This article will use the three tools Dune / Nansen / Arkham, taking $NEIRO as an example, to demonstrate in detail the steps we take to review profitable addresses, and the process of analyzing "smart money".

If you also want to learn on-chain data analysis and find the next "100-fold golden dog", be sure to read it.

What are the profit addresses for the capital token NEIRO (ETH)?

* Please note that there is a certain gap between the writing time of this article and the actual release time. The profit-taking results in the article now query through Dune are likely to be different from those shown in the article.

Generally, to check the profit of an ERC20 token, you can directly use Dune's existing token profit inquiry address board. There are many similar boards in Dune. Here we use https://dune.com/dannyatlas / erc20-holder-analysis, you only need to fill in the token address and execute it to get the results.

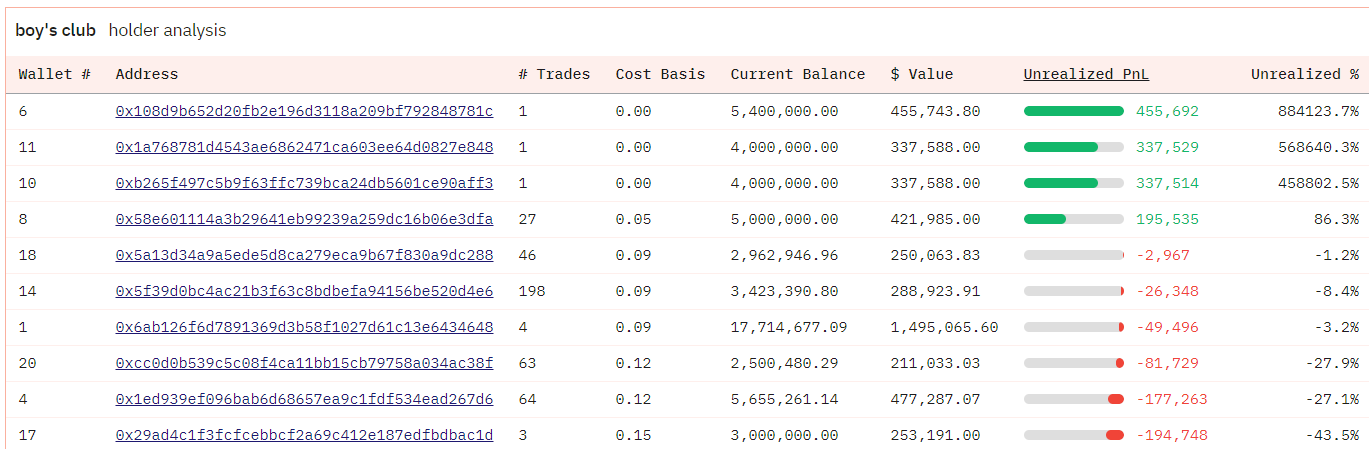

The top ten most profitable addresses of capital tokens after execution are as follows:

The top ten addresses with the largest profit multiples are as follows:

* We sort the maximum profit address and the maximum multiple address in descending order to facilitate understanding the maximum profit and the highest multiple of a token respectively. The significance of distinguishing the two is that the maximum profit is often not necessarily the maximum multiple. , because the larger an investor's position is, his rational take-profit multiple should be significantly smaller than that of investors with small positions.

Through the above two results, you can see:

- There are currently a small number of large investors in upper-case tokens that are in floating profits, most addresses are in floating losses, and the top four addresses of the two types of addresses are exactly the same;

- Except that the fourth place has a larger position, the profit multiple of 86% is relatively reasonable. The top three addresses not only won the maximum profit amount, but also achieved ultra-high multiples ranging from 450 to 880 times. There is a huge difference from the fourth place. ;

- Judging from the Trades (number of transactions) on the far left, there is only one transaction. For a MEME token, generally addresses that can reach such extremely exaggerated multiples can basically be directly judged as "insider trading."

It should be noted here that since most of the possible "insider trading addresses" have completely taken profits, the three addresses that appear in the table do not represent the largest "insider trading addresses", but only represent the unstoppable ones at the time of writing. Ying's address.

Next, we use Nansen/Arkham to dig deeper into these three addresses to see what else is found.

Profitable address analysis of capital token NEIRO (ETH): Address 1

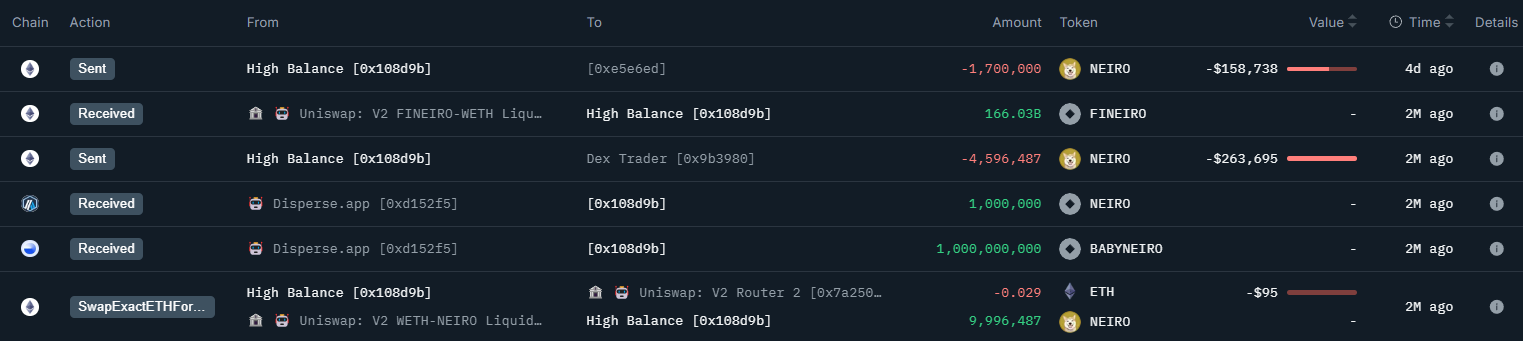

0x108d9b652d20fb2e196d3118a209bf792848781c (suspected Wintermute sub-wallet)

Dune shows that the address made a profit of US$450,000, exceeding 880 times the profit. This data is for reference only. Nansen shows that due to its high trading frequency, it is impossible to calculate the exact profit data.

At the beginning of the release of capital tokens, this address spent only $95 in exchange for nearly 10 million tokens and transferred them to

0x9b3980716cb055bf0a2a05b3bc723d6806e1bf4d (address a)

