Author:Simon de la Rouviere

Compiled by: TechFlow

The reason I consider myself a socialist in a sense is that I want more people in society to have more wealth. This is not just about the welfare state supporting public services through taxation, but is closer to the classic meaning of socialism: having more people directly own the "means of production". When more people own capital, capitalism can function at its best.

In the cryptocurrency field, since the emergence of Dogecoin in 2013, internet Memes have gradually become an important part of the market. With the improvement of blockchain scalability and user experience, issuing any token has become unprecedented simple, and this trend has resurfaced since 2021, with a market value exceeding $50 billion.

For some, cryptocurrencies themselves are difficult to understand, let alone Memecoins. From an external perspective, this seems to be a zero-sum game, full of scams promising high returns, ultimately just extracting money from investors. While this situation does exist, some people also enjoy participating in this financial confrontation. If you delve into the reasons behind it, you may find that the lessons contained therein can provide insights for improving the modern economic system. Sometimes, solutions need to be sought from a unique perspective.

Community atmosphere. Memecoins are not just an investment, but more of an entertainment, full of fun and excitement. By purchasing Memecoins, people can easily integrate into a social community.

Improved fairness. Over time, the opportunities for wealth creation have become more equitable. Although this community atmosphere may not appeal to everyone (after all, trading animal derivatives or political Memecoins similar to 4chan do not have widespread appeal), the fairness aspect reveals some problems in the current structure of wealth creation. Many successful Memecoins are considered "fair" at the time of issuance, meaning they avoid the situation of a few people getting rich, often without a centralized leader, and the rules are enforced through transparent and verifiable smart contracts. Therefore, the risk of investors being "harvested" is relatively low.

Therefore, the appeal of Memecoins lies in the fact that they treat wealth creation as an entertainment product, providing fair and convenient opportunities for participation. If the issuance of Memecoins is fair (without a specific group in control), and is subject to minimal regulatory restrictions, this means that anyone can participate, regardless of their location or identity. Once involved, the opportunities are equal, whether you are a wealthy fashion designer in Manhattan or a self-sufficient farmer in the Philippines.

However, the reality is that most forms of wealth creation are now only open to the rich, with increasingly high barriers to entry. For example, it has become difficult to obtain liquidity, certain rules favor the rich, and the public's opportunities to enter the market are also decreasing.

The problem of liquidity

Not everyone can enjoy sufficient liquidity. For example, starting a tech company in South Africa is much more difficult than in the United States, because the US has more capital willing to invest in new ideas. Entrepreneurship itself is not easy, and the increasing compliance requirements make it even more difficult.

The problem of accessing opportunities

Even in the US, you may be excluded from some investment opportunities due to lack of funds. In some cases, companies only allow accredited investors to participate when selling securities. For example, under Rule 506c of the Securities Act, if you want to publicly advertise a private investment, only accredited investors can participate. If you don't have enough financial resources, you're out of luck. Essentially, this regulation excludes some people, even though it is considered necessary to maintain an "orderly market".

Investing in the public market

Assuming you cannot become an accredited investor, what avenues do you have to participate in wealth creation investments? In the US, apart from a few private investment opportunities, the main choice is the public market, such as directly holding stocks, ETFs, and bonds. Although companies may achieve significant returns after going public, most of the significant gains are actually realized before the IPO.

