After the National Day holiday, the first trading day saw another wave of limit-up surges in the A-share market, with the total trading volume reaching nearly 3.5 trillion yuan, setting a new record. During the continuous bull run in the A-share market, the US stock market, Japanese stock market, Indian stock market, and the cryptocurrency market have all experienced varying degrees of capital outflows. To alleviate the pressure of capital outflows, some markets have successively introduced measures to boost the market. First, the US Department of Labor released an extremely impressive September non-farm employment data, significantly revising upward the employment figures for July and August, in an attempt to suppress the rapidly rising recession expectations. Secondly, the Japanese media has been heavily promoting that "investment guru" Warren Buffett plans to issue yen-denominated bonds for the second time this year and intends to use the raised funds to invest in Japanese financial and shipping stocks, aiming to convey Buffett's confidence in the recovery of the Japanese economy. Only the cryptocurrency market is in a "no milk to feed" state, and therefore, over the past week, due to the continuous outflow of funds, the USDT discount rate has dropped from -0.56% to as low as -3%.

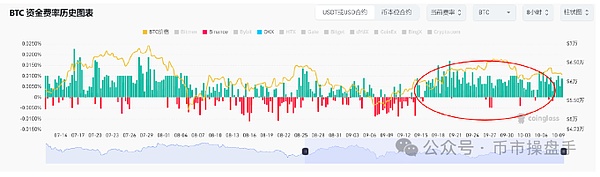

It is worth noting that although the USDT discount rate has continued to widen in the past week, the adjustment in the cryptocurrency market has been relatively mild, with Bitcoin's cumulative decline being only 2.5%. Furthermore, during the period of significant capital outflows from USDT, the Bitcoin perpetual contract funding rates on the Binance and OKEX platforms have mostly remained in positive territory, indicating that the most sensitive capital in the market is completely unaffected by this type of negative news. This also reflects that the capital flowing out of USDT is not primarily the active buying power in the market.

According to some USDT traders, the main reasons for the recent capital outflows from USDT are as follows: First, due to the significant depreciation of the US dollar, overseas funds have started to flow back, and some funds have quickly converted from US dollars to Chinese yuan through USDT, avoiding the cumbersome exchange settlement process and scrutiny. Second, under the continued fermentation of the money-making effect in the A-share market, the funds that previously engaged in financial management and arbitrage in the cryptocurrency market through USDT are gradually shifting towards the A-share market. However, as the exchange rate between the US dollar and the Chinese yuan stabilizes and the A-share market enters a volatile phase, the USDT discount rate has begun to narrow, and the pressure of capital outflows has eased. As long as Tether's redemption does not encounter any problems, the state of USDT trading at a significant discount will not last too long.

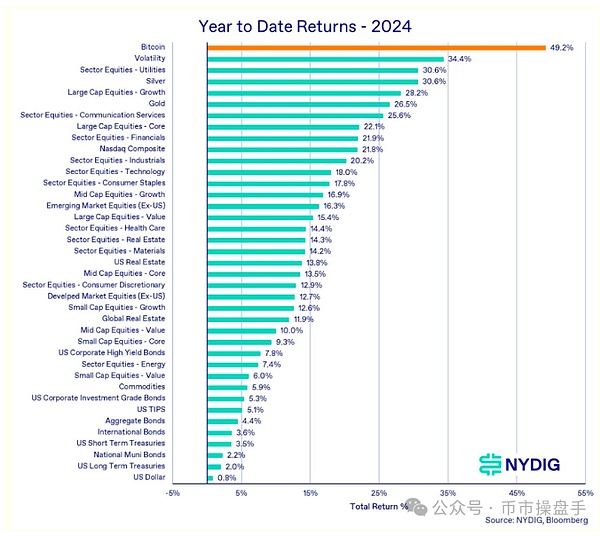

Although the cryptocurrency market has been seen as a shadow market of the US stock market this year, Bit remains the best-performing asset class in the US stock market. Not only have the ETFs linked to Bit outperformed the US stock market, but the US-listed companies with Bit as the underlying asset have also performed exceptionally well. For example, since September 6, the cumulative gain of MicroStrategy's stock price has reached 68%, far exceeding the 8.3% of Nasdaq and the 7.1% of the S&P 500. Bloomberg industry research data shows that the MicroStrategy 2X leveraged ETF issued by REX Shares and Tuttle Capital Management has attracted nearly $130 million in net inflows within two weeks of its listing, becoming one of the best-performing new ETFs in the market. This phenomenon indicates that Bit is still the hottest asset in the US stock market. If the upward trend of the US stock market remains unchanged, holding Bit can still earn the leveraged gains of the US stock market.

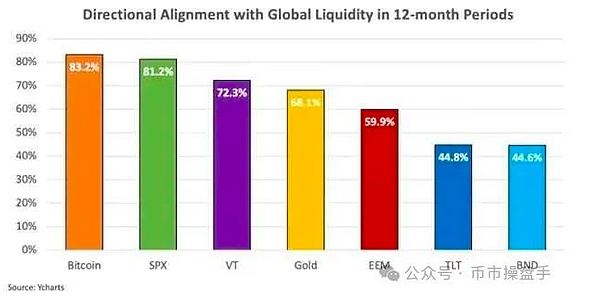

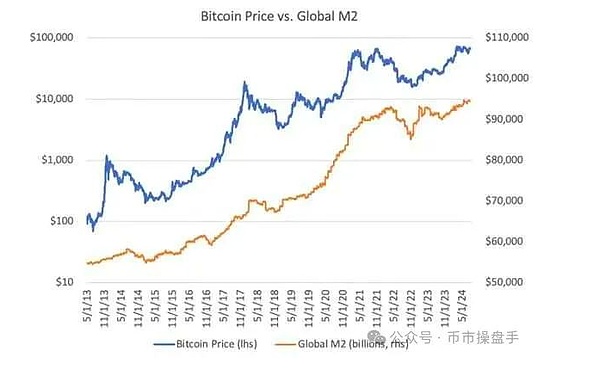

By analyzing the structure of the unexpectedly strong September non-farm employment data in the US, it can be found that the addition of 918,000 government employees and 121,000 part-time workers are the main reasons for the better-than-expected employment data, while the private sector employment, which better reflects the employment situation, actually decreased by 458,000. However, this non-farm employment report, which is full of water, has still successfully reversed the market's recession expectations. After the release of the non-farm data, the pricing of US Treasury bond futures for the current rate cut cycle fell from 245 basis points to 185 basis points, and the yield on the 10-year US Treasury bond rose from 3.80% to 4.02%, with the US dollar stabilizing and rebounding. Although the rate cut expectations have shrunk, as long as the economy does not fall into a recession, the decline in interest rates can still bring the effect of credit expansion. And this window period coincides with the imminent launch of a new round of large-scale economic stimulus by the world's second-largest economy, so the global M2 will inevitably enter a new upward cycle. According to research by the financial institution Swan Bit, Bit has been consistent with the global liquidity trend 83% of the time within any 12-month period, a higher proportion than any other major asset class. If the historical data is valid, Bit will embark on a new round of upward trend in the 12 months after the rate cut in September.

After the release of the US non-farm employment data, Buffett continued to express his concerns about the economic outlook by selling, selling, and selling. However, with the coordinated stabilization measures of the US government and the Federal Reserve, the US stock market will most likely continue to fluctuate upwards before the election. After all, historically, Buffett's sell signals usually lag by 8 to 13 months. Therefore, the author still believes that October and November are the best windows for the market to go long.