Review of 12 DeFi Coins with Solid Fundamentals and High-Value Binding

The founder of Itsblockchain.com, @hmalviya9, reviews 10 projects in the DeFi space that have fundamentals and actually bind real yield to their governance tokens, explaining their binding mechanisms and how investors can participate. These tokens enhance their value through diversified revenue models and lock-up incentives, and bind them to the long-term participation of users, creating long-term investment incentives.

The crypto research team has also added 2 coins with strong fundamentals: $PENDLE and $AERO.

Aave $AAVE

Aave proposes a "Buy & Distribute" plan, using the surplus to repurchase AAVE and distribute it to holders of staked AAVE (StkAAVE), enhancing the token's value.

Further reading: Aave Introduction Guide | Tutorial on how to use DeFi lending, is "flash loan" infamous?

Curve $CRV

Curve Finance's CRV holders can lock their tokens for up to four years to earn a portion of the transaction fee revenue, increasing the appeal of long-term holding.

Further reading: 【Curve Tutorial】Introduction to the Stable Coin Exchange Protocol Curve

Further reading: Introduction to Curve Stable Coin crvUSD | LLAMMA Liquidation & 3 Key Features to Enhance Decentralized Stable Coins

Maple $MPL

In the Maple protocol, MPL stakers can receive xMPL, and if the protocol's revenue exceeds operating costs, 50% of the profits will be shared with the stakers. MPL can also be used as single-sided collateral to earn 10% interest, but if the loan defaults, the MPL portion will be lost.