0xe5e6ed8184ebdc2c0d1b23db4c943f006de83fb0 (address b)

addressa

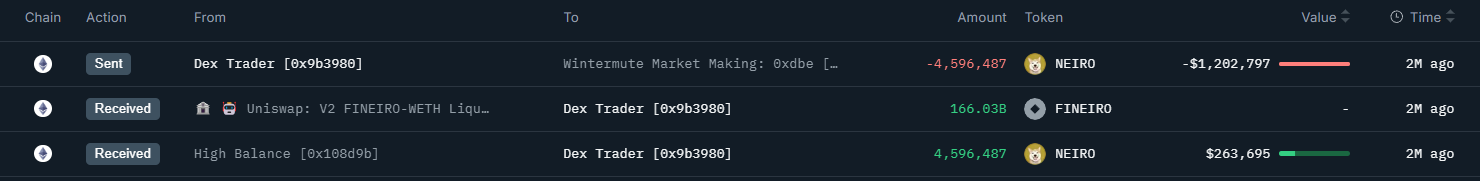

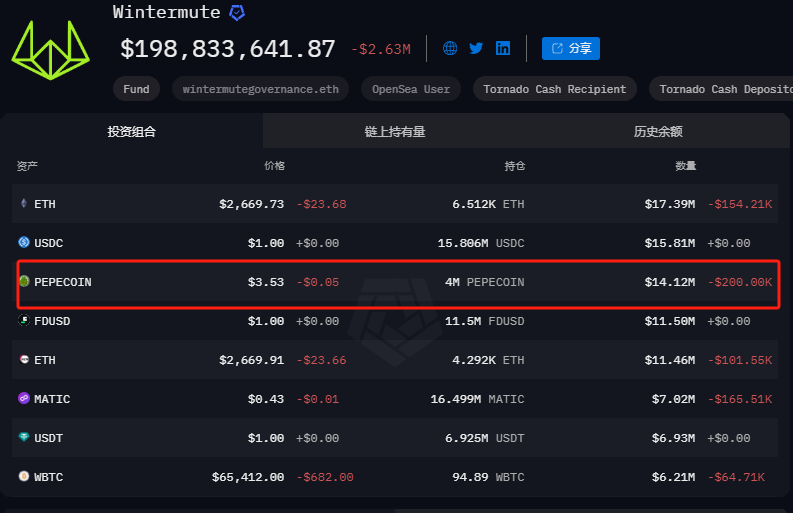

According to the records, we found that this was a sub-address under the market maker Wintermute. On August 7, 1.2 million U.S. dollars of capital tokens were directly transferred to the Wtinermute market-making address. The latter received a total of 15 million capital tokens from three different addresses. coins, and then transferred to another market-making address: 0xdbf5e9c5206d0db70a90108bf936da60221dc080

The last address is its direct trading address, which carries out a large number of transfer and receive operations.

Superimposed on its various behaviors of continuously increasing positions in capital tokens, we reasonably speculate that Wintermute may be one of the "cabal" behind capital tokens.

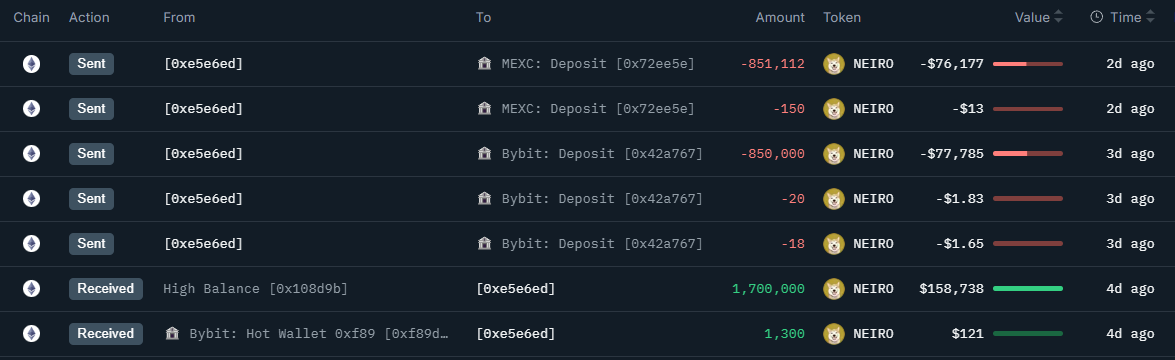

- Address b

The positions of address b are much smaller than those of address a. According to historical records, it is an address that was established recently. The operation is to transfer the tokens to Bybit and MEXC exchanges respectively after receiving them.

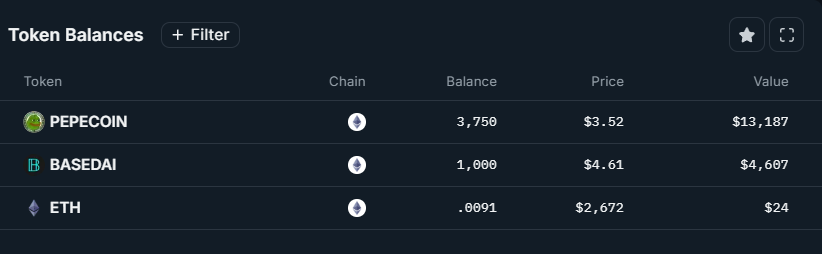

We can find PEPE and BasedAI from other holdings of this address, and by looking at the total holdings of Wintermute through Arkham, we can also find that PEPE and BasedAI are two important tokens. From this, we can infer that this address is also a sub-wallet of Wintermute.

Profitable address analysis of capital token NEIRO (ETH): Address 2

0x1a768781d4543ae6862471ca603ee64d0827e848

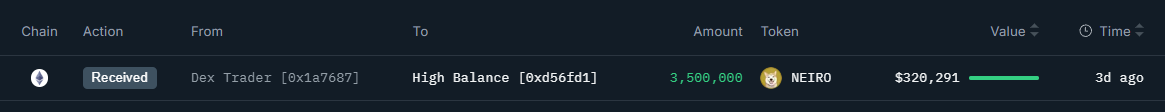

This address also bought capital tokens worth $131 at the beginning of the release, and then transferred them out in two tranches before February and recently. We use address c and address d as replacements.

Address c: 0xd56fd17fcc0b9d346d6b1bd011dd1d93c67b497b

Address c has never sold since it was received and has no other open positions.

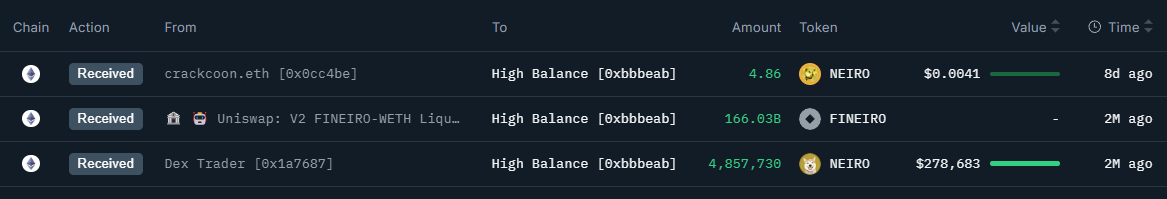

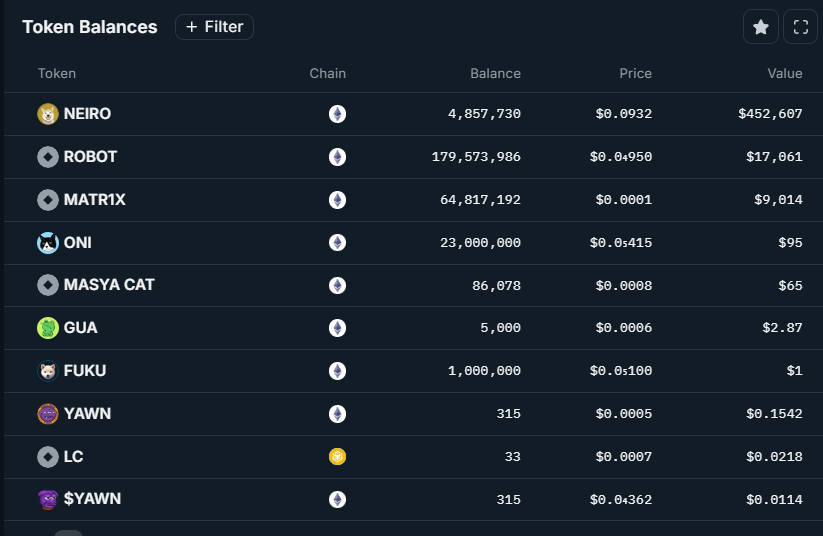

Address d: 0xbbbeab557377314cfa82c6467e51bd0c53462faf

Likewise, address d did not sell any uppercase tokens.

