There are concerns that Ethereum (ETH) is linked to the notorious PlusToken Ponzi scheme and may eventually be transferred to cryptocurrency exchanges. In fact, some have already been sent to cryptocurrency exchanges and may be cashed out.

As a result of this situation, the ETH price has dropped by about 4% compared to its Wednesday high. At the time of writing, it is trading around $2,400.

$1.3 Billion Worth of ETH, Potential for Sale

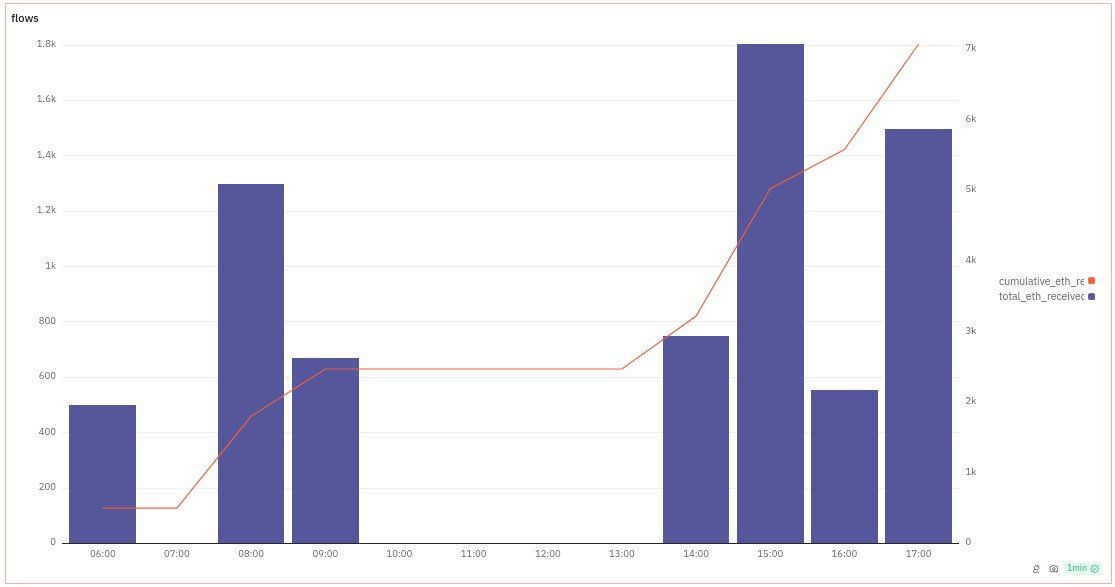

Crypto researcher FreeSamourai claimed that 7,000 ETH out of the 542,000 ETH seized from PlusToken have reached exchanges including Bitget, Binance, and OKX.

The PlusToken scam, similar to Bitconnect, was a Ponzi scheme that gained attention in China between 2018 and 2019. This Ponzi scheme attracted 2.6 million participants. Authorities eventually dismantled it and seized a large amount of cryptocurrency, including 194,000 BTC and 833,000 ETH.

Read more: Top Crypto Bankruptcies: What You Need to Know

Court documents from 2020 reported that the seized assets were transferred to Bejing Zhipan Technology for the purpose of being used as compensation. At the time, authorities sold BTC on exchanges, and some ETH was also sold, leaving the remaining 542,000 ETH.

In early August, EmberCN observed that this ETH had moved for the first time since 2021.

On October 9th, FreeSamourai reported that 15,700 ETH had moved from the tracked wallets, but had not yet reached exchanges. FreeSamourai predicts that this movement could suggest the potential sale of the remaining ETH.

"Given the recent efforts to re-obscure the ETH, the active distribution of the 15,700 ETH moved yesterday is unlikely to be the last of the 542,000 ETH supply distribution," FreeSamourai said.

News of the potential selling pressure from a large institution often triggers concerns among investors. In July, the German government sold $300 million worth of Bitcoin, causing the BTC price to drop from $65,600 to $57,800. More recently, the U.S. Supreme Court allowed the sale of 69,370 BTC seized from Silk Road.

Read more: Ethereum (ETH) Price Prediction 2024/2025/2030

The crypto community is concerned about the impact a $130 million selling pressure could have on ETH.

"This is why we can't have nice things. There could be $130 million in selling pressure on ETH from PlusToken. There could be $400 million in selling pressure on BTC from the US government's Silk Road sale. Sad," a crypto investor said.