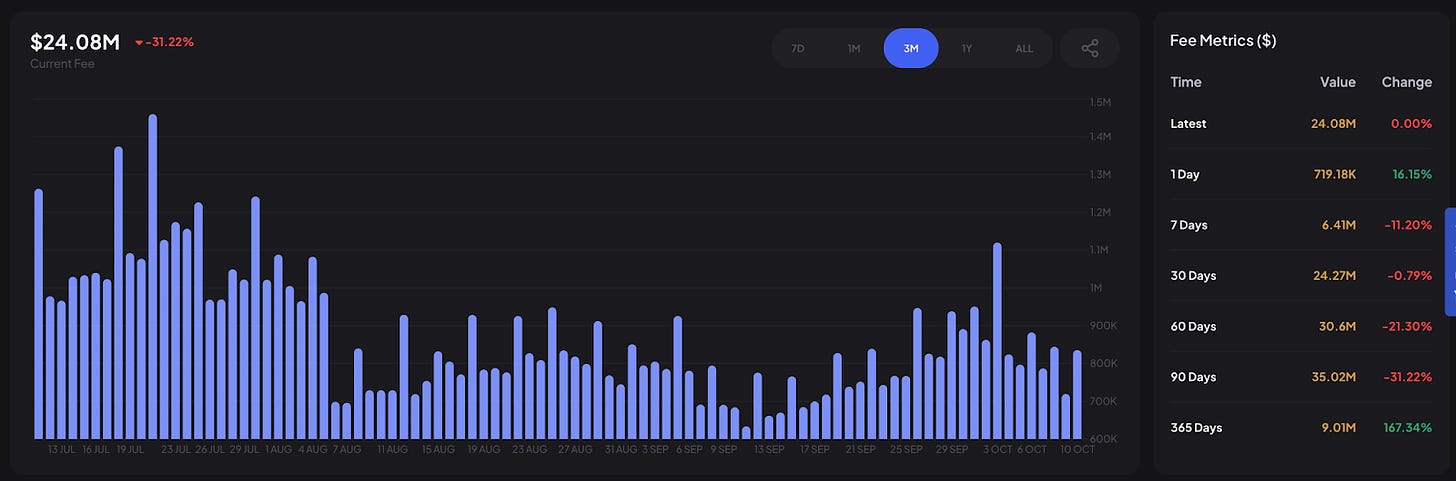

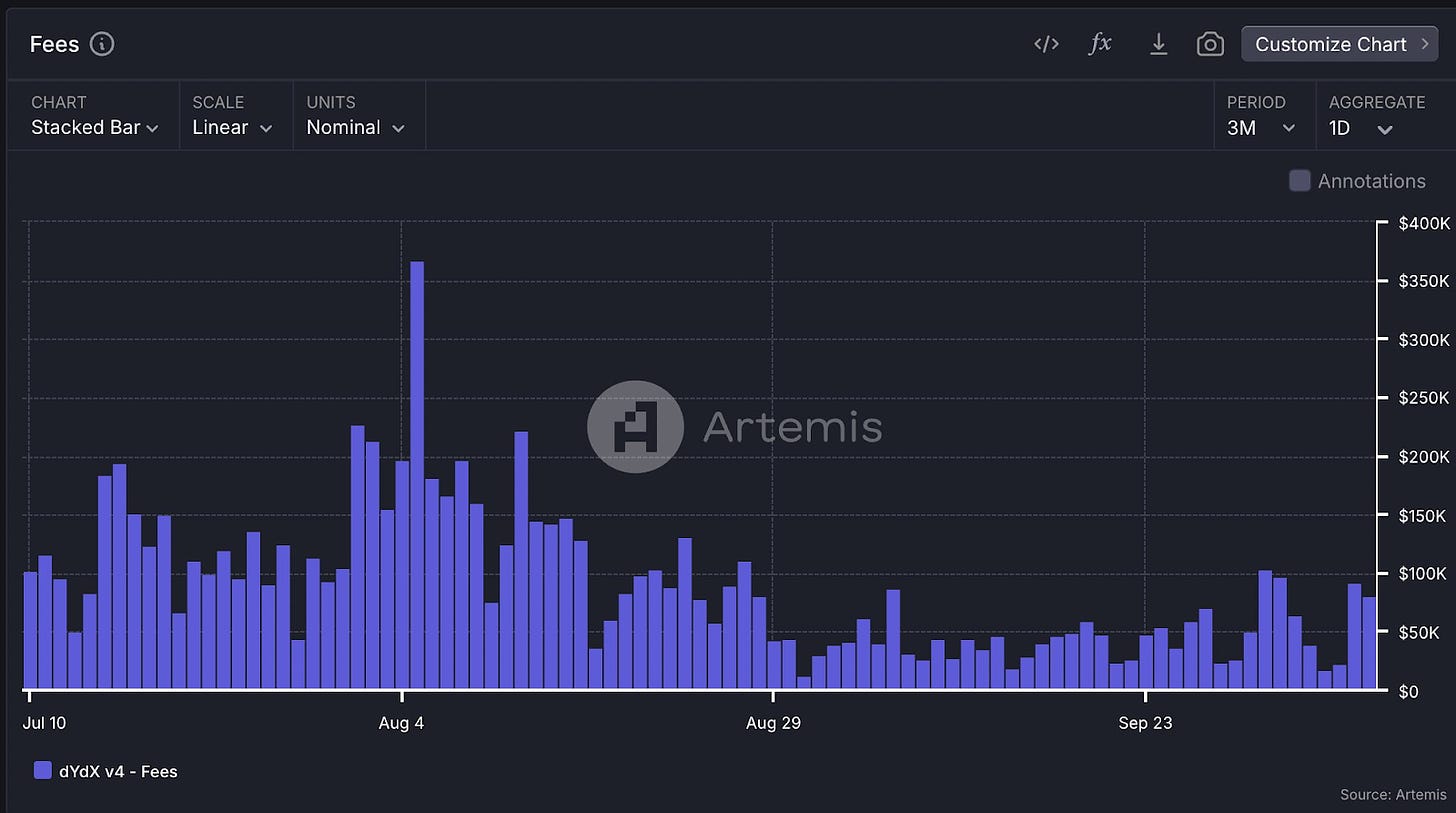

dYdX $DYDX

The top 60 validators on the dYdX Chain can receive the full revenue from V4 trading fees, and token holders can also delegate their tokens to higher-yielding validators.

Further reading: What is dYdX, Introduction | Will the DYDX token rise? Tutorial, in-depth analysis of trading depth

Banana Gun $BANANA

40% of the trading bot revenue will be used to repurchase BANANA and distribute it proportionally to all token holders, strengthening the token's value. $BANANA has recently gained attention and is one of the relatively undervalued meme-sector tokens with high liquidity.

