PayPal has announced the first commercial transaction using its proprietary Token PYUSD , a stablecoin pegged to the U.S. dollar, to demonstrate the convenience of using the currency for commercial payments. The Silicon Valley-based digital payments company has made an invoice payment to multinational accounting firm Ernst & Young, according to Bloomberg.

PayPal's Director of Market Development, Steve Everett, Chia :

“Business-to-business payments have a lot of room for improvement and modernization, and digital currencies can add significant value in these use cases.”

He also said the money PayPal paid to Ernst & Young was deposited into the accounting firm's Coinbase account.

To complete this transaction, PayPal used an enterprise-grade digital currency hub, however, the specific amount of the transaction was not disclosed.

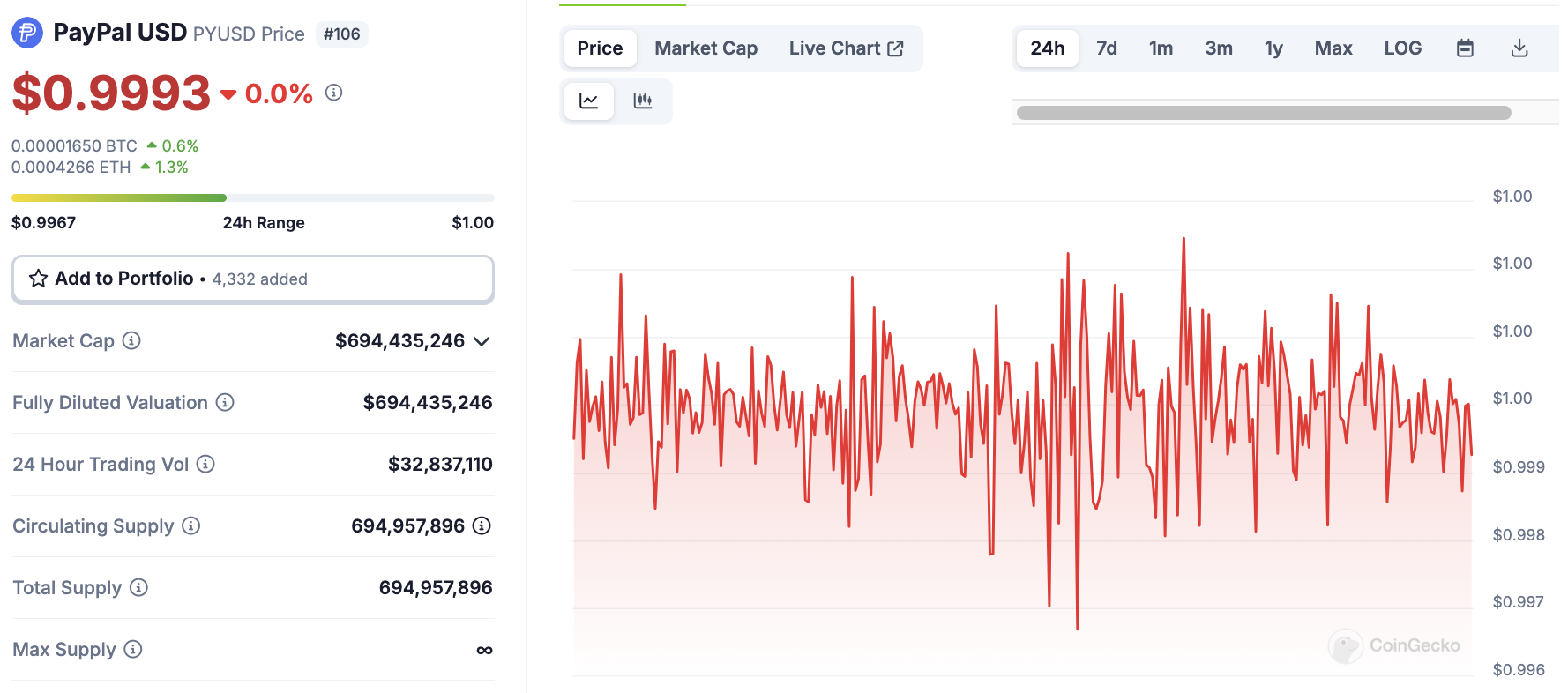

PYUSD's market Capital has dropped significantly since its launch more than a year ago. While PYUSD's market Capital surpassed $1 billion in August, it currently stands at around $694 million. Meanwhile, other stablecoins such as Tether 's USDT and Circle 's USDC still lead the market with Capital in the tens of billions of dollars.

Source: Coingecko

PayPal has been aggressively expanding its partnerships and initiatives in recent times to grow its digital asset business and promote the use of PYUSD. Last week, the company announced plans to allow U.S.-based corporate customers to buy, sell, hold, and transfer cryptocurrencies.

Everett emphasizes that requiring payment terms like “net-30” can restrict cash flow and negatively impact business operations.

“With digital currencies like stablecoins, payments can happen 24/7, funds are transferred almost instantly, and transactions are executed almost in real time.”

Join Telegram: https://t.me/tapchibitcoinvn

Follow Twitter (X): https://twitter.com/tapchibtc_io

Follow Tiktok: https://www.tiktok.com/@tapchibitcoin

Annie

According to The Block