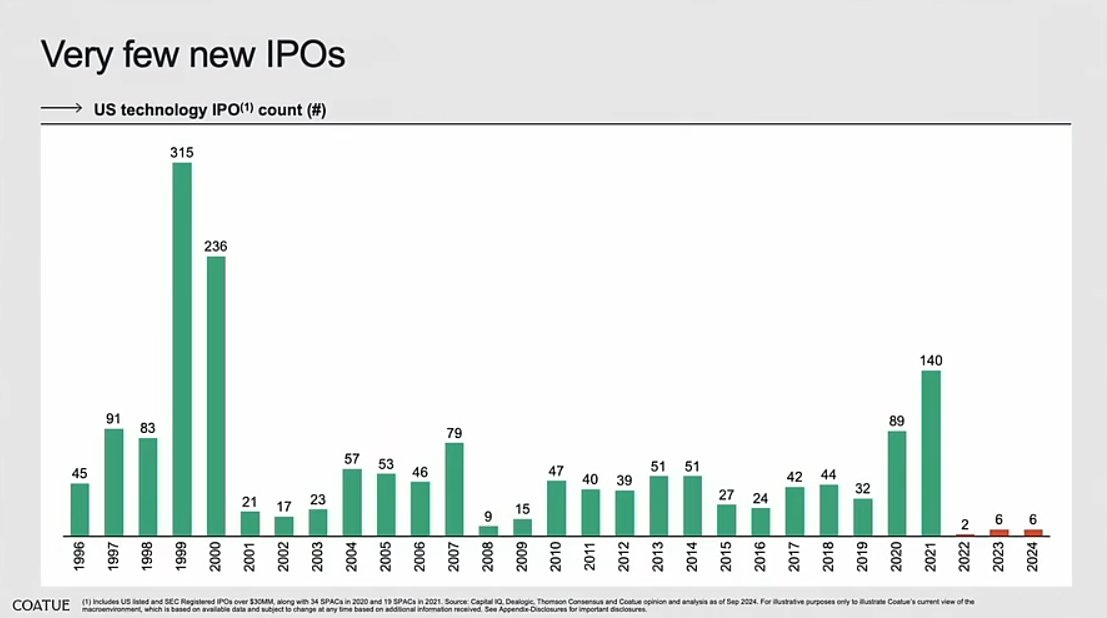

However, if you want to invest in the US public market, the cost of an IPO is quite high, and the enthusiasm for IPOs has waned since 2022. In 2019 alone, the average legal and accounting fees exceeded $2 million. In the US, the number of IPOs has been decreasing.