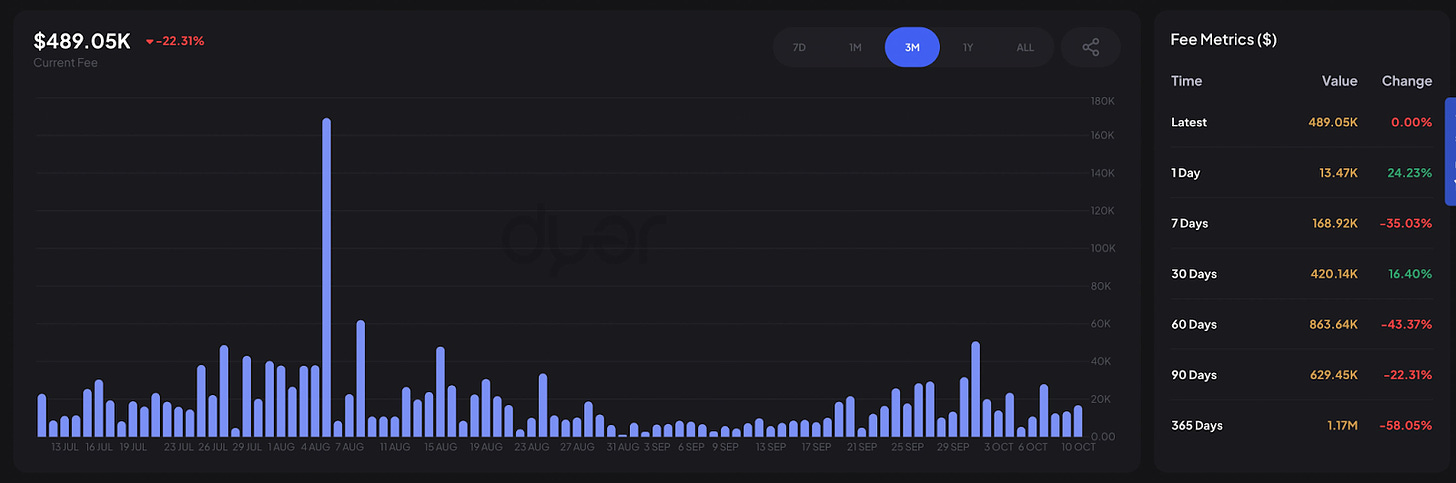

Liquity $LQTY

LQTY stakers can enjoy all the income generated by the protocol, and receive a share of the fee income proportional to their staked amount. Liquity is also about to launch v2 soon.

Further reading: Liquity Protocol and MakerDAO - DeFi Central Bank and New Generation 0 Interest Lending Protocol

Synthetix $SNX

Synthetix charges a 0.3% trading fee on the Kwenta Exchange and distributes the revenue as "real yield" to SNX stakers.

Further reading: The Progenitor of DeFi Derivative Trading Platforms - Synthetix

Further reading: Highlights of Kwenta | Synthetix Team's Derivative Trading Platform on Optimism

