U.S. spot Bitcoin exchange-traded funds (ETFs) experienced $242.53 million in outflows on Tuesday, the largest single-day net outflow since September 3, ending an eight-day streak of net inflows.

Table of Contents

ToggleBitcoin interrupts continuous net inflows

According to SoSoValue data, Fidelity’s FBTC spot Bitcoin ETF had the largest outflow, reaching $144.67 million. ARKB, co-launched by Ark and 21Shares, ranked second with net outflows of $84.35 million, the fund's largest outflow since August 27. Bitwise's BITB also saw a net outflow of $32.7 million, while VanEck reported a net outflow of $15.75 million. As the second largest spot Bitcoin ETF by net asset value, Grayscale’s GBTC experienced a net outflow of $5.9 million.

However, among all 12 ETFs, only BlackRock's IBIT saw net inflows, recording $40.84 million in capital.

Ethereum ETF is also bleak

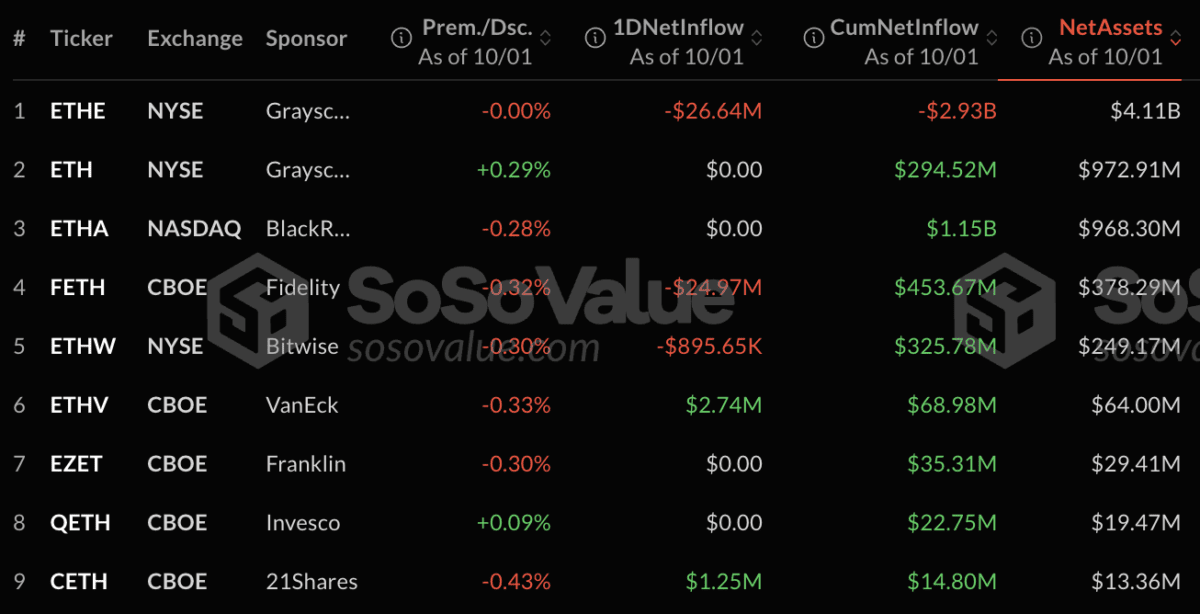

The U.S. Ethereum spot ETF recorded a net outflow of $48.52 million on Tuesday.

Grayscale's ETHE led the outflow with a net outflow of $26.64 million, while Fidelity's FETH reported an outflow of $24.97 million, marking its largest ever single-day net outflow. Bitwise’s ETHW also experienced a net outflow of $895,650.

VanEck's ETHV recorded a net inflow of US$2.74 million, and 21Shares' CETH also had a capital inflow of US$1.25 million. The remaining four spot Ethereum ETFs did not experience capital flows.