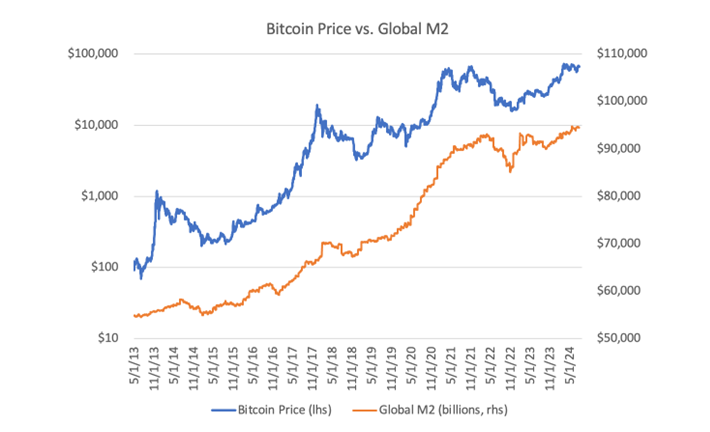

For Bitcoin, Jamie Coutts, chief crypto analyst at RealVision, believes things are not looking good.

“Global liquidity is accelerating to the upside, and the 6-month correction has removed excessive bullish sentiment and positioning, creating the necessary reset for a significant upside,” he concluded in an Oct. 1 X post.

Bitcoin has traditionally been associated with global liquidity conditions.

BTC/USD and global M2 money supply (screenshot). Source: Lyn Alden