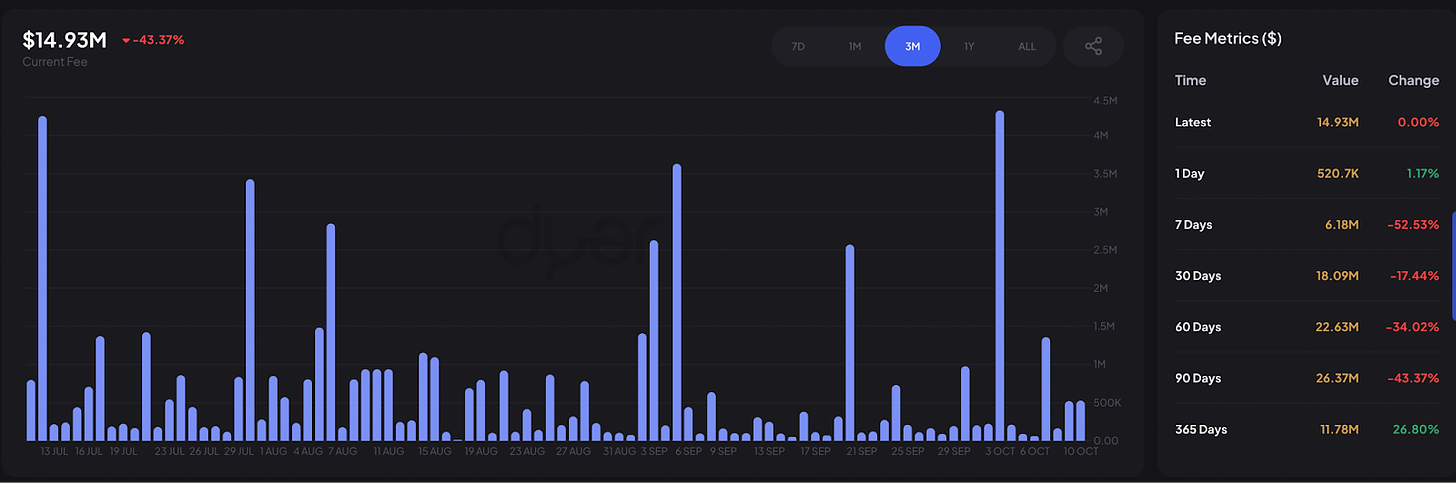

MakerDAO $MKR -> $SKY

MakerDAO (now renamed to $SKY) generates revenue from stablecoin fees, liquidation penalties, and Dai trading fees, which are distributed to MKR holders and the MakerDAO treasury. Repaid loans are converted to MKR and burned, further accruing value to MKR holders.

Further reading: MKR Token | What is MakerDAO? The Pioneer of Stablecoin Dai | Ambitions of a DeFi Blue Chip!

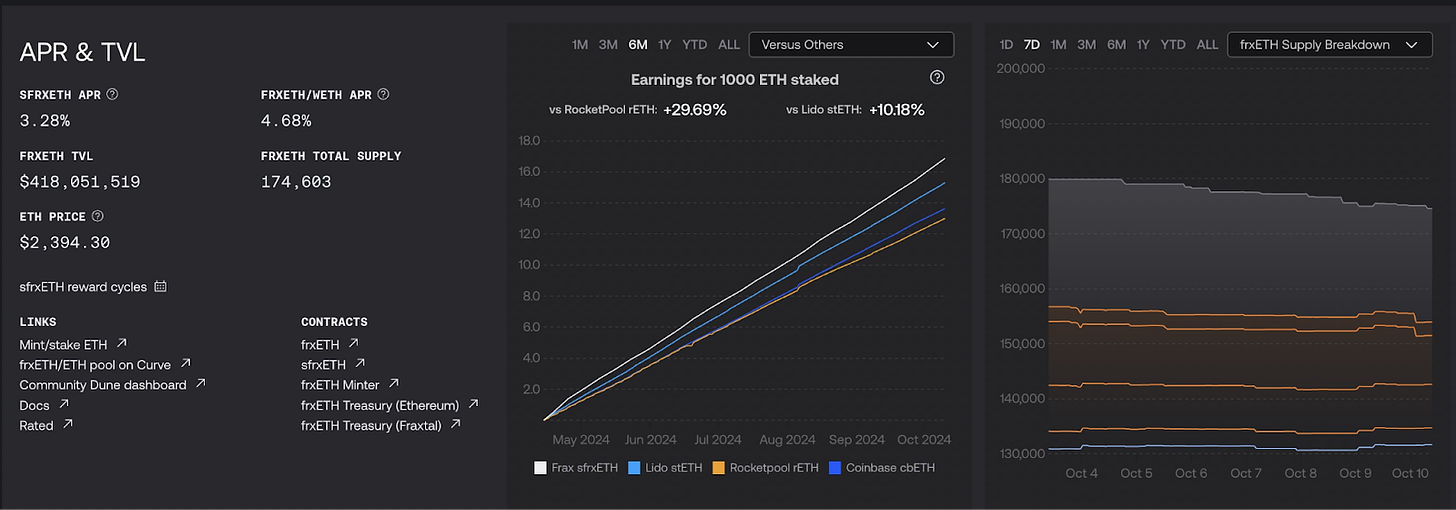

Frax Share $FXS

Frax Share participates in the dominant position in the Curve pools, and shares the revenue with participants who lock FXS, strengthening the token's ecosystem value.