It owns many unknown MEME coins, but the overall position value is far less than NEIRO itself.

In addition, address d has recently received 4 uppercase tokens transferred from crackoon.eth (0x0cc4bed1190019cb4be95e81fd4c4fc7cee600a4). Following the clues, we found that crackoon.eth recently bought 10 US dollars of tokens, which were distributed to many addresses in large quantities. , its purpose is presumably to test large-scale transfers in the future.

The First Funder of crackoon.eth also comes from the well-known dark pool project Railgun address, further supporting the conjecture mentioned above. However, due to the strong privacy of the dark pool itself, we are unable to further dig out the real transaction subjects behind it, and the overall mining work of address 2 can only come to an end temporarily.

Profitable address analysis of capital token NEIRO (ETH): Address 3

0xb265f497c5b9f63ffc739bca24db5601ce90aff3

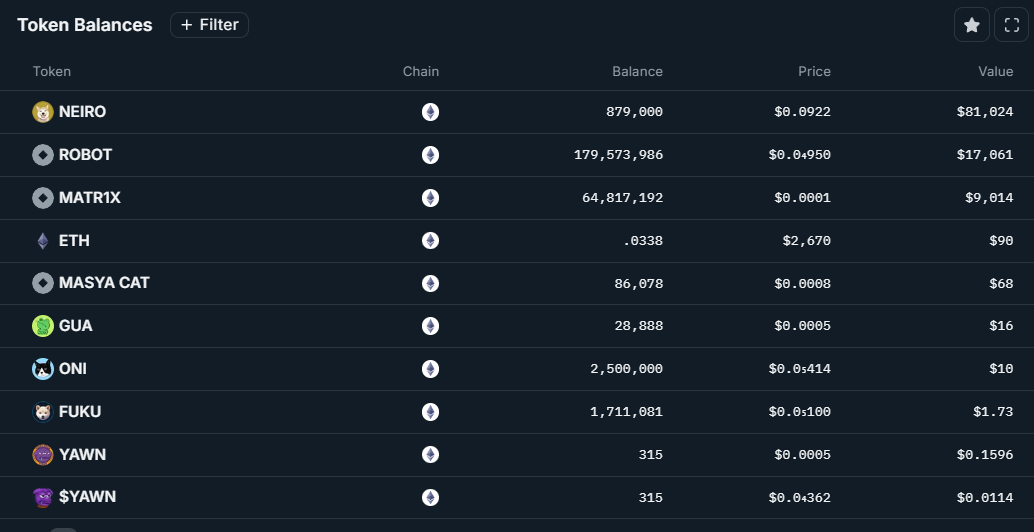

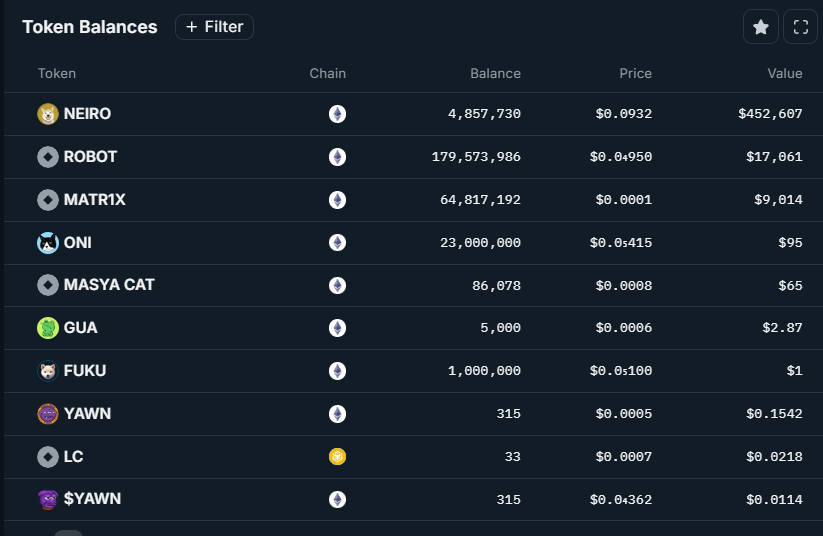

Coincidentally, the positions of address 3 and address d are almost exactly the same:

The address d is posted here again: 0xbbbeab557377314cfa82c6467e51bd0c53462faf

This completely shows that the same group of people are behind Address 2 and Address 3.

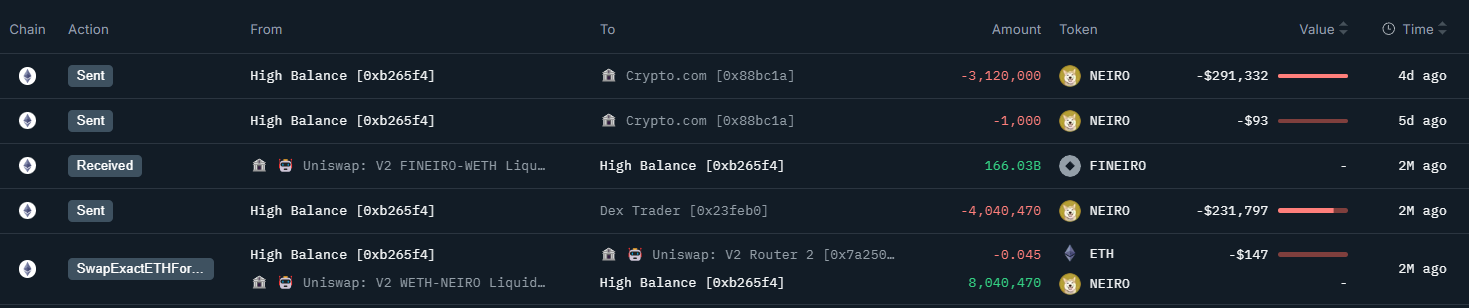

According to address 3 records, it transferred the tokens to 0x23feb0f143990a9b3aa327ba516ce432b6dfafa1 (address e), and the Crypto.com exchange for shipment.

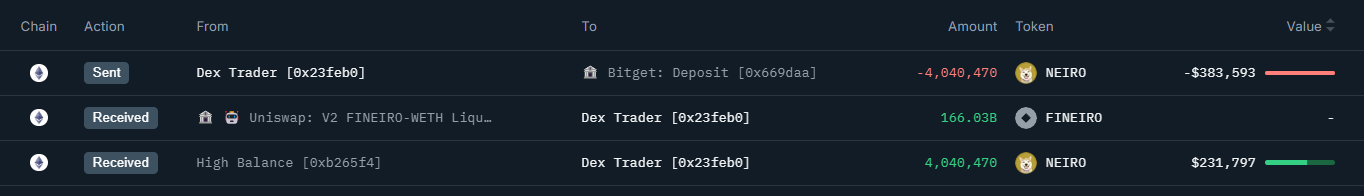

Address e: 0x23feb0f143990a9b3aa327ba516ce432b6dfafa1

Address e directly switched to Bitget for shipment, and the direct profit was US$380,000, which is quite considerable.