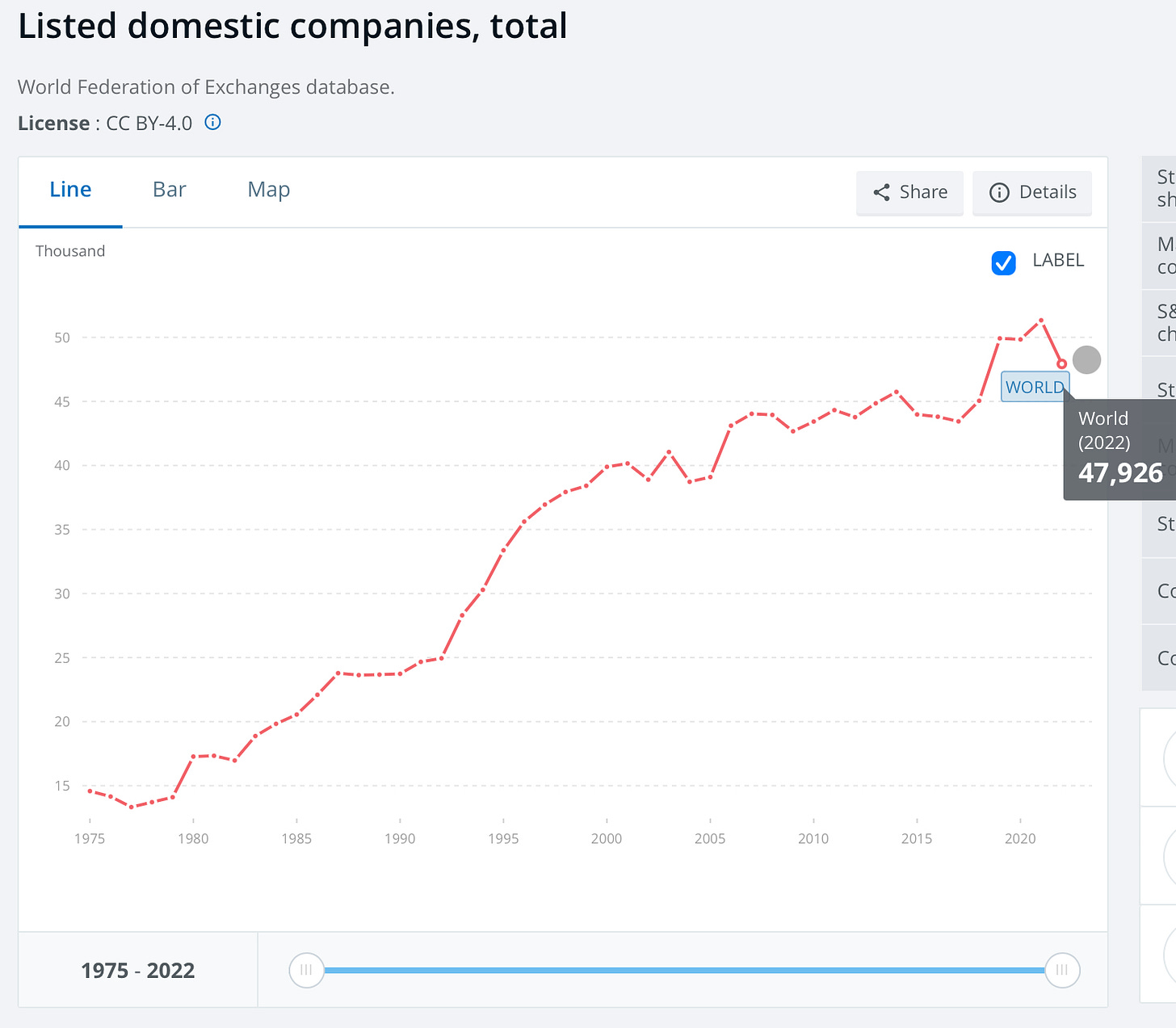

Looking at the total number of publicly listed companies globally, the situation does not seem very optimistic either. I tried to obtain global data, but in the World Bank data, there was an abnormal peak in China's data, which I could not verify the source of. So the unverified global data is roughly as follows:

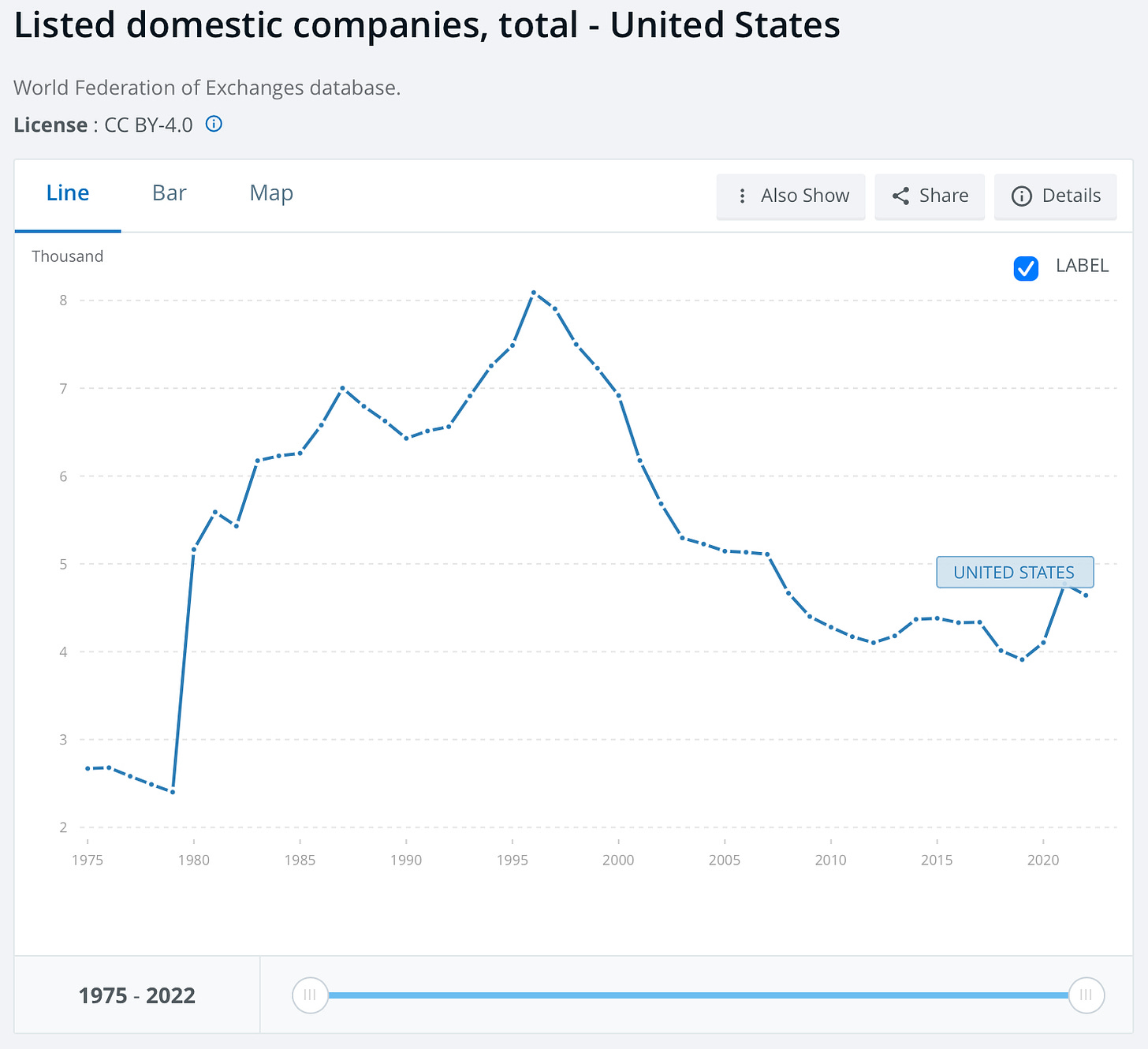

But more specifically, the situation in the US looks like this:

Globally, as other regions industrialize, the per capita investment opportunities in some places have increased, but in developed countries like the US, this growth has stagnated. Will this trend continue as more countries catch up with industrialization, or will it become the norm?

So, how should we respond?

Faced with these dilemmas, many may be inclined to choose to relax regulations, but this requires weighing the pros and cons. The original intention of financial regulation is to ensure the orderly operation of the market, protect investors, and maintain a relatively healthy investment environment. While increasing compliance layers can indeed reduce risk, it also means that capital may flow to places where investors feel more secure, even if this excludes many from these investment opportunities.

Comprehensive deregulation may help increase ownership in some ways, but it could also undermine many well-intentioned efforts to create wealth.

Therefore, the solution may not be simply to relax regulations, but to rethink how to effectively protect investors in modern society. Many existing protection measures were designed before the internet era, such as the problem of bearer stock certificate fraud. So, if we want to provide reasonable protection without adding too many obstacles, how should modern society achieve this goal?

One area to focus on is Memecoins. The successful Memecoins in the financial game show that we can reconsider how to access wealth creation opportunities earlier and ensure reasonable investor protection by setting up safeguards at different stages. This means:

Protect investors not by exclusion, but by providing certainty through innovative means.

Ensure transparency does not rely on expensive, extensive administrative compliance and documentation requirements, but on code that prevents misconduct.

Maintain market order through a systemic perspective, rather than just focusing on individual impacts.