Further reading: FXS Token | Understanding the Frax Hybrid Algorithm Stablecoin & the Future Plasticity of the Protocol

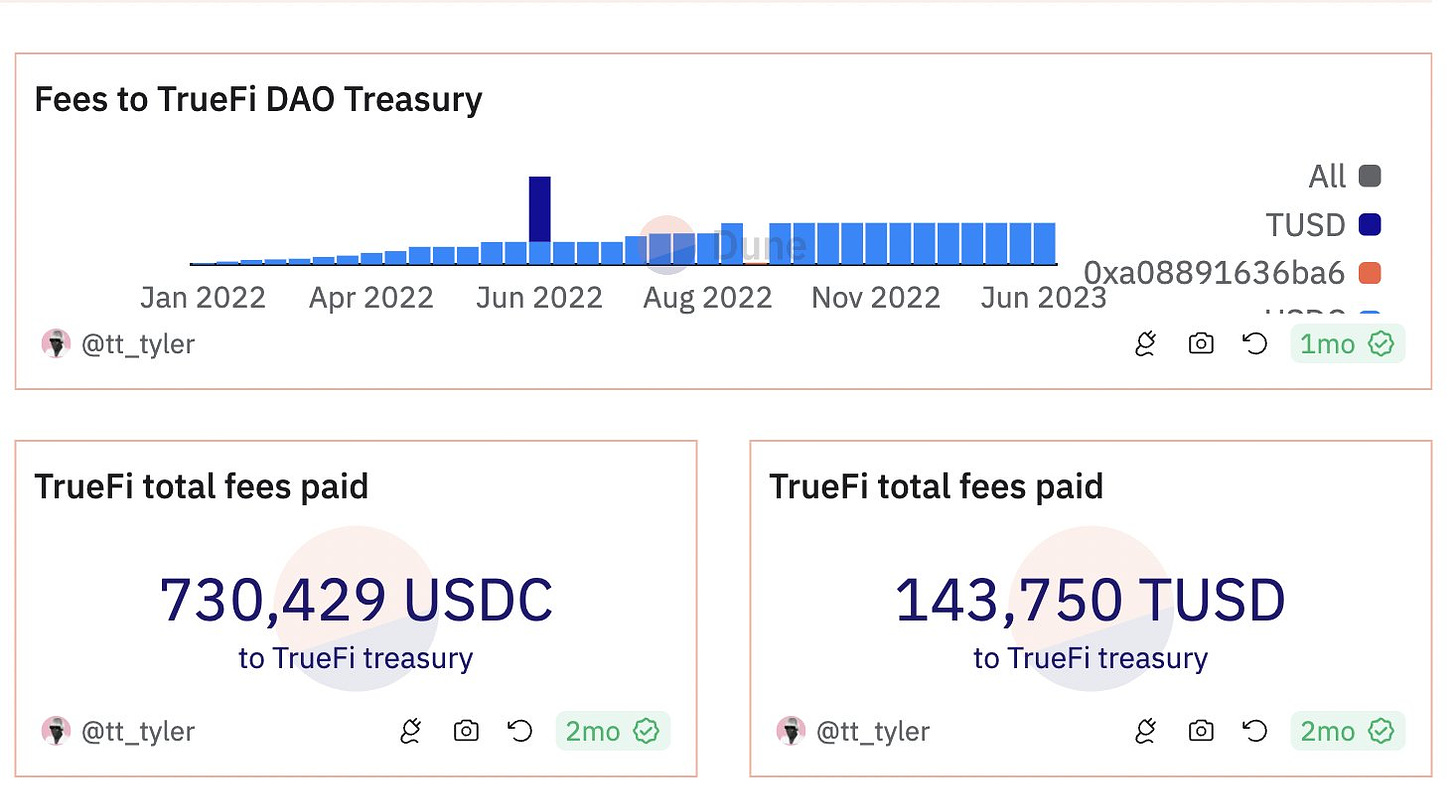

TrueFi $TRU

TrueFi charges a 0.50% fee on loans on the platform and shares a portion of the revenue with TRU stakers.