Analysis summary of profit addresses of capital token NEIRO (ETH)

Therefore, through the analysis of the three most profitable addresses, we found out that Wintermute and another force (the same person behind address 2 and address 3) are members of the "cabal" with the capital NEIRO.

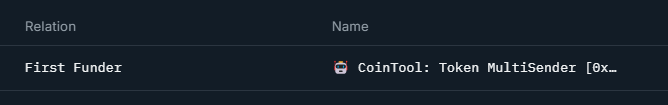

Through further analysis by Nansen, it can be found that there is actually a connection between these three addresses: they are tokens distributed by the same CoinTool currency splitter, and the address is: 0xcec8f07014d889442d7cf3b477b8f72f8179ea09.

According to the wallet creation record, behind the coin splitter and behind addresses 2 and 3 are directly linked to a final binance account address: 0x3f5ce5fbfe3e9af3971dd833d26ba9b5c936f0be.

This address can be used as an address for our follow-up monitoring. Most of its holdings are tokens that are relatively unfamiliar to us. Based on the holding shares, it can be roughly inferred that these tokens may also be owned by this address, so as to further look for trading opportunities for these tokens. .

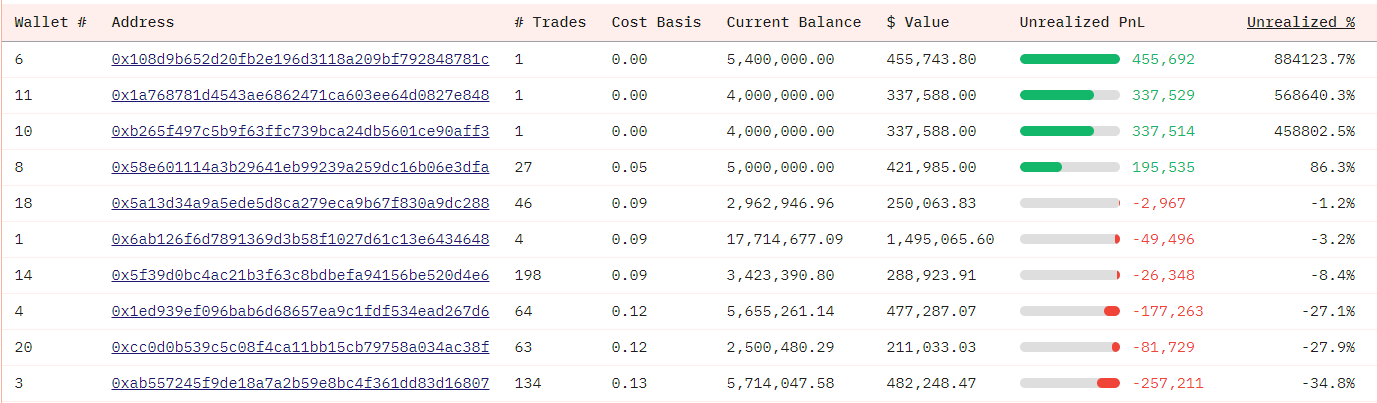

What profit addresses are there for the lowercase token NEIRO (CTO)?

Also use Dune's dashboard to find the profit-making address of the lowercase token.

Lowercase token contract address: 0x812ba41e071c7b7fa4ebcfb62df5f45f6fa853ee

Among them, the top ten most profitable addresses are as follows:

The top ten addresses with the largest profit multiples are as follows:

Based on the first purchase time, it can be clearly found that many addresses purchased the token at the same time when it was issued. It can be concluded that there is the same "insider trading" problem as the capital token.

Let’s analyze the top addresses with the largest profit and the largest multiple address respectively.

Analysis of profit addresses of lowercase token NEIRO (CTO): the person who makes the most money

Basic situation

Address: 0x794e31c25fb4655056be42bbe10f02d342b7d868

Position value: $3.18 million

PNL: $3.15 million

PNL%:11686%

operate

On July 27, a large number of lowercase tokens were bought when they were released, and a MEV Bot was used to purchase.

During the process, I received a transfer from the Disperse.app address 0xd152f549545093347a162dce210e7293f1452150. The latter is a common tool for airdrops, reward distribution and other scenarios.

In the first two months, tokens were mainly added to positions in the early stage, but since last month, tokens have been transferred out one after another. Two transfers are likely to be shipments:

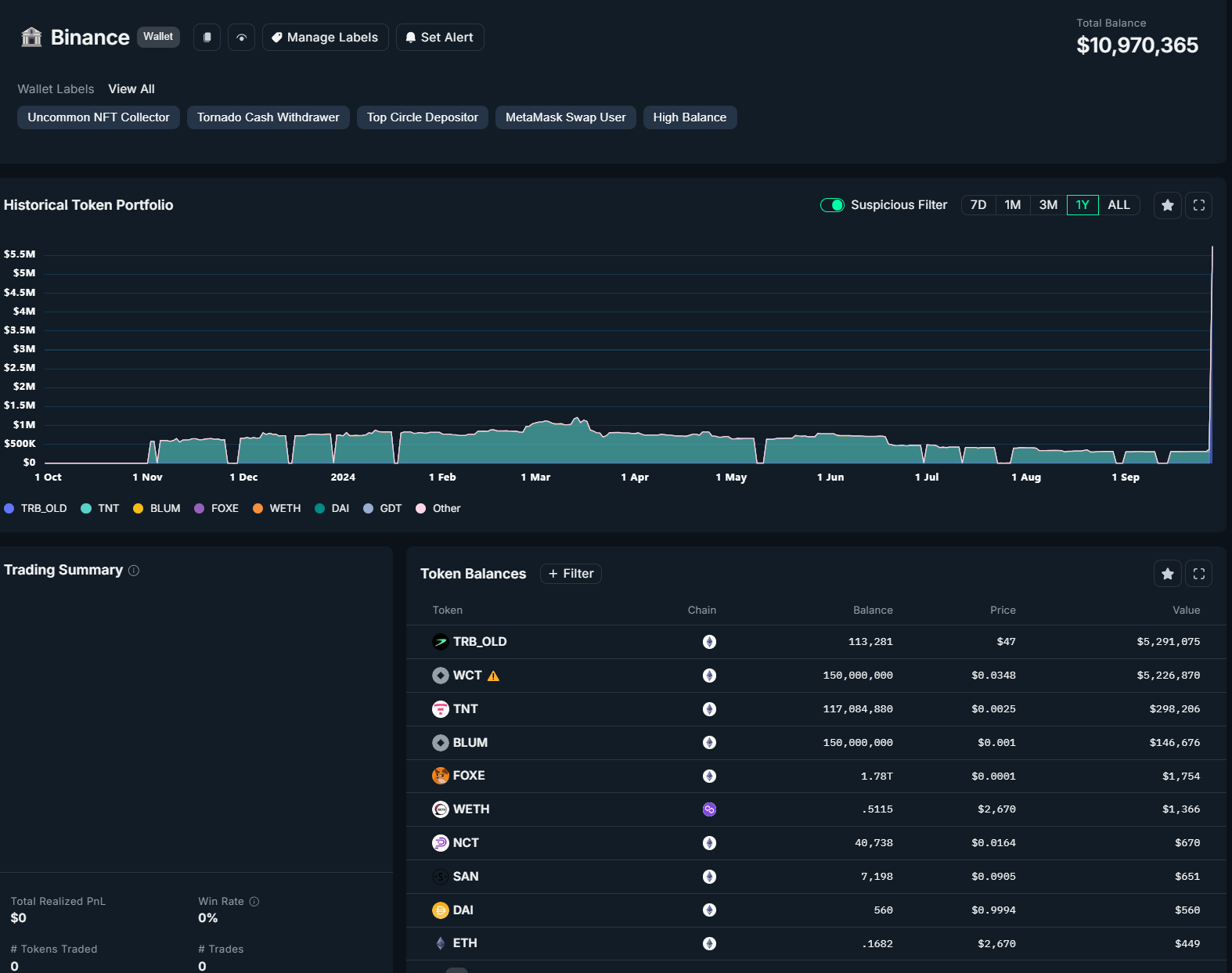

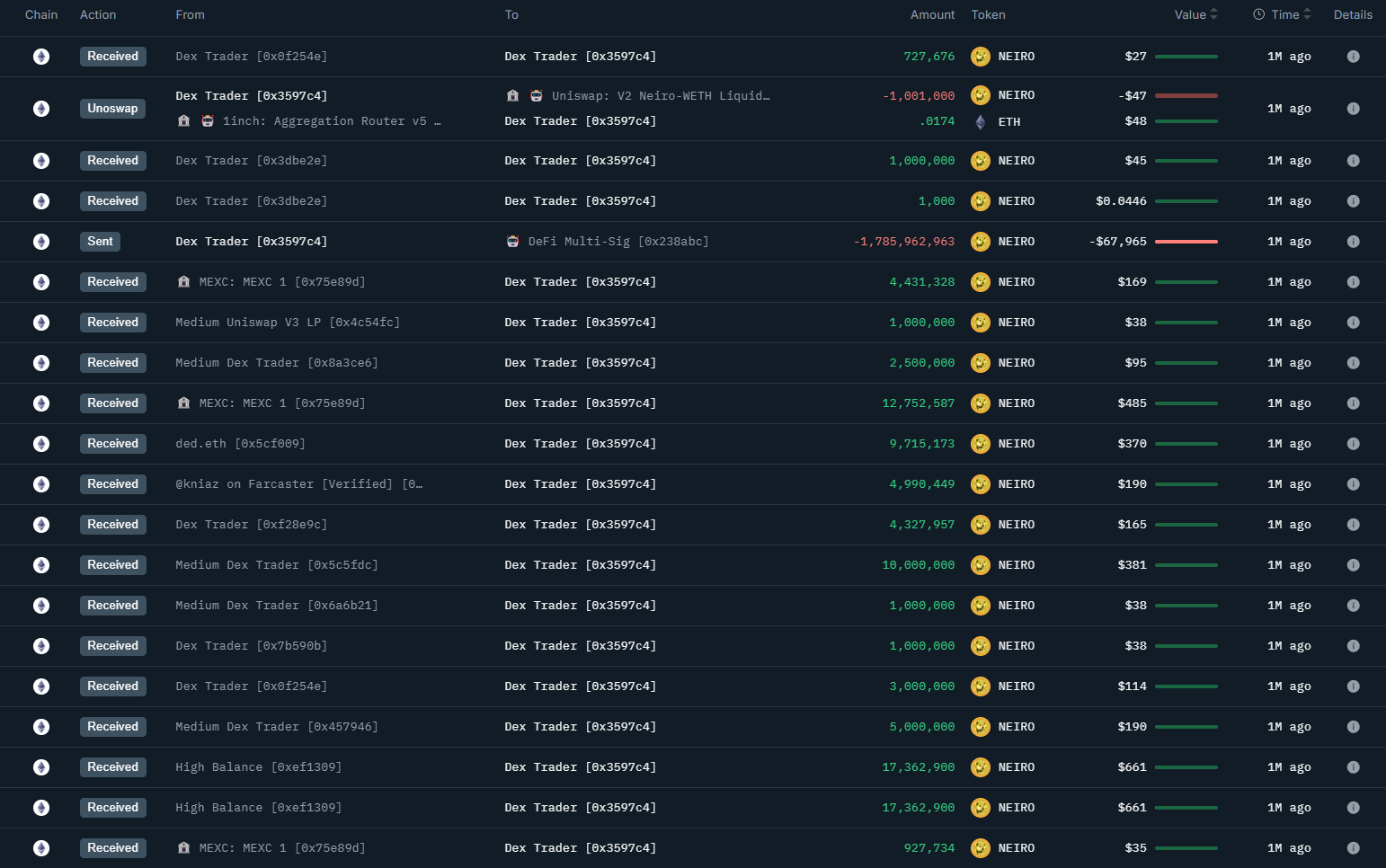

Transfer address 1: 0x3597c4ecbc988c6c4ed40a1be487149a7e6e6fda

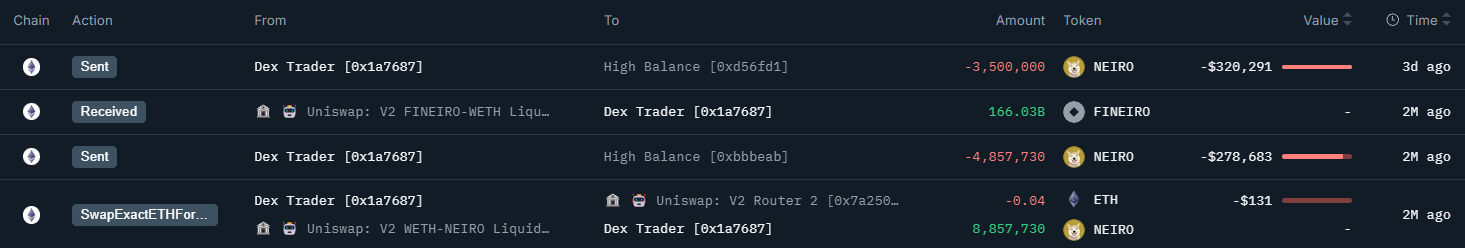

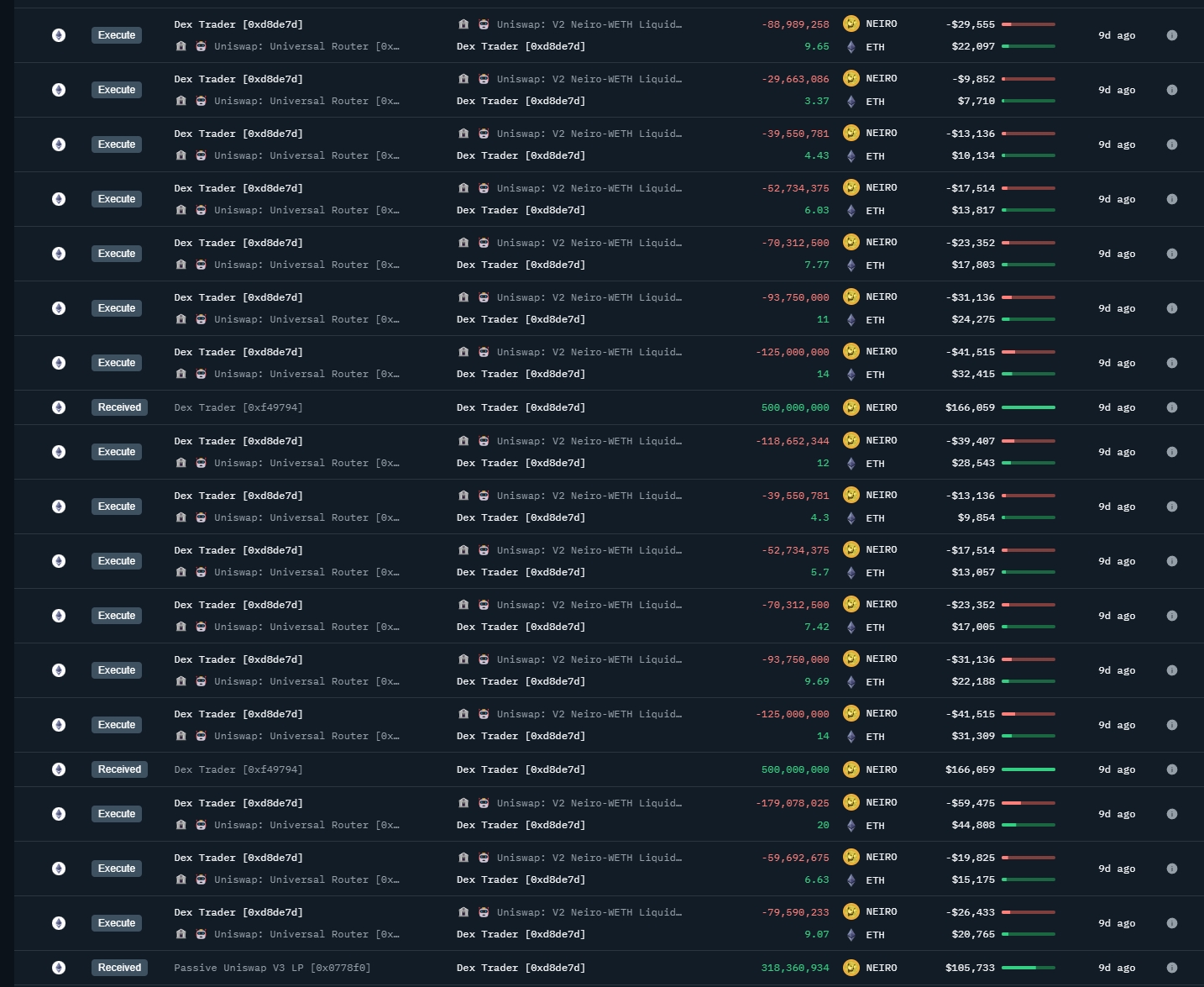

The original address sent 1.7 billion NEIRO to the address labeled Dex Trader on July 31. The latter's records showed that tokens