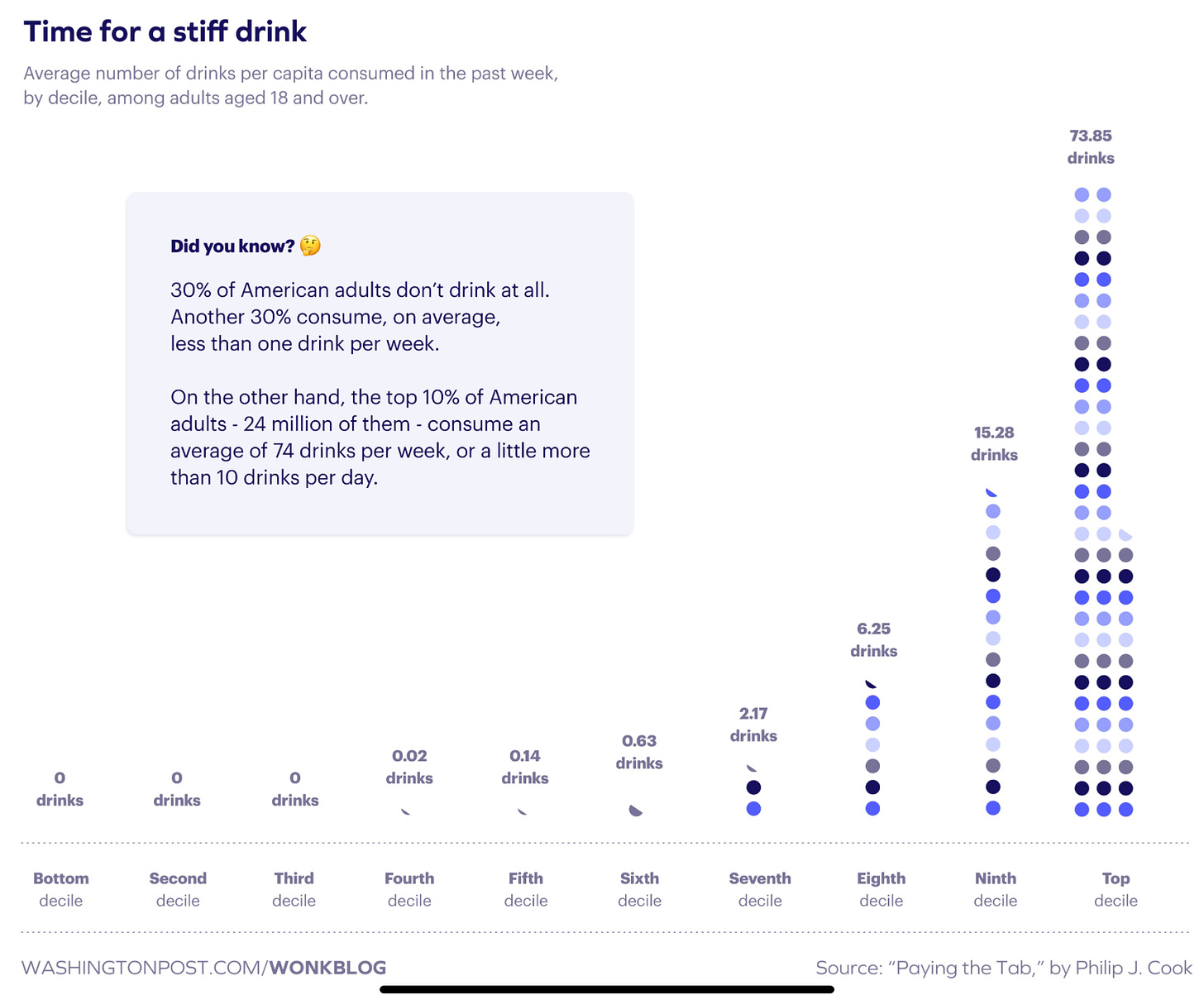

If the top tenth of individual freedom leads to systemic negative impacts, society may view it differently. The alcohol problem is a typical example, although it leads to drunk driving accidents, abuse, and intolerable public disorder, it is still tolerated by society. In the case of gun control, however, despite the fact that most gun owners may be responsible, it is not as tolerant due to the tragic nature of mass and indiscriminate gun violence.

Therefore, some freedoms that may seem harmless at the individual level can evolve into complex social problems. From this perspective, financial regulation of certain individuals is not only to ensure market order, but also to reduce excessive financial transaction activities in daily life. I understand this and why some societies tend to take such measures.

Therefore, whether we want to live in a more financialized world is a different question from how we ensure the accessibility of the current world. If you agree that we should increase opportunities for wealth creation and accept the trade-offs that come with it, then we can draw lessons from Memecoins without having to fully deregulate.

Funds and liquidity flow into Memecoins, partly because the rules of the traditional financial system were established before the internet and cryptocurrencies emerged. These rules were intended to provide an orderly market and investor protection for the past era, but in reality, they have exacerbated inequality. If we can update these rules to 21st century standards, hopefully, we can reduce this class gap. This way, more people can participate in the "production of Memes".

If the top tenth of individual freedom leads to systemic negative impacts, society may view it differently. The alcohol problem is a typical example, although it leads to drunk driving accidents, abuse, and intolerable public disorder, it is still tolerated by society. In the case of gun control, however, despite the fact that most gun owners may be responsible, it is not as tolerant due to the tragic nature of mass and indiscriminate gun violence.

Therefore, some freedoms that may seem harmless at the individual level can evolve into complex social problems. From this perspective, financial regulation of certain individuals is not only to ensure market order, but also to reduce excessive financial transaction activities in daily life. I understand this and why some societies tend to take such measures.

Therefore, whether we want to live in a more financialized world is a different question from how we ensure the accessibility of the current world. If you agree that we should increase opportunities for wealth creation and accept the trade-offs that come with it, then we can draw lessons from Memecoins without having to fully deregulate.

Funds and liquidity flow into Memecoins, partly because the rules of the traditional financial system were established before the internet and cryptocurrencies emerged. These rules were intended to provide an orderly market and investor protection for the past era, but in reality, they have exacerbated inequality. If we can update these rules to 21st century standards, hopefully, we can reduce this class gap. This way, more people can participate in the "production of Memes".