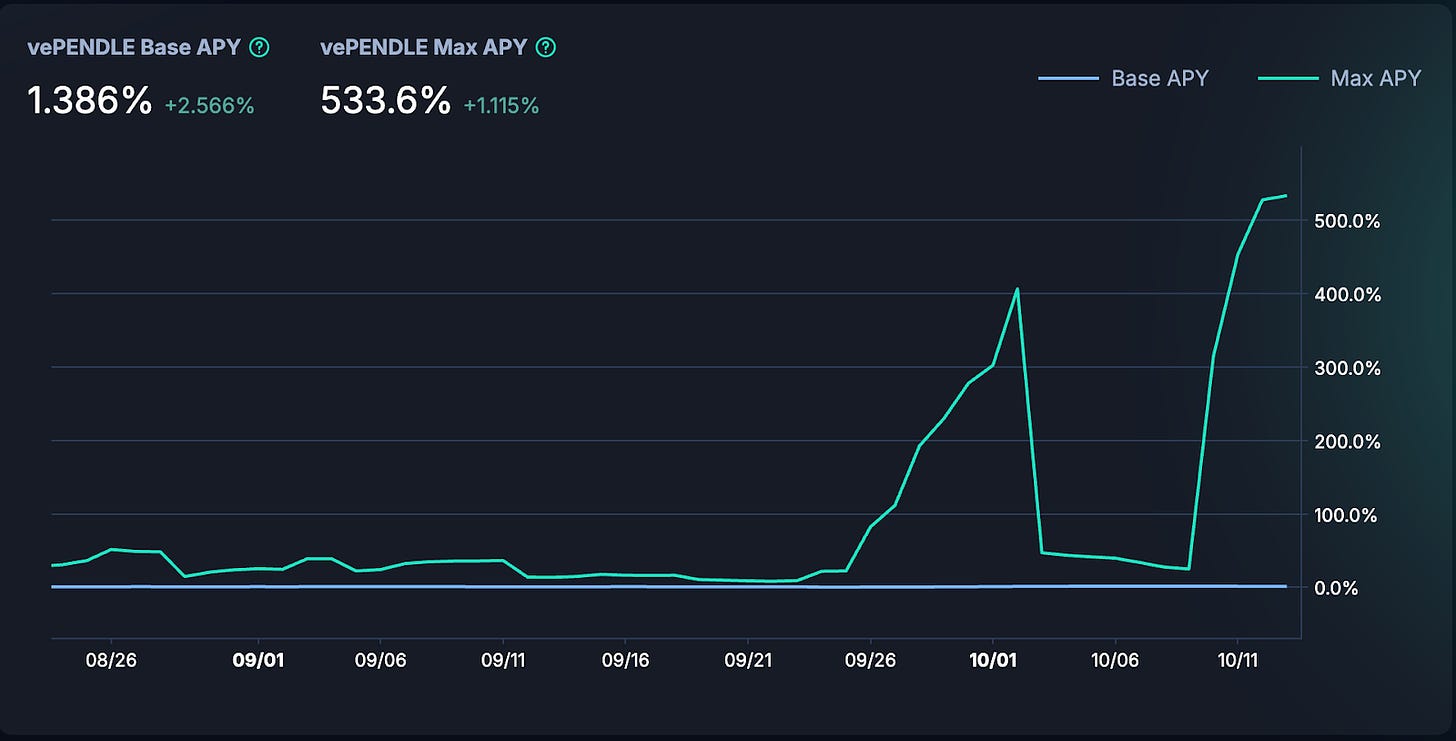

Pendle $PENDLE

Source: https://app.pendle.finance/vependle/stats

Pendle distributes the YT fee revenue from the protocol to vePENDLE holders and distributes the swap fee revenue to vePENDLE holders of the corresponding voting pools.

Further reading: Riding the LSD liquidity staking craze, why did the 10x bull run Pendle Finance become so popular?