were received from many addresses and exchanges and transferred to the same multi-signature address as the original address.

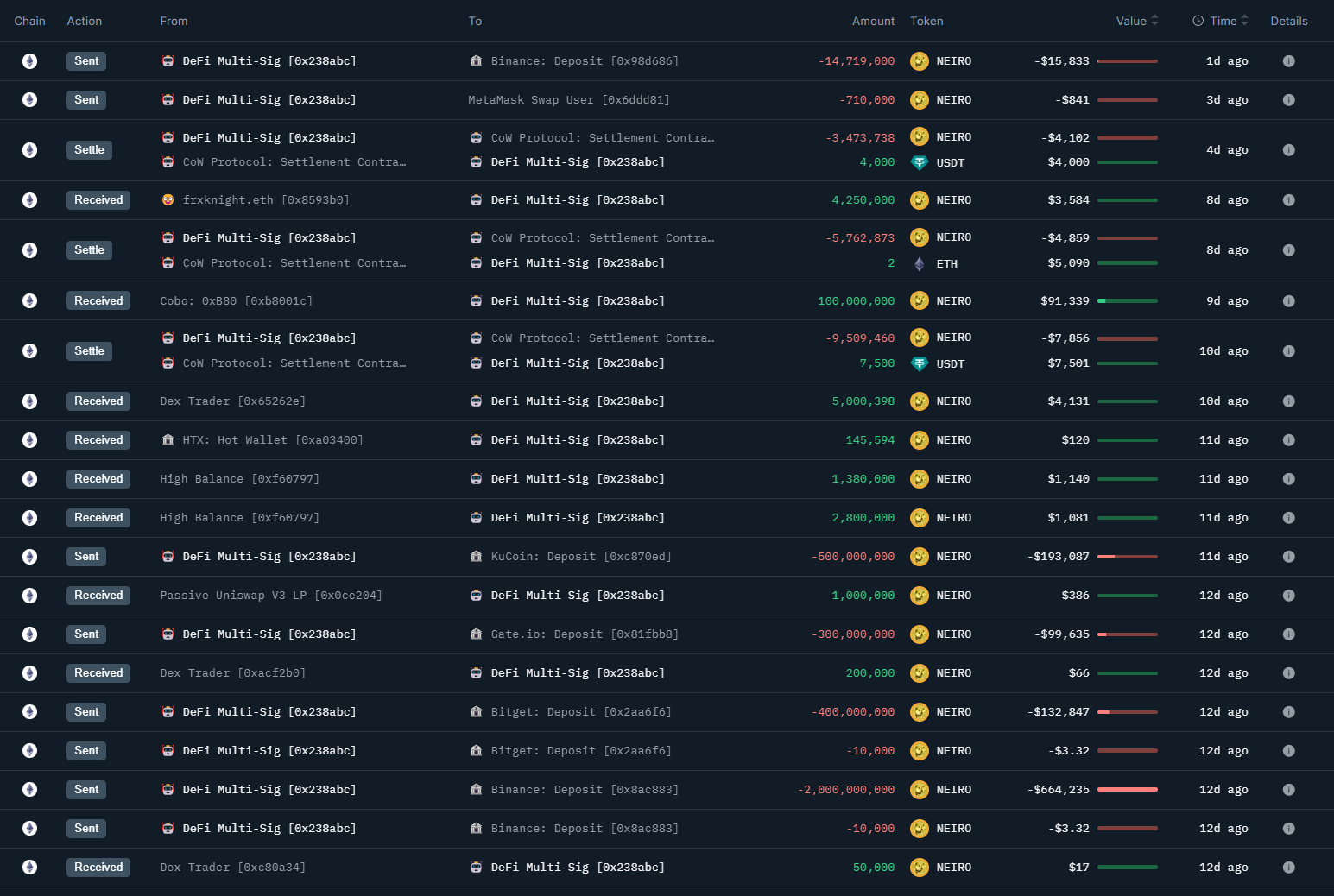

This multi-signature address obtained lowercase tokens from 14 different addresses, and its operations are basically direct shipments:

Another transfer out is also worthy of our attention.

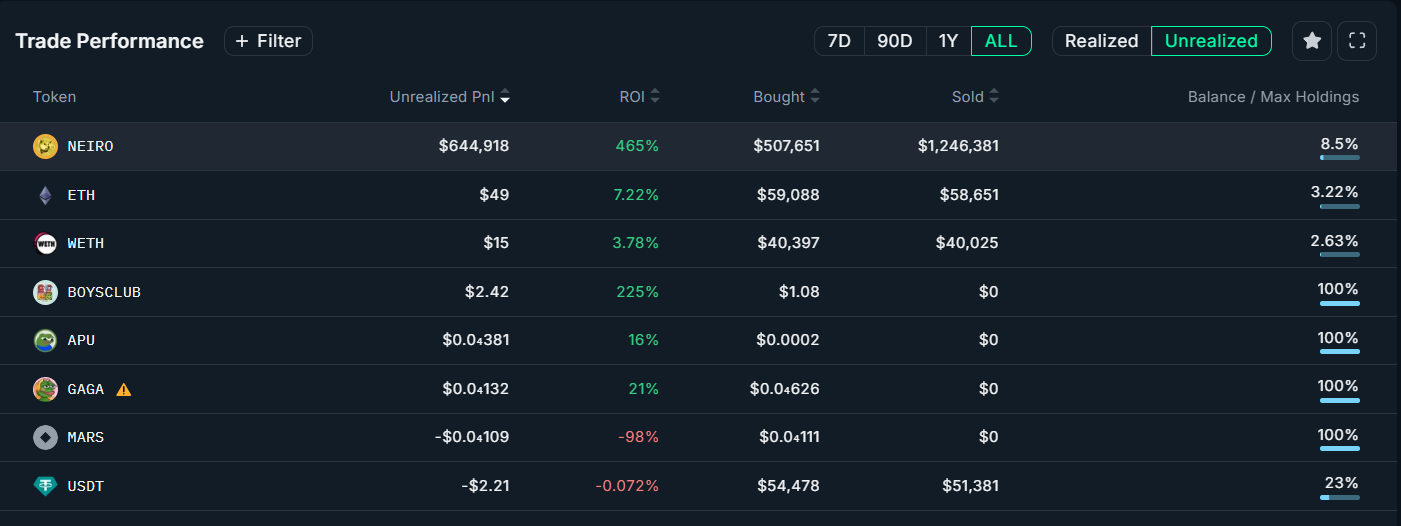

Transfer address 2: 0x238abc9f9a567802e5d2b07cc2d09dca83f59fe9

The original address transferred $300,000 worth of tokens to the wallet after it was listed on Binance on August 23, and records show that the NEIRO received by the address came from multiple wallets, and eventually flowed to Binance or KuCoin. Approximately $1.24 million of NEIRO was sold.

Profit address analysis of lowercase token NEIRO (CTO): the person with the largest profit multiple

Basic situation

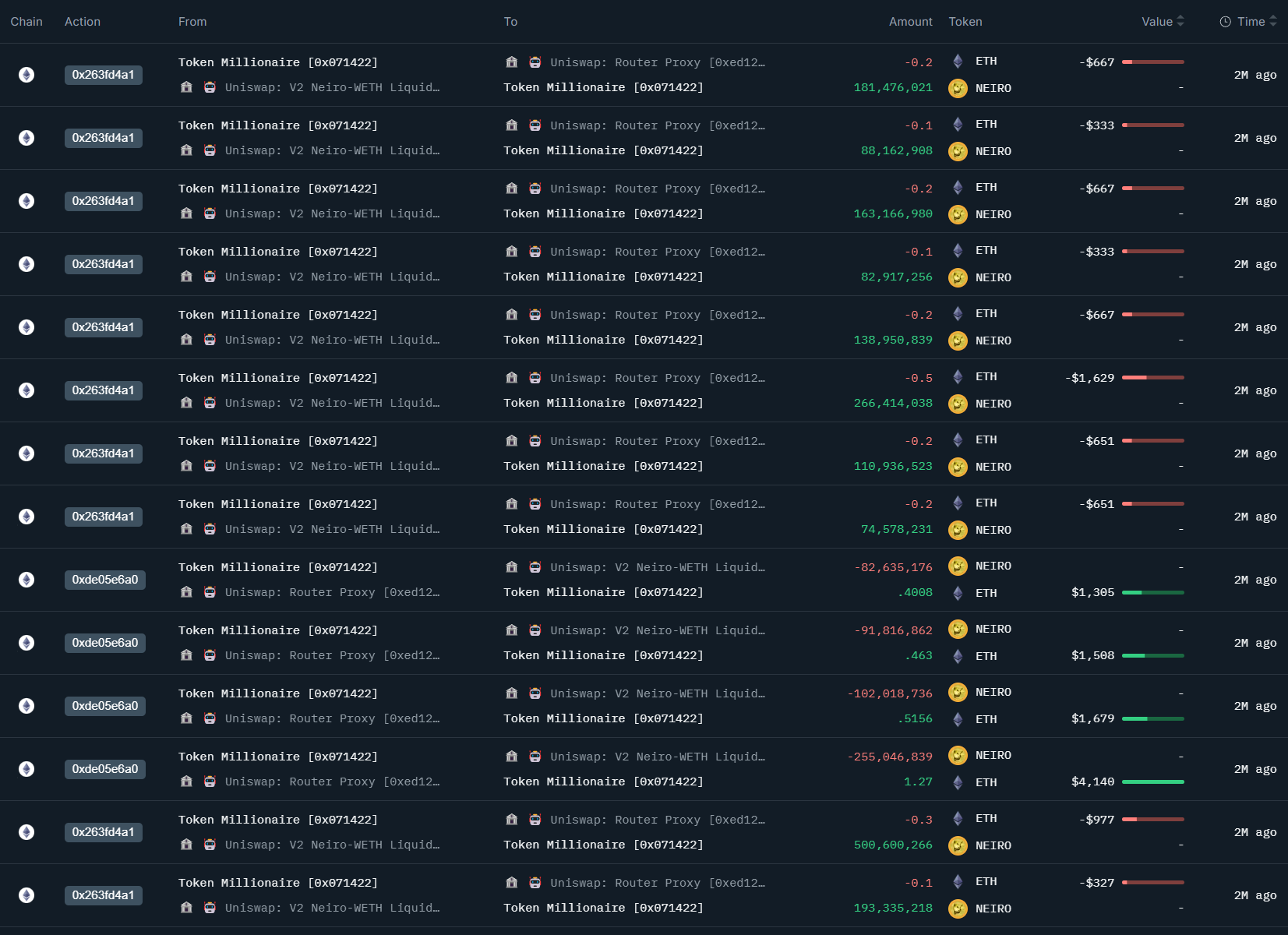

Address: 0x0714225f3e9f051ff8f4d2951dc1ca028c221dca

Position value: $1.69 million

PNL: $1.68 million

PNL%:24426%

operate

From July 28th to August 1st, positions were opened in batches with small amounts (several thousand dollars), and then shipped in large quantities, and then used the earned ETH to reinvest.

On August 4, 900 million NEIRO were invested into the LP pool of UNI V3, and 1 billion tokens were transferred to 0xf4979415def634142815671a3fde8ae3c84fa792.

Then, 0xf497 transferred the 1 billion tokens to the third address: 0xd8de7db6b2a89e80f2f96abc0214f64b4614f013. On the day of listing on Binance on September 16, he withdrew 300 million tokens from LP, including the 1 billion previously transferred, for a total of 13 All 100 million NEIROs were sold.

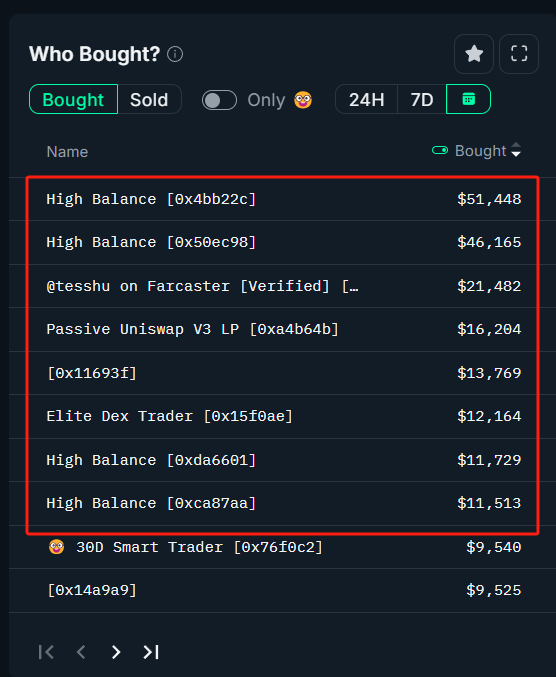

For lower case, in addition to the two representative addresses mentioned in the previous article, we also need to pay additional attention to the address that bought the most on September 15th, that is, trying to find out who was buying a lot the day before the Binance Spot was launched, so as to infer whether it was insider trading.