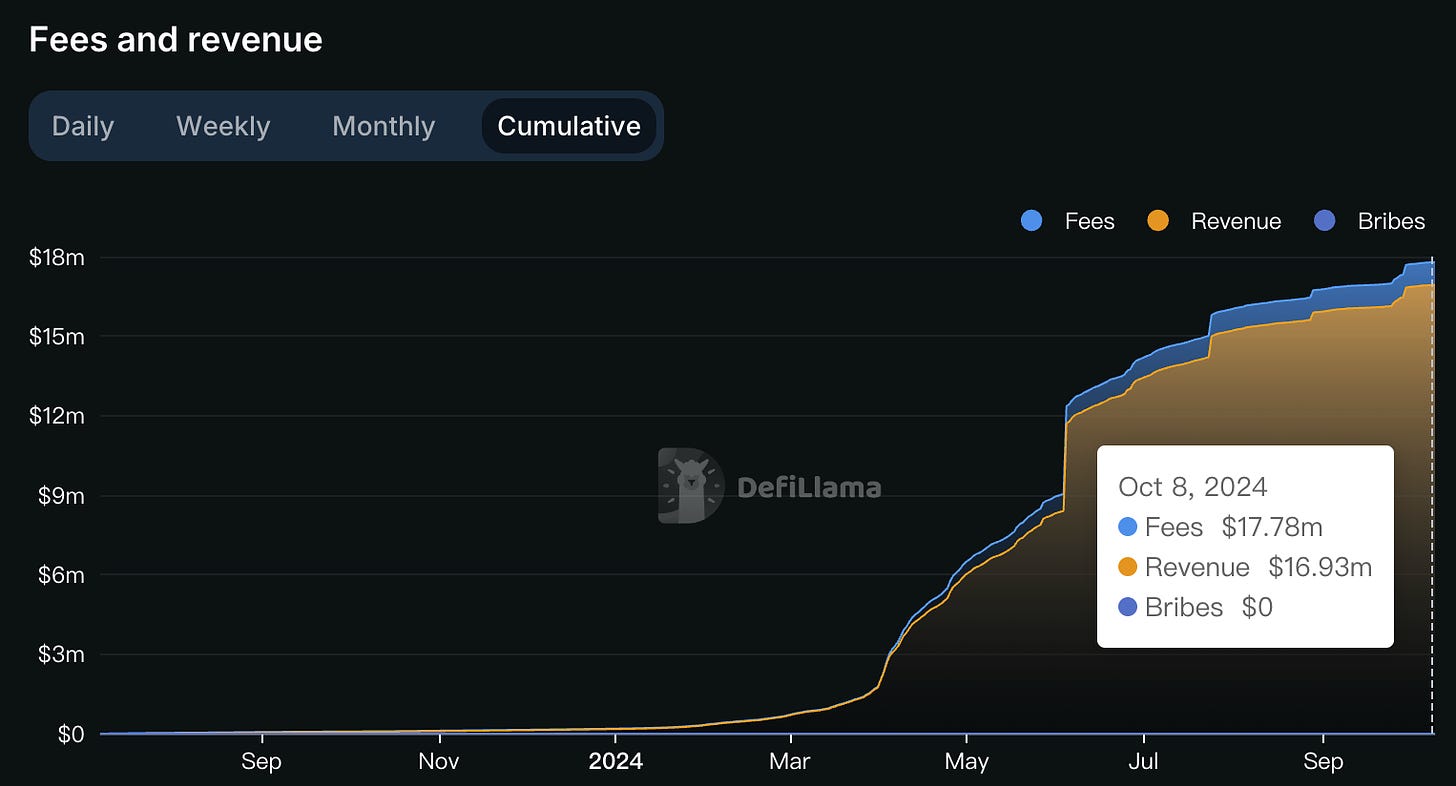

Aerodrome $AERO

Source: https://dune.com/0x_danw/veaero-rewards-program

Aerodrome earns revenue through its Automated Market Maker (AMM) service and distributes 100% of the trading fees to veAERO holders, proportional to their locked AERO amount.

Further reading: The leading protocol on the Base chain and the liquidity hub | An introduction to Aerodrome Finance with a built-in bribery mechanism

Summary: DeFi Summer

This bull market has seen criticism of low-circulation, high FDV tokens, where many tokens had their bubbles inflated during the fundraising period, and the bubble burst as soon as they were issued. Some traders have shifted from a "chasing the dream" mentality to a "real yield-bound" value investment strategy, so terms like "real yield", "fundamentals", "token economics", and "token utility" have come to the fore again, and the market is also starting to focus on tokens that have firmly established themselves in the DeFi track and become quality "cash cows", as whether DeFi projects can truly implement their products and attract revenue may be more important than narratives, institutional funding, and exchange support in the future.

Further reading: A review of the latest developments of the DeFi Summer blue-chip protocols! Uniswap, Aave, MakerDAO, Curve

Original link: https://x.com/hmalviya9/status/1844243942084313348