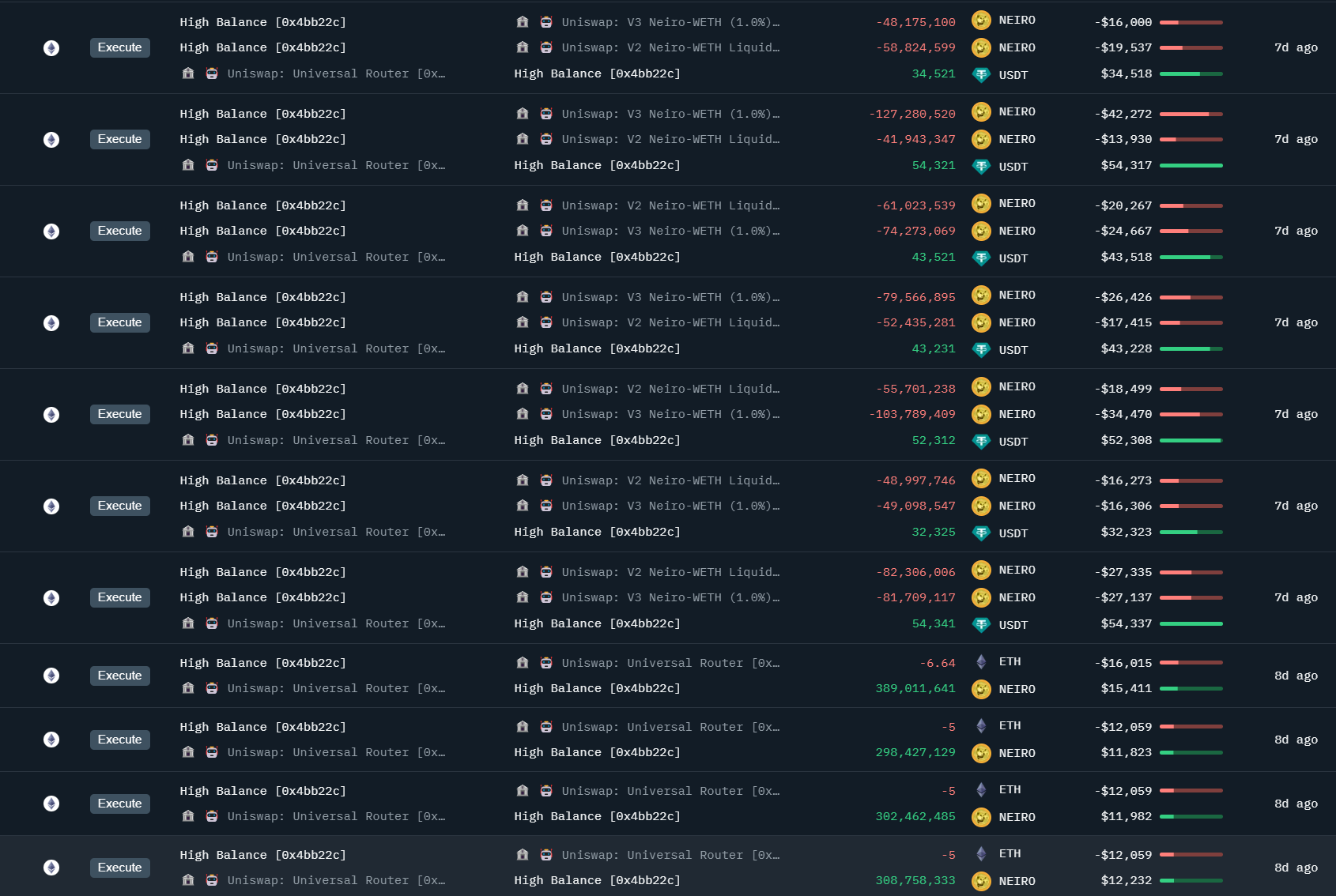

Filter the date directly through Nansen and select September 15th to get the following results:

There are 8 addresses that have traded more than 10,000 US dollars. Let's continue to take the first one as an example to observe how this address operates.

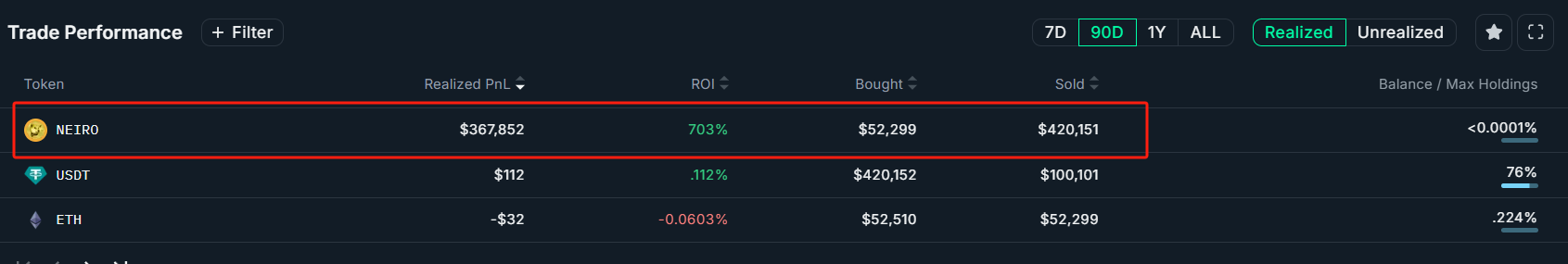

Basic situation

Address: 0x4bb22cbc4b177880a9f7d0677c61b4693d66a585

Position value: Cleared

PNL: $420,000

PNL%:703%

operate

On September 15, 22 ETH were transferred from a Bybit hot wallet (not the main wallet) and $50,000 in lowercase tokens were purchased on UniSwap.

On September 16, Binance launched lowercase NEIRO (CTO), and sold all of them in exchange for USDT.

These USDT were transferred in large quantities to several other unknown addresses. (It is suspected to be a packaging for some privacy operations, and the source cannot be traced for the time being.)

Based on its operation, we speculate that the address is suspected to be an insider trader who knew the listing in advance and therefore made a lot of profits. You can pay attention to whether there are any subsequent operations on this address.

Summary of uppercase and lowercase NEIRO address analysis

$NEIRO is a token that has been highly discussed and controversial this year. The dispute between upper and lower case also brings a lot of wealth effects. But behind this, we found that a large number of "insider trading" addresses profited from it, or it may even be said that most of the token profits were earned by these addresses.

This type of project is extremely risky, so you need to take profit and stop losses before participating, and be sure to pay attention to various risks.

On the bright side, at least these two tokens have brought new hype narratives to the MEME market. They are more popular and may have opportunities in the future, but more time is